Press release

Leading Growth Driver in the Insurance, Reinsurance And Insurance Brokerage Market in 2025: Surging Demand For Cyber Insurance Is Addressing Internet-Related Risks In An Evolving Landscape Driver's Influence

What market dynamics are playing a key role in accelerating the growth of the insurance, reinsurance and insurance brokerage market?The surge in internet usage along with the amplified risks involved in conducting critical transactions online are propelling the need for cyber insurance. This type of insurance provides coverage for risks originating from the internet and issues tied to IT infrastructure. It further offers protection against stolen property, disruptions in business, loss of software and data, cyber blackmail, network failure liabilities, cyber-related crimes, and physical asset damages. For example, a report from the National Telecommunications and Information Administration, a government agency of the US, revealed that the count of internet users in the United States saw an upsurge by 13 million in 2023 as opposed to 2021. Thus, the accelerated rise in internet usage coupled with the heightened risks linked to its usage intensify the demand for insurance, reinsurance, and insurance brokerage markets.

Get Your Insurance, Reinsurance And Insurance Brokerage Market Report Here:

https://www.thebusinessresearchcompany.com/report/insurance-reinsurance-and-insurance-brokerage-global-market-report

How will the growth rate of the insurance, reinsurance and insurance brokerage market shape industry trends by 2034?

The market sector for insurance, reinsurance, and insurance brokerage has seen a significant expansion recently. The expected market augmentation from $8846.3 billion in 2024 to $9499.25 billion in 2025, indicates a compound annual growth rate (CAGR) of 7.4%. Factors contributing to the growth experienced in the historic period include the influence of COVID-19, adoption of reinsurance in healthcare, inflated healthcare expenses, and an increase in home ownership and mortgages.

The market size of insurance, reinsurance, and insurance brokerage is projected to witness substantial growth in the coming years. The market is expected to surge to $12498.55 billion by 2029 at a compound annual growth rate (CAGR) of 7.1%. The factors that contribute to the growth in the projected period include a rise in chronic illnesses and disabilities, the expansion of the middle-class in developing markets, increased governmental assistance, swift urbanization and growing demand for insurance plans. The notable trends anticipated over the forecast period are an increase in chronic diseases and disabilities, middle-class expansion in emerging markets, increased government support, fast-paced urbanization, and rising demand for insurance policies.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3544&type=smp

What are the emerging trends shaping the future of the insurance, reinsurance and insurance brokerage market?

The concept of peer-to-peer insurance is steadily gaining traction in both nascent and established markets, propelled by the lower premium costs in emerging nations thanks to increased internet access in such areas. This insurance model hinges on collecting premium payments from involved parties to cover unforeseen future losses, with any surplus amount distributed back among the participants. Its primary objectives include lowering premium and overhead expenses relative to conventional insurance firms, enhancing operational efficiency, and boosting business transparency.

Which primary segments of the insurance, reinsurance and insurance brokerage market are driving growth and industry transformations?

The insurance, reinsurance and insurance brokerage market covered in this report is segmented -

1) By Type: Insurance, Insurance Brokers And Agents, Reinsurance

2) By Mode: Online, Offline

3) By End-User: Corporate, Individual

Subsegments:

1) By Insurance: Life Insurance, General Insurance, Health Insurance, Specialty Insurance

2) By Insurance Brokers And Agents: Independent Insurance Brokers, Captive Agents, Online Insurance Brokers, Insurance Agencies

3) By Reinsurance: Treaty Reinsurance, Facultative Reinsurance, Excess-of-Loss Reinsurance, Proportional Reinsurance

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=3544

Which geographical regions are pioneering growth in the insurance, reinsurance and insurance brokerage market?

North America was the largest region in the insurance, reinsurance, and insurance brokerage market in 2024. Asia/Pacific was the second largest region in insurance, reinsurance, and insurance brokerage. The regions covered in the insurance, reinsurance and insurance brokerage market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Who are the influential players reshaping the insurance, reinsurance and insurance brokerage market landscape?

Major companies operating in the insurance, reinsurance and insurance brokerage market include Allianz Group, Ping An Insurance, China Life Insurance Company Limited, Axa Group, Centene Corporation, Assicurazioni Generali S.p.A., Humana Inc, The People's Insurance Company (Group) of China Limited, Berkshire Hathaway, Munich Re, General Insurance Corporation of India (GIC Re), New India Assurance - General Insurance Brokers, Oriental Insurance Company, ICICI Lombard General Insurance Company, United India Insurance, HDFC ERGO Non-Life Insurance Company, Fanhua Inc, Chang'an Insurance Brokers Co., Ltd, Mintaian Insurance Surveyors & Loss Adjusters Group Co., Ltd, Shenzhen Huakang Insurance Agency Co. (China), Ltd., CPIC, China Property and Casualty Reinsurance Company Ltd, PICC Reinsurance Co. Ltd., Taiping Reinsurance Co. Ltd., Peak Reinsurance Co. Ltd, SCOR Reinsurance Co. (Asia) Ltd., Korean Reinsurance Company, Tokio Marine & Nichido Fire Insurance Co. Ltd., Aioi Nissay Dowa Insurance Co. Ltd, Sompo Japan Nipponkoa Insurance Inc., Toa Reinsurance Co., Mitsui Sumitomo Insurance Co. Ltd., PVI Reinsurance Company, Singapore Reinsurance Corporation Ltd, Marsh & McLennan Companies UK Limited, Arthur J Gallagher & Co, Willis Towers Watson plc., Lloyd's of London Limited, Aon Holding Deutschland GmbH, Funk Gruppe GmbH, Ecclesia Holding GmbH, Hannover Re, Swiss Re, Crédit Agricole Assurances, CNP Assurance, Société Générale, BNP Paribas Cardiff, Sogaz Insurance Group, Ingosstrakh Insurance Co., Russian Re Co. Ltd, Polskie Towarzyst Reasekuracji S.A., Nationale-Nederlanden (NN) Life Insurance Co. Ltd, Uniqa Insurance Group AG, Ceská Pojištovna, MAI Insurance Brokers Poland Sp. z o.o, European Investment Bank (EIB), VIG RE zajist'ovna a.s., Brighthouse Financial (MetLife), Northwestern Mutual, New York Life, Prudential, Lincoln National, MassMutual, John Hancock, Transamerica, Manulife Financial, Chubb Life, Great-West Lifeco, Inc, Sun Life Financial, IA Financial Group, RBC Insurance, Empire Life, National Indemnity Company, Everest Reinsurance Company, XL Reinsurance America, Reinsurance Group of America, Inc, Fairfax Financial Holdings Ltd., Transatlantic Holdings Inc, Markel Corporation, Companhia de seguros alliance do Brazil, Bradesco Vida E Previdencia S.A, AR LIFE, MAPFRE Argentina, Crecer Seguros, Ohio National Seguros de Vida, Instituto de Resseguros do Brasil(IRB), Alliance Insurance, Mashreq bank, Buruj Cooperative Insurance, Al Alamiya, Menora Mivtachim Insurance, Oman Insurance Company, Kuwait Reinsurance company, Arab Re (Lebanon), RGA Re, African Reinsurance Corporation, Compagnie Centrale de Réassurance, J.B.Boda Insurance & Reinsurance Brokers Pvt. Ltd., Société Centrale de Réassurance, Insurance Brokers Of Nigeria (IBN), Northlink Insurance Brokers, Carrier Insurance Brokers, Hogg Robinson Nigeria, Union Commercial Insurance Brokers, Misr Life Insurance Company, Metlife Egypt, GIG Egypt.

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/sample.aspx?id=3544&type=smp

What Is Covered In The Insurance, Reinsurance And Insurance Brokerage Global Market Report?

• Market Size Forecast: Examine the insurance, reinsurance and insurance brokerage market size across key regions, countries, product categories, and applications.

• Segmentation Insights: Identify and classify subsegments within the insurance, reinsurance and insurance brokerage market for a structured understanding.

• Key Players Overview: Analyze major players in the insurance, reinsurance and insurance brokerage market, including their market value, share, and competitive positioning.

• Growth Trends Exploration: Assess individual growth patterns and future opportunities in the insurance, reinsurance and insurance brokerage market.

• Segment Contributions: Evaluate how different segments drive overall growth in the insurance, reinsurance and insurance brokerage market.

• Growth Factors: Highlight key drivers and opportunities influencing the expansion of the insurance, reinsurance and insurance brokerage market.

• Industry Challenges: Identify potential risks and obstacles affecting the insurance, reinsurance and insurance brokerage market.

• Competitive Landscape: Review strategic developments in the insurance, reinsurance and insurance brokerage market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Leading Growth Driver in the Insurance, Reinsurance And Insurance Brokerage Market in 2025: Surging Demand For Cyber Insurance Is Addressing Internet-Related Risks In An Evolving Landscape Driver's Influence here

News-ID: 3901936 • Views: …

More Releases from The Business Research Company

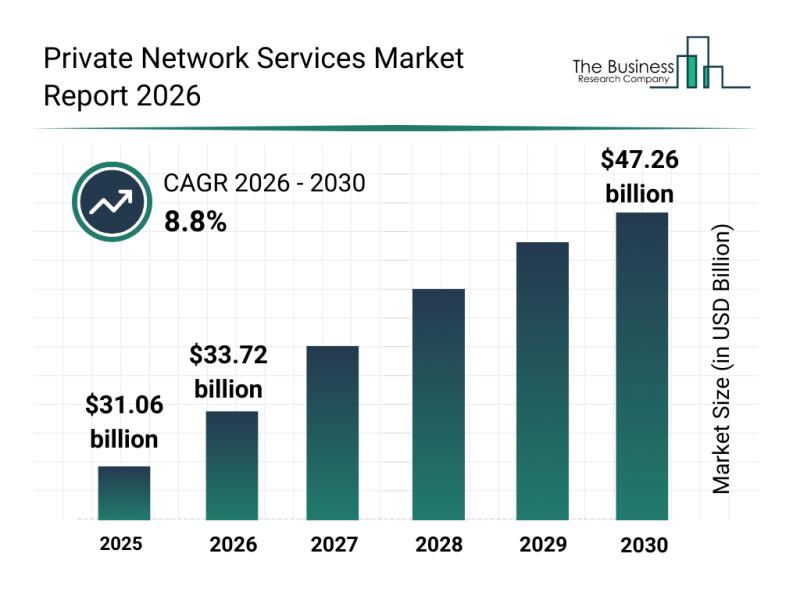

Leading Companies Fueling Innovation and Growth in the Private Network Services …

The private network services sector is set to experience remarkable growth as demand for secure, high-performance connectivity continues to rise across various industries. With advancements in wireless technology and evolving network needs, this market is positioning itself for widespread adoption and innovation over the coming years. Let's explore the market size, key players, driving trends, and segmentation to better understand what lies ahead.

Private Network Services Market Size and Growth Outlook…

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Po …

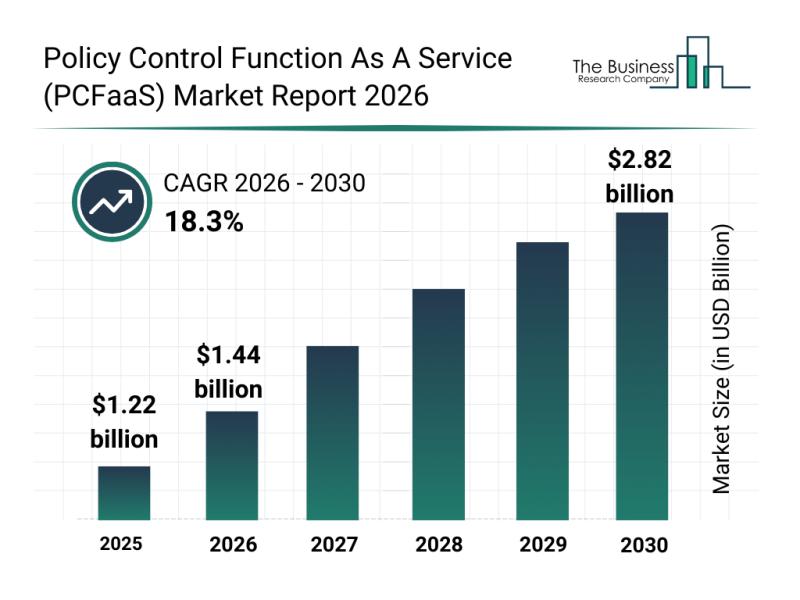

The policy control function as a service (PCFaaS) market is on track for substantial expansion over the coming years, driven by technological advancements and increasing demand in telecommunications. This sector is transforming rapidly as operators adapt to next-generation network requirements and cloud-native approaches. Let's delve into the market's expected valuation, key players, emerging trends, and notable segmentations shaping its future.

Significant Growth Forecast for the Policy Control Function As A Service…

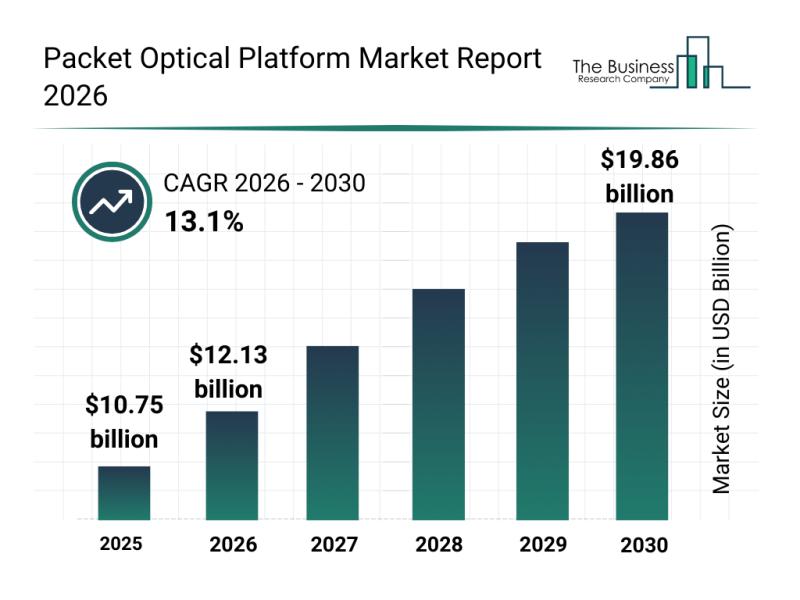

Top Players and Competitive Dynamics in the Packet Optical Platform Market

The packet optical platform market is positioned for significant expansion in the coming years, driven by advances in network technology and increasing demand for high-capacity data transmission. As digital infrastructure evolves, this sector is set to play a crucial role in supporting the growing needs of data centers, telecom providers, and cloud services. Let's explore the market's projected size, key players, emerging trends, and the segments contributing to its growth.

Forecasted…

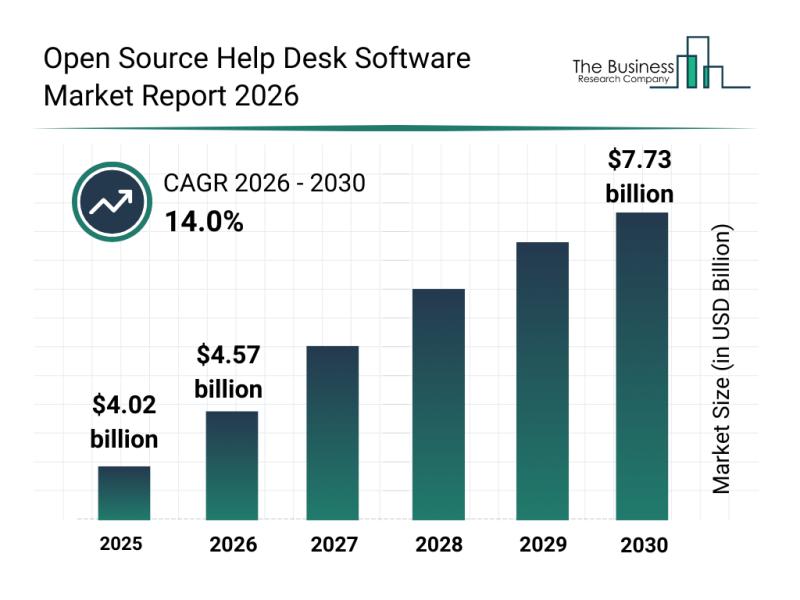

Analysis of Segmentation, Market Trends, and Competitive Landscape in the Open S …

The open source help desk software market is set to experience significant expansion in the coming years, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital customer support, this market is positioned for notable growth through 2030. Below is an in-depth exploration of the market size, leading players, key trends, and segmentation insights.

Projected Market Size and Growth Rate of the Open Source Help Desk Software Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…