Press release

Crop Insurance Market Size Worth USD 65.07 Bn by 2030 With CAGR of 6.1 Percent

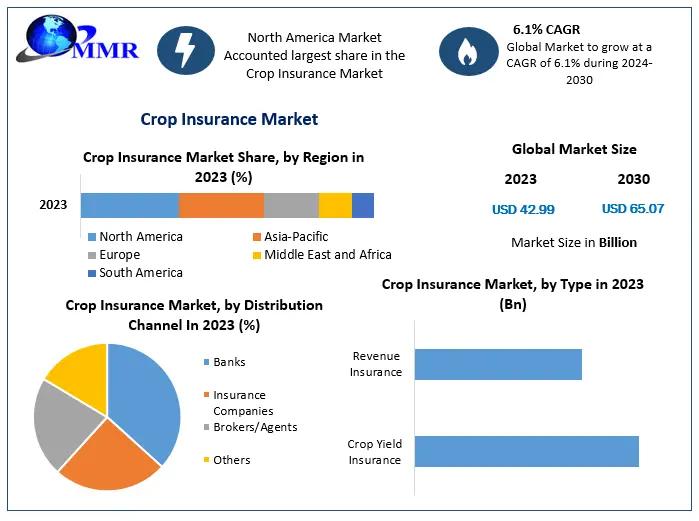

The Crop Insurance Market was valued at $42.99 billion in 2023, and is expected to reach $65.07 billion by 2030, at a CAGR of 6.1% during the forecast period. The growth is mainly attributed to rising government initiatives to protect farmers against income fluctuations along with innovations in technology improving insurance accessibility.Request Sample Link For More Details:https://www.maximizemarketresearch.com/request-sample/148613/

Drivers and Opportunities of the Market Growth

Climate change, uncertain weather patterns, and natural disasters contribute to worsening challenges for agriculture, resulting in increased risks for farmers. Governments across the globe are already taking supportive measures to address these risks. One such initiative is the Pandemic Cover Crop Program (PCCP) launched by the United States Department of Agriculture (USDA) in 2022, which incentivizes cover crop adoption with premium payouts to farmers, supporting sustainable practices and providing economic relief. Over the years, India was better equipped to manage a financial crisis largely due to the FDI cap being raised to 49% in 2016 which saw foreign investments flowing in to the agricultural insurance sector making it increasingly viable and widespread.

Technology-induced innovations are also transforming the crop insurance landscape. State-of-the-art AI combined with geo-referenced cadastral mapping supports easy application and accurate reporting of insured areas. Furthermore, this technological progress is helping to lower administrative costs, and also allows for more tailored insurance products and ultimately helps address the cost incurred by individual farmers, driving a higher uptake.

Segmentation Analysis

Based on coverage type, the crop insurance market is segmented into multiple-peril crop insurance and crop-hail insurance, while based on application, the crop insurance market is segmented into developed countries/countries and emerging countries/countries.

Coverage Type:

Crop-Yield Insurance The Crop-Yield Insurance segment provides coverage against loss in crop yield due to natural disasters such as droughts, floods, and pests. Farmers are compensated if their actual yield is below a predetermined threshold.

Crop-Revenue Insurance- This protects farmers from revenue losses arising from a decrease in market prices or yield. It guarantees the income for farmers and stabilizes their financial planning.

Want to access more insights? The journey starts from requesting Sample : https://www.maximizemarketresearch.com/request-sample/148613/

Application:

Banks: Provide crop insurance as part of their agricultural loan products, which ensures the repayment of loans offered to farmers and helps them manage risks.

Dedicated insurance firms focused solely on agriculture create specialized products that meet particular regional risks and farmer needs.

Brokers/Agents - These intermediaries are essential for helping farmers understand what they can insure and what policies they should select, as well as helping them through the claims process, creating a bridge between them and insurance providers.

Country-Level Analysis

United States: The United States has a mature crop insurance program heavily subsidized by the federal government. USDA's Risk Management Agency (RMA) manages programs offering coverage across many crops and regions, resulting in broad farmer participation. New schemes, such as the value of the PCCP, were established in 2022 to promote sustainable farming practices, marking a shift towards the inclusion of environmental factors in insurance schemes.

Germany: Crop insurance is gaining traction among German farmers as an instrument to mitigate climate-related risks. Farmers are increasingly turning to crop insurance schemes to protect their income, with the German government backing multi-peril schemes that cover a wide range of calamity events, particularly following recent extreme weather and pest-induced losses. Public-private partnerships are making these insurance products more affordable and accessible.

China: One of the world's biggest agricultural producers, China has greatly grown its crop insurance programs. This increased uptake has also been made possible by government subsidies that have helped make premiums more affordable for farmers. The emphasis is on safeguarding staple crops such as rice, wheat, and corn, while pilot programs are testing coverage for specialty crops and innovative insurance models.

India: Agriculture is a key sector in India, contributing a significant share of India's GDP and a wide base of employment. The Pradhan Mantri Fasal Bima Yojana (PMFBY), introduced in 2016, seeks to offer extensive protective coverage for crops. Though this did present a challenge in implementation, the initiatives have been put in place to be able to bridge the gap from increasing farmer awareness to streamlining the claims settlement process and technology will play a decisive role in these advancements.

Brazil: Brazil is vulnerable to a number of risks, given its different climate zones and large agricultural area. The government has been introducing rural insurance programs and providing subsidies to make the premiums more accessble to the farmers. It emphasizes including all parties, from soybeans and corn to coffee and sugarcane, noting the diversity of the country's crops.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report :https://www.maximizemarketresearch.com/market-report/crop-insurance-market/148613/

Competitive Analysis

There are several players in the crop insurance market that are trying to seek out their market share, and such players are focusing on wide range of initiatives. Notable companies include:

PICC (People's Insurance Company of China): One of the largest insurers in China, PICC has a strong agricultural insurance portfolio, and their services are growing to meet the diverse needs of Chinese farmers.

Zurich (Zurich Insurance Group): As a insurer, Zurich provides numerous crop insurance products, drawing on its worldwide experience to offer local markets innovative solutions.

Operating in several nations, Chubb has extensive crop coverage insurance plans with an emphasis on not only conventional, but specialized plants as well, all while stressing risk management and prevention of loss.

QBE Insurance: QBE is a leading provider of agricultural insurance products with a strong focus on the Asia-Pacific region.

China United Property Insurance: This insurer focuses on property and casualty protection and has expanded greatly into the agricultural sector in China.

Industry trends show mergers and acquisitions focusing on market consolidation and growth in service offerings as well. For example, in 2022, Chubb finalized the buyout of Cigna's life and non-life insurance businesses across various markets, adding to its presence in the Aisa-Pacific region and expanding its product offering.

Conclusion

The crop insurance market is also anticipated to grow substantially during this period, due to rising agricultural risks, government policies, and technology advancements. Farmers ly are more prepared as stakeholders are partnering to co-create novel and affordable insurance products.

More Trending Reports by Maximize Market Research :

♦ Digital Music Content Market : https://www.maximizemarketresearch.com/market-report/global-digital-music-content-market/23501/

♦ Maternity Wear Market : https://www.maximizemarketresearch.com/market-report/maternity-wear-market/145717/

♦ Ski Gear and Equipment Market : https://www.maximizemarketresearch.com/market-report/global-ski-gear-and-equipment-market/71297/

♦ Cat Litter Product Market : https://www.maximizemarketresearch.com/market-report/global-cat-litter-product-market/115958/

♦ Premium Wine Cooler Market : https://www.maximizemarketresearch.com/market-report/premium-wine-cooler-market/127098/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is a rapidly expanding market research and business consulting firm, serving clients worldwide. Our commitment to revenue-driven insights and growth-focused research has established us as a trusted partner for many Fortune 500 companies. With a diverse portfolio, we cater to a wide range of industries, including IT & telecom, chemicals, food & beverages, aerospace & defense, healthcare, and more.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crop Insurance Market Size Worth USD 65.07 Bn by 2030 With CAGR of 6.1 Percent here

News-ID: 3889269 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…