Press release

Surety Market to Reach USD 30.03 Billion by 2030

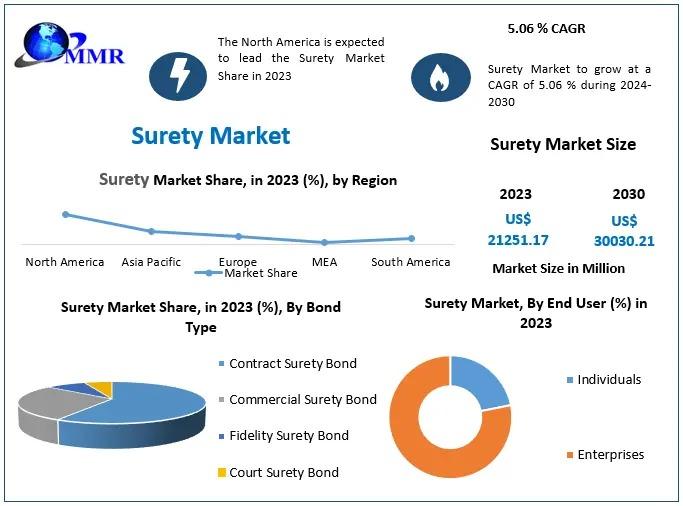

The Surety Market size was valued at USD 21251.17 Million in 2023 and the total Surety Market revenue is expected to grow at a CAGR of 5.06 % from 2024 to 2030, reaching nearly USD 30030.21 Million. This expansion is primarily fueled by increased infrastructure spending, technological advancements in surety bond issuance, and evolving regulatory frameworks that support market adoption. The growing demand for surety bonds in construction, energy, and government projects is also playing a critical role in shaping market dynamics.Request Sample Link for More Details:https://www.maximizemarketresearch.com/request-sample/185094/

Market Estimation, Growth Drivers, and Opportunities

The surety market is expanding as businesses and governments seek financial safeguards against default and non-performance risks in large-scale projects. Several key factors are driving the market:

Rising Infrastructure Development: Governments worldwide are investing heavily in infrastructure projects, fueling the demand for contract surety bonds to ensure project completion. In the United States, the $1.2 trillion Infrastructure Investment and Jobs Act has significantly increased public-sector construction activities, further driving market growth.

Digital Transformation in Surety Bonds: The industry is undergoing a technological shift, with blockchain and artificial intelligence (AI) enabling faster and more secure bond issuance. Automated underwriting and digital verification processes are reducing administrative burdens, making surety bonds more accessible.

Regulatory and Policy Support: Government initiatives, such as the U.S. Small Business Administration's expansion of the Surety Bond Guarantee Program, have facilitated small businesses' access to surety bonds, increasing their participation in large-scale projects.

Expanding Role of Surety in New Industries: While traditionally dominant in construction, surety bonds are gaining traction in the financial services, healthcare, and renewable energy sectors. The rise of green energy projects and public-private partnerships (PPPs) is creating new opportunities for surety providers.

Emerging Markets Driving Demand: Rapid urbanization and infrastructure development in Asia-Pacific, particularly in China and India, are boosting demand for surety bonds. Governments are implementing stricter contractual obligations, increasing reliance on surety services.

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/surety-market/185094/

U.S. Market Trends and Investments in 2024

The U.S. surety market, accounting for a significant share of global revenues, witnessed several key trends in 2024:

Adoption of AI-Driven Underwriting: Major insurers are integrating AI and machine learning into their underwriting processes, improving risk assessment and expediting approvals.

Increase in Federal Infrastructure Projects: With billions allocated for highways, bridges, and renewable energy, the demand for performance and payment bonds surged in 2024.

Growth in Private Construction Surety Bonds: The real estate sector has seen a rise in private development surety bonds, as developers seek financial guarantees against contractor defaults.

Regulatory Updates Supporting Small Businesses: The U.S. government raised the threshold for SBA-backed surety bonds, making it easier for small and mid-sized firms to participate in federal contracts.

Market Segmentation and Leading Segments

The surety market is categorized based on bond type and end-user industries. The largest segment includes:

Contract Surety Bonds: This category holds the largest market share, primarily due to its essential role in public and private infrastructure projects. Performance bonds, bid bonds, and payment bonds continue to dominate.

Construction Industry: The construction sector remains the largest consumer of surety bonds, with growing investments in commercial and residential projects worldwide.

Request Sample Link for More Details:https://www.maximizemarketresearch.com/request-sample/185094/

Competitive Landscape and Key Players

The global surety market is competitive, with key players adopting strategies such as acquisitions, digital transformation, and product diversification. The top five companies dominating the market include:

Travelers Companies, Inc.: A leading surety provider, Travelers has invested in AI-driven risk assessment and digital bond issuance platforms, streamlining the underwriting process.

Chubb Limited: Chubb has expanded its global footprint, investing in emerging markets and leveraging blockchain technology to enhance the transparency and security of surety bond transactions.

Zurich Insurance Group: With a strong presence in Europe and North America, Zurich has focused on diversifying its surety bond portfolio, targeting renewable energy and infrastructure projects.

Liberty Mutual Insurance: Liberty Mutual has introduced innovative surety solutions tailored for small and mid-sized businesses, increasing accessibility to financial guarantees.

Hiscox Ltd.: Hiscox has focused on technology-driven surety solutions, launching automated underwriting platforms to reduce processing times for contractors and businesses.

Regional Analysis: USA, UK, Germany, France, Japan, and China

The surety market shows varying trends across key regions:

USA (35% Market Share): The U.S. leads the global surety market, supported by strong infrastructure investments and a well-established regulatory framework. Government-backed surety programs continue to drive market participation.

UK: Growth is driven by increased construction activities and financial regulations requiring surety bonds for various corporate transactions.

Germany & France: European markets are witnessing steady growth, fueled by infrastructure modernization and public-private partnerships.

Japan: The demand for surety bonds is rising due to government-backed smart city initiatives and urban redevelopment projects.

China: Holding a growing market share, China's emphasis on mega infrastructure projects under its Belt and Road Initiative is fueling surety bond adoption.

Conclusion and Future Outlook

The global surety market is set for steady growth, driven by infrastructure expansion, digital innovation, and regulatory support. Companies that leverage AI-driven risk assessments, blockchain integration, and emerging market penetration will remain competitive. As demand for financial security increases across industries, the surety sector will continue to evolve, offering enhanced solutions to meet modern project requirements. The rise of renewable energy projects and green construction further opens new avenues for market expansion.

Important Businesses Discussed in This Research Report:

♦ Global Forming Films Market https://www.maximizemarketresearch.com/market-report/global-forming-films-market/87344/

♦ Global Tank Container Shipping Market https://www.maximizemarketresearch.com/market-report/global-tank-container-shipping-market/69869/

♦ Global Fabric Freshener Market https://www.maximizemarketresearch.com/market-report/global-fabric-freshener-market/92197/

♦ Global Cubitainers Market https://www.maximizemarketresearch.com/market-report/global-cubitainers-market/32338/

♦ Asia Pacific Tea Market https://www.maximizemarketresearch.com/market-report/asia-pacific-tea-market/21686/

♦ China Eyewear Market https://www.maximizemarketresearch.com/market-report/china-eyewear-market/21972/

♦ Global Badminton Equipment Market https://www.maximizemarketresearch.com/market-report/global-badminton-equipment-market/52380/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surety Market to Reach USD 30.03 Billion by 2030 here

News-ID: 3899004 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Surety

Surety Bonds Without Private Equity Pressure

As private equity continues to reshape the insurance and surety landscape, White Lion Bonding & Insurance Services is reaffirming its commitment to surety bonds and performance bonds, including site improvement bonds, grading bonds, and utilities bonding, delivered through a founder-led, relationship-driven approach. This focus on surety bonds for site improvements, grading, and utilities has guided the firm from its earliest days to its growth as a nationally respected surety brokerage.

Founded…

Surety Market Size to Reach USD 33146.14 Million by 2032 | Global Surety Bonds I …

The global Surety Market was valued at USD 23462.34 Million in 2025 and is projected to grow at a CAGR of 5.06% from 2025 to 2032, reaching USD 33,146.14 Million by 2032, according to Maximize Market Research.

Market Overview

The Surety Market plays a critical role in global financial risk management by providing guarantees that contractual obligations will be met. In this arrangement, a surety assures an obligee (project owner or client)…

Growth Of Digital Payment Services Driving Expansion In The Surety Market: A Key …

The Surety Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Surety Market Size and Its Estimated Growth Rate?

The surety market has seen strong growth in recent years. It will grow from $19.62 billion in 2024 to $21 billion in 2025 at…

Top Factor Driving Surety Market Growth in 2025: Growth Of Digital Payment Servi …

Which drivers are expected to have the greatest impact on the over the surety market's growth?

The growing use of digital payment services is expected to fuel the growth of the surety market. Digital payments, facilitated by smartphones and enhanced security features, are transforming how people transact. Surety services provide financial guarantees for businesses, ensuring reliability and protection against risks like fraud or service disruptions. According to the Ministry of Electronics…

Surety Bond Market Future Business Opportunities 2022-2030 | HUB International L …

Global "Surety Bond Market" to grow with an impressive CAGR over the forecast period from 2022-2030. The report on Surety Bond offers the customers with a comprehensive analysis of vital driving factors, customer behavior, growth trends, product application, key player analysis, brand position and price patterns. The statistics on estimating patterns is obtained by studying product prices of key players as well as emerging market players. Additionally, Surety Bond market…

Surety Market- Industry Research Report by DeepResearchReport

DeepResearchReports has uploaded a latest report on Surety Industry from its research database. Surety Market is segmented by Regions/Countries. All the key market aspects that influence the Surety Market currently and will have an impact on it have been assessed and propounded in the Surety Market research status and development trends reviewed in the new report.

The new tactics of Surety Industry report offers a comprehensive market breakdown on…