Press release

Mobile Payment Technologies Market Set to Surge to $111.2 Trillion by 2032 | Persistence Market Research

Introduction: A New Era of Digital TransactionsThe mobile payment technologies market is undergoing an unprecedented transformation, driven by technological advancements, changing consumer preferences, and increasing adoption of cashless payment solutions. With an estimated market valuation of $111.2 trillion by 2032, this industry is poised for exponential growth. As digital wallets, contactless payments, and blockchain-based transactions become the norm, businesses and consumers alike are embracing the convenience, security, and efficiency that mobile payments offer.

Get a Sample Report: https://www.persistencemarketresearch.com/samples/33065

Market Growth Drivers: What's Fueling the Expansion?

Several factors are driving the rapid expansion of mobile payment technologies:

1. Increasing Smartphone Penetration: The widespread adoption of smartphones across global markets has made mobile payments more accessible than ever. With millions of users relying on their devices for day-to-day transactions, businesses are compelled to integrate mobile payment solutions.

2. Rising E-commerce Transactions: The growth of online shopping platforms has fueled the demand for seamless and secure mobile payment options, with consumers opting for digital wallets and UPI-based payments.

3. Government Initiatives for Cashless Economies: Many governments worldwide are promoting digital transactions to enhance financial transparency, reduce fraud, and improve economic efficiency. Programs like India's Digital India initiative and China's cashless push have significantly accelerated mobile payment adoption.

4. Technological Innovations: Advancements in blockchain, NFC (Near Field Communication), biometric authentication, and artificial intelligence are enhancing the security and efficiency of mobile payments.

5. Consumer Demand for Convenience: Today's consumers expect frictionless payment experiences. The shift toward tap-and-go transactions, QR code payments, and peer-to-peer (P2P) transfers is meeting these evolving expectations.

Contactless Payment Revolution: The Future of Transactions

Contactless payments have emerged as a dominant trend in the mobile payment sector. Consumers prefer contactless transactions due to their speed, security, and hygiene benefits, particularly post-pandemic. Technologies like NFC and RFID (Radio Frequency Identification) are enabling seamless tap-and-pay solutions, reducing dependency on physical cash or cards. Major companies such as Apple Pay, Google Pay, and Samsung Pay are further driving the adoption of contactless payment solutions worldwide.

Digital Wallets: Changing the Way We Pay

Digital wallets have revolutionized the financial landscape, providing users with a secure and convenient way to store multiple payment methods in one place. Platforms such as PayPal, Venmo, Alipay, and WeChat Pay have witnessed a surge in usage, particularly in regions with high mobile penetration. The ability to integrate loyalty programs, cashback rewards, and instant fund transfers has made digital wallets an essential tool for modern consumers and businesses alike.

Mobile Payment Security: Addressing Challenges and Risks

As mobile payment adoption grows, so do concerns regarding security and fraud prevention. The industry is addressing these challenges through:

• Advanced Encryption Technologies: Data protection measures like end-to-end encryption and tokenization are securing payment transactions.

• Biometric Authentication: Fingerprint and facial recognition technology are enhancing security, making mobile payments more secure than traditional methods.

• Regulatory Compliance: Governments and financial institutions are implementing stringent policies to safeguard consumer transactions and prevent cyber threats.

Regional Insights: Leading Markets and Emerging Trends

• North America: With a strong fintech ecosystem and widespread adoption of mobile banking, North America remains a key player in the market. The U.S. and Canada are witnessing a significant rise in mobile payment users, driven by consumer preference for digital-first banking solutions.

• Asia-Pacific: The fastest-growing region, led by China and India, where mobile payment adoption is nearly universal. The region's vast smartphone user base and government support for digital payments are fueling rapid expansion.

• Europe: Contactless payments are becoming the norm, with businesses and consumers actively using digital wallets. The European Union's push for financial digitization is further accelerating market growth.

• Latin America & Middle East: These emerging markets are witnessing increasing mobile payment adoption, particularly in urban centers, where fintech startups are introducing innovative solutions tailored to local economies.

The Role of Fintech Companies in Shaping the Market

Fintech companies are at the forefront of the mobile payment revolution. With seamless integration of AI-driven analytics, fraud detection, and blockchain solutions, these firms are making digital payments more efficient and secure. Companies such as Square, Stripe, and Revolut are pioneering new-age mobile payment solutions that cater to both businesses and consumers.

Future Outlook: Where is the Market Heading?

By 2032, the mobile payment technologies market is expected to continue its upward trajectory, with:

• Increased adoption of cryptocurrency-based payments

• Growth in wearable payment technology, such as smartwatches and fitness bands

• Expansion of cross-border mobile transactions

• Wider implementation of AI-powered fraud detection systems

Conclusion: The Digital Payment Revolution is Here to Stay

As mobile payment technologies advance, businesses and consumers must adapt to the evolving landscape. The surge toward a cashless economy is not just a trend but a necessity in today's digital world. With the market projected to reach $111.2 trillion by 2032, embracing mobile payment innovations will be crucial for financial growth, security, and global economic progress.

Read More Trending "PMR Exclusive Article":

https://www.linkedin.com/pulse/specialties-lube-oil-refinery-industry-y4rwe

https://www.linkedin.com/pulse/indias-cem-market-set-grow-176-cagr-reaching-us-4lide

https://www.linkedin.com/pulse/automotive-turbocharger-industry-booming-news-zyvff

https://www.linkedin.com/pulse/automotive-steering-system-industry-trends-bqzxe

https://www.linkedin.com/pulse/33-dimethylacrylic-acid-methyl-ester-market-pnfff

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Technologies Market Set to Surge to $111.2 Trillion by 2032 | Persistence Market Research here

News-ID: 3905781 • Views: …

More Releases from Persistence Market Research

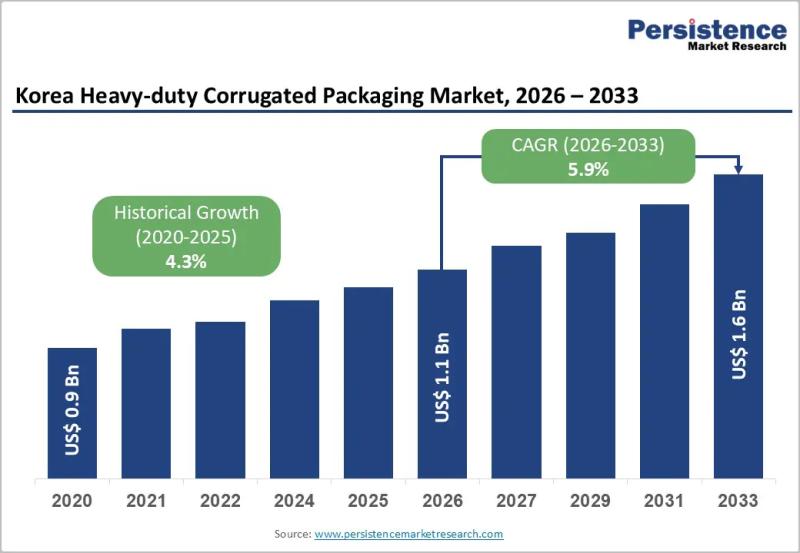

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…