Press release

Precious Metals Market Trajectory Indicates Growth to US$ 456 Bn by 2031 - Persistence Market Research

The global precious metals market is set to experience a steady expansion, projected to grow from US$313.5 Bn in 2024 to US$456 Bn by 2031, with a CAGR of 5.5% during the forecast period.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response):

https://www.persistencemarketresearch.com/samples/4343

Market Overview and Growth Outlook

The global market for precious metals continues to gain momentum, driven by a mix of industrial applications, investment interests, and technological advancements. These naturally occurring rare metallic elements hold significant economic value due to their luster, durability, and industrial utility.

Precious metals such as gold, silver, and platinum group metals (PGMs) serve dual purposes as both investment assets and industrial commodities. Gold and silver remain key players in jewelry and coinage, whereas PGMs like palladium, platinum, rhodium, and iridium find increasing applications in automotive, electronics, and aerospace industries.

Market Trends Fueling Growth

1. Technological Advancements and Industrial Applications: Innovations in electronics and renewable energy continue to boost demand for silver, platinum, and palladium.

2. Inflationary Pressures Driving Investment Demand: Rising inflation and economic uncertainties are encouraging investors to hedge wealth using precious metals, particularly gold and silver.

3. Demand Surge in Automotive Industry: The growing use of palladium and platinum in catalytic converters to meet stringent emission standards is accelerating market growth.

Key Drivers Supporting Market Expansion

Economic Indicators Influence the Demand for Precious Metals

Economic stability and central bank policies directly impact the demand for precious metals. A volatile economy, coupled with geopolitical tensions, prompts investors to shift towards safe-haven assets like gold and silver, which maintain their value over time.

Additionally, economic growth spurs demand for industrial commodities, including silver, platinum, and palladium, particularly in the electronics, automotive, and renewable energy sectors.

Diverse Industrial Applications in Multiple Sectors

Electronics: Silver, platinum, and palladium are critical in circuit boards, connectors, and electrodes used in consumer electronics such as smartphones, laptops, and televisions.

Automotive Manufacturing: Precious metals play a pivotal role in emission control systems. Catalytic converters in vehicles utilize platinum, palladium, and rhodium to curb harmful emissions.

Aerospace and Aviation: High-temperature-resistant and corrosion-proof properties of platinum and palladium make them indispensable in turbine blades, aircraft engines, and sensors.

Healthcare: Precious metals like gold and silver are widely used in medical equipment, dental fillings, and pharmaceutical applications due to their antibacterial properties.

Market Challenges Hindering Growth

Emergence of Substitute Materials

Advancements in materials science and technology pose a challenge to the market. Innovations in semiconductors may reduce the reliance on silver in electronics, while alternative catalysts could replace platinum and palladium in automotive applications.

Cost Efficiency of Alternatives: As substitutes become more affordable and accessible, industries may shift from precious metals to lower-cost alternatives, impacting market demand.

Fluctuating Currency Strength

The value of major currencies, particularly the US dollar, influences the pricing of precious metals. A stronger dollar makes these commodities expensive for foreign buyers, thereby affecting global demand and market stability.

Investors often turn to gold and silver when currency values fluctuate, as they provide a hedge against inflation and economic downturns.

Future Opportunities for Market Players

Global Transition Towards Green Economy

The increasing emphasis on sustainability is opening new avenues for precious metals, particularly in clean energy technologies and energy-efficient appliances.

Silver in Solar Panels: Due to its superior conductivity, silver is a vital component in photovoltaic cells used in solar panels.

Platinum and Palladium in Hydrogen Fuel Cells: These metals are crucial for fuel cell technology, aiding in the development of alternative energy solutions.

Inflation Hedge & Growing Investment Appeal

Amid economic uncertainties, central banks and investors are turning to precious metals to safeguard wealth. Gold-backed exchange-traded funds (ETFs) and futures contracts continue to see strong inflows, creating lucrative opportunities for market participants.

Rising Demand for Safe-Haven Assets

Geopolitical tensions and volatile financial markets are pushing investors toward gold and silver as reliable assets for wealth preservation. The historic reputation of precious metals as a store of value ensures sustained interest from global investors.

Category-Wise Market Insights

Gold Remains the Dominant Category

Gold continues to lead the precious metals segment due to its stability, liquidity, and cultural significance. Central banks, financial institutions, and retail investors contribute to the strong demand.

The rising purchasing power of consumers in emerging economies, particularly in Asia Pacific, further bolsters gold sales for jewelry and investment purposes.

Regional Insights

Asia Pacific Leads the Market

Asia Pacific emerges as both the largest producer and consumer of precious metals, driven by strong demand in China and India. Increasing disposable incomes and industrial advancements are key contributors to regional growth.

India & China: These countries account for substantial gold consumption due to cultural traditions, investment preferences, and industrial applications.

Future Growth: Expanding industrial activities and urbanization in emerging economies like India and China will continue driving demand for precious metals in the coming years.

Competitive Landscape

The market is characterized by intense competition among mining companies focusing on resource exploration, production efficiency, and cost management. Sustainable mining practices and technological advancements remain key differentiators among players.

Companies are investing in advanced refining processes to enhance product quality and reduce environmental impact, gaining a competitive edge.

Leading Companies in the Global Precious Metals Market

Barrick Gold

First Quantum Minerals

Goldcorp Freeport McMoRan Copper & Gold Inc.

Gold Fields Limited

Gabriel Resources Limited

Lundin Mining

GlencoreXstrata

Harmony Gold Mining Company Limited

Market Segmentation

By Application:

Jewelry

Investments

Industrial

Others

By Type:

Gold

Silver

Platinum Group Metals

By Region:

North America

Europe

Asia Pacific

Latin America

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 25.92, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Precious Metals Market Trajectory Indicates Growth to US$ 456 Bn by 2031 - Persistence Market Research here

News-ID: 3911551 • Views: …

More Releases from Persistence Market Research

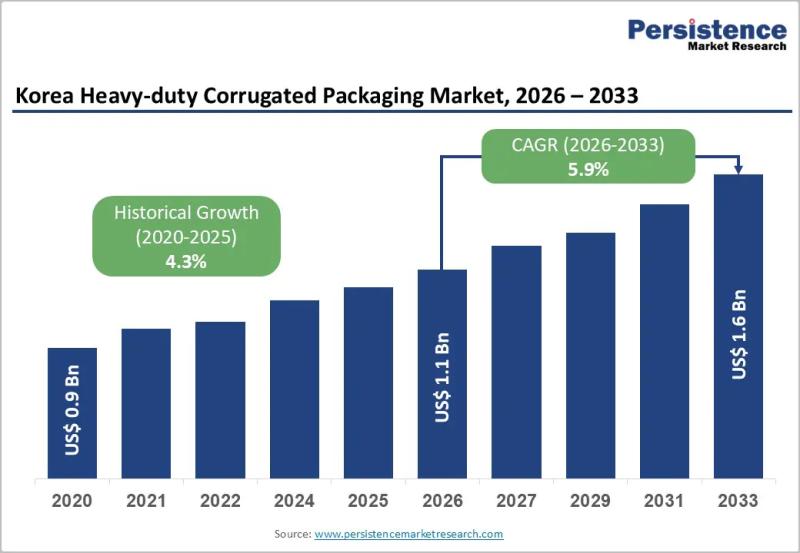

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Gold

Gold Concentrate Market Is Going to Boom | Major Giants - Barrick Gold, Gold Fie …

HTF MI just released the Global Gold Concentrate Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered:

Barrick Gold (CAN), Newmont (US), AngloGold Ashanti…

Gold Mining Market - Key Players & Qualitative Insights 2025 | Gold Corp, Barric …

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…

Global Gold Mining Market to 2025: Newmont Mining, Gold Reserve, Royal Gold, Hom …

Researchmoz added Most up-to-date research on "Global Gold Mining Market Insights, Forecast to 2025" to its huge collection of research reports.

This report researches the worldwide Gold Mining market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global Gold Mining breakdown data by manufacturers, region, type and application, also analyzes the market status, market share, growth…

Gold Metals Market Demands with Major Quality Things: Pure Gold, Mixed Color Gol …

Gold Metals Market By Product (Pure Gold, Mixed Color Gold, Color Gold and Other Products) and Application (Luxury Goods, Automotive, Electronics and Other Applications) - Global Industry Analysis And Forecast To 2025.

Industry Outlook:

The gold is an element having the symbol Au (from the Latin name: aurum) and the atomic number been 79, making it the element with higher atomic number that happen normally. In the most pure form, it is…

Gold Mining Market Highlights On Product Demand 2025 | Gold Corp, Barrick Gold

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…

Gold Mining Market - Heightened demand 2025 | Gold Corp, Barrick Gold

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…