Press release

Reinsurance Market Expected to Maintain Upward Momentum, Surpassing US$ 558.8 Bn by 2031

The global reinsurance market is projected to grow at a CAGR of 4.3% from 2024 to 2031, expanding from USD 416.2 billion in 2024 to USD 558.8 billion by the end of the forecast period. Increasing awareness about risk management, evolving economic landscapes, and emerging technologies are driving market expansion.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response):

https://www.persistencemarketresearch.com/samples/34151

Market Overview

Reinsurance plays a pivotal role in the broader financial ecosystem by mitigating risks and ensuring financial stability for insurers. As businesses face increasing uncertainty due to supply chain disruptions, catastrophic events, and shifting consumer behaviors, reinsurance solutions serve as a vital safeguard. The sector is witnessing strong demand as insurers seek comprehensive coverage to mitigate potential losses.

Key Market Drivers

Surging Demand for Risk Mitigation

The rising frequency of natural disasters, geopolitical uncertainties, and economic fluctuations has amplified the need for robust risk transfer mechanisms. Businesses, especially within the consumer goods, healthcare, and infrastructure sectors, are increasingly leveraging reinsurance to protect against financial volatility.

Expanding Insured Values Across Industries

As the global economy grows, companies are expanding their coverage portfolios. Industries such as property, life, and health insurance have seen an increase in insured asset values, boosting the demand for reinsurance services. This trend highlights the market's role in maintaining long-term industry resilience.

Market Restraints

Regulatory Challenges and Compliance Complexity

The reinsurance market is subject to stringent global and regional regulatory frameworks, requiring companies to allocate significant resources toward compliance. Regulatory complexities often limit the entry of new players and challenge existing companies in adapting to evolving guidelines.

Economic Uncertainties Affecting Investment Strategies

Global economic instabilities, fluctuating interest rates, and geopolitical events continue to impact investment strategies in the reinsurance sector. Insurers and reinsurers alike are facing challenges in maintaining profitability amid economic volatility.

Opportunities in the Market

Technological Advancements Driving Innovation

Artificial intelligence (AI), blockchain, and predictive analytics are revolutionizing the reinsurance landscape. AI-driven risk assessment tools are enabling insurers to make more accurate underwriting decisions, while blockchain technology is enhancing transparency and efficiency in contract management.

Expansion into Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa present significant growth opportunities. As insurance penetration increases in these regions, reinsurers are expanding their footprints to tap into new revenue streams and diversify their portfolios.

Analyst Insights

Short-Term Outlook

The short-term growth trajectory of the reinsurance market remains moderate yet stable, driven by increasing risk awareness and advancements in technology. However, economic uncertainties and regulatory challenges may create temporary slowdowns.

Long-Term Outlook

In the long run, climate change risks, cyber threats, and demographic shifts are expected to drive the demand for innovative reinsurance solutions. Strategic partnerships and digital transformation initiatives will be key to sustaining market expansion beyond 2031.

Supply-Side Dynamics

Alternative Capital Sources Enhancing Reinsurance Capacity

The influx of insurance-linked securities (ILS) and catastrophe bonds has significantly increased capital availability in the reinsurance sector. These alternative risk-transfer mechanisms have intensified competition and introduced new market dynamics.

Regulatory Frameworks Shaping Market Equilibrium

Evolving solvency and risk management regulations continue to impact reinsurance supply and demand. Regulatory bodies in North America, Europe, and Asia-Pacific are implementing policies aimed at enhancing industry resilience and financial stability.

Competitive Landscape

The reinsurance sector is led by major players such as Munich Re, Swiss Re, and Berkshire Hathaway Reinsurance Group. These companies leverage their financial strength, global reach, and technological advancements to maintain market dominance.

Key Competitive Strategies:

AI-Driven Risk Assessment Solutions

Strategic Mergers and Acquisitions

Expansion into High-Growth Markets

Investments in Climate Risk Analytics

Key Market Developments

1. InsureTech Solutions Introduces AI-Powered Risk Assessment Platform

A cutting-edge AI-powered platform has been launched to enhance risk profiling and underwriting accuracy. This development is set to redefine industry standards in risk management and decision-making.

2. Climate Risk Modeling Initiative by ReClimate Analytics

A new initiative focusing on climate change-related risk modeling is helping reinsurers manage catastrophic risk portfolios. The use of advanced predictive analytics is expected to improve financial sustainability in the sector.

3. ReAssure International's Strategic Merger

ReAssure International has merged with a leading reinsurer to expand its global market presence. This move strengthens its portfolio and enhances service capabilities in the growing reinsurance market.

Key Companies Profiled

Berkshire Hathaway Inc.

MAPFRE

Tokio Marine HCC

Everest Re Group, Ltd.

AXA XL

Hannover Re

Munich Re

RGA Reinsurance Company

China Reinsurance (Group) Corporation

Markel Corporation

SCOR

BMS Group

Next Insurance, Inc.

Market Segmentation

By Type

Facultative Reinsurance

Treaty Reinsurance

By Product

Property & Casualty Reinsurance

Life & Health Reinsurance

By Distribution Channel

Broker

Direct Writing

By Region

North America

Europe

East Asia

South Asia & Oceania

Latin America

Middle East & Africa

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 25.92, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Reinsurance Market Expected to Maintain Upward Momentum, Surpassing US$ 558.8 Bn by 2031 here

News-ID: 3920942 • Views: …

More Releases from Persistence Market Research

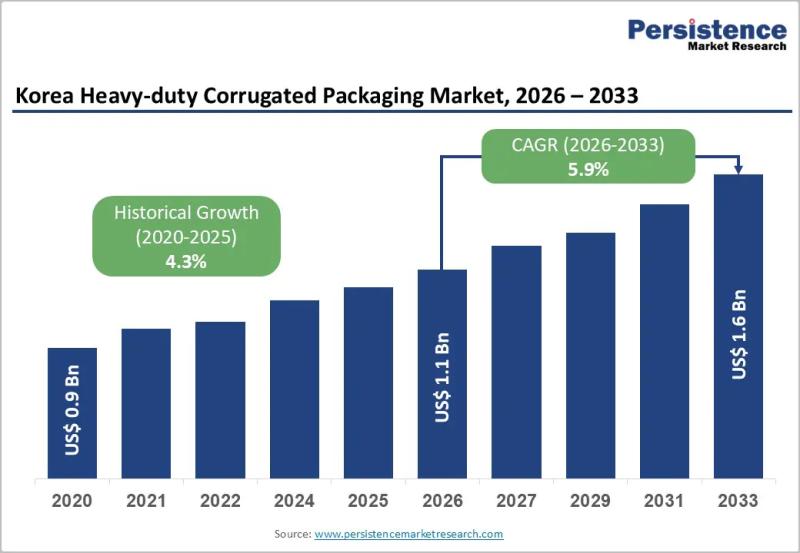

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Reinsurance

Reinsurance Services Market SWOT Analysis by Key Players Hannover Re, Korean Rei …

The Latest research coverage on Reinsurance Services Market provides a detailed overview and accurate market size. The study is designed considering current and historical trends, market development and business strategies taken up by leaders and new industry players entering the market. Furthermore, study includes an in-depth analysis of global and regional markets along with country level market size breakdown to identify potential gaps and opportunities to better investigate market status,…

Crop Reinsurance Market Is Booming So Rapidly | Munich Reinsurance, Swiss Reinsu …

The Crop Reinsurance Market study with 65+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyze futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2029. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that…

Agriculture Reinsurance Market Is Booming Worldwide : Agroinsurance, Swiss Reins …

The Latest Released Agriculture Reinsurance market study has evaluated the future growth potential of Agriculture Reinsurance market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers, challenges,…

Recent Reinsurance Market Investment Activity From Established Companies Are to …

The latest release from WMR titled Reinsurance Market Research Report 2022-2028 (by Product Type, End-User / Application, and Regions / Countries) provides an in-depth assessment of the Reinsurance including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies, key players company profiles, and strategies. Global Reinsurance Market study with 100+ market data Tables, Pie Chat, Graphs & Figures is now released BY WMR. The report presents a complete assessment…

Life Reinsurance Market is Going to Boom | Swiss Re, Munich Reinsurance, Korean …

Advance Market Analytics published a new research publication on “Life Reinsurance Market Insights, to 2026″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Life Reinsurance market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…

Reinsurance Market To See Stunning Growth | Munich, Korean Reinsurance, Swiss

Latest Market Research on “Reinsurance Market” is now released to provide hidden gems performance analysis in recent years and years to come. The study explains a detailed overview of market dynamics, segmentation, product portfolio, business plans, and the latest development in the industry. Staying on top of market trends & drivers is always remain crucial for decision-makers and marketers to hold emerging opportunity.

Get the inside scoop with Sample report https://www.htfmarketreport.com/sample-report/3185812-global-reinsurance-market-26

Know…