Press release

The Future of Transactions: How Mobile Payment Technologies Are Revolutionizing the Digital Economy

Innovation remains at the core of Digital Wallets Market success, driving growth and customer engagement. Mobile Payment Technologies Market continuously invests in research and development to stay ahead of industry changes. By leveraging advanced technology, Contactless Payment Solutions Market enhances its solutions to meet consumer expectations. The strategic approach of Mobile Payment Technologies Market ensures that new products and services remain competitive. Mobile Payment Technologies Market remains a pioneer, delivering top-tier solutions with innovative strategies.Mobile Commerce Market plays a crucial role in shaping global market trends through its dynamic approach. The influence of Mobile Payment Technologies Market extends across industries, inspiring growth and development. Companies look to Smartphone Payment Systems Market as a benchmark for success, recognizing the brand's leadership. By staying updated with consumer needs, Mobile Payment Technologies Market maintains its strong position. The adaptability of Cashless Transaction Market ensures continued influence in shaping industry patterns.

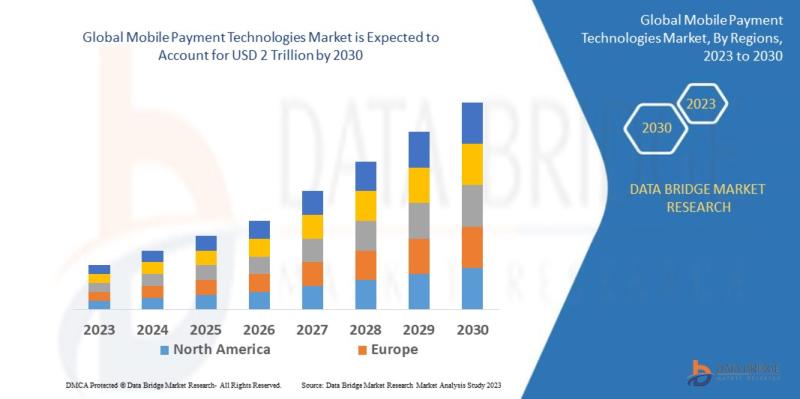

Our comprehensive Mobile Payment Technologies Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://www.databridgemarketresearch.com/reports/global-mobile-payment-technologies-market

**Segments**

- By Payment Mode: NFC, SMS, Wireless Application Protocol (WAP)

- By Type of Mobile Payment: Peer-to-Peer Transfer, M-commerce, Prepaid Mobile Wallet, Mobile Banking

- By End User: Personal, BFSI, Retail, Telecom & IT, Healthcare, Transportation, Others

The global mobile payment technologies market is segmented based on various criteria to provide a detailed analysis of the industry. One key segmentation is by payment mode, including Near Field Communication (NFC), SMS, and Wireless Application Protocol (WAP). NFC technology allows secure communication between devices within a close proximity, enabling contactless payments. SMS-based transactions involve payment processing through text messages, while WAP facilitates transactions through a wireless network. Another crucial segmentation is by the type of mobile payment, such as Peer-to-Peer Transfer, M-commerce, Prepaid Mobile Wallet, and Mobile Banking. Peer-to-Peer Transfer allows individuals to send money directly to each other, while M-commerce involves purchasing goods and services through mobile devices. Prepaid mobile wallets store funds for online transactions, and mobile banking enables banking services through mobile applications. Additionally, the market is segmented by end-users, including personal consumers, BFSI (Banking, Financial Services, and Insurance) companies, retail businesses, telecom & IT sectors, healthcare organizations, transportation companies, and others.

**Market Players**

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Alphabet Inc.

- PayPal Holdings, Inc.

- Visa Inc.

- Mastercard

- American Express Company

- Alipay.com

- Tencent

- Square, Inc.

Several key players dominate the global mobile payment technologies market, contributing to its growth and innovation. Apple Inc., known for its Apple Pay service, offers secure and convenient mobile payment solutions for its users. Samsung Electronics Co. Ltd. provides Samsung Pay, a mobile payment platform that works with NFC and MST (Magnetic Secure Transmission) technologies. Alphabet Inc., the parent company of Google, offersThe global mobile payment technologies market is experiencing significant growth and innovation, with key players such as Apple Inc., Samsung Electronics Co. Ltd., and Alphabet Inc. leading the way. Apple Inc., with its Apple Pay service, has revolutionized the mobile payment landscape by offering a secure and convenient payment solution for its vast user base. Samsung Electronics Co. Ltd., on the other hand, has made a mark with its Samsung Pay platform, which utilizes NFC and MST technologies to enable seamless transactions. Alphabet Inc., the parent company of Google, has also made strides in the mobile payment industry with Google Pay, providing users with a simple and secure way to make payments online and in-store.

In addition to these tech giants, other major players in the global mobile payment technologies market include PayPal Holdings, Inc., Visa Inc., Mastercard, American Express Company, Alipay.com, Tencent, and Square, Inc. PayPal is a renowned player in the digital payment sector, offering a range of services that include mobile payments for both online and offline transactions. Visa Inc. and Mastercard are leading payment processing companies that have expanded their services to cater to the growing demand for mobile payments. American Express Company is also a significant player in the market, known for its premium card services and innovative payment solutions.

Alibaba's Alipay.com and Tencent are two Chinese tech giants that have captured a significant market share in the mobile payment industry. Alipay.com, owned by Alibaba Group, is a widely used mobile payment platform in China, offering a variety of financial services to users. Tencent, known for its messaging app WeChat, has integrated payment services into its platform, allowing users to make seamless mobile transactions within the app. Square, Inc., founded by Jack Dorsey of Twitter fame, offers Square Cash, a mobile payment app that facilitates peer-to-peer transactions.

Moreover, the ongoing digital transformation across various industries has led to increased adoption of mobile payment technologies. The BFSI sector is leveraging mobile payments to offer convenient banking services to customersThe global mobile payment technologies market has been witnessing significant growth, driven by the increasing adoption of smartphones, advancements in digital technology, and changing consumer preferences towards cashless transactions. The segmentation of the market based on payment modes, types of mobile payments, and end-users has provided a comprehensive view of the diverse applications and services offered by mobile payment technology providers.

Near Field Communication (NFC) technology has emerged as a popular payment mode, enabling secure and contactless transactions between devices in close proximity. NFC technology is widely used in mobile wallets and payment solutions offered by companies like Apple Inc. and Samsung Electronics Co. Ltd. SMS-based transactions and Wireless Application Protocol (WAP) have also seen adoption, especially in regions with limited access to internet connectivity or where traditional banking infrastructure is lacking.

In terms of types of mobile payments, Peer-to-Peer transfers have gained popularity for their convenience in sending money between individuals without the need for physical cash. M-commerce, or mobile commerce, has seen exponential growth with the rise of e-commerce platforms optimized for mobile devices. Prepaid mobile wallets offer a secure way to store funds for online transactions, while mobile banking services provide users with access to banking services on their smartphones.

Key Questions Answered by the Global Mobile Payment Technologies Market Report:

What is the current state of the Mobile Payment Technologies Market, and how has it evolved?

What are the key drivers behind the growth of the Mobile Payment Technologies Market?

What challenges and barriers do businesses in the Mobile Payment Technologies Market face?

How are technological innovations impacting the Mobile Payment Technologies Market?

What emerging trends and opportunities should businesses be aware of in the Mobile Payment Technologies Market?

Browse More Reports:

https://dbmrwebmarketing.blogspot.com/2025/02/luxury-activewear-market-growth-drivers.html

https://dbmrwebmarketing.blogspot.com/2025/02/acrylic-emulsions-market-growth-drivers.html

https://dbmrwebmarketing.blogspot.com/2025/02/water-filters-market-challenges-growth.html

https://dbmrwebmarketing.blogspot.com/2025/02/horticulture-lighting-market-insights.html

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Future of Transactions: How Mobile Payment Technologies Are Revolutionizing the Digital Economy here

News-ID: 3910162 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

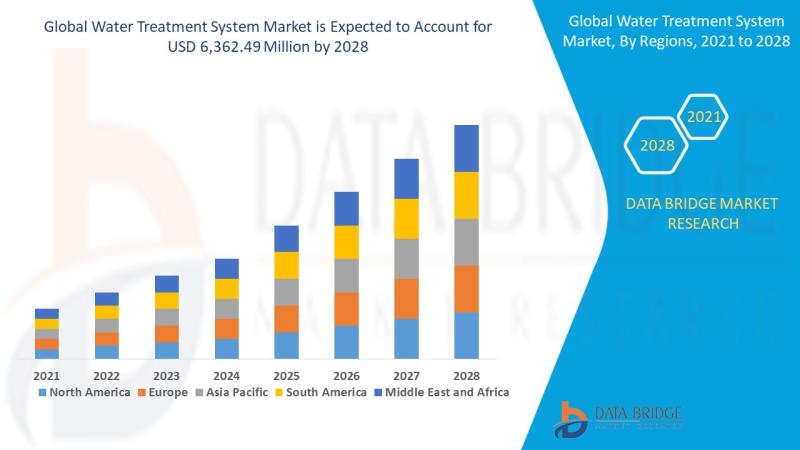

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…