Press release

Surging Credit Card Demand Fuels Expansion Growth Trends In The Credit Card Issuance Services Market Driver: A Major Catalyst in the Evolution of the Credit Card Issuance Services Market in 2025

What market dynamics are playing a key role in accelerating the growth of the credit card issuance services market?Anticipations of a surge in the demand for credit cards are fueling the growth prospects of the credit card issuance services industry. A credit card is a financial tool offered by banks that allows users to borrow funds up to a certain approved limit. The role of credit card issuers is crucial as they manage card transactions, repay previously approved expenditures, and handle requests for chargeback. For example, the Federal Reserve Bank of New York, a US federal bank overseeing the second district of the Federal Reserve System, reported in February 2023 that there was a rise of $61 billion in credit card balances, reaching a total of $986 billion in the USA in the last quarter of 2022. This number surpasses the pre-pandemic high of $927 billion. Hence, the surging demand for credit cards is propelling the expansion of the credit card issuance service industry.

Get Your Credit Card Issuance Services Market Report Here:

https://www.thebusinessresearchcompany.com/report/credit-card-issuance-services-global-market-report

How will the growth rate of the credit card issuance services market shape industry trends by 2034?

The market size for credit card issuance services has seen a robust growth in the past few years. The expansion is set to continue from $520.01 billion in 2024 to $567.83 billion in 2025, with a compound annual growth rate (CAGR) of 9.2%. Factors driving the growth during the historic period include patterns in consumer expenditure, efforts towards financial inclusion, economic advancement, loyalty schemes, and shifts in regulations.

The market for credit card issuance services is predicted to experience substantial growth in the coming years, escalating to a size of $787.39 billion by 2029 with a compound annual growth rate (CAGR) of 8.5%. Contributing factors to the anticipated growth during this forecast period include the adoption of contactless payments, data protection issues, the emergence of cryptocurrencies, the ascendance of embedded finance, and the trend toward customization and personalization. Some of the predominant trends for this forecast period are biometric authentication, incorporation with financial wellness services, real-time payment processing, the use of blockchain for security, and the application of artificial intelligence and predictive analytics.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=12484&type=smp

What are the emerging trends shaping the future of the credit card issuance services market?

The emergence of innovative technologies is a predominant trend observed in the credit card issuance service sector. Dominant players in this industry are incorporating novel technologies to maintain their market standing. A perfect example of this would be AU Small Finance Bank, an established banking institution based in India, which introduced two distinct credit card insurances in April 2024. These include the NOMO (No Missing Out) Secured Credit Card and the AU SPONT Rupay Credit Card. The NOMO Credit Card targets individuals who might not meet the criteria for conventional unsecured credit cards. This could be due to low credit scores, limited credit activity, or inadequate income proof. It offers an impressive array of benefits such as reward points, fuel surcharge waivers, and airport lounge accessibility. The Rupay Credit Card distinguishes itself by letting its holders associate the card with their favored UPI-enabled application, facilitating easy payments via the UPI Scan and Pay feature. Additionally, it also provides a 1% cashback on most transactions and COINS rewards for UPI-related transactions processed through the AU 0101 app, thereby appealing to customers from all economic backgrounds.

Which primary segments of the credit card issuance services market are driving growth and industry transformations?

The credit card issuance services market covered in this report is segmented -

1) By Type: Consumer Credit Cards, Business Credit Cards

2) By Issuers: Banks, Credit Unions, Non-Banking Financial Companies

3) By End-User: Personal, Business

Subsegments:

1) By Consumer Credit Cards: Standard Credit Cards, Rewards Credit Cards, Secured Credit Cards, Student Credit Cards, Premium Credit Cards

2) By Business Credit Cards: Small Business Credit Cards, Corporate Credit Cards, Commercial Credit Cards, Business Rewards Credit Cards, Charge Cards

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12484

Which geographical regions are pioneering growth in the credit card issuance services market?

North America was the largest region in the credit card issuance services market in 2024. The regions covered in the credit card issuance services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Who are the influential players reshaping the credit card issuance services market landscape?

Major companies operating in the credit card issuance services market include JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., American Express Company, HSBC Holdings plc., Toronto-Dominion Bank Group, Goldman Sachs Group Inc., Capital One Financial Corporation, Barclays Bank PLC, U.S. Bancorp, Standard Chartered PLC, PNC Financial Corp., Fiserv Inc., Synchrony Financial, Fidelity National Information Services Inc., Stripe Inc., Wells Fargo & Co., Fifth Third Bank NA, Navy Federal Credit Union, Huntington Bancshares Incorporated, Santander Bank N.A., Giesecke+Devrient GmbH, Synovus Financial Corp., Penfed Federal Credit Union, Marqeta Inc., Entrust Corporation, Comenity Bank, Nium Pte. Ltd.

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/sample.aspx?id=12484&type=smp

What Is Covered In The Credit Card Issuance Services Global Market Report?

• Market Size Forecast: Examine the credit card issuance services market size across key regions, countries, product categories, and applications.

• Segmentation Insights: Identify and classify subsegments within the credit card issuance services market for a structured understanding.

• Key Players Overview: Analyze major players in the credit card issuance services market, including their market value, share, and competitive positioning.

• Growth Trends Exploration: Assess individual growth patterns and future opportunities in the credit card issuance services market.

• Segment Contributions: Evaluate how different segments drive overall growth in the credit card issuance services market.

• Growth Factors: Highlight key drivers and opportunities influencing the expansion of the credit card issuance services market.

• Industry Challenges: Identify potential risks and obstacles affecting the credit card issuance services market.

• Competitive Landscape: Review strategic developments in the credit card issuance services market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surging Credit Card Demand Fuels Expansion Growth Trends In The Credit Card Issuance Services Market Driver: A Major Catalyst in the Evolution of the Credit Card Issuance Services Market in 2025 here

News-ID: 3895691 • Views: …

More Releases from The Business Research Company

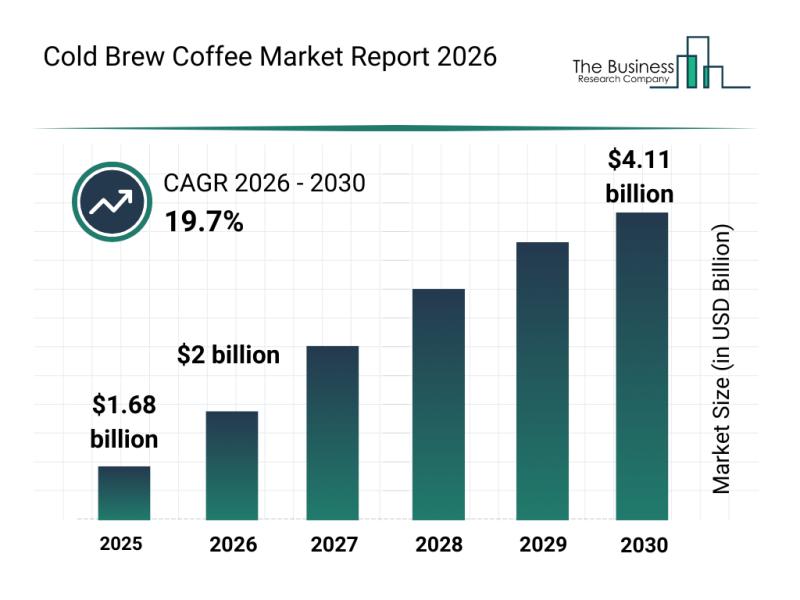

Analysis of Key Market Segments Influencing the Cold Brew Coffee Market

The cold brew coffee sector is rapidly evolving, attracting growing consumer interest due to its unique flavor profiles and convenience. As preferences shift toward healthier and sustainable beverage options, this market is positioned for substantial expansion over the coming years. Let's explore the current market value outlook, key players, emerging trends, and the primary segments contributing to this growth.

Projected Growth and Market Size of the Cold Brew Coffee Industry …

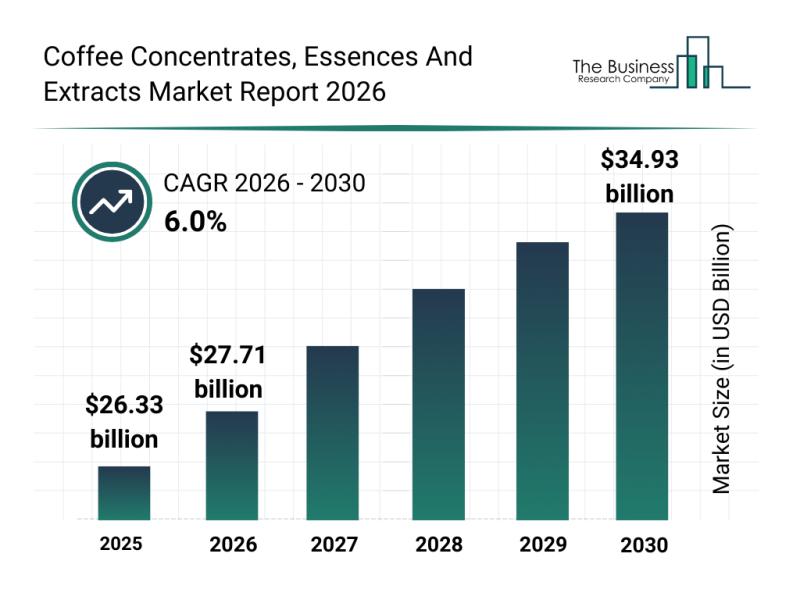

Market Trend Analysis: The Impact of Recent Innovations on the Coffee Concentrat …

The coffee concentrates, essences, and extracts market is positioned for significant expansion over the coming years, driven by evolving consumer preferences and innovative product developments. This sector is experiencing a shift toward more premium and convenient coffee options, which is shaping its growth trajectory through 2030.

Projected Growth and Market Size of the Coffee Concentrates, Essences, and Extracts Market

The market for coffee concentrates, essences, and extracts is anticipated to…

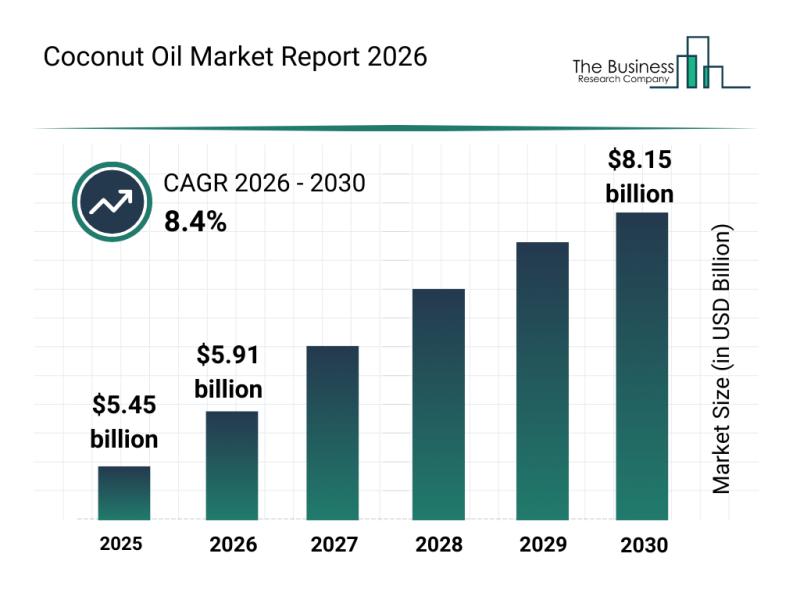

Trends in Growth, Market Segments, and Competitive Strategies Influencing the Co …

The coconut oil industry is poised for remarkable expansion in the coming years, driven by evolving consumer preferences and innovations across various sectors. As demand grows for healthier and sustainable products, the market is expected to witness significant developments that will shape its future trajectory. Let's explore the current market value, key players, trends, and segmentation of the coconut oil industry.

Projected Market Value and Growth Outlook for the Coconut Oil…

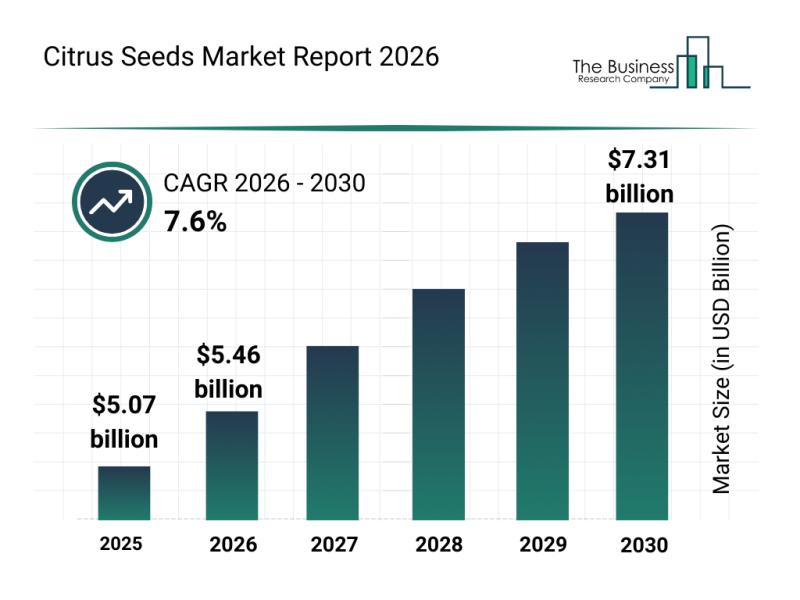

Analysis of Key Market Segments Driving the Citrus Seeds Market

The citrus seeds market is attracting significant attention due to its expanding role in agriculture, cosmetics, and food industries. With increasing emphasis on sustainability and innovative uses, this sector is set to experience notable growth in the coming years. Let's explore the current market size, influential trends, leading companies, and segmentation details shaping the future of the citrus seeds industry.

Citrus Seeds Market Size and Forecast Through 2030

The citrus…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…