Press release

WealthTech Solutions Market to Reach USD 17.83 Billion by 2030, Growing at 15.58% CAGR

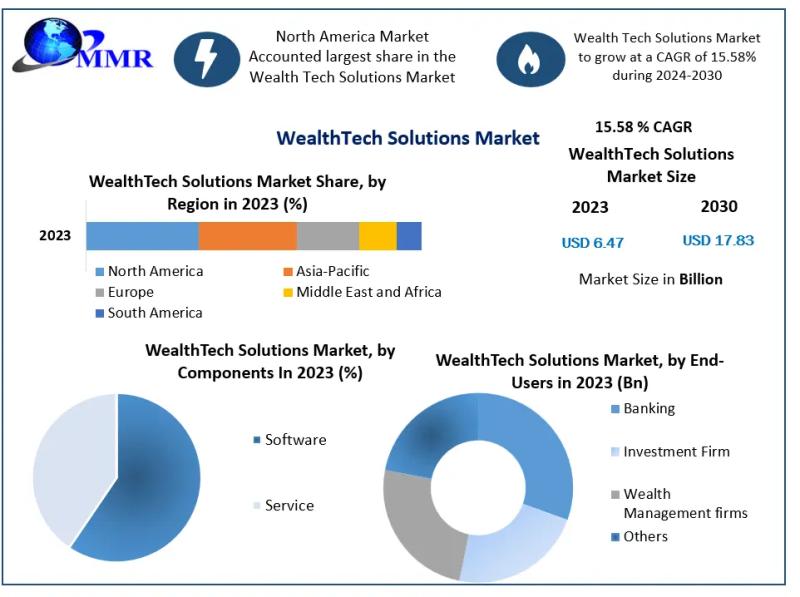

Press Release: WealthTech Solutions Market Poised for Remarkable Growth Across Global RegionsThe global WealthTech solutions market is experiencing unprecedented growth, driven by evolving customer preferences and rapid technological advancements. Valued at approximately $6.47 billion in 2023, the market is projected to reach $17.83 billion by 2030, exhibiting a robust Compound Annual Growth Rate (CAGR) of 15.58% during the forecast period.

To explore this subject matter further, please click on the link provided:

https://www.maximizemarketresearch.com/request-sample/167061/

Competitive Landscape and Regional Demand

The WealthTech landscape is characterized by a dynamic mix of established financial institutions and innovative startups. Companies such as Fiserv, Objectway, and SEI Investments are at the forefront, offering diverse solutions ranging from portfolio management to customer relationship management.

Regionally, the Asia-Pacific area is experiencing a surge in demand for WealthTech solutions, driven by a growing affluent population and increased digital adoption.

United States: WealthTech Growth and Consolidation

In the United States, the WealthTech sector is witnessing significant growth, propelled by technological innovation and a mature financial ecosystem. The market's expansion is further accelerated by strategic mergers and acquisitions, as firms seek to enhance their technological capabilities and expand their service offerings

For additional resources and details on this research, check out:

https://www.maximizemarketresearch.com/request-sample/167061/

Segmentation Analysis

by Deployment Type

1.Cloud

2.Premises

by Components

1.Software

2.Service

The wealthtech solution market is divided into solutions and services. In 2023, the solution segment dominated the market. The rapid adoption of automation solutions across industries is propelling the wealthtech solution forward. Many small consulting firms and major banks are recognizing new generation client expectations such as tech-enabled financial solutions, automatic rebalancing, and portfolio construction, and they are working on altering the industry by identifying inefficiencies throughout the financial services value chain.

by Organization Size

1.Large Enterprises

2.Small-Medium Size Enterprise

by End-Users

1.Banking

2.Investment Firm

3.Wealth Management firms

4.Others

Want a comprehensive Market analysis? Check out the summary of the research report :

https://www.maximizemarketresearch.com/market-report/wealthtech-solutions-market/167061/

Key Market Participants:

1. Acorns

2. Active Asset Allocation

3.Additiv

4.Advestis

5.Advisor Software

6. Advize

7. Aixigo

8.Albert

9.Allocare

10. Aspiration

11. BestInvest

12. Bitbond

13. Calastone

14. Comply Advantage

15.ComplySci

16.ComplySolutions

17. Delio

18.Digit

19.Drive Wealth

20.Elinvar

21.Ellevest

22. Estate Guru

23. Etoro

24.EQIS

25.Expersoft

26.Financeware

27. Tindeco

28. TrackInsight

29. Trade Republic

30.True Potential

31. TrueWealth

32. Valphi

33.Vestmark

34. Vestwell

35.VisualVest

36.Walnut

37.Wealtharc

Catch Up with Trending Topics:

Europe Blockchain Market :

https://www.maximizemarketresearch.com/market-report/europe-blockchain-market/2951/

Retail Media Networks Market :

https://www.maximizemarketresearch.com/market-report/retail-media-networks-market/147754/

Data Historian Market :

https://www.maximizemarketresearch.com/market-report/global-data-historian-market/63023/

Global B2B Telecommunication Market :

https://www.maximizemarketresearch.com/market-report/global-b2b-telecommunication-market/63857/

Loyalty Management Market:

https://www.maximizemarketresearch.com/market-report/global-loyalty-management-market/6878/

Contact Us:

MAXIMIZE Market RESEARCH PVT. LTD.

3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

About Us:

Maximize Market Research is one of the fastest-growing Market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release WealthTech Solutions Market to Reach USD 17.83 Billion by 2030, Growing at 15.58% CAGR here

News-ID: 3912638 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

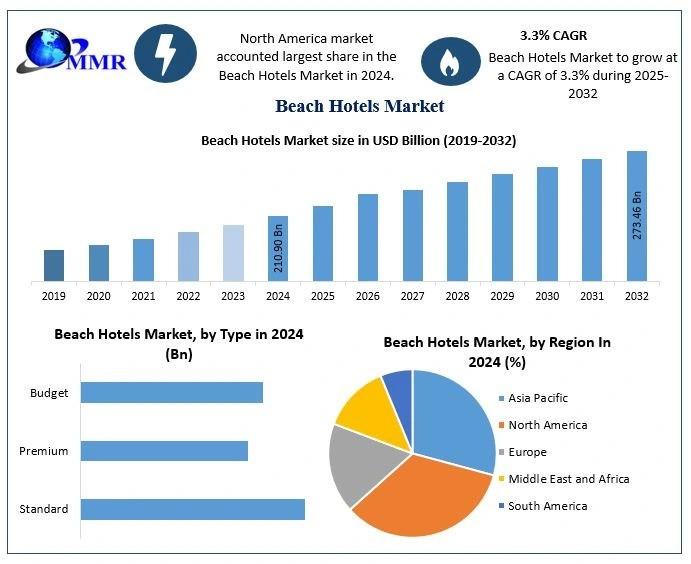

Beach Hotels Market Report Highlighting CAGR and Long-Term Revenue Growth

Beach Hotels Market size was valued at USD 210.90 Billion in 2024 and the total Beach Hotels revenue is expected to grow at a CAGR of 3.3% from 2025 to 2032, reaching nearly USD 273.46 Billion.

Beach Hotels Market Overview:

The beach hotels market represents a dynamic segment of the global hospitality industry, driven by rising leisure travel, experiential tourism, and demand for premium coastal accommodations. Beach hotels cater to a wide…

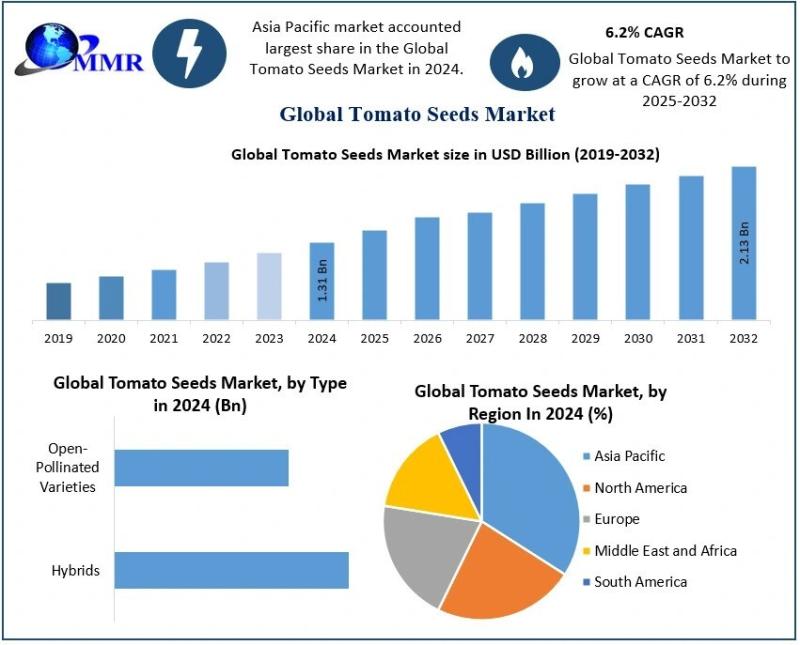

Tomato Seeds Market Growth Opportunities in Hybrid and Protected Cultivation

Tomato Seeds Market size was valued at USD 1.31 Billion in 2024 and the total Tomato Seeds revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 2.13 Billion.

Tomato Seeds Market Overview:

The tomato seeds market represents a vital segment of the global agricultural inputs industry, underpinning fresh produce supply chains, food processing industries, and commercial horticulture. Tomato seeds are used across open-field farming,…

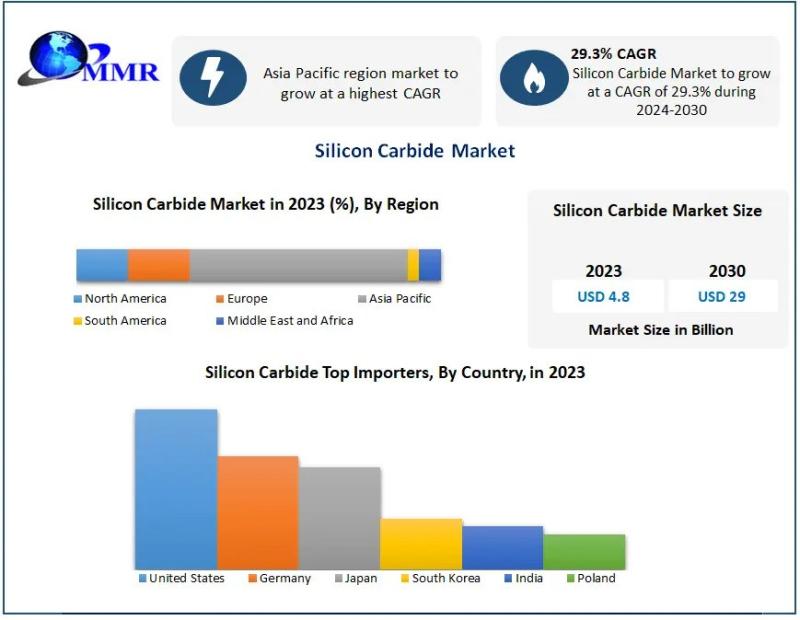

Silicon Carbide Market to Reach Nearly USD 29 Billion by 2030, Driven by Rapid G …

Silicon Carbide Market size was valued at USD 4.8 Bn. in 2023 and the total Silicon Carbide revenue is expected to grow by 29.3% from 2024 to 2030, reaching nearly USD 29 Bn.

Silicon Carbide Market Overview:

The silicon carbide market has emerged as a strategically important segment within advanced materials and semiconductor ecosystems, driven by its exceptional thermal conductivity, high breakdown voltage, and superior durability under extreme operating conditions. Silicon carbide…

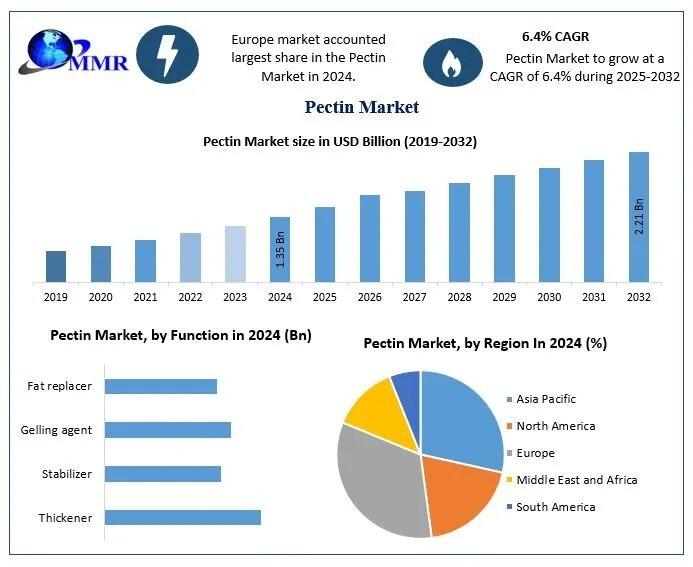

Pectin Market Outlook Improves with Increasing Use in Low-Sugar Formulations

Pectin Market size was valued at USD 1.35 Billion in 2024 and the total Pectin revenue is expected to grow at a CAGR of 6.4% from 2025 to 2032, reaching nearly USD 2.21 Billion.

Pectin Market Overview:

The pectin market occupies a strategic position within the global food ingredients and nutraceutical landscape, driven by its multifunctional role as a gelling, thickening, stabilizing, and texturizing agent. Pectin is primarily extracted from citrus peels…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…