Press release

Timothy Edward Dankha Drives Prolific Mortgage to the Forefront of Innovative Lending Solutions

Image: https://www.globalnewslines.com/uploads/2025/03/1741179831.jpgBirmingham, MI - The mortgage industry is undergoing a transformation, and Timothy Edward Dankha [http://timothyedwarddankha.com/] is leading the charge with Prolific Mortgage. As a visionary in the lending space, Dankha has built a company that prioritizes efficiency, transparency, and client success. Through cutting-edge solutions and customer-centric services, Prolific Mortgage is redefining how homebuyers and investors secure financing.

A Leader in Mortgage Lending

With extensive experience in the mortgage industry, Timothy Edward Dankha [https://timdankhaofficial.com/] has a deep understanding of borrowers' challenges. His expertise has driven Prolific Mortgage to develop streamlined lending processes that eliminate common frustrations.

Prolific Mortgage was founded with a mission to provide seamless, efficient lending solutions tailored to each borrower. Whether assisting first-time homebuyers, seasoned investors, or individuals looking to refinance, the company's goal remains the same: making homeownership and real estate investment more accessible.

Revolutionizing the Mortgage Process

Prolific Mortgage simplifies the mortgage process with fast approvals, competitive rates, and personalized services. Unlike traditional lenders bogged down by lengthy paperwork and delays, the company leverages technology and strategic methodologies to accelerate loan approvals and enhance the client experience.

Key advantages of Prolific Mortgage include:

*

Expedited Loan Approvals: A quick and efficient approval process designed to meet tight timelines.

*

Competitive Interest Rates: Affordable rates that help borrowers secure better financial outcomes.

*

Customer-First Approach: Dedicated loan specialists provide personalized guidance and support.

*

Innovative Technology: Digital tools simplify documentation, approvals, and communication for a seamless experience.

Empowering Homebuyers and Investors

Prolific Mortgage empowers a diverse range of clients. First-time homebuyers receive hands-on support, real estate investors gain access to tailored financing options, and homeowners looking to refinance benefit from favorable loan terms.

Clients consistently praise Prolific Mortgage for its efficiency, professionalism, and dedication. Borrowers have shared success stories about how the company made home financing stress-free, reaffirming its commitment to excellence.

Shaping the Future of Mortgage Lending

Looking ahead, Timothy Edward Dankha [http://timothyedwarddankha.com/] envisions an even more dynamic future for Prolific Mortgage. As the industry evolves, the company remains committed to adapting to market trends, interest rate fluctuations, and regulatory changes. By continuously refining its approach and integrating advancements in mortgage technology, Prolific Mortgage is poised to remain a leader.

"We are redefining the mortgage experience by making it faster, easier, and more accessible for everyone," said Dankha. "Our goal is to ensure homebuyers and investors have the tools and support they need to succeed."

Your Home, Your Future-Financed with Confidence by Prolific Mortgage

Prolific Mortgage's commitment to innovation, efficiency, and customer satisfaction is at the heart of everything it does. Under the leadership of Timothy Edward Dankha, the company continues to set new standards in mortgage lending, making home financing simpler and more attainable.

For those looking to buy, invest, or refinance, now is the perfect time to explore Prolific Mortgage's services. Take the first step toward a seamless lending experience by visiting Timothy Edward Dankha [https://timdankhaofficial.com/] today.

Learn More About Prolific Mortgage

As Prolific Mortgage continues to set new standards in the lending industry, prospective borrowers are encouraged to explore the company's innovative mortgage solutions.

For more information about Timothy Edward Dankha and Prolific Mortgage, visit Timothy Edward Dankha [https://timdankhaofficial.com] or contact below.

Media Contact

Contact Person: Timothy Edward Dankha

Email: Send Email [http://www.universalpressrelease.com/?pr=timothy-edward-dankha-drives-prolific-mortgage-to-the-forefront-of-innovative-lending-solutions]

Phone: (248) 533-8480

Address:166 W Maple Rd Ste 200

City: Birmingham

State: MI 48009

Country: United States

Website: http://timothyedwarddankha.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. GetNews makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Timothy Edward Dankha Drives Prolific Mortgage to the Forefront of Innovative Lending Solutions here

News-ID: 3899924 • Views: …

More Releases from Getnews

81-Year-Old American Veteran Spencer Wainright III Launches Inspirational Childr …

Image: https://www.globalnewslines.com/uploads/2026/02/50112cb7400752da6f08d6262b0c5642.jpg

Photo Courtesy: Spencer Wainright III

PUTNAM COUNTY, FL - Spencer Wainright III, an 81-year-old disabled American Veteran, has launched his children's book series, Jon, Kallie & Boo Saga, a heartwarming collection that celebrates the virtues of faith, resilience, and the importance of helping others. Available on major global platforms such as Amazon, Barnes & Noble, IngramSpark, Google Books, and iBooks, this series is poised to inspire a new generation of…

Apple Roofing in Blue Springs, MO Expands Storm Damage Roof Replacement Services …

Image: https://www.globalnewslines.com/uploads/2026/02/1771362626.jpg

Blue Springs, MO - February 18, 2026 - Apple Roofing Blue Springs [https://appleroof.com/our-process/#storm-damage-repair], a trusted name in residential and commercial roofing, has announced the expansion of its storm damage roof replacement services throughout Blue Springs and the greater Kansas City Metro area. Following an increase in severe weather events across Missouri, the company is scaling its operations to better serve homeowners dealing with hail, wind, and storm-related roof damage.

With…

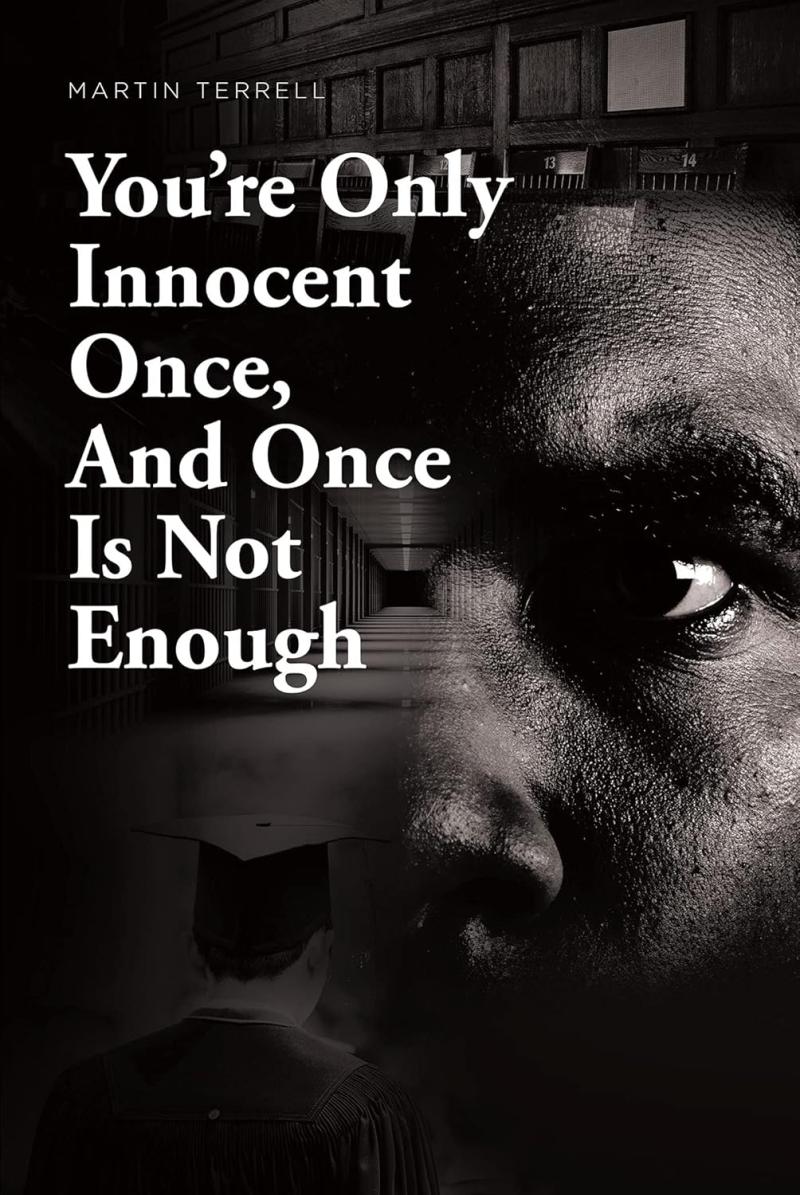

Two Powerful Works Illuminate Injustice Redemption and the Unseen Wounds of Urba …

Image: https://www.aionewswire.com/storage/images/ckeditor//81rGKMxE4aL._SL1500__1771341922.jpg

Two compelling literary works, You Are Only Innocent Once, and Once Is Not Enough [https://www.amazon.com/Youre-Only-Innocent-Once-Enough-ebook/dp/B09CG1BW43/ref] and Unseen Scars [https://www.amazon.com/Unseen-Scars-Martin-Terrell/dp/B0D9QKJ434/ref], offer unflinching examinations of injustice, resilience, and the lasting impact of systemic inequality in America. Together, these books provide timely and deeply human narratives that resonate amid ongoing conversations about criminal justice reform, racial bias, and personal redemption.

You Are Only Innocent Once, and Once Is Not Enough chronicles the extraordinary…

Apple Roofing Dallas Recognized for Top-Rated Roof Leak Repair Services in North …

Image: https://www.globalnewslines.com/uploads/2026/02/1771352421.jpg

Dallas, TX - February 17, 2026 - Apple Roofing Dallas [https://appleroof.com/dallas/], a leading provider of roofing services in the Dallas-Fort Worth area, has been recognized for delivering top-rated roof leak repair solutions backed by strong customer reviews and consistent quality workmanship. With hundreds of satisfied clients and an A+ rating from the Better Business Bureau, the company has cemented its reputation as one of the most trusted roofing contractors…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…