Press release

Private Banking Market Set to Reach $676.94 Billion by 2029 with 7.5% Yearly Growth

What combination of drivers is leading to accelerated growth in the private banking market?The surge in demand for private equity investment is projected to fuel the expansion of the private banking industry. Private equity investments are the type that are made in companies, which do not have their stocks publicly traded in the stock market. Several factors contribute to its demand, such as its flexibility and innovative approaches, rendering it appealing for companies and investors interested in growth and strategic guidance. In the context of private banking, private equity is utilized as an investment opportunity to diversify, increase returns, provide access to exclusive possibilities, personalize investment solutions, maximize investment portfolios, and maintain wealth in the long run. For instance, Invest Europe, a Belgium-based association - representing Europe's private equity, venture capital, and infrastructure sectors - reported in May 2024 that investments from European private equity and venture capital funds represented 0.44% of European GDP in 2023. As such, the rising demand for private equity contributes to the growth of the private banking sector.

Get Your Private Banking Market Report Here:

https://www.thebusinessresearchcompany.com/report/private-banking-global-market-report

What is the projected compound annual growth rate (CAGR) of the private banking market from 2025 to 2034, and what factors influence it?

The size of the private banking market has seen significant growth recently. The market is projected to expand from a size of $461.07 billion in 2024 to $507.57 billion in 2025, posting a compound annual growth rate (CAGR) of 10.1%. The substantial growth observed in the preceding years can be ascribed to factors like the accumulation of wealth, heightened globalization, regulatory changes, demographic shifts, and enhanced competition coupled with market consolidation.

In the ensuing years, it is predicted that the private banking sector will experience significant expansion, reaching a market size of $676.94 billion in 2029, with a compound annual growth rate (CAGR) of 7.5%. The surge in growth during the projection period can be linked to growing economic trends, heightened expectations for customization and personalization, an increase in sustainable finance, the evolution of geopolitical factors, and the implementation of AI and automation. The forecast period is bound to see several prevailing trends such as technological breakthroughs, investment trends, developments in wealth transfer solutions, improved digital customer interaction, and an upswing in sustainable investing.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=14166&type=smp

How are the latest trends influencing the growth of the private banking market?

Leading firms in the private banking sector are shifting their focus towards establishing banks that supply innovative banking solutions. These include digital private banks certified by FINMA that apply state-of-the-art digital services, in order to stay competitive and adjust to their clients' changing requirements. This bank has secured a banking permit from the Swiss Financial Market Supervisory Authority (FINMA) to function as a digital banking platform, utilizing the proficiency of conventional private banks to dispense innovative and tailored banking and investment services. For example, in October 2022, Alpian SA, a regulated and licensed banking organization based in Switzerland, debuted a digital private bank licensed by FINMA. This bank features a mobile-first digital service bridging regular and private banking services, giving clients the liberty to access services normally exclusive to conventional private banks. Furthermore, it offers trustworthiness, safety, deposit insurance, and a wide range of financial services, making it a compelling option for native and international account holders.

What are the major segments of the private banking market and their role in driving growth?

The private banking market covered in this report is segmented -

1) By Type: Asset Management Service, Insurance Service, Trust Service, Tax Consulting, Real Estate Consulting, Private Banking

2) By Bank Type: Full-Services Banks, Tax Planning, Boutique Banks

3) By Application: Personal, Enterprise

Subsegments:

1) By Asset Management Service: Portfolio Management, Wealth Advisory

2) By Insurance Service: Life Insurance, Property And Casualty Insurance

3) By Trust Service: Estate Planning, Trustee Services

4) By Tax Consulting: Tax Planning, Compliance Services

5) By Real Estate Consulting: Property Valuation, Real Estate Investment Advisory

6) By Private Banking: Personal Banking Services, Customized Financial Solutions

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=14166

Which regions are key players in the growth of the private banking market?

North America was the largest region in the private banking market in 2024. The regions covered in the private banking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Who are the key firms paving the way for growth in the private banking market?

Major companies operating in the private banking market are JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., Santander Private Banking, HSBC Holdings plc, Wells Fargo & Co., Morgan Stanley Co. LLC, Royal Bank of Canada (RBC), BNP Paribas SA, Goldman Sachs Group Inc., Internationale Nederlanden Groep, UBS Group AG, Barclays plc, Societe Generale, Credit Agricole SA, Standard Chartered plc, PNC Financial Services Group Inc., Bank of New York Mellon, National Westminster Bank, Mizuho Financial Group Inc., DBS Bank Ltd., Commerzbank AG, Raiffeisen Bank International AG, ABN AMRO Bank N.V., Northern Trust Corporation, Hang Seng Bank Ltd.

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/customise?id=14166&type=smp

What Is Covered In The Private Banking Global Market Report?

•Market Size Forecast: Examine the private banking market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the private banking market for a structured understanding.

•Key Players Overview: Analyze major players in the private banking market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the private banking market.

•Segment Contributions: Evaluate how different segments drive overall growth in the private banking market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the private banking market.

•Industry Challenges: Identify potential risks and obstacles affecting the private banking market.

•Competitive Landscape: Review strategic developments in the private banking market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private Banking Market Set to Reach $676.94 Billion by 2029 with 7.5% Yearly Growth here

News-ID: 3917192 • Views: …

More Releases from The Business Research Company

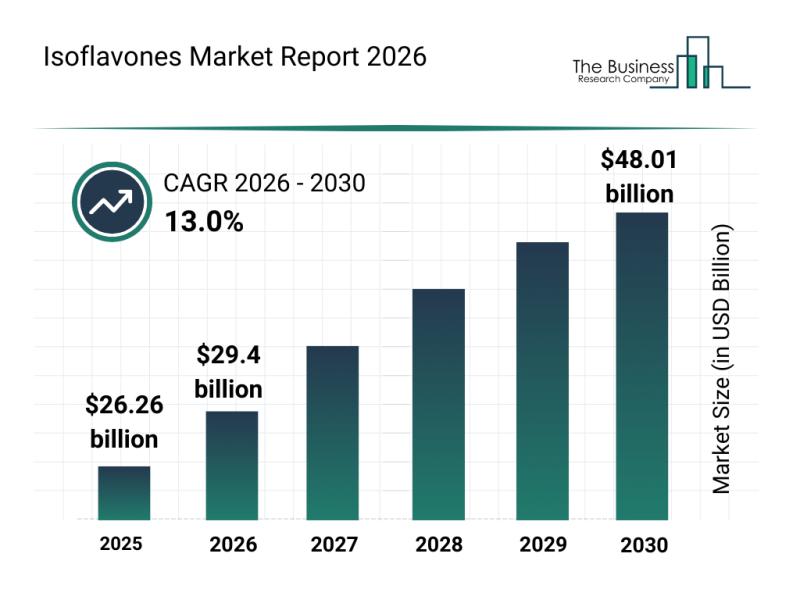

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

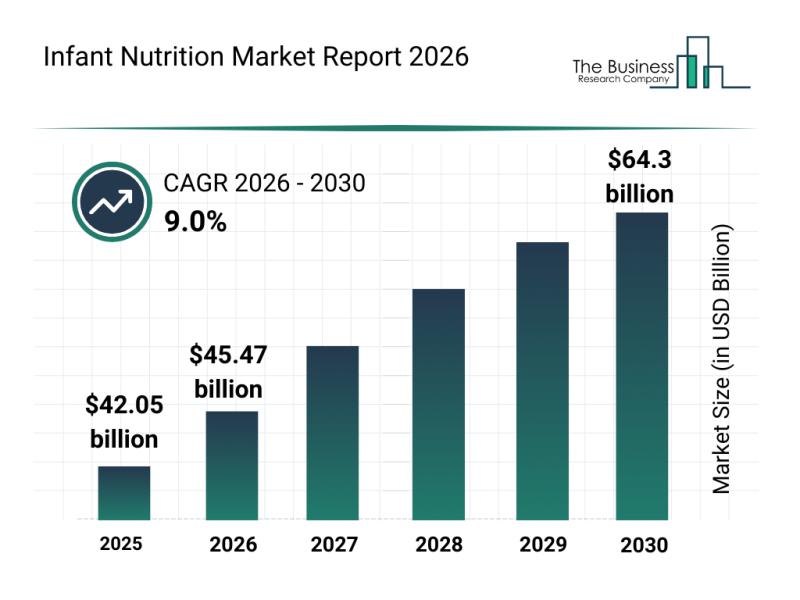

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

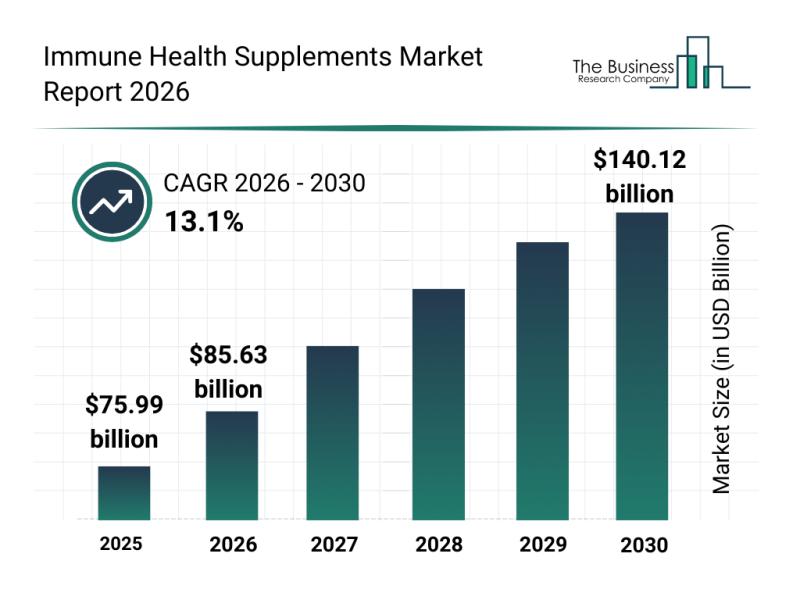

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

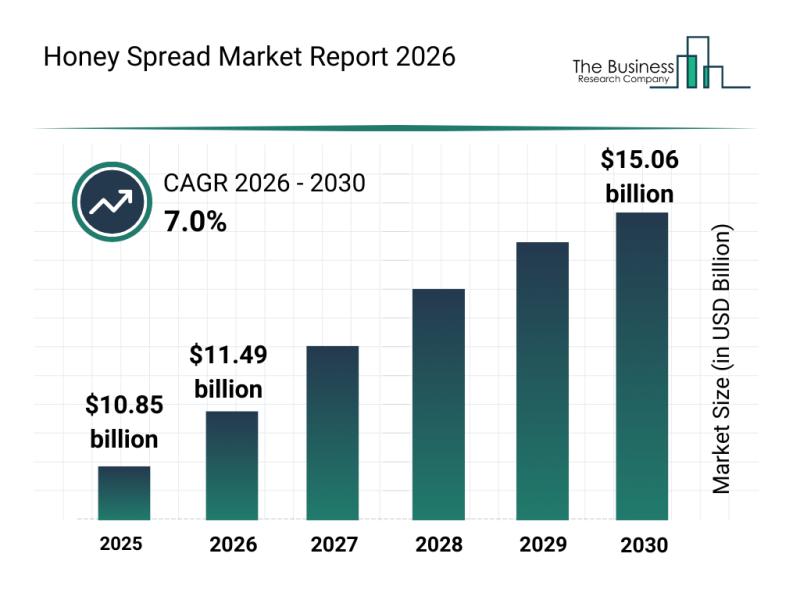

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…