Press release

Wealth management firms are increasingly offering hybrid services, including standardized and personalized advice, to their clients globally. The need for standardization and personalization of advice mainly arises due to the growing demand for consistent

What market dynamics are playing a key role in accelerating the growth of the investments market?A lot of wealth management firms are now leveraging big data analytics to illuminate insights that can enhance their service offerings, therefore augmenting their revenue streams. The purpose of implementing these big data solutions is to provide clarity around various factors such as client segments, product penetration, and the effectiveness of training programs. These technologies are being utilized to evaluate both current and potential clients' propensity to buy different products and services offered by a wealth management organization, their lifetime worth, investment trends, and their capacity to handle risks. These tools are proving beneficial for wealth management firms in monitoring their business performance, improving their client acquisition and retention rates, boosting their sales, and providing instantaneous investment advice. To illustrate, CargoMetrics, a Boston-based investment company, employed the Automatic Identification System (AIS), for tracking data on commodity movement such as cargo location and cargo size, which was used to create an analytics platform for trading commodities, currencies, and equity index funds. This tool was later marketed to other hedge funds and wealth managers.

Get Your Investments Market Report Here:

https://www.thebusinessresearchcompany.com/report/investments-global-market-report

How will the growth rate of the investments market shape industry trends by 2034?

The market size for investments has witnessed remarkable expansion in the preceding years. It is projected to progress from $4147.38 billion in 2024 to $4447.99 billion in 2025, with a compound annual growth rate (CAGR) of 7.2%. The significant growth during the historical timeframe can be credited to factors such as high inflation rates, economic prosperity, global events, business profits, government regulations, and commodity prices.

The market for investments is projected to experience substantial expansion in the years to come, reaching a market value of $5912.89 billion in 2029. This corresponds to a compound annual growth rate (CAGR) of 7.4%. The predicted growth during this forecast period can be ascribed to factors like sustainable investing, evolution of digital currencies, fluctuations in global trade, changes in regulatory policies, and increased concerns about cybersecurity. Key trends expected to prevail in this period involve the widespread use of robo-advisors, investments in private equity and venture capital, real asset and infrastructure investments, application of artificial intelligence in devising investment strategies, and diversification of investment portfolios.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=1888&type=smp

What trends are poised to drive the future success of the investments market?

There is a growing trend among global wealth management companies to provide hybrid services, encompassing both standardized and tailor-made advice, to their clients. This evolving need for uniformity and customization in advice provision primarily stems from consumers' escalating demand for reliable and consistent solutions. Consequently, these wealth management firms are leveraging computer-generated analysis for delivering standardized consulting services, alongside ensuring precision in their provision through customized solutions.

Which primary segments of the investments market are driving growth and industry transformations?

The investments market covered in this report is segmented -

1) By Type: Wealth Management, Securities Brokerage And Stock Exchange Services, Investment Banking

2) By Mode: Online, Offline

3) By End User: B2B, B2C

Subsegments:

1) By Wealth Management: Private Wealth Management, Portfolio Management, Financial Planning, Estate Planning

2) By Securities Brokerage And Stock Exchange Services: Full-Service Brokerage, Discount Brokerage, Online Trading Platforms, market Making Services

3) By Investment Banking: Mergers And Acquisitions Advisory, Equity Capital markets Underwriting, Debt Capital markets Underwriting, Financial Advisory Services

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=1888

Which geographical regions are pioneering growth in the investments market?

Western Europe was the largest region in the investments market in 2024. North America was the second-largest region in the investments market. The regions covered in the investments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Who are the influential players reshaping the investments market landscape?

Major companies operating in the investments market include Berkshire Hathaway Inc., Industrial and Commercial Bank of China (ICBC), JPMorgan Chase & Co., Bank of America Corporation, Legal & General Group plc, Citigroup Inc., INTL FCStone Inc., MORGAN STANLEY & Co. Inc., Goldman Sachs Group Inc., UBS Group AG, Fidelity Investments, Charles Schwab Corporation, Bank of New York Mellon Corporation, BlackRock Inc., Ameriprise Financial Inc., State Street Corporation, Raymond James Financial Inc., Vanguard Group Inc., Franklin Resources Inc., Jefferies Financial Group Inc., Northern Trust Corporation, T. Rowe Price Group Inc., Invesco Ltd., Evercore Inc., Lazard Ltd., Affiliated Managers Group Inc., E*TRADE Financial Corporation, Houlihan Lokey Inc., PJT Partners Inc., Moelis & Company, CNP Assurances

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/customise?id=1888&type=smp

What Is Covered In The Investments Global Market Report?

•Market Size Forecast: Examine the investments market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the investments market for a structured understanding.

•Key Players Overview: Analyze major players in the investments market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the investments market.

•Segment Contributions: Evaluate how different segments drive overall growth in the investments market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the investments market.

•Industry Challenges: Identify potential risks and obstacles affecting the investments market.

•Competitive Landscape: Review strategic developments in the investments market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wealth management firms are increasingly offering hybrid services, including standardized and personalized advice, to their clients globally. The need for standardization and personalization of advice mainly arises due to the growing demand for consistent here

News-ID: 3908648 • Views: …

More Releases from The Business Research Company

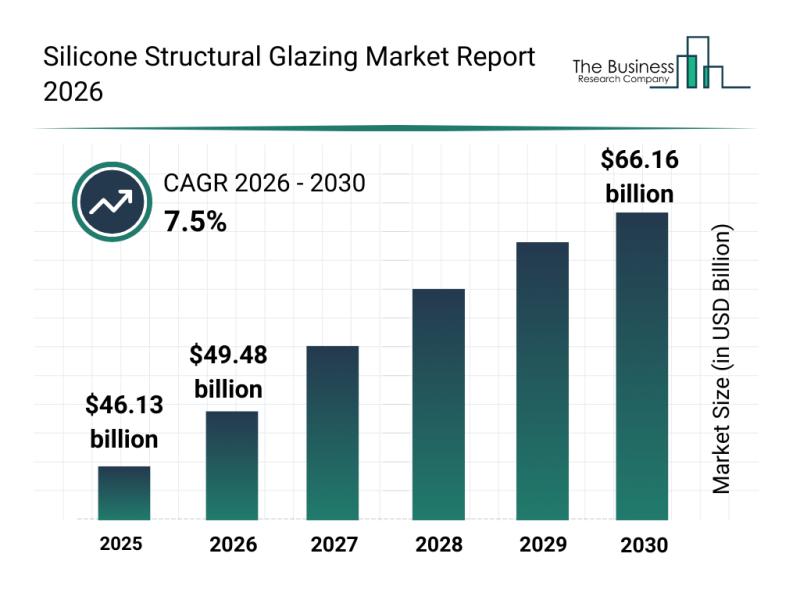

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

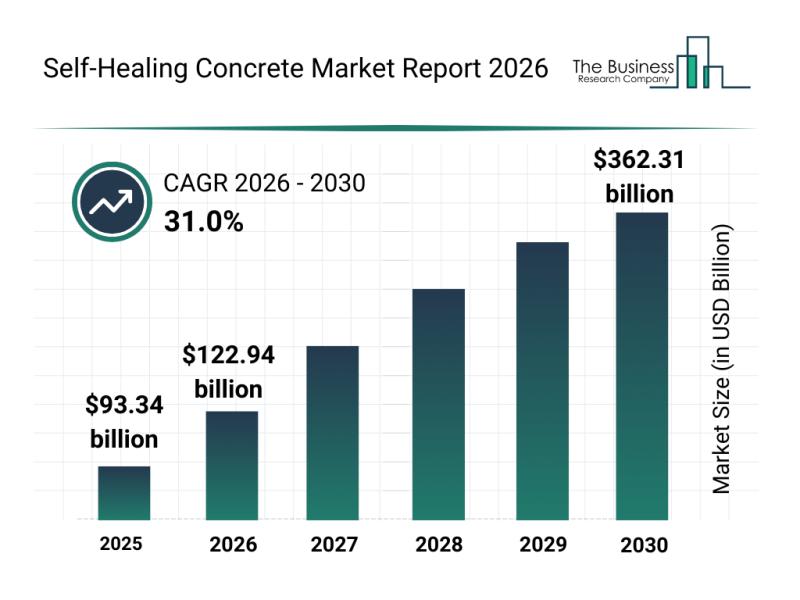

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

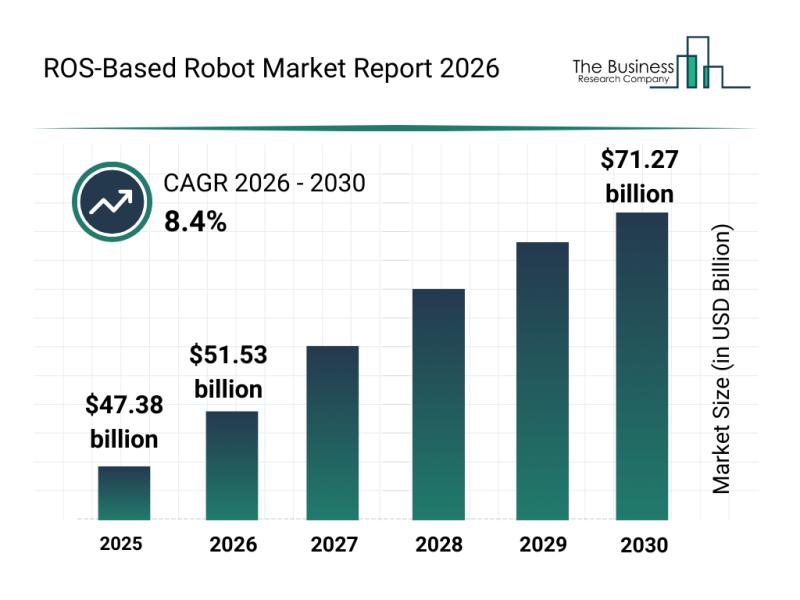

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

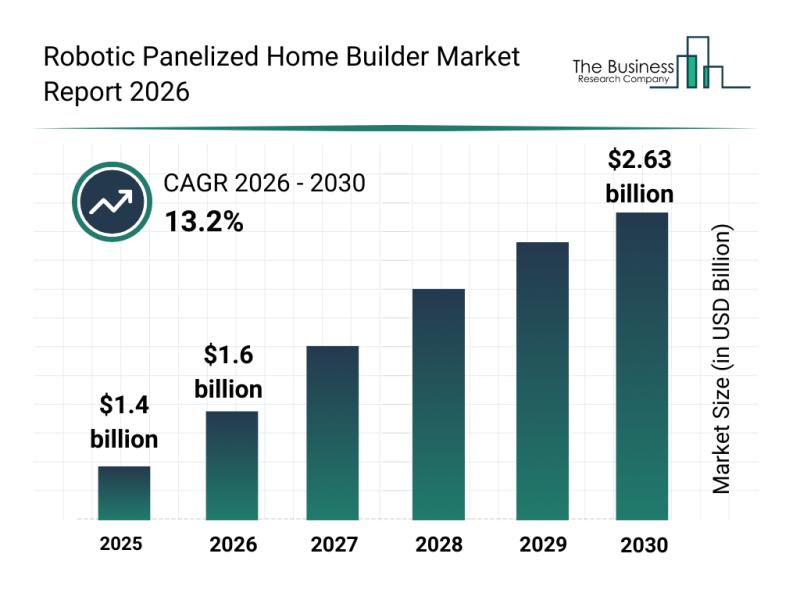

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Investment

ST Investment Co., Ltd: Pioneering the Global Investment Trend

Since its establishment in 2017 in the United Kingdom, ST Investment Co., Ltd has rapidly emerged as a shining star in the global investment sector. Through its diversified business portfolio and exceptional financial services, the company provides a comprehensive wealth growth platform for clients worldwide. Its services span key sectors such as artificial intelligence-based smart contracts, private equity, gold investments, and wealth management, all aimed at delivering stable and diverse…

Lakshmishree Investment: Common Investment Mistakes When Markets Are High

One big mistake many investors make is taking too much risk because they fear missing out.

Stock markets around the world are on fire! From the bustling streets of Wall Street to the vibrant Bombay Stock Exchange (BSE), markets are scaling new highs, leaving many investors excited and bewildered. While this bull run is thrilling, it can also be confusing. Should you jump in and buy more? Hold on tight…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

China Investment Bank, China Investment Consultant, China Investment Corporation …

Pandacu is a company that specializes in cross-border investment in China. The company was founded in china and has since grown to become one of the leading cross-border investment firms in China. Pandacu offers a wide range of services to its clients, including investment advisory, market research, due diligence, and post-investment support.

http://pandacuads.com/

Investment banking consultant

Email:nolan@pandacuads.com

Cross-border investment in China can be a complex and challenging process, as the country has a unique…

Trident Steels - Investment Casting, Stainless Steel Investment Casting, Steel I …

With decades of experience in this industry, we have become the preferred partner for global companies who look for high-end metal casting manufacturing from India. Our investment casting company in India offers best-in-class quality products and services to our customers. We are a customer-centric company and invest in our people, processes, and technology to provide high-quality products every time. This has helped us to become the preferred partner for companies…

Investment Management Market Growth Improvement Highly Witness | NWQ Investment …

Investment management is designed to help investors or owners to recognize, manage, and communicate the performance and risks of assets and related investments. As an alternative to spending time pursuing data and manually creating reports, fund managers, owners, and operators can focus on maximizing performance.

Investment Management market size is expected to grow at a compound annual growth rate of xx% for the forecast period of 2021 to 2028.

Market IntelliX report…