Press release

US Factoring Services Industry Expanding at 9.1% CAGR Through 2031 | Persistence Market Research Analysis

Introduction: A Booming Industry on the RiseThe US factoring services industry is experiencing remarkable growth, with a projected compound annual growth rate (CAGR) of 9.1% through 2031. Factoring services have gained widespread acceptance across various industries as businesses seek alternative financing solutions to improve cash flow and working capital management. With small and medium-sized enterprises (SMEs) increasingly leveraging factoring to sustain and expand operations, the industry is witnessing rapid evolution driven by technology, regulatory shifts, and market demand.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/34770

The Growing Demand for Factoring Services

Factoring services have become a vital financial tool for businesses facing cash flow constraints. Rather than waiting for customers to pay invoices, businesses sell their accounts receivable to a factoring company in exchange for immediate funds. This financing option is particularly beneficial for industries with long payment cycles, such as transportation, healthcare, construction, and manufacturing.

The increasing reliance on factoring services is driven by:

• Cash Flow Management: Businesses use factoring to bridge gaps between invoicing and payment cycles, ensuring smooth operations.

• SME Growth: With limited access to traditional bank loans, SMEs turn to factoring as an accessible financing alternative.

• Economic Uncertainty: Fluctuations in the economy encourage businesses to seek flexible financing solutions to maintain financial stability.

• Rise in B2B Transactions: Factoring is becoming more popular as companies engage in larger and more complex business-to-business (B2B) transactions.

How Factoring Services Empower Businesses

Factoring services play a crucial role in strengthening businesses by providing immediate access to capital. The benefits of factoring services include:

1. Improved Cash Flow

By converting unpaid invoices into immediate cash, businesses can meet operational expenses, invest in growth, and maintain financial stability without waiting for payments from clients.

2. Reduced Credit Risk

Factoring companies often assume the responsibility of credit evaluation, helping businesses mitigate the risk of bad debts. Non-recourse factoring further eliminates liability for unpaid invoices.

3. Business Expansion Opportunities

With increased liquidity, businesses can take on larger contracts, expand operations, and invest in new opportunities without financial constraints.

4. No Additional Debt

Unlike traditional loans, factoring does not add debt to a company's balance sheet. Instead, it enables businesses to access funds tied to existing invoices, making it an attractive financing option.

Key Factors Driving Market Growth

Several key drivers are propelling the US factoring services industry forward:

1. Digital Transformation and Automation

The integration of AI-driven credit analysis, blockchain for secure transactions, and cloud-based factoring platforms is making factoring services more accessible, efficient, and secure. These technologies enhance transparency, reduce processing time, and lower operational costs.

2. SME Financing Needs

Small businesses continue to struggle with obtaining traditional bank loans due to stringent credit requirements. Factoring provides a viable financing solution, helping SMEs sustain and grow their businesses.

3. Expansion of Non-Bank Lenders

Non-traditional financial institutions and fintech companies are entering the factoring market, offering more competitive rates, flexible terms, and streamlined application processes. This diversification is expanding the industry's reach.

4. Industry-Specific Demand

Sectors like healthcare, transportation, and construction are increasingly relying on factoring services due to their long payment cycles and cash flow challenges. The rise of e-commerce and logistics has further driven demand.

Challenges Facing the US Factoring Services Industry

Despite its growth, the factoring services market faces several challenges:

1. Regulatory and Compliance Issues

The financial sector is subject to stringent regulations, and factoring companies must comply with evolving laws related to anti-money laundering (AML), financial reporting, and consumer protection.

2. Competition from Alternative Financing Options

Businesses now have multiple financing options, including merchant cash advances, peer-to-peer lending, and crowdfunding. Factoring companies must differentiate themselves by offering better terms and services.

3. High Fees and Costs

Factoring fees can be higher than traditional bank loans, making it a less attractive option for some businesses. Companies must weigh the cost-benefit ratio before opting for factoring.

4. Customer Creditworthiness

Factoring depends on the creditworthiness of a business's customers. If customers have poor payment histories, factoring companies may decline to purchase invoices, limiting access to funds.

Future Outlook: What Lies Ahead?

The US factoring services industry is poised for continued expansion, driven by advancements in financial technology, the growing reliance on alternative financing, and the increasing participation of non-bank lenders. Some notable future trends include:

1. AI and Data Analytics for Credit Assessment

Factoring companies will leverage AI-powered tools to assess credit risk more accurately, allowing for faster and more reliable financing decisions.

2. Blockchain for Secure Transactions

The use of blockchain technology can enhance transparency, security, and efficiency in invoice financing, reducing fraud risks and transaction costs.

3. Embedded Factoring Solutions

More businesses will integrate factoring services directly into their financial operations through digital platforms, enabling seamless transactions without manual intervention.

4. Growing Focus on Sustainable Financing

With ESG (Environmental, Social, and Governance) principles gaining importance, factoring companies may develop green financing solutions tailored for businesses committed to sustainability.

Conclusion: A Promising Future for Factoring Services

The US factoring services industry is undergoing a significant transformation, expanding at an impressive 9.1% CAGR through 2031. As businesses seek efficient cash flow solutions, factoring continues to emerge as a preferred financing alternative. While the industry faces challenges such as regulatory compliance and competition, advancements in technology and the rise of fintech-driven solutions are paving the way for sustained growth.

With increasing SME adoption, digital innovations, and industry-specific demand, the future of factoring services looks promising. As more businesses recognize the benefits of factoring, the industry is set to play a crucial role in shaping the financial landscape of the US economy.

Explore the Latest Trending "Exclusive Article":

https://www.linkedin.com/pulse/asia-pacific-leads-high-pressure-seals-gntde

https://www.linkedin.com/pulse/europe-see-fastest-growth-cold-seal-packaging-c5oee

https://www.linkedin.com/pulse/north-america-leads-aerospace-thermoplastics-s4rse

https://www.linkedin.com/pulse/us-surveillance-drone-market-hit-42-billion-2031-36jhe

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release US Factoring Services Industry Expanding at 9.1% CAGR Through 2031 | Persistence Market Research Analysis here

News-ID: 3918826 • Views: …

More Releases from Persistence Market Research

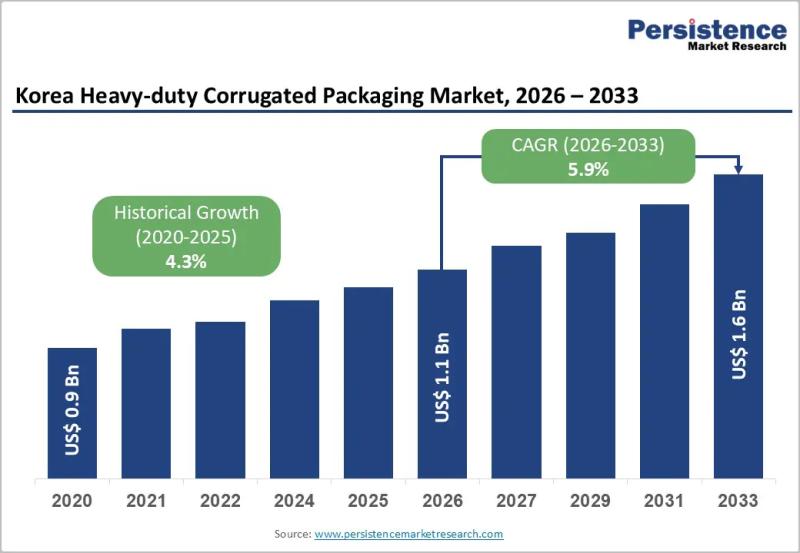

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Factoring

Growing Reverse Factoring Adoption Boosts Market Growth: Critical Driver Shaping …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Reverse Factoring Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

Over the past few years, the reverse factoring market has seen significant growth. It is expected to increase from $539.41 billion in 2024 up to $592.1 billion in 2025, representing a compound annual growth rate…

Factoring Market Next Big Thing | Major Giants BNP Paribas, HSBC, Deutsche Facto …

HTF MI just released the Global Factoring Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Giants in Factoring Market are:

BNP Paribas, HSBC, Deutsche Factoring Bank, Eurobank,…

What's Driving the Reverse Factoring Market 2025-2034: Growing Reverse Factoring …

What Are the Projections for the Size and Growth Rate of the Reverse Factoring Market?

The market size of reverse factoring has seen significant growth over the last few years. It is projected to expand from $539.41 billion in 2024 to $592.1 billion in 2025, displaying a compound annual growth rate (CAGR) of 9.8%. The growth trajectory in the past can be linked to the increased awareness of supply chain finance…

Reverse Factoring Market

The reverse factoring market has been experiencing significant growth, with its market size accounted for USD 530.8 billion in 2022. It is projected to achieve a remarkable market size of USD 1,452.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2032. This substantial growth is driven by various market trends, emerging opportunities, and a competitive landscape that is continuously evolving.

Download Free Reverse…

Factoring Market Outlook 2024-2030: Trends and Opportunities|BNP Paribas, Deutsc …

Infinity Business Insights is providing qualitative and informative knowledge by adding the title factoring Market to recognize, describe and forecast the global market. The report provides systematic consideration analysis along with forecasts for market players. The report aims to facilitate understanding of the global factoring market forecast through statistical and numerical data in the form of tables, graphs, and charts. The study provides a calculated assessment of new recent developments,…

Factoring Services Market is Booming Worldwide | Deutsche Factoring Bank, Euroba …

The Latest Released Factoring Services market study has evaluated the future growth potential of Global Factoring Services market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers,…