Press release

Who is the winner? Global oil and gas giant's barrel of oil cost PK

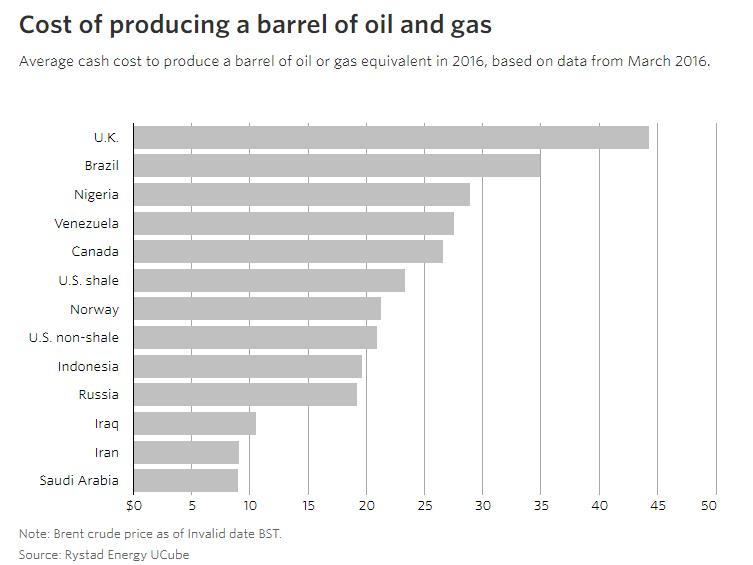

The latest financial report shows that CNOOC has good cost control in the first three quarters, with a barrel of oil cost (full cost of barrel of oil) of US$28.37, a year-on-year decrease of 6.3%. Based on the results of the first half of this year's financial report, the cost of barrel of oil was US$28.17, analysts pointed out that CNOOC is expected to control the cost of barrel of oil below US$30 again in 2023.Low cost has become the core competitiveness of oil companies and the key to improving profitability and combating the risk of oil price fluctuations.Faced with many unstable factors in the current international crude oil market, global oil companies are scrambling to reduce costs and improve efficiency, try to reduce unnecessary capital expenditures and strictly control operating costs - because this is the only way for companies to survive and fully prepare for future development. Metrics.

The cost of a barrel of oil for foreign giantsIn the second half of the year, international oil prices fell from highs, and the net profits of the three international oil and gas giants Total, Chevron, and Exxon Mobil generally declined in the third quarter, recording adjusted net profits of US$6.45 billion, US$5.72 billion, and US$9.07 billion respectively. Compared with the same period last year, they decreased by 35%, 47% and 54% respectively.The situation is pressing, and the cost of a barrel of oil is an eternal development indicator for large international oil companies.

Image: https://ecdn6.globalso.com/upload/p/137/image_other/2023-11/655725e8e467430145.jpg

In recent years, Total has continued to strengthen cost control, and its break-even point has dropped from US$100/barrel in 2014 to the current US$25/barrel; BP's average production costs in the North Sea have also dropped from a peak of more than US$30 per barrel in 2014. to below $12 per barrel. However, oil giants such as Total and BP have a wide range of global investments, and the cost gap between offshore, onshore and shale is huge. ExxonMobil has said it will reduce the cost of oil extraction in the Permian to about $15 per barrel, a level only found in giant oil fields in the Middle East, but other independent shale companies in the Permian do not have such good data.

According to a Rystad Energy report, only 16 U.S. shale oil companies have an average cost of new wells in the Permian Basin below $35 per barrel; Exxon Mobil aims to increase production in the region fivefold by 2024. Reaching about 1 million barrels per day, the company can earn a profit of $26.90 per barrel there.

According to the 2023 semi-annual report, the cost of a barrel of oil for Occidental Petroleum's U.S. shale oil project is approximately US$35. Reuters reported that as the drilling depth of the U.S. Gulf of Mexico migrates from diving to deep water, the cost of a barrel of oil in the region will also rise from about US$18 to about US$23 from 2019 to 2022.

According to information from Russia's authoritative pricing agency, the cost per barrel of Urals crude oil shipped from ports on the Baltic Sea is about US$48.Comparing the cost of barrels of oil among major companies, CNOOC still has a price advantage over international oil companies such as Total, Exxon Mobil, and BP.

Low cost is the core competitiveness

Comparing the financial reports of "Three Barrels of Oil" in the past two years, CNOOC's gross profit margin is as high as over 50%.With a net profit margin of 35%, unique profitability and low cost, it has become CNOOC's core competitiveness.

The financial reports of the past four years show that in 2019, CNOOC successfully controlled the cost of barrels of oil below US$30 (US$29.78/barrel). In 2020, it hit a new low in the past ten years, falling to US$26.34/barrel, especially in 2020. In the first half of the year, CNOOC's barrel oil cost reached a surprising US$25.72/barrel, and will be US$29.49/barrel and US$30.39/barrel in 2021 and 2022 respectively. This does not include foreign markets. You must know that the cost of a barrel of oil from CNOOC's Guyana and Brazilian oil fields is even lower, only about US$21.

Media Contact

Company Name: SICHUAN GRANTECH NEW ENERGY TECHNOLOGY CO., LTD.

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=who-is-the-winner-global-oil-and-gas-giants-barrel-of-oil-cost-pk]

Country: China

Website: https://www.thedrillingrigparts.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Who is the winner? Global oil and gas giant's barrel of oil cost PK here

News-ID: 3895018 • Views: …

More Releases from ABNewswire

Genloop Meets Prime Minister Narendra Modi to Advance Vision for Ethical, Scalab …

Genloop leaders met with India's Prime Minister to discuss advancing ethical, scalable AI from innovation to real-world deployment.

Santa Monica, CA - January 14, 2026 - Genloop [https://genloop.ai/?utm_source=ABNews&utm_medium=email&utm_campaign=1752vc], a portfolio company of 1752vc [http://1752.vc/?utm_source=abnews] (formerly Pegasus Angel Accelerator), announced that its leadership met with the Prime Minister of India, Narendra Modi, at his official residence, 7 Lok Kalyan Marg, for a high-level strategic discussion on the future of artificial intelligence in…

Alopecia Areata Market to Witness Promising Upswing by 2034, DelveInsight Foreca …

The Key Alopecia Areata Companies in the market include - Eli Lilly and Company/Incyte Corporation, Pfizer, Legacy Healthcare, Pfizer, Q32 Bio Inc., AbbVie, Amgen, Concert Pharmaceuticals, Bristol-Myers Squibb, Reistone Biopharma, Inmagene LLC, Suzhou Zelgen Biopharma, Nektar Therapeutics, AnaptysBio, Inc., LEO Pharma, Eli Lilly and Company, and others.

The Alopecia Areata market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage…

Neko Case Neon Grey Midnight Green 2026: Affordable Tickets + CITY10 Code for In …

Neko Case's Neon Grey Midnight Green Tour rocks North America in 2026, celebrating her acclaimed Sept 2025 album-first new solo work since 2018-with raw, live-recorded tracks, powerful vocals, and hits like "Hold On, Hold On." Catch her with Des Demonas (East/Midwest) or Destroyer (West) from Jan 8 Montreal to March dates in CO, CA & more!

Neko Case [https://www.capitalcitytickets.com/Neko-Case-Tickets] is embarking on her electrifying Neon Grey Midnight Green Tour in 2026,…

Toogood Gold Expands Footprint, Positioned for High-Impact Growth 2026 Alongside …

Toogood Gold Corp. (TSXV: TGC | OTCQB: TGGCF) reported final drilling assays from its 100%-owned Toogood Gold Project in Newfoundland, delivering results that significantly expand the scale, continuity, and upside potential of its gold discovery heading into 2026.

The Company's 2025 drill program confirmed the Quinlan target as a large, coherent gold system, with gold intersected in all 30 drill holes completed to date. High-grade intervals and visible gold were reported…

More Releases for CNOOC

Natural Gas Filling Stations Market Massive Growth opportunity Ahead | CNOOC, Gu …

The Latest Study Published by HTF MI Research on the "Natural Gas Filling Stations Market'' evaluates market size, trend and forecast to 2030. The Natural Gas Filling Stations market study includes significant research data and evidences to be a practical resource document for managers and analysts is, industry experts and other key people to have an easily accessible and self-analysed study to help understand market trends, growth drivers, opportunities and…

High Temperature Asphalt market: Market Players Leveraging on Growth Opportuniti …

"The High Temperature Asphalt global market is thoroughly researched in this report, noting important aspects like market competition, global and regional growth, market segmentation and market structure. The report author analysts have estimated the size of the global market in terms of value and volume using the latest research tools and techniques. The report also includes estimates for market share, revenue, production, consumption, gross profit margin, CAGR, and other key…

Lubricating Grease market global outlook and forecast 2021 -2027|CNPC ,CNOOC

The report gives a complete investigation of the Lubricating Grease industry and key market improvements. The exploration record comprises of past and figure showcase data, prerequisite, territories of use, value strategies, and friends portions of the main organizations by topographical district. The Lubricating Grease report separates the market size, by volume and worth, depending upon the kind of utilization and area. With everything taken into account, the keyword…

Transformer Oil Market Outlook And Opportunities In Grooming Regions| Petrochina …

QYR Consulting offers its latest report on the global Transformer Oil market that includes a comprehensive analysis of a range of subjects such as market opportunities, competition, segmentation, regional expansion, and market dynamics. It prepares players as well as investors to take competent decisions and plan for growth beforehand. This report is expected to help the reader understand the market with respect to its various drivers, restraints, trends, and opportunities…

Asphalt Market 2019 | Worldwide Forecast 2025 | Major Players – CNPC. Sinopec, …

Up Market Research has added the latest research report on “Asphalt Market Forecast to 2025” to its huge pool of market research reports database. The most up to date report comprises the latest trends that influence the market competition in the forecast period.

The Asphalt Market Report 2025 provides a regional analysis of the market. The regional analysis focuses on manufacturers, suppliers, segmentation according to the application, major players, customers, and…

Global Oilfield Stimulation Chemical Market 2025 | Schlumberger, Nalco Champion, …

Researchmoz added Most up-to-date research on "Global Oilfield Stimulation Chemical Market Insights,Forecast to 2025" to its huge collection of research reports.

Commonly used stimulation techniques are 1) acidizing and 2) fracturing. Oil and natural gas stimulation differs-- natural gas wells require stimulation roughly twice as often as oil wells. Completion & Stimulation includes Clear brine fluids, Shale inhibitors, Lubricants, Non-emulsifiers, H2S scavengers, Defoamers, Surfactants, Viscosifiers, Anti-sludge, Acid retarders, Asphaltene control, Corrosion…