Press release

Global AI in Banking Market to Reach $50.63 Billion by 2029, Growing at 34.7% CAGR

What market dynamics are playing a key role in accelerating the growth of the ai in banking market?The growing necessity for mobile banking services is predicted to spur the expansion of the AI in banking market in the future. This service, afforded by banks or other fiscal institutions, empowers customers to manage financial matters virtually through mobile gadgets such as smartphones or tablets. Leveraging smartphones and banking applications enables individuals to gain access to their financial accounts and complete transactions anytime, anywhere. This surge in mobile banking demand is bolstering the uptake of AI in banking, a trend forecasted to persist. For example, E-commerce Tips, an American company specializing in e-commerce advice and insights, reported in January 2024 that the proportion of people utilizing at least two types of digital payments in the States raised from 51% in 2021 to 62% in 2022. Additionally, e-commerce, which constitutes the lion's share of the universal digital payment market, stepped on $6.310 trillion in 2023 and is projected to escalate to $6.913 trillion by 2024. Prominently, even as digital wallets like PayPal, Venomo, and ApplePay ascend, in the B2B payment landscape in the US, credit cards and checks still represent 39% and 26%, correspondingly. Therefore, the surging demand for mobile banking services is propelling the trajectory of the AI in banking market in the future.

Get Your AI in Banking Market Report Here:

https://www.thebusinessresearchcompany.com/report/ai-in-banking-global-market-report

How will the growth rate of the ai in banking market shape industry trends by 2034?

In the past few years, the market size of AI in banking has witnessed a substantial expansion. Its growth is projected to increase from $11.71 billion in 2024 to $15.37 billion in 2025, demonstrating a compound annual growth rate (CAGR) of 31.3%. The surge in growth during the historic period is due to numerous factors including an increase in data in banking, improved capabilities for fraud detection and prevention, superior customer service, cost-cutting via automation, and competitive tension.

Anticipations of a substantial escalation in the AI in banking market are high over the next few years. A growth surge to $50.63 billion by 2029 is expected, boasting an impressive CAGR of 34.7%. This upward trend in the forecast period largely owes to the integration of AI in several areas such as credit scoring, multichannel support via chatbots, AI-centric wealth management, open banking strategies, and explainable AI for improved transparency. The forecast period will see key trends such as the incorporation of voice and chatbot interfaces for customer interactions, employing predictive analytics for customized banking services, meeting regulatory compliance with the help of AI solutions, the introduction of blockchain technology for increased security and transparency, and the rising prominence of wealth management robo-advisors.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=10506&type=smp

What are the most significant trends transforming the ai in banking market today?

Rapid advancements in technology are gaining traction as a major trend in the AI in banking sector. Firms in this market are embracing innovative technologies to maintain their market foothold. Case in point, Jordan Ahli Bank, a Jordanian finance services provider, unveiled an AI system technology named ahliGPT in April 2023. With ahliGPT, clients facing queries or challenges in banking and financial services can efficiently secure accurate solutions, resulting in time and effort savings for both bank consumers and staff.

Which primary segments of the ai in banking market are driving growth and industry transformations?

The AI in banking market covered in this report is segmented -

1) By Component: Solution, Service

2) By Technology: Machine Learning And Deep Learning, Natural Language Processing (NLP), Computer Vision, Other Technologies

3) By Organization Size: Small And Medium Sized Banks, Large Overseas Banks

4) By Application: Risk Management Compliance And Security, Customer Service, Back Office or Operations, Financial Advisory, Other Applications

Subsegments:

1) By Solution: Chatbots and Virtual Assistants, Fraud Detection and Prevention Solutions, Risk Management Solutions, Customer Analytics Solutions, Automated Wealth Management Solutions

2) By Service: Consulting Services, Implementation Services, Maintenance and Support Services, Training and Education Services, Managed Services

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=10506

Which geographical regions are pioneering growth in the ai in banking market?

Asia-Pacific was the largest region in the AI in banking market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global AI in banking market report during the forecast period. The regions covered in the AI in banking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Who are the influential players reshaping the ai in banking market landscape?

Major companies operating in the AI in banking market include Google LLC, Intel Corporation, Hewlett Packard Enterprise Development LP, accenture* plc, International Business Machines Corporation., Cisco Systems Inc., Oracle Corporation, SAP SE, Infosys Limited, Ally Financial Inc., Fair Isaac Corporation, SAS Institute Inc., International Business Machines Corporation, IPsoft Inc., Nuance Communications, Inc., HighRadius Corporation, Vectra AI, Inc., Amazon Web Services Inc., Kreditech Holding SSL GmbH, Kensho Technologies, Inc., RapidMiner Inc., BigML Inc., Lingxi Technology Co. Ltd.

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/sample.aspx?id=10506&type=smp

What Is Covered In The AI in Banking Global Market Report?

• Market Size Forecast: Examine the ai in banking market size across key regions, countries, product categories, and applications.

• Segmentation Insights: Identify and classify subsegments within the ai in banking market for a structured understanding.

• Key Players Overview: Analyze major players in the ai in banking market, including their market value, share, and competitive positioning.

• Growth Trends Exploration: Assess individual growth patterns and future opportunities in the ai in banking market.

• Segment Contributions: Evaluate how different segments drive overall growth in the ai in banking market.

• Growth Factors: Highlight key drivers and opportunities influencing the expansion of the ai in banking market.

• Industry Challenges: Identify potential risks and obstacles affecting the ai in banking market.

• Competitive Landscape: Review strategic developments in the ai in banking market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global AI in Banking Market to Reach $50.63 Billion by 2029, Growing at 34.7% CAGR here

News-ID: 3901457 • Views: …

More Releases from The Business Research Company

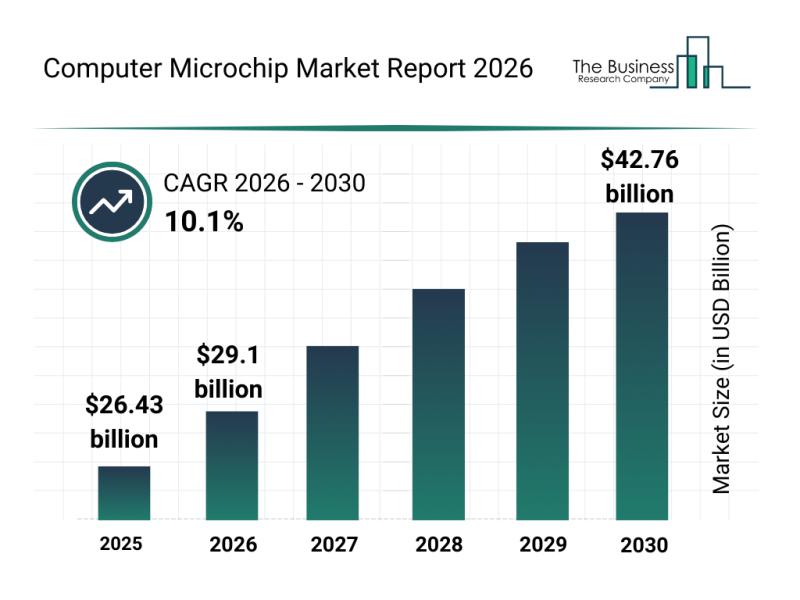

Leading Companies Spearheading Innovation and Growth in the Computer Microchip M …

The computer microchip industry is on the brink of substantial expansion, driven by advancements in various high-tech fields and increasing demand across numerous sectors. As technology continues to evolve rapidly, microchips are becoming more integral to innovations in communications, computing, and automation. Below is a detailed overview of the market size, key players, trends, and segmentation that define this thriving market.

Projected Growth and Market Size of the Computer Microchip Industry…

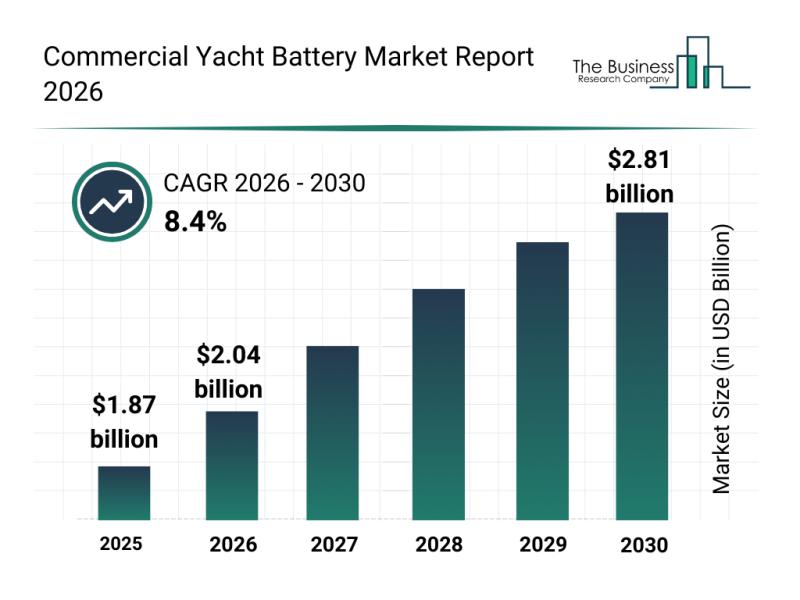

Future Prospects: Key Trends Shaping the Commercial Yacht Battery Market Up to 2 …

The commercial yacht battery market is on track for significant expansion as more advanced battery technologies and stricter environmental regulations reshape the marine industry. With growing interest in sustainable yachting and energy-efficient solutions, this market is expected to experience notable growth over the coming years. Below is a detailed overview of the market size, key drivers, major players, emerging trends, and important market segments shaping its future.

Forecasted Growth and Market…

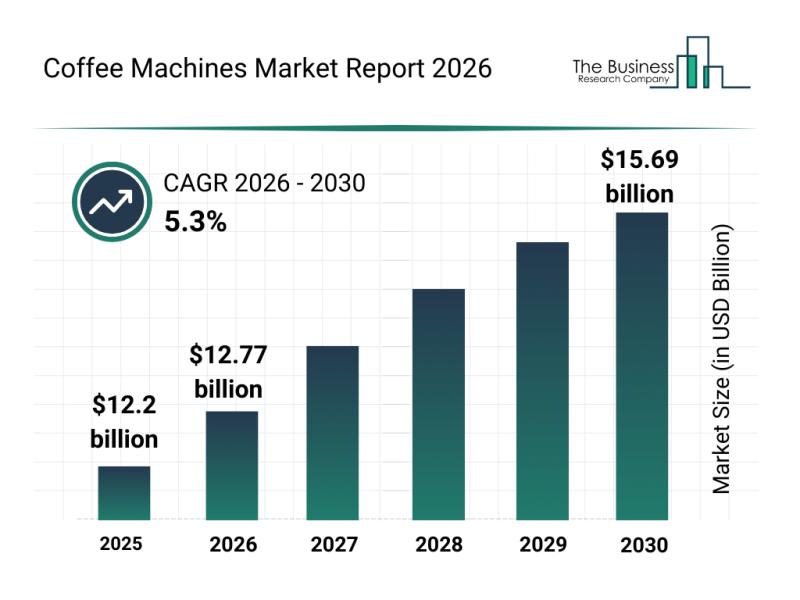

Emerging Sub-Segments Transforming the Coffee Machines Market Landscape

The coffee machines market is gaining considerable attention as coffee culture continues to evolve with consumer preferences leaning toward convenience and quality. With ongoing advancements in technology and changing lifestyles, this sector is set to experience significant growth and innovation in the coming years. Let's examine the current market valuation, key players, emerging trends, and segmentation shaping the coffee machines industry.

Projected Market Valuation and Growth Expectations in the Coffee Machines…

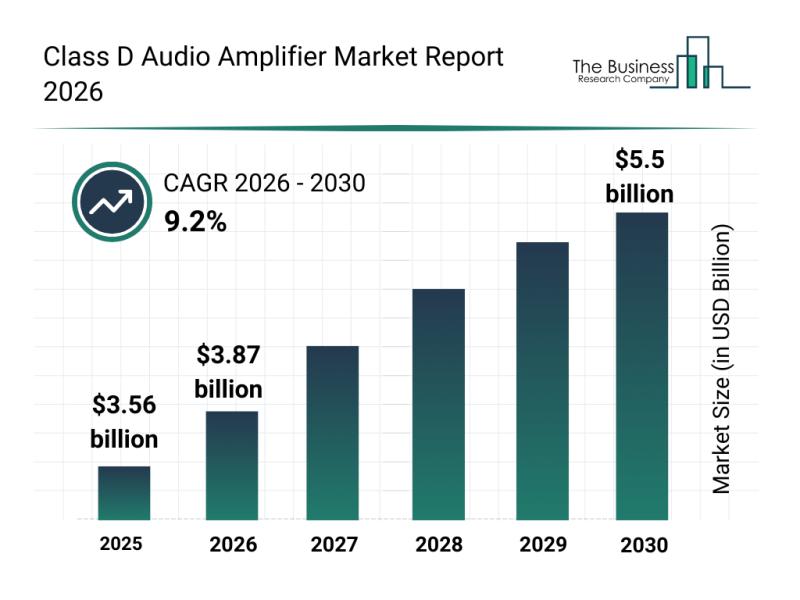

Market Driver Insights: The Impact of Recent Innovations on the Class D Audio Am …

The class D audio amplifier market is positioned for significant expansion in the coming years, driven by technological advancements and growing demand across various sectors. This market is witnessing increasing interest due to its efficiency and adaptability in multiple audio applications, ranging from consumer electronics to automotive systems. Below, we explore the market size, key players, emerging trends, and segmentation to provide a comprehensive overview of this evolving industry.

Projected Market…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…