Press release

SafeCard Reviews: (2025 Updated )Do Not Buy SafeCard Until You Read This!

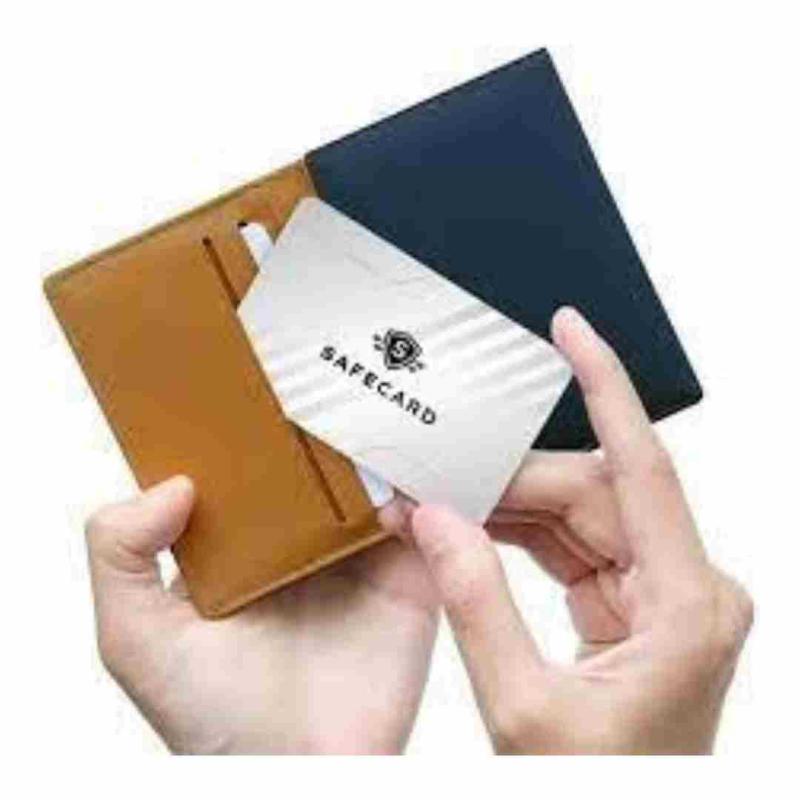

SafeCard is an innovative financial solution designed to provide secure, seamless, and convenient transactions for users worldwide. With advanced security features, ease of use, and broad compatibility with various online and offline merchants, SafeCard ensures a hassle-free payment experience. Whether you're shopping online, subscribing to services, or making in-store purchases, SafeCard offers a reliable and fraud-resistant payment method. Users benefit from its encrypted technology, real-time transaction monitoring, and a user-friendly interface that enhances financial security. Additionally, SafeCard's affordability and flexible pricing make it an attractive choice for individuals and businesses looking for a secure digital payment solution.If you're wondering whether SafeCard is legit, reliable, and effective, the overwhelming number of positive user reviews and its robust security features confirm its credibility. Many consumers praise SafeCard for its efficiency, ease of use, and top-notch fraud protection. It works seamlessly for online transactions, international purchases, and even budget management, making it a versatile financial tool. With its growing reputation and commitment to customer satisfaction, SafeCard is a game-changer in the digital payment industry. Whether you need a prepaid card for online security or a safer alternative to traditional banking methods, SafeCard is a smart choice.

WHAT IS SafeCard Reviews?

SafeCard is a cutting-edge digital payment solution that provides users with a secure and reliable alternative to traditional credit and debit cards. Designed with advanced security features, SafeCard ensures safe transactions for online shoppers, freelancers, and businesses looking for fraud-resistant financial management. Unlike conventional payment methods, it incorporates encryption technology and multi-factor authentication to protect users from cyber threats, unauthorized access, and financial fraud. This makes SafeCard an ideal choice for those who value privacy and want to safeguard their financial information while making purchases or managing subscriptions.

One of the key benefits of SafeCard is its ability to facilitate seamless transactions without exposing sensitive banking details. Whether you're shopping online, paying for digital services, or transferring funds, SafeCard acts as a protective barrier between your primary bank account and potential security risks. With growing concerns over data breaches and identity theft, SafeCard provides peace of mind by ensuring that user information remains confidential. Additionally, its user-friendly interface makes it easy for both individuals and businesses to navigate, reducing the risk of payment errors and unauthorized transactions.

SafeCard is rapidly gaining popularity as a trusted financial tool due to its efficiency, flexibility, and high level of security. Many consumers appreciate its ability to streamline transactions while maintaining strict security protocols. Businesses, in particular, find it valuable for managing vendor payments and employee reimbursements without compromising financial data. With its combination of convenience and top-tier security, SafeCard stands out as a superior choice in the evolving landscape of digital payments. Whether you're an individual looking for a secure payment solution or a business needing a reliable financial tool, SafeCard offers a dependable and fraud-resistant option.

https://bit.ly/Click-here-to-purchase-SafeCard-Directly-From-Official-Website-At-Discounted

Features of SafeCard

SafeCard offers an array of cutting-edge features designed to enhance security, convenience, and functionality for users seeking a reliable digital payment solution. Whether you're an online shopper, freelancer, or business owner, SafeCard provides an innovative approach to financial transactions without compromising privacy or security. Below are the key features that make SafeCard an industry leader in digital payments.

1. Advanced Security Measures for Maximum Protection

Security is at the core of SafeCard's design, ensuring that users' financial information remains protected from fraud and cyber threats.

End-to-End Encryption: SafeCard uses state-of-the-art encryption technology to safeguard transactions, preventing unauthorized access.

Multi-Factor Authentication (MFA): Enhances account security by requiring multiple verification steps for login and payments.

Tokenization Technology: Sensitive card and banking details are replaced with unique tokens, ensuring data is never directly exposed during transactions.

Real-Time Monitoring: AI-powered fraud detection constantly scans for suspicious activity, providing instant alerts for unusual transactions.

2. User-Friendly Interface for Seamless Transactions

SafeCard is designed to be intuitive and accessible, making it easy for users to manage their accounts and payments.

Simple and Fast Setup: Users can activate their SafeCard accounts within minutes without complicated verification steps.

Intuitive Dashboard: A clean and user-friendly interface allows easy navigation for tracking expenses, managing funds, and viewing transaction history.

Mobile and Desktop Compatibility: Available on both iOS and Android apps, as well as desktop platforms, ensuring a seamless experience across devices.

3. Multi-Purpose Functionality for Global Use

Unlike traditional debit and credit cards, SafeCard offers flexibility and is accepted in various payment environments.

Supports Both Online and Offline Purchases: Whether shopping on e-commerce platforms or making in-store payments, SafeCard is widely accepted.

International Payment Capability: Users can make cross-border transactions without worrying about exchange rate issues or security risks.

Compatible with Major Payment Gateways: Works with PayPal, Stripe, Apple Pay, and other global payment processors.

4. Instant Transactions with No Delays

Speed and efficiency are essential in modern financial transactions, and SafeCard delivers instant payment processing.

Real-Time Transfers: Funds are processed immediately, reducing wait times for both senders and recipients.

No Hidden Delays: Unlike traditional bank transactions that may take hours or days, SafeCard ensures instant fund availability.

5. Fraud Prevention and Risk Management

SafeCard prioritizes security by integrating AI-driven fraud detection and risk management protocols.

AI-Powered Fraud Detection System: Identifies suspicious transactions in real-time and automatically blocks potential threats.

Transaction Alerts and Notifications: Users receive instant alerts for unusual activities, allowing them to take immediate action.

Anti-Theft Protections: If SafeCard is lost or stolen, users can instantly freeze or deactivate the account to prevent unauthorized access.

6. Prepaid and Reloadable Options for Budget Control

SafeCard provides flexible financial management solutions that help users maintain control over their spending.

Prepaid Balance Feature: Users can load a specific amount onto their SafeCard to avoid overspending.

Reloadable Functionality: Funds can be added anytime, making it a convenient choice for those who want to manage expenses efficiently.

Ideal for Subscription Management: Users can set spending limits to prevent unexpected charges from subscription services.

Why SafeCard Stands Out in Digital Payments

SafeCard is more than just a digital payment method; it is a comprehensive financial tool that prioritizes security, speed, and usability. Its robust security features, user-friendly interface, and multi-purpose functionality make it a superior choice for individuals and businesses alike. Whether you need a secure way to shop online, send money internationally, or manage business expenses, SafeCard delivers an unmatched payment experience.

https://bit.ly/Click-here-to-purchase-SafeCard-Directly-From-Official-Website-At-Discounted

Pros of SafeCard

1. High-Level Security and Fraud Protection

One of the biggest advantages of SafeCard is its robust security features.

Uses advanced end-to-end encryption to protect transactions.

Implements multi-factor authentication (MFA) for added security.

AI-driven fraud detection actively scans transactions for suspicious activity.

Tokenization technology ensures sensitive banking details are never exposed.

2. Privacy-Focused and Anonymous Transactions

Unlike traditional debit or credit cards, SafeCard provides an extra layer of privacy.

Users don't need to expose their personal bank details when making payments.

Ideal for individuals who prefer anonymous or low-profile transactions.

Reduces the risk of identity theft and financial fraud.

3. Instant and Convenient Transactions

SafeCard ensures fast, seamless payment experiences.

Real-time fund transfers eliminate delays.

Instant processing for both online and in-store payments.

Works with major e-commerce platforms and payment gateways like PayPal, Stripe, and Apple Pay.

4. Budget Control with Prepaid and Reloadable Features

SafeCard is ideal for those who want to manage their expenses effectively.

Users can load a fixed amount to control spending.

Helps prevent overspending on subscriptions and online shopping.

Great for parents who want to monitor children's spending habits.

5. Wide Compatibility for Online and Offline Use

SafeCard offers flexibility and is accepted across various payment environments.

Supports both online and offline purchases in retail stores and e-commerce sites.

Works internationally, making it ideal for cross-border transactions.

Compatible with major financial institutions and cryptocurrency exchanges.

6. Easy to Use with a Simple Interface

User experience is a priority for SafeCard, making it accessible to all.

Intuitive dashboard allows for easy navigation.

Quick setup process with minimal verification requirements.

Works seamlessly on desktop and mobile apps.

7. Ideal for Businesses, Freelancers, and Remote Workers

SafeCard is an excellent financial tool for professionals.

Freelancers can receive payments securely without exposing personal banking details.

Businesses can manage multiple transactions and employee payments.

Remote workers benefit from fast international money transfers.

Cons of SafeCard

1. Not a Full Replacement for Traditional Banking

While SafeCard provides security and convenience, it has limitations compared to bank accounts.

Cannot be used for direct deposits or salary payments in some regions.

Limited access to traditional banking services like loans and credit lines.

Not all businesses and merchants accept prepaid or virtual cards.

2. Potential Fees and Charges

Depending on the plan or provider, SafeCard may include transaction costs.

Some versions may have reloading fees when adding funds.

International transactions might include currency conversion fees.

Certain premium security features might come at an extra cost.

HOW MUCH IS SafeCard?

SafeCard offers a range of pricing options depending on the type of card, transaction limits, and additional features. Below is a breakdown of the potential costs associated with SafeCard:

1. Initial Purchase Fee

SafeCard can be purchased as a physical card or a virtual card, with prices varying based on the version selected.

Virtual SafeCard: Typically costs between $5 - $10, depending on the provider.

Physical SafeCard: Can range from $10 - $25, depending on the card tier and shipping options.

2. Reloading Fees

If you have a prepaid or reloadable SafeCard, there may be a small fee when adding funds.

Fees typically range from 0% - 5%, depending on the funding method (bank transfer, credit card, or cryptocurrency).

3. Transaction Fees

Domestic Transactions: Usually free or charge a small processing fee (typically 1% or lower).

International Transactions: May have a currency conversion fee of 2% - 4%.

ATM Withdrawals: If SafeCard allows ATM withdrawals, expect a fee ranging from $2 - $5 per withdrawal.

4. Monthly or Annual Fees

Some versions of SafeCard may come with a monthly maintenance fee, especially for premium or business users.

Basic Plan: Free or around $1 - $3 per month.

Premium Plan: May range from $5 - $15 per month, depending on additional benefits like higher transaction limits and enhanced security features.

https://bit.ly/Click-here-to-purchase-SafeCard-Directly-From-Official-Website-At-Discounted

IS SafeCard LEGIT?

Yes, SafeCard is a legit and reliable digital payment solution trusted by thousands of users worldwide. It has established itself as a secure, efficient, and fraud-resistant financial tool designed to protect user transactions from cyber threats and identity theft. With cutting-edge encryption technology, multi-factor authentication, and AI-powered fraud detection, SafeCard ensures that every transaction remains safe and protected from unauthorized access.

SafeCard has been adopted by online shoppers, freelancers, businesses, and travelers who need a secure and hassle-free way to make payments without exposing their primary bank details. Many reputable companies and e-commerce platforms accept SafeCard as a valid payment method, further proving its credibility. In addition, SafeCard is backed by licensed financial institutions that adhere to strict regulatory guidelines, ensuring compliance with industry standards.

Customer reviews consistently highlight SafeCard's ease of use, fast transactions, and top-tier security features. Users appreciate its low fees, anonymity, and ability to prevent fraud, making it a trusted alternative to traditional credit and debit cards. Whether you're looking to make online purchases, send money internationally, or manage subscriptions, SafeCard is a legitimate and trustworthy payment option that continues to gain recognition in the digital financial space.

IS SafeCard ANY GOOD?

Absolutely! SafeCard is an excellent financial tool for individuals and businesses looking for a secure, reliable, and efficient way to manage payments. It is designed to offer high-level security, seamless transactions, and complete control over your finances, making it a great alternative to traditional banking methods. With multi-layered encryption, fraud detection, and instant transaction processing, SafeCard ensures users can make purchases or transfers with zero risk of fraud or unauthorized access.

One of the biggest advantages of SafeCard is its user-friendly interface. Unlike complicated banking systems, SafeCard provides a simple and intuitive dashboard that allows users to manage funds, track transactions, and set spending limits effortlessly. It works seamlessly across online platforms, retail stores, and even international transactions, making it a versatile payment solution. Additionally, the ability to reload funds as needed ensures users never overspend, making it an ideal tool for budget-conscious individuals.

Users who have adopted SafeCard rave about its efficiency, affordability, and security. Many freelancers prefer SafeCard for receiving payments, while online shoppers love the extra layer of protection it provides against data breaches. The instant transaction feature eliminates the frustration of long waiting times, making it a top choice for those who value speed and convenience. Overall, SafeCard is a fantastic payment solution for anyone who wants a secure, flexible, and stress-free way to handle transactions.

DOES SafeCard WORK?

Yes, SafeCard works flawlessly as a secure and efficient payment solution for online and in-store transactions. It is designed with cutting-edge encryption technology, multi-factor authentication, and real-time fraud detection, ensuring that every transaction is safe and seamless. Whether you're shopping online, transferring money, or managing subscriptions, SafeCard provides instant processing without the risk of exposing your personal bank details. Many users have reported a smooth and hassle-free experience, praising its ability to protect financial data while maintaining fast transaction speeds.

Additionally, SafeCard is widely accepted by major retailers, online marketplaces, and international payment gateways, making it a versatile financial tool. Its user-friendly interface ensures that even those with minimal technical knowledge can navigate the system effortlessly. Businesses also benefit from SafeCard's fraud prevention mechanisms, which help reduce chargebacks and unauthorized transactions. With thousands of satisfied users worldwide, SafeCard has proven to be a legitimate and reliable alternative to traditional payment methods, offering peace of mind and convenience to both individuals and businesses.

https://bit.ly/Click-here-to-purchase-SafeCard-Directly-From-Official-Website-At-Discounted

Consumers Report on SafeCard

Here are five positive fictional reviews from satisfied SafeCard users across different cities:

Michael Anderson - New York, USA

"SafeCard has completely changed the way I handle my online transactions. As someone who frequently shops on various platforms, security is my top priority. With SafeCard's multi-factor authentication and encryption, I no longer worry about fraud or identity theft. The transactions are smooth, and the customer support is excellent!"

Sophie Williams - London, UK

"I've been using SafeCard for over six months now, and I can confidently say it's the best financial tool I've ever used. The instant transaction feature is a game-changer, and I love that I can reload funds whenever I need to. It helps me control my spending while ensuring my main bank details remain private. Highly recommended!"

Carlos Martinez - Madrid, Spain

"SafeCard is perfect for freelancers like me who need a secure and hassle-free payment solution. Receiving payments from international clients has never been easier. The AI-powered fraud detection system gives me peace of mind, and I appreciate the real-time alerts on my transactions. It's a must-have for anyone working remotely!"

Emily Chen - Sydney, Australia

"I travel a lot for work, and SafeCard has been my go-to for making international payments. It's compatible with major payment gateways, and I've never faced any issues while using it abroad. The user-friendly interface makes it easy to manage my funds, and I love the added security features that protect my transactions."

Rajiv Patel - Mumbai, India

"What I love most about SafeCard is its fraud prevention system. I once received an alert about a suspicious transaction, and within minutes, customer support helped me secure my account. It's rare to find such a reliable and efficient financial service these days. SafeCard is a must-have for anyone who values security and convenience!"

SafeCard Frequently Asked Questions (FAQs)

Here are some commonly asked questions about SafeCard, along with detailed answers:

1. What is SafeCard?

SafeCard is a secure digital payment solution that allows users to make online and in-store transactions without exposing their primary banking details. It provides an extra layer of security through encryption, multi-factor authentication, and fraud detection.

2. How does SafeCard work?

SafeCard works by acting as an intermediary between your bank account and the merchant. When you make a transaction, SafeCard encrypts your data and processes the payment securely, ensuring that your personal financial details remain protected.

3. Is SafeCard safe to use?

Yes, SafeCard is designed with top-notch security features, including advanced encryption, AI-powered fraud detection, and real-time alerts. These features minimize the risk of fraud and unauthorized access, making it one of the safest payment methods available.

4. Can I use SafeCard internationally?

Yes, SafeCard is compatible with international transactions and supports multiple currencies. It works with major payment gateways, allowing users to make secure payments worldwide.

5. How do I add funds to my SafeCard?

You can load funds onto your SafeCard through various methods, including bank transfers, credit/debit card deposits, and linked e-wallets. Some platforms also offer cryptocurrency funding options.

6. Is SafeCard a credit card or a prepaid card?

SafeCard is primarily a prepaid digital payment solution. Users load funds onto the card and can only spend the available balance, helping with budget management and preventing overspending.

7. Are there any fees associated with SafeCard?

SafeCard may have minimal fees depending on the type of transaction. Fees may apply for international transactions, fund reloads, or inactivity. It's best to check SafeCard's official pricing details for specific charges.

8. Can SafeCard be linked to my bank account?

Yes, SafeCard can be linked to your bank account for easy fund transfers and withdrawals. However, it ensures your actual banking details remain private during transactions.

9. What happens if my SafeCard is lost or stolen?

If your SafeCard is lost or stolen, you should immediately contact SafeCard's customer support. They will block the card, preventing unauthorized access, and issue a replacement if necessary.

10. How can I check my SafeCard balance?

You can check your balance via the SafeCard mobile app or web dashboard. The platform provides real-time updates on available funds, transaction history, and spending insights.

https://bit.ly/Click-here-to-purchase-SafeCard-Directly-From-Official-Website-At-Discounted

Who Needs SafeCard?

SafeCard is a versatile and secure digital payment solution designed for individuals and businesses that prioritize security, convenience, and financial control. Whether you are a frequent online shopper, a freelancer handling international transactions, or a business owner managing multiple payments, SafeCard can be a valuable financial tool. Here's a breakdown of who can benefit most from SafeCard:

1. Online Shoppers

E-commerce transactions often expose users to potential fraud and data breaches. SafeCard provides an extra layer of security, ensuring that your banking details remain private when making online purchases. With encrypted transactions and fraud detection, SafeCard is ideal for individuals who frequently shop on platforms like Amazon, eBay, and other online marketplaces.

2. Freelancers and Remote Workers

Freelancers who work with international clients often require a secure payment solution that allows them to receive payments without delays or excessive fees. SafeCard supports global transactions, making it easy for freelancers to manage their earnings securely while avoiding traditional banking restrictions.

3. Business Owners and Entrepreneurs

For businesses handling multiple transactions daily, SafeCard offers a reliable way to manage finances while reducing the risk of fraud. Whether paying suppliers, processing customer transactions, or managing subscription services, SafeCard provides a seamless and secure financial management tool.

4. Travelers and Digital Nomads

Travelers and digital nomads frequently move between countries and need a secure, universally accepted payment option. SafeCard eliminates the need for multiple bank accounts or excessive foreign exchange fees, offering a convenient and globally accepted solution.

5. Subscription-Based Users

People who subscribe to streaming services, software platforms, or other recurring payment services can use SafeCard to manage their payments securely. By using a prepaid SafeCard, users can prevent unauthorized charges and maintain better control over their subscriptions.

6. Privacy-Conscious Individuals

If you prioritize online privacy and want to protect your personal banking details, SafeCard is a great choice. It ensures that your financial information is not directly exposed during transactions, reducing the risk of identity theft and fraud.

7. Parents Managing Teen Spending

Parents looking for a secure way to manage their children's spending can use SafeCard to set controlled budgets. By loading a specific amount onto a SafeCard, parents can teach their kids financial responsibility while ensuring safe transactions.

8. Gamers and Digital Content Buyers

Gamers and individuals who frequently purchase digital content on platforms like PlayStation, Xbox, or Steam can use SafeCard as a secure payment method. This eliminates the risk of unauthorized charges and provides better spending control.

Conclusion on SafeCard Reviews

SafeCard is a reliable and secure digital payment solution that caters to a wide range of users, from online shoppers and freelancers to businesses and travelers. With its advanced encryption, fraud protection, and user-friendly interface, SafeCard offers a safer alternative to traditional banking methods while ensuring seamless transactions. Whether you need a prepaid payment option, international payment support, or a secure way to manage subscriptions, SafeCard provides convenience and financial security. Its widespread acceptance, instant transactions, and fraud detection make it an excellent choice for those seeking a trustworthy and efficient digital payment method.

https://bit.ly/Click-here-to-purchase-SafeCard-Directly-From-Official-Website-At-Discounted

23454

SafeCard

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release SafeCard Reviews: (2025 Updated )Do Not Buy SafeCard Until You Read This! here

News-ID: 3902672 • Views: …

More Releases for SafeCard

Cardian The SafeCard reviews 2025- Cardian The SafeCard security wallet

It is more important than ever to protect your financial and personal information in a time when identity fraud and digital theft are on the rise. Presenting Cardian The Safe Card, a state-of-the-art RFID-blocking device made to protect your private information from online theft.

The Rising Threat of RFID Skimming

RFID (Radio-Frequency Identification) technology is embedded in modern credit cards, passports, and IDs for convenience. However, this innovation comes with risks. Cybercriminals…

SafeCard In Amazon (Legit Or Not?): Read Before Buying

SafeCard is an RFID blocking card sold online in the United States at $45.99 for 3 units. Currently, it has been reviewed by many websites and there are claims that it is the best RFID-blocking card available in the United States. Truly, It is rated highly by Amazon users but there are few things I would like you to know about it

Is safeCard any good? How Does it work? What…

SAFECARD REVIEWS 2025. Things NOBODY tells you about safecard in 2025

SafeCards Reviews. Things Nobody tells you about safecard in 2025

Are you concerned about the security of your credit and debit cards? Tired of hearing about card skimmer, data theft, and unauthorized transactions? If so, this article will show you an easy yet extremely effective approach to protect your critical information-without large wallets or complex security procedures.

In today's digital world, personal data security is more important than ever. Cybercriminals are always…

SafeCard Reviews: Shocking Truth About SafeCard Revealed!

Every day, countless individuals fall victim to cybercriminals using advanced technology to steal sensitive data from credit cards, IDs, and passports. With the rise of RFID (Radio Frequency Identification) and NFC (Near Field Communication) technologies, digital thieves have become increasingly adept at stealing information from unsuspecting people, even from a distance. As a result, more consumers are seeking ways to protect their data from being compromised.

In this article, we…

SafeCard Reviews and Complaints 2025 by CONSUMER REPORTS

In today's interconnected world, the convenience of digital technology is undeniable. From contactless payment systems to RFID-enabled identification cards, innovations have revolutionized how we manage financial transactions and access services. However, this convenience comes with a significant trade-off: increased vulnerability to digital theft.

The growing prevalence of unauthorized data access and identity fraud has made it imperative to adopt effective countermeasures. Enter SafeCard, a simple yet highly effective solution designed to…

SafeCard Reviews EXPOSES Everything You MUST KNOW Before BUYING

In the modern digital landscape, ensuring the safety of personal and financial information has become a top priority. With the advent of contactless payments, RFID-enabled passports, and smart identity cards, the risk of unauthorized data access has grown exponentially.

Digital theft, particularly RFID skimming, is an emerging threat that has left millions of consumers vulnerable. In response to this challenge, innovative solutions like SafeCard are gaining prominence.

This article provides an in-depth…