Press release

B2B2C Insurance Market Forecast 2025-2034: Analysing Major Trends, Opportunities, and Growth Drivers

Which drivers are expected to have the greatest impact on the over the b2b2c insurance market's growth?The B2B2C insurance market is set to grow, fuelled by the expansion of the automobile industry. Made up of various businesses and organizations that contribute to the design, production, promotion, and sale of cars, the automotive industry is highly diverse. B2B2C insurance offers coverage to safeguard the policyholder's assets, including vehicles, against financial losses and damages. This serves as a long-term contract that covers the cost of potential damages due to unexpected incidents. The Government of India report indicated a substantial increase in Passenger Vehicle Exports from April 2023 to March 2024, from 6,62,891 to 6,72,105 units, showing a positive growth of 13.8%. Consequently, the rise in the automotive market boosts the B2B2C insurance market's growth.

Get Your B2B2C Insurance Market Report Here:

https://www.thebusinessresearchcompany.com/report/b2b2c-insurance-global-market-report

What is the future CAGR of the b2b2c insurance market, and how will it impact industry expansion?

The size of the B2B2C insurance market has seen significant expansion in the past few years, with projections showing an increase from $4.27 billion in 2024 to $4.64 billion in 2025, representing a compound annual growth rate (CAGR) of 8.6%. The surge experienced in the historical period can be linked to factors such as commercial risk complexities, industry-specific insurance needs, and risk management tactics. Further contributing factors include the demands for regulatory compliance and the internationalization of business activities.

Expectations are high for the B2B2C insurance market size to swiftly broaden in the coming years. It is anticipated to escalate to $6.96 billion in 2029 with a compound annual growth rate (CAGR) of 10.7%. Reasons for the growth during the predicted period can be traced back to environmental and climatic threats, strategies for business continuity, employee wellness programs, diversification in insurance products, and customized coverage. Significant trends during the forecast period consist of digital revolution in distribution networks, breakthroughs in insurtech, alliances in ecosystems, utilization-based insurance models, and amalgamation with digital ecosystems.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=5231&type=smp

What are the most significant trends transforming the b2b2c insurance market today?

The inception of groundbreaking initiatives to broaden the scope of the insurance industry is molding the B2B2C insurance market. Prevalent businesses in the B2B2C insurance realm are concentrating on introducing revolutionary programs to craft solutions by harnessing avant-garde technologies. For example, FairPlay, a firm based in California that offers Fairness-as-a-Service, unveiled Input Intelligence in August 2022. It is an instrumental tool for insurance firms to identify bias. This tool aids these companies in scrutinizing their data for bias and ensuring that it does not reflect safeguarded attributes such as race or gender indirectly.

Which key market segments comprise the b2b2c insurance market and drive its revenue growth?

The B2B2C insurance market covered in this report is segmented -

1) By Type: Life Insurance, Non-Life Insurance

2) By Distribution Channel: Online, Offline

3) By End Use Industry: Bank And Financial Institutions, Automotive, Utilities, Retailers, Telecom, Other End Use Industries

Subsegments:

1) By Life Insurance: Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Group Life Insurance

2) By Non-Life Insurance: Health Insurance, Property Insurance, Liability Insurance, Motor Insurance, Travel Insurance, Business Interruption Insurance

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=5231

What regions are at the forefront of b2b2c insurance market expansion?

Asia-Pacific was the largest region in the B2B2C insurance market in 2024. The regions covered in the B2B2C insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Who are the leading players fueling growth in the b2b2c insurance market?

Major companies operating in the B2B2C insurance market include UnitedHealth Group Inc., Berkshire Hathaway Inc., Allianz SE, Axa S.A., Japan Post Holdings Co., BNP Paribas S.A., Prudential Financial Inc., Aditya Birla Group, Munich Re Group, Swiss Reinsurance Company Ltd., Zurich Insurance Group Ltd., Porto Seguro S.A., Tata-AIG General Insurance Co. Ltd., ICICI Lombard General Insurance Company Limited, Bolttech Management Limited, Bsurance GmbH, Edelweiss General Insurance Company Limited, BridgeNet Insurance, DriveWealth LLC, ASSICURAZIONI GENERALI S.P.A., China Life Insurance Group, Alpaca VN, Inclusivity Solutions, The Digital Insurer, Wrisk Ltd., Anorak Technologies Limited, Dream Insurance, Assurity Group Inc., Bajaj Allianz Life Insurance Co. Ltd., Afficiency

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/sample.aspx?id=5231&type=smp

What Is Covered In The B2B2C Insurance Global Market Report?

• Market Size Forecast: Examine the b2b2c insurance market size across key regions, countries, product categories, and applications.

• Segmentation Insights: Identify and classify subsegments within the b2b2c insurance market for a structured understanding.

• Key Players Overview: Analyze major players in the b2b2c insurance market, including their market value, share, and competitive positioning.

• Growth Trends Exploration: Assess individual growth patterns and future opportunities in the b2b2c insurance market.

• Segment Contributions: Evaluate how different segments drive overall growth in the b2b2c insurance market.

• Growth Factors: Highlight key drivers and opportunities influencing the expansion of the b2b2c insurance market.

• Industry Challenges: Identify potential risks and obstacles affecting the b2b2c insurance market.

• Competitive Landscape: Review strategic developments in the b2b2c insurance market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release B2B2C Insurance Market Forecast 2025-2034: Analysing Major Trends, Opportunities, and Growth Drivers here

News-ID: 3903184 • Views: …

More Releases from The Business Research Company

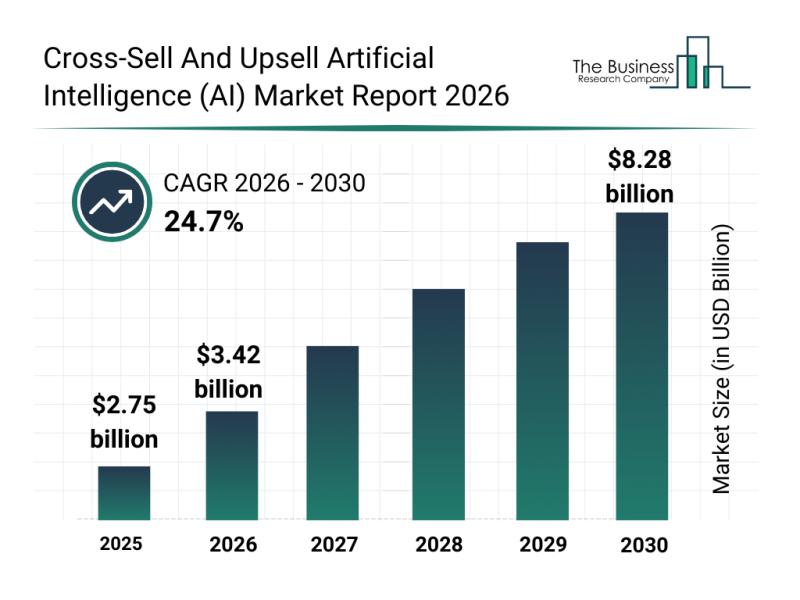

Leading Companies Fueling Growth and Innovation in the Cross-Sell and Upsell Art …

The cross-sell and upsell artificial intelligence (AI) market is on the brink of rapid expansion, driven by the increasing need for smarter sales strategies and personalized customer experiences. This sector is set to transform how businesses engage with consumers, leveraging AI technologies to enhance revenue streams and optimize customer journeys. Let's explore the market's size, key players, emerging trends, and the segmentation that define this growing industry.

Forecasted Growth in the…

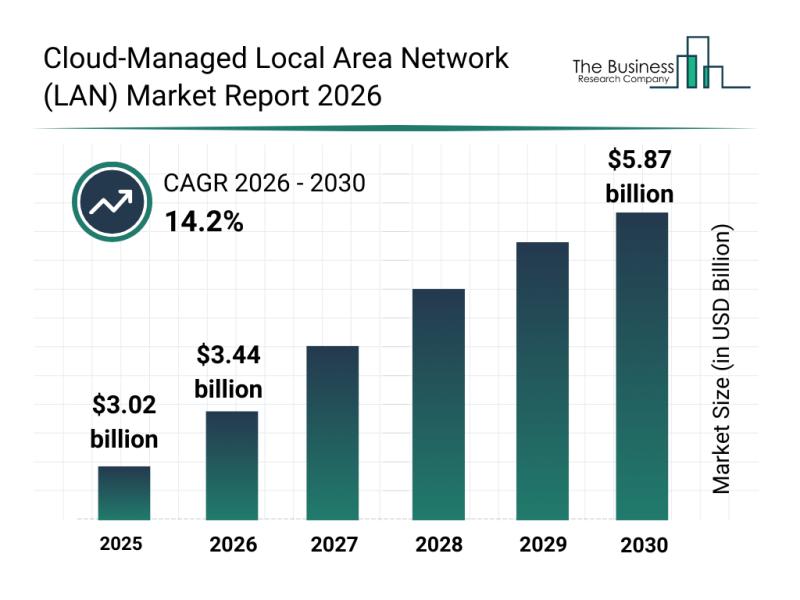

Cloud-Managed Local Area Network (LAN) Market Overview: Major Segments, Strategi …

The cloud-managed local area network (LAN) market is set for impressive growth over the coming years, driven by technological advancements and changing business needs. As organizations increasingly adopt cloud-first approaches and remote work continues to expand, this market is poised to reach significant valuation milestones by 2030. Let's explore the market's projected size, key players, emerging trends, and detailed segment analysis to understand the future direction of cloud-managed LAN solutions.

Expected…

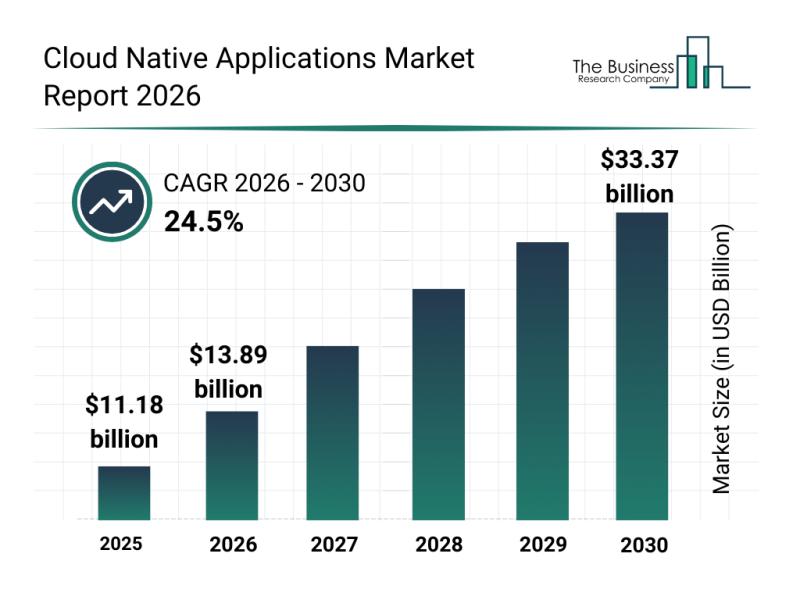

Analysis of Segments and Major Growth Areas in the Cloud Native Applications Mar …

The cloud native applications market is on track for significant expansion as businesses increasingly adopt cloud-first strategies and seek agility in software development. This sector is rapidly evolving with innovations that enable faster delivery, improved security, and seamless management of applications across diverse cloud environments. Let's explore the market's size projections, key players, trends driving growth, and important segmentations shaping its future.

Projected Size and Growth Trajectory of the Cloud Native…

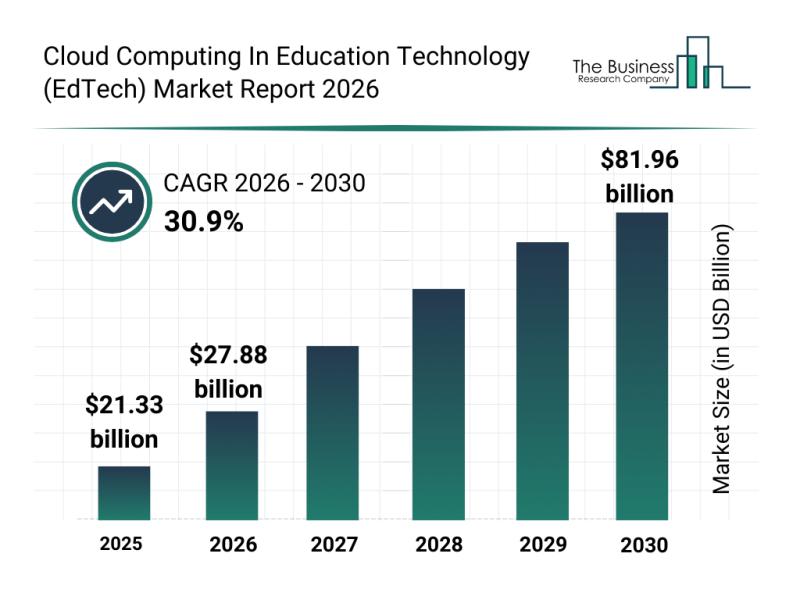

Key Strategic Developments and Emerging Changes Shaping the Cloud Computing Land …

The education technology sector is undergoing a remarkable transformation, largely fueled by the rapid adoption of cloud computing. As institutions embrace digital solutions, the integration of cloud-based tools is reshaping teaching and learning methods. This evolution promises significant market growth and new opportunities through 2030.

Cloud Computing in Education Technology Market Size and Growth Outlook

The cloud computing segment within education technology is projected to experience explosive growth, reaching a…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…