Press release

Global Freight Marine Lability Insurance Market to Reach $41.7 Billion by 2029, Growing at 4.3% CAGR

What market dynamics are playing a key role in accelerating the growth of the freight marine lability insurance market?The surge in natural disasters is predicted to spur the freight marine liability insurance market's expansion. These calamities, which stem from earth's biological phenomena like earthquakes, hurricanes, floods, or wildfires, inflict extensive harm on living beings, property, and the environment. To help shipping companies safeguard against potential losses from natural catastrophes incurred during sea-borne goods transport, freight marine liability insurance is employed. It helps cover costs related to damage to cargo, ships, and third parties, thus lessening the brunt of natural disasters on the maritime industry. For instance, in January 2024, the National Centers for Environmental Information (NCEI), a US-based governmental entity that oversees a global archive of atmospheric, coastal, geophysical, and oceanic data, reported that in 2023, there were 28 weather-related and climate crisis events, surpassing the former record of 22 from 2020, with an incurred minimum cost of $92.9 billion. Therefore, the increasing frequency of natural disasters is the propelling force behind the growth of the freight marine liability insurance market.

Get Your Freight Marine Lability Insurance Market Report Here:

https://www.thebusinessresearchcompany.com/report/freight-marine-lability-insurance-global-market-report

How will the growth rate of the freight marine lability insurance market shape industry trends by 2034?

The market size of freight marine liability insurance has witnessed a robust growth in the past few years. The market is predicted to expand from $33.36 billion in 2024 to $35.22 billion in 2025, reflecting a compound annual growth rate (CAGR) of 5.6%. This substantial growth during the historic period can be credited to factors such as performance optimization, player analytics, fan engagement, injury prevention, and data-centric decision-making processes.

The market size for marine freight liability insurance is anticipated to experience consistent growth in the coming years. Its growth is projected to reach $41.7 billion in 2029, exhibiting a compound annual growth rate (CAGR) of 4.3%. Factors contributing to the growth throughout this forecast period include progress in computer vision, bespoke training initiatives, real-time decision-making support, enhancing fan experiences, and worldwide sports events. Key trends expected during the forecast period encompass integration with nascent technologies, tech progress in wearable devices, opportunities for sponsorship and revenue, prevention and rehabilitation of injuries, and the incorporation of wearable tech.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=13664&type=smp

What new trends are reshaping the freight marine lability insurance market and its opportunities?

Major enterprises involved in the marine freight liability insurance sector are concentrating on offering revolutionary insurance products, such as personalized marine general liability insurance coverages. This kind of insurance provides full protection for businesses engaged in maritime commerce. For instance, Axa XL, an insurance firm based in the US, introduced a custom marine general liability insurance coverage specifically designed for marine artisans in the US in December 2023. This new offering aims to safeguard marine artisans who are employed as contractors for building, maintaining, and repairing boats. In addition, their product line includes inland marine, ocean freight, blue and brown water hulls, protection and indemnity, and secondary and primary marine liabilities.

Which primary segments of the freight marine lability insurance market are driving growth and industry transformations?

The freight marine lability insurance market covered in this report is segmented -

1) By Policy Type: Time Policy, Voyage Policy, Floating Policy, Valued Policy, Others

2) By Insurance Coverage: Loss Or Damage, Fire Or Explosion, Natural Calamity, Others

3) By Premium Type: Large market, Middle market, Small market

Subsegments:

1) By Time Policy: Annual Policies, Multi-Year Policies

2) By Voyage Policy: Single Voyage Policies, Specific Route Policies

3) By Floating Policy: Open Cover Policies, Master Policies

4) By Valued Policy: Fixed Value Policies, Agreed Value Policies

5) By Others: Combined Policies, Custom Policies Based On Specific Needs

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=13664

Which geographical regions are pioneering growth in the freight marine lability insurance market?

Europe was the largest region in the freight marine lability insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the freight marine lability insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Who are the influential players reshaping the freight marine lability insurance market landscape?

Major companies operating in the freight marine lability insurance market report are Berkshire Hathaway Inc., Ping An Insurance, Allianz SE, Axa S.A., Assicurazioni Generali SpA, State Farm Mutual Automobile Insurance Company, Reliance Nippon Life Insurance Company Limited, Nationwide Mutual Insurance Company, American International Group Inc., Tokio Marine Group, Allstate Insurance Company, Liberty Mutual Insurance Company, Chubb Limited, Zurich Insurance Group Ltd., Travelers Indemnity Company, Intact Insurance Company, The Hartford Financial Services Group Inc., Aviva PLC, Marsh & McLennan Companies Inc., Markel Corporation, Pacific Life Insurance Company, Aon PLC, HDI Global SE, Arthur J. Gallagher & Co., Beazley Group, Aspen Insurance Holdings Limited, RLI Corp, Swiss Re Ltd., United India Insurance Co. Ltd.,

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/sample.aspx?id=13664&type=smp

What Is Covered In The Freight Marine Lability Insurance Global Market Report?

• Market Size Forecast: Examine the freight marine lability insurance market size across key regions, countries, product categories, and applications.

• Segmentation Insights: Identify and classify subsegments within the freight marine lability insurance market for a structured understanding.

• Key Players Overview: Analyze major players in the freight marine lability insurance market, including their market value, share, and competitive positioning.

• Growth Trends Exploration: Assess individual growth patterns and future opportunities in the freight marine lability insurance market.

• Segment Contributions: Evaluate how different segments drive overall growth in the freight marine lability insurance market.

• Growth Factors: Highlight key drivers and opportunities influencing the expansion of the freight marine lability insurance market.

• Industry Challenges: Identify potential risks and obstacles affecting the freight marine lability insurance market.

• Competitive Landscape: Review strategic developments in the freight marine lability insurance market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Freight Marine Lability Insurance Market to Reach $41.7 Billion by 2029, Growing at 4.3% CAGR here

News-ID: 3908412 • Views: …

More Releases from The Business Research Company

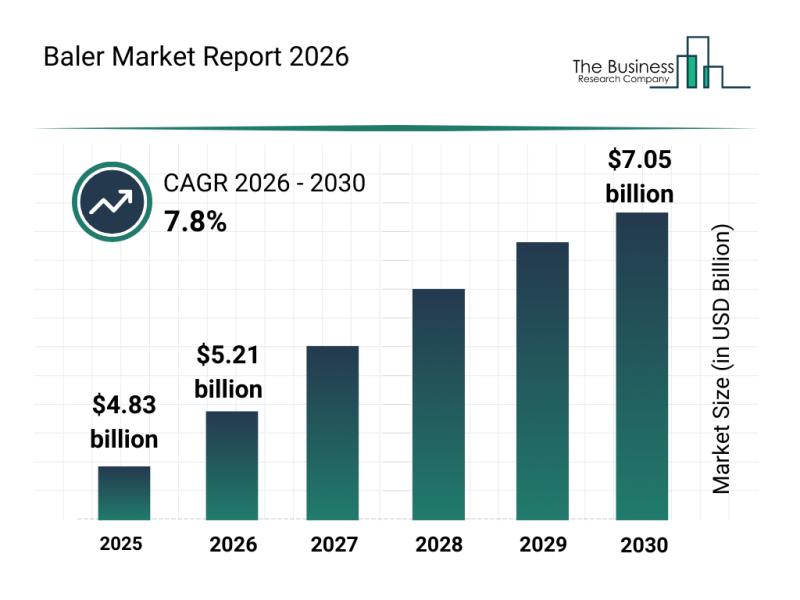

Baler Market Overview: Major Segments, Strategic Developments, and Leading Compa …

The baler market is set to experience significant expansion over the coming years, driven by technological advancements and increasing demand across various sectors. This growth is fueled by innovations in machinery and a broader adoption of smart farming techniques, which together promise to reshape the industry landscape by 2030.

Baler Market Size Expected to Expand Rapidly Through 2030

The baler market is projected to grow steadily, reaching a valuation of $7.05…

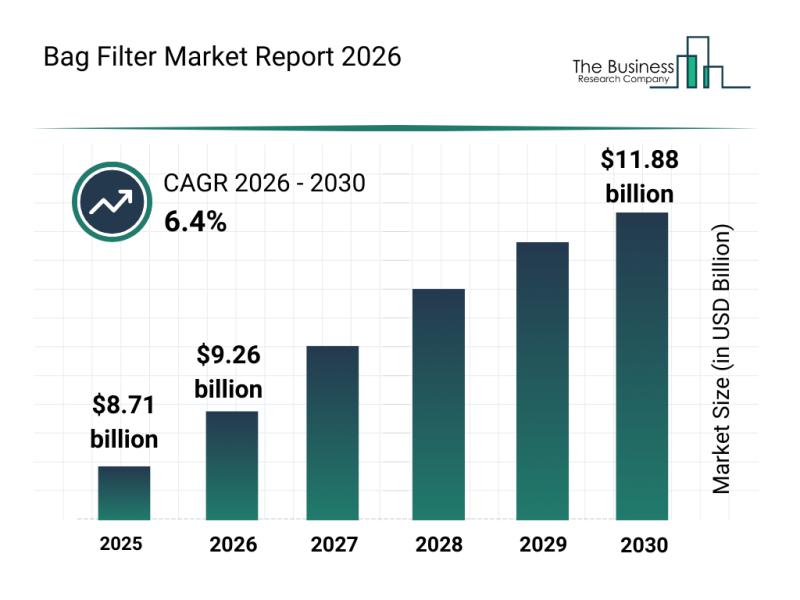

Segmentation, Major Trends, and Competitive Overview of the Bag Filter Market

The bag filter market is on track for significant expansion in the coming years, driven by various environmental and industrial factors. As industries adopt stricter pollution control measures and embrace sustainable practices, the demand for efficient filtration solutions is expected to rise steadily. This overview will explore the market size, key players, influential trends, and segmentation that define the current and future state of the bag filter industry.

Forecasted Market Size…

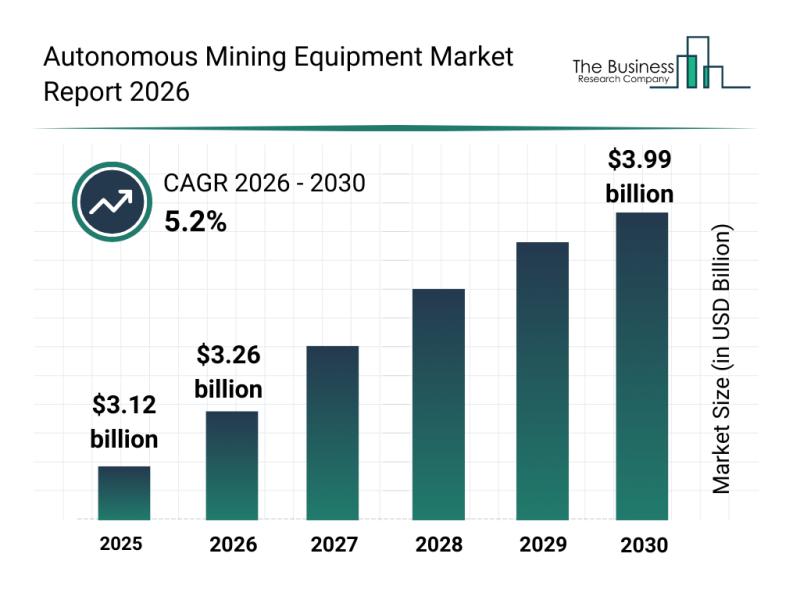

Leading Companies Fueling Innovation and Growth in the Autonomous Mining Equipme …

The autonomous mining equipment sector is on the cusp of significant expansion, driven by technological advancements and rising operational demands. As mining companies increasingly embrace automation and digital solutions, the market is poised for steady growth with promising opportunities ahead.

Forecasted Market Size Growth for Autonomous Mining Equipment by 2030

The autonomous mining equipment market is projected to grow substantially, reaching a valuation of $3.99 billion by 2030. This reflects a…

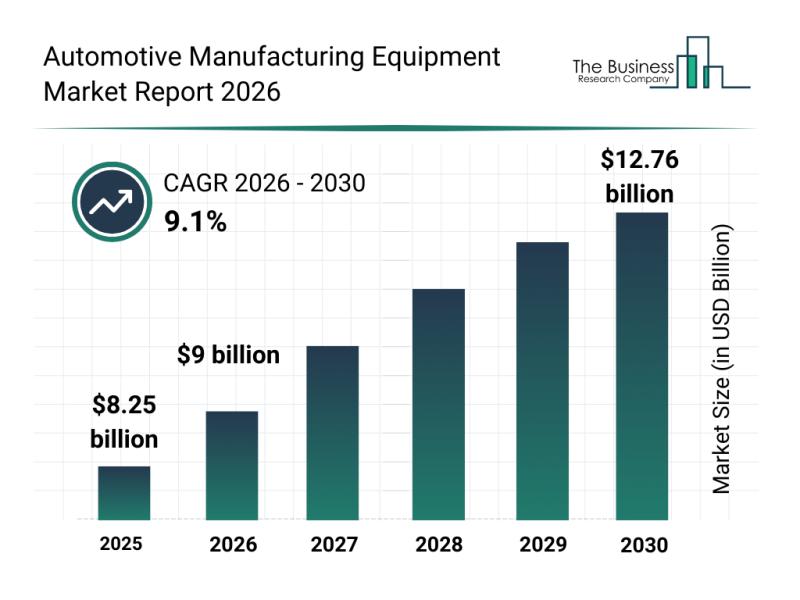

Global Trends Overview: The Rapid Evolution of the Automotive Manufacturing Equi …

The automotive manufacturing equipment sector is on track for substantial growth over the coming years, driven by rapid technological advancements and evolving industry demands. As electric vehicles gain popularity and digital technologies become more integrated into production processes, this market is set to transform significantly. Here's a detailed look at its expected growth, key players, influential trends, and market segmentation.

Projected Growth Trajectory of the Automotive Manufacturing Equipment Market

The automotive…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…