Press release

Third Party Banking Software Market to Witness Stunning Growth | Major Giants Deltek, Sage Group, COA Solutions

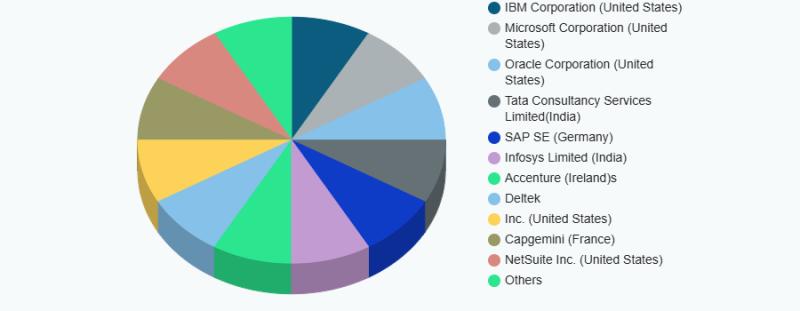

HTF Market Insights recently introduced Global Third Party Banking Software Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market study's segmentation by important regions is speeding up the marketization process. Third Party Banking Software study is a perfect mix of qualitative and quantitative Market data collected and validated majorly through primary data and secondary sources.Key Players in This Report Include:

IBM Corporation (United States), Microsoft Corporation (United States), Oracle Corporation (United States), Tata Consultancy Services Limited(India), SAP SE (Germany), Infosys Limited (India), Deltek, Inc. (United States), Capgemini (France), NetSuite Inc. (United States) and Temenos (Switzerland), COA Solutions (United Kingdom), Epicor Software Corporation (United States), Exact Software (Netherlands), Infor (United States), Sage Group (United Kingdom)

Get a FREE Sample Report PDF 👉 https://www.htfmarketinsights.com/sample-report/2833488-third-party-banking-software-market

According to HTF Market Insights, the Global Third Party Banking Software market is expected to grow from 2 Billion USD in 2024 to 5 Billion USD by 2032, with a CAGR of 16% from 2025 to 2032.

The Third Party Banking Software Market is segmented by Types (Fraud Detection, Multi-currency, API, Data Analytics, Transaction Management), Application (Banking, Financial Services, E-commerce, Retail, Insurance) and by Geography (North America, South America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA).

Definition:

The industry segment focused on banking solutions developed by external vendors to help financial institutions manage core banking functions, digital payments, risk management, compliance, and customer relationships. These software solutions include core banking systems, online banking platforms, fraud detection tools, loan management systems, and API-driven banking services. Market growth is driven by the digital transformation of financial services, increasing demand for secure and scalable banking solutions, regulatory compliance requirements, and the adoption of cloud-based banking technologies. Key players include banking software providers, fintech companies, and enterprise IT service firms.

Dominating Region:

• North America

Fastest-Growing Region:

• Europe

Market Drivers:

Increasing Adoption Of Cloud-Based Techniques In Banking

Increase In Use Of Mobile And Online Banking

Market Trend:

Penetration Of Smartphone Users Globally

Restraints:

Data Privacy and Security Concerns

Opportunities:

Growing Demand For Standardized Activities In The Banking Sector

Increased Adoption Of Customer-Centric Core Banking

Challenges:

Cost Of Updating Legacy Systems to Automated Systems

Have a query? Market an enquiry before purchase 👉 https://www.htfmarketinsights.com/customize/2833488-third-party-banking-software-market

The market's titled segments and sub-sections are shown below:

Comprehensive evaluation of Third Party Banking Software market segments by Types: Fraud Detection, Multi-currency, API, Data Analytics, Transaction Management

In-depth evaluation of Third Party Banking Software market segments by Applications: Banking, Financial Services, E-commerce, Retail, Insurance

Geographically, the following regions' consumption, income, market share, and growth rate were thoroughly examined:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Buy Now Latest Edition of Third Party Banking Software Market Report 👉 https://www.htfmarketinsights.com/buy-now?report=2833488

Third Party Banking Software Market Research Objectives:

- Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

- To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

- To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

- To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

- To deliberately profile the key players and systematically examine their growth strategies.

PESTLE ANALYSIS and FIVE FORCES:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Get 10-25% Discount on Immediate purchase 👉 https://www.htfmarketinsights.com/request-discount/2833488-third-party-banking-software-market

Points Covered in Table of Content of Global Third Party Banking Software Market:

Chapter 01 - Third Party Banking Software Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Third Party Banking Software Market - Pricing Analysis

Chapter 05 - Global Third Party Banking Software Market Background or History

Chapter 06 - Global Third Party Banking Software Market Segmentation (e.g. Type, Application)

Chapter 07 - Key and Emerging Countries Analysis Worldwide Third Party Banking Software Market

Chapter 08 - Global Third Party Banking Software Market Structure & worth Analysis

Chapter 09 - Global Third Party Banking Software Market Competitive Analysis & Challenges

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Third Party Banking Software Market Research Methodology

We appreciate your interest in this article. You can also obtain separate chapters or report editions by area, such as North America, LATAM, Europe, Japan, Australia, or Southeast Asia.

Contact Us:

Nidhi Bhavsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Third Party Banking Software Market to Witness Stunning Growth | Major Giants Deltek, Sage Group, COA Solutions here

News-ID: 3916531 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Customized Food Gift Solutions Market Is Booming Worldwide | Major Giants Knack …

HTF MI just released the Global Customized Food Gift Solutions Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key Players in This Report Include:

Knack Shops, Godiva, Harry…

Adventure Water Sports Tourism Market Is Likely to Experience a Tremendous Growt …

HTF MI just released the Global Adventure Water Sports Tourism Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key Players in This Report Include:

Red Bull, GoPro, PADI,…

Precious Jewelry and Loose Diamonds Market: A Comprehensive Study Explores Huge …

HTF MI just released the Global Precious Jewelry and Loose Diamonds Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key Players in This Report Include:

De Beers, ALROSA,…

Gems & Jewelry Market Is Likely to Experience a Tremendous Growth in Near Future …

HTF MI just released the Global Gems & Jewelry Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key Players in This Report Include:

Chow Tai Fook, De Beers,…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…