Press release

New Jersey Bankruptcy Attorney Daniel Straffi Explains How Bankruptcies Affect Background Checks

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/do-bankruptcies-show-up-on-background-checks/), of Straffi & Straffi Attorneys at Law, recently addressed a common concern among individuals considering bankruptcy: Do bankruptcies show up on background checks? The insights provide valuable information for those worried about how past financial struggles may impact their employment prospects.Bankruptcy is designed to offer individuals a financial reset, but its presence on a credit report can have lasting effects. New Jersey bankruptcy attorney Daniel Straffi explains that while bankruptcy can sometimes be seen negatively, it also signals that a person has taken steps toward financial responsibility. Employers may review bankruptcy records as part of their hiring process, particularly for jobs that involve financial management.

While bankruptcy appears on credit reports, not all background checks include credit history. Employers conducting criminal background checks will not see bankruptcies. However, positions requiring financial responsibility often include credit checks, which do show bankruptcy records. New Jersey bankruptcy attorney Daniel Straffi notes that this is especially relevant for applicants in banking, finance, or other roles that involve money management.

Understanding how long bankruptcy stays on a record is crucial. Attorney Daniel Straffi clarifies that a Chapter 7 bankruptcy remains on a credit report for up to 10 years, while Chapter 13 bankruptcy is removed after seven years. These time frames begin from the date of filing.

Importantly, federal law prohibits government employers from discriminating against job applicants solely based on a past bankruptcy. However, private employers are not subject to the same restrictions. Daniel Straffi advises job seekers to be aware that private employers may consider bankruptcy as one of several factors in their hiring decisions.

Federal regulations under the Fair Credit Reporting Act (FCRA) limit how bankruptcy records are used in hiring. According to New Jersey bankruptcy attorney Daniel Straffi, employers hiring for jobs with salaries under $75,000 cannot report Chapter 13 bankruptcies that are more than seven years old. Chapter 7 bankruptcies, however, can be reported for up to 10 years.

Before running a background check, employers must obtain written consent from the applicant. If an employer takes adverse action-such as denying a job based on a bankruptcy record-they must inform the applicant and provide a copy of the credit report if requested.

New Jersey has specific laws aligning with the FCRA to protect job seekers. Employers must obtain explicit written consent before checking an applicant's credit history. Additionally, employers must provide written notice that a credit check may include personal financial details. If a hiring decision is based on the findings of a credit report, employers are legally required to notify the applicant.

Daniel Straffi highlights that these laws aim to balance an employer's need for financial screening with an applicant's right to fair consideration. In New Jersey, while private employers can consider bankruptcy in hiring decisions, they cannot deny employment solely based on bankruptcy.

Beyond employment, bankruptcy can also affect housing opportunities. Landlords may review an applicant's credit history before approving a lease. New Jersey bankruptcy attorney Daniel Straffi advises individuals with past bankruptcies to be upfront with potential landlords. If an applicant can demonstrate financial stability and consistent income, many landlords may overlook a past bankruptcy.

"A responsible landlord will prioritize an applicant's ability to pay rent over their bankruptcy history," says Daniel Straffi. In some cases, bankruptcy may even work in an applicant's favor by eliminating other financial burdens, making rent payments more manageable.

Bankruptcy filings are public records, meaning they are accessible indefinitely, even after being removed from a credit report. However, most employers do not conduct searches specifically for bankruptcy records.

In some cases, an employer may become aware of a bankruptcy if wage garnishment is involved. New Jersey bankruptcy attorney Daniel Straffi explains that in Chapter 7 bankruptcy, employers are usually unaware unless a creditor has previously issued a wage garnishment. In Chapter 13 bankruptcy, where a structured repayment plan is in place, an employer may become aware if wages are garnished to meet repayment obligations.

Filing for bankruptcy significantly impacts credit scores, but the effects vary by bankruptcy type. Daniel Straffi explains that Chapter 7 bankruptcy stays on credit reports longer and can lower credit scores more than Chapter 13 bankruptcy. Financial institutions often view Chapter 13 filers more favorably, as they have made efforts to repay debts. Credit score recovery is possible after bankruptcy. Many individuals can rebuild credit within a few years through responsible financial habits.

Federal laws protect employees from workplace discrimination based on bankruptcy. New Jersey bankruptcy attorney Daniel Straffi emphasizes that employers cannot fire, demote, or reduce an employee's salary due to bankruptcy. However, employees can still be terminated for performance-related reasons. If an individual suspects their bankruptcy filing led to wrongful termination, they may have grounds for legal action.

Filing for bankruptcy is a significant decision that can impact employment, housing, and financial opportunities. Seeking legal advice can help individuals understand their rights and manage potential challenges.

About Straffi & Straffi Attorneys at Law:

Straffi & Straffi Attorneys at Law is a New Jersey-based law firm dedicated to helping individuals address financial challenges through bankruptcy solutions. Led by Daniel Straffi, the firm provides legal representation for clients seeking financial relief through Chapter 7 and Chapter 13 bankruptcy.

Embeds:

YouTube Video: https://www.youtube.com/watch?v=Ppe3CFIxzEc

GMB: https://www.google.com/maps?cid=18340758732161592314

Email and website

Email: familyclient@straffilaw.com

Website: https://www.straffilaw.com/

Media Contact

Company Name: Straffi & Straffi Attorneys at Law

Contact Person: Daniel Straffi

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-jersey-bankruptcy-attorney-daniel-straffi-explains-how-bankruptcies-affect-background-checks]

Phone: (732) 341-3800

Address:670 Commons Way

City: Toms River

State: New Jersey 08755

Country: United States

Website: https://www.straffilaw.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Jersey Bankruptcy Attorney Daniel Straffi Explains How Bankruptcies Affect Background Checks here

News-ID: 3899702 • Views: …

More Releases from ABNewswire

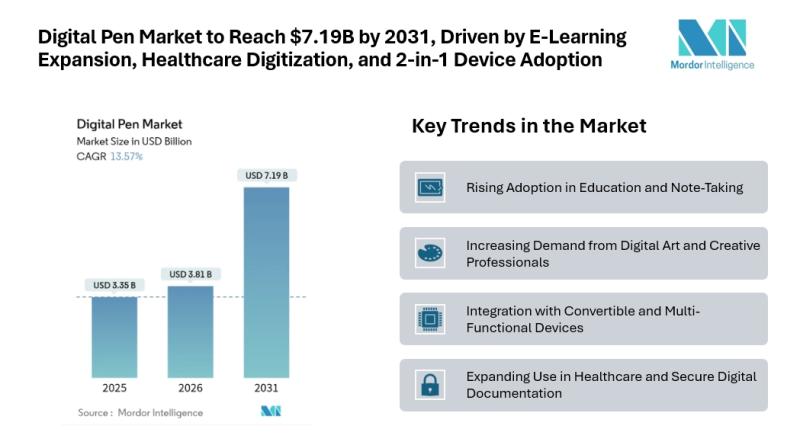

Digital Pen Market to Reach $7.19B by 2031, Driven by E-Learning Expansion, Heal …

Mordor Intelligence has published a new report on the digital pen market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Digital Pen Market Overview

According to Mordor Intelligence, the digital pen market size [https://www.mordorintelligence.com/industry-reports/digital-pen-market?utm_source=abnewswire] was valued at USD 3.35 billion in 2025 and reached USD 3.81 billion in 2026. It is projected to grow to USD 7.19 billion by 2031, registering a CAGR of 13.57% during the forecast period.…

Shollenberger Januzzi & Wolfe, LLP Expands Expertise as Leading Personal Injury …

When injuries disrupt your life, the path to justice can feel overwhelming. In Pennsylvania, victims of accidents and negligence deserve dedicated legal advocates committed to protecting their rights and securing fair compensation. At Sholl Jan Law, our experienced Personal Injury Lawyers Pennsylvania [https://www.sholljanlaw.com/personal-injury/] provide compassionate representation and aggressive advocacy, ensuring your voice is heard and your case is handled with integrity.

From car accidents and slip-and-fall injuries to medical malpractice and…

Pro-Mix Concrete Ltd Explains How Mix-On-Site Concrete Trucks Deliver Fresh, Cus …

Image: https://www.abnewswire.com/upload/2026/02/0778b549193ba88a1c647b1e6b1f58b4.jpg

Ordering concrete used to mean guessing how much you'd need, paying for the full load, and racing the clock before it hardened in the drum. That's not how it works anymore. A mix on site concrete truck [https://www.pro-mixconcrete.co.uk/mix-on-site-concrete-prices/] operators use today carries raw materials separately and mixes fresh concrete right at your location. You get exactly the amount you need, mixed to your exact specs, with zero waste. If…

Sente Athletics Rashguards Are Making Waves in Vancouver's Growing BJJ Community

Image: https://www.abnewswire.com/upload/2026/02/88c9dcd8b3d607f24b49ba8268887376.jpg

VANCOUVER, BC - As of 2026 the Brazilian Jiu Jitsu scene across Vancouver continues to grow at an impressive pace, with dozens of academies and a rapidly expanding athlete base, and within this momentum Sente Athletics is establishing itself as a major provider of high quality BJJ rashguards [https://senteathletics.com/]that combine durability, comfort, and thoughtful design in a way that resonates strongly with both recreational practitioners and competitive athletes, their…

More Releases for Straffi

New Jersey Bankruptcy Attorney Daniel Straffi, Jr. Explains Chapter 7 Income Lim …

TOMS RIVER, NJ - Individuals considering Chapter 7 bankruptcy in New Jersey must meet specific income requirements determined by the federal means test, which compares a six-month income average against state median income guidelines. New Jersey bankruptcy attorney Daniel Straffi, Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/what-are-income-limits-chapter-7-bankruptcy/) explains how the income thresholds work, what counts as income in the calculation, and what options exist for those whose income…

New Jersey Bankruptcy Attorneys Straffi & Straffi Attorneys at Law Announce Guid …

Toms River, NJ - New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/how-long-after-filing-bankruptcy-can-you-buy-a-house-in-new-jersey/), led by attorney Daniel Straffi Jr., announce comprehensive guidance for residents seeking a path to homeownership after bankruptcy. The firm's new advisory explains practical timelines, loan options, and documentation standards for applicants rebuilding credit, providing clear steps for pursuing a mortgage in New Jersey following Chapter 7 or Chapter 13 proceedings.

The guidance details how…

New Jersey Emergency Bankruptcy Attorney Daniel Straffi Provides Clarity on Emer …

Understanding how to protect assets during a financial crisis is critical, particularly when swift legal action is required. New Jersey emergency bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-an-emergency-bankruptcy-filing-in-new-jersey/) explains how an emergency bankruptcy filing can provide immediate relief for those facing foreclosure, wage garnishment, or other urgent creditor actions. In a recent article published by Straffi & Straffi Attorneys at Law, Daniel Straffi outlines the essential steps and key considerations involved in…

Straffi & Straffi Attorneys at Law Publishes New Article on No Asset Bankruptcy …

New Jersey Chapter 7 bankruptcy lawyer Daniel Straffi of Straffi & Straffi Attorneys at Law has published an article discussing the concept and implications of a no asset bankruptcy New Jersey [https://www.straffilaw.com/new-jersey-chapter-7-bankruptcy-lawyer/no-asset/]. This type of bankruptcy is commonly filed by individuals who have little to no nonexempt assets available for creditors. As explained by Straffi, a no asset bankruptcy can be an effective path toward financial relief for those who…

New Jersey Bankruptcy Attorney Daniel Straffi Discusses Medical Debt Relief Thro …

Medical debt continues to be a leading cause of financial distress for many Americans, and New Jersey residents are no exception. In a detailed article titled "Can My Medical Debt Be Paid Off With Bankruptcy?", New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how individuals burdened with overwhelming healthcare expenses may find relief through the bankruptcy process. The article, published by Straffi & Straffi Attorneys at Law, provides a comprehensive…

New Jersey Bankruptcy Attorney Daniel Straffi Explains Debt Restructuring Soluti …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-debt-restructuring-in-new-jersey/) offers important insights into how individuals and businesses can regain control of their finances through debt restructuring. In a recent article titled "What is Debt Restructuring in New Jersey?", Straffi addresses the growing financial strain many face due to job loss, unexpected expenses, or business challenges, and outlines the available options for restructuring debt to avoid default. Straffi & Straffi Attorneys at Law…