Press release

Venture Capital Investment Market Size, And Trends Report 2033

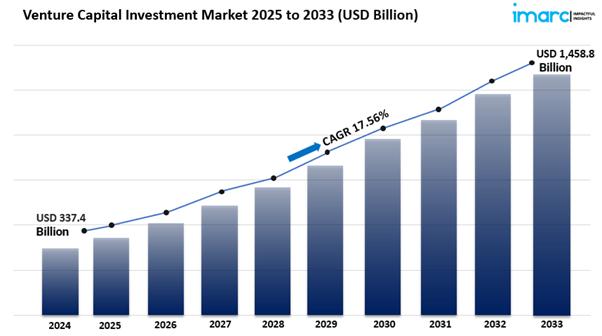

IMARC Group, a leading market research company, has recently released a report titled "Venture Capital Investment Market Report by Sector (Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, and Others), Fund Size (Under $50 M, $50 M to $100 M, $100 M to $250 M, $250 M to $500 M, $500 M to $1 B, Above $1 B), Funding Type (First-Time Venture Funding, Follow-on Venture Funding), and Region 2025-2033". The study provides a detailed analysis of the industry, including the global venture capital investment market trends, trends, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.The global venture capital investment market size reached USD 337.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,458.8 Billion by 2033, exhibiting a growth rate (CAGR) of 17.56% during 2025-2033.

Request to Get the Sample Report: https://www.imarcgroup.com/venture-capital-investment-market/requestsample

Venture Capital Investment Market Trends

The venture capital investment landscape is set to change significantly. This change comes from technological advances, sustainability efforts, and global diversification. As industries adapt to new consumer behaviors and market needs, investors focus more on startups using innovative technologies to tackle urgent issues. By 2025, digital transformation will continue shaping investment strategies. We will see more funding directed at sectors like artificial intelligence, biotechnology, and clean energy.

The rise of impact investing will push venture capitalists to find companies that value social and environmental responsibility. This aligns financial goals with broader societal aims. This trend may draw a new generation of investors who seek profit and want to make a positive impact.

Furthermore, the globalization of venture capital will create new investment opportunities. Firms can explore emerging markets that are ready for innovation. As the venture capital ecosystem becomes more connected, collaboration between investors and entrepreneurs across borders will thrive. This will foster growth and innovation, transforming the venture capital investment landscape.

Market Dynamics of the Venture Capital Investment Market

Increasing Focus on Technology and Innovation

The venture capital investment market is shifting towards technology-driven sectors. This change is fueled by rapid innovation and digital transformation. Businesses are using technology to boost efficiency and create new revenue streams. As a result, investors are interested in startups with innovative solutions. Key focus areas include artificial intelligence, fintech, health tech, and renewable energy. By 2025, venture capital firms are expected to invest more in these high-growth sectors for better returns.

The COVID-19 pandemic has sped up the use of digital technologies. This has led to a rise in startups that meet new needs, like remote work solutions, telehealth services, and e-commerce platforms. A growing network of incubators and accelerators also supports these early-stage companies. They provide resources and mentorship to help them succeed. As a result, the venture capital landscape is more competitive. Firms are eager to find and invest in the next wave of groundbreaking technologies that can change markets and consumer behavior.

Shift Towards Sustainability and Impact Investing

As awareness of environmental and social issues grows, venture capital is shifting toward sustainability. Investors see the value in funding companies that focus on social responsibility and environmental care. This shift has led to the rise of impact investing as a key trend. By 2025, a large share of venture capital is expected to support startups that emphasize sustainable practices, clean technologies, and social equity.

This change stems from consumer demand for ethically made products and regulatory pressure for sustainability. Venture capital firms now use Environmental, Social, and Governance (ESG) criteria in their investment decisions. They evaluate potential investments by considering their social and environmental impacts, as well as financial returns.

This trend encourages collaboration between venture capitalists and mission-driven entrepreneurs. Together, they create a strong ecosystem that boosts innovation in sustainability. Consequently, the venture capital market is likely to see more funds directed toward ventures that promise financial growth and benefit society and the planet.

Global Expansion and Diversification of Investment Portfolios

The venture capital market is going global. Investors are looking for opportunities beyond their usual markets. This shift is driven by the fact that innovation isn't just in Silicon Valley or other tech hubs. Emerging markets are building strong entrepreneurial ecosystems, which offer unique investment chances. By 2025, venture capital firms will likely invest in startups from Asia, Africa, and Latin America. These regions have many innovative companies tackling local and global issues.

Advancements in communication and technology help investors connect with entrepreneurs, regardless of location. Remote work and digital platforms enable startups to grow efficiently and attract global venture capital. This trend opens investment opportunities and promotes collaboration and knowledge sharing. As the venture capital landscape changes, global diversification will be crucial for future investment strategies.

Buy Now: https://www.imarcgroup.com/request?type=report&id=2336&flag=F

Venture Capital Investment Market Report Segmentation:

Breakup By Sectors:

· Software

· Pharma and Biotech

· Media and Entertainment

· Medical Devices and Equipment

· Medical Services and Systems

· IT Hardware

· IT Services and Telecommunication

· Consumer Goods and Recreation

· Energy

· Others

Software accounts for the majority of shares due to its rapid growth potential, scalability, and the increasing demand for innovative digital solutions across various industries.

Breakup By Fund Size:

· Under $50 M

· $50 M to $100 M

· $100 M to $250 M

· $250 M to $500 M

· $500 M to $1 B

· Above $1 B

$500 M to $1 B dominates the market growth as they allow venture capitalists to invest in larger rounds, supporting the scaling of promising startups and addressing their capital needs effectively.

Breakup By Funding Type:

· First-Time Venture Funding

· Follow-on Venture Funding

Follow-on venture funding holds the majority of shares because it enables investors to capitalize on the growth of previously invested companies, reinforcing their commitment and fostering long-term relationships.

Breakup By Region:

· North America

· Asia Pacific

· Europe

· Others

North America holds the leading position due to its established venture ecosystem, concentration of innovative startups, and significant availability of capital from a diverse range of investors.

Top Venture Capital Investment Market Leaders:

The venture capital investment market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

· Accel

· Andreessen Horowitz

· Benchmark

· Bessemer Venture Partners

· First Round Capital LLC

· Founders Fund LLC

· Ggv Management L.L.C.

· Index Ventures

· Sequoia Capital Operations LLC

· Union Square Ventures LLC

Ask Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=2336&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

USA +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Venture Capital Investment Market Size, And Trends Report 2033 here

News-ID: 3887379 • Views: …

More Releases from IMARC Group

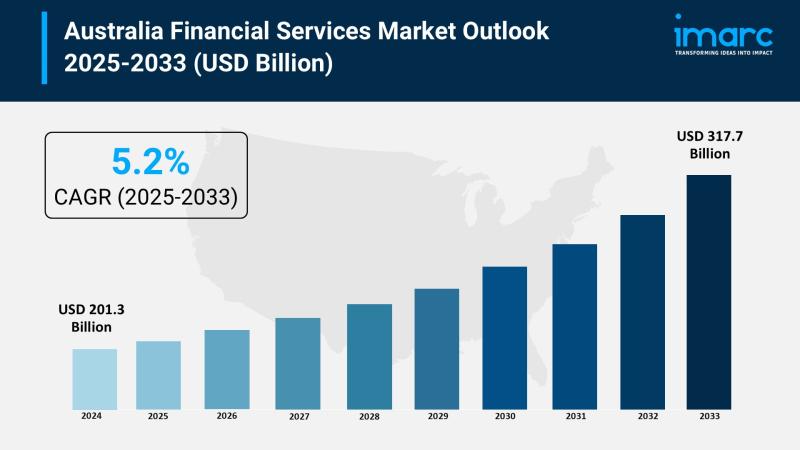

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

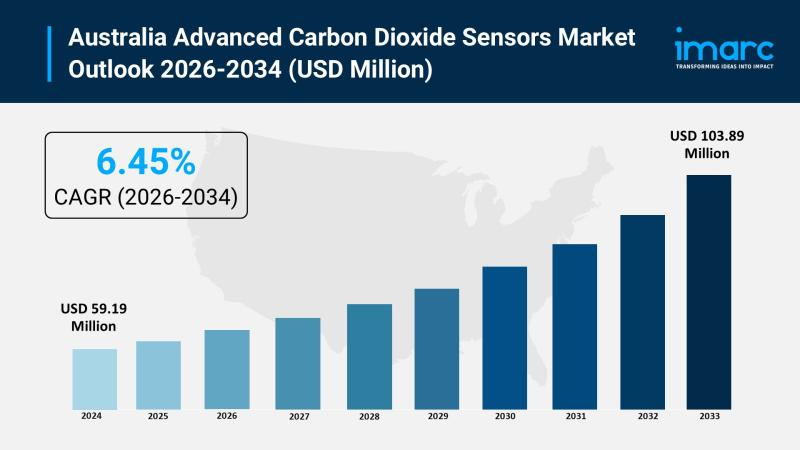

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

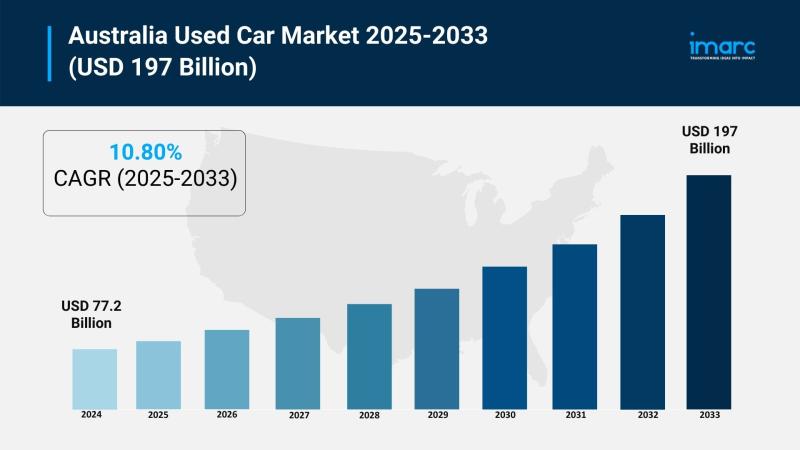

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

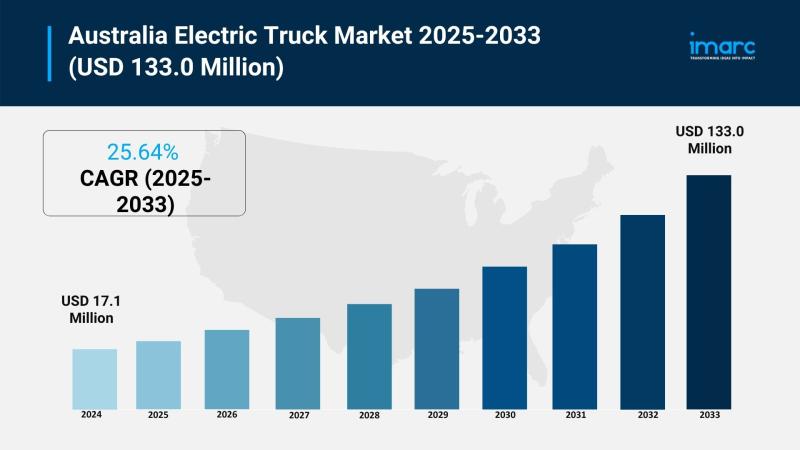

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Venture

1752VC Launches 14th Venture Fellow & Emerging Angel Cohort, Training the Next G …

1752VC has launched the 14th cohort of its Venture Fellow and Emerging Angel program, an eight-week, hands-on experience designed to help aspiring investors, founders, and professionals gain real-world venture capital skills and access early-stage deal flow.

Santa Monica, CA - November 4, 2025 - 1752VC [http://www.1752.vc] announced the launch of its 14th Venture Fellow cohort, further expanding its nationwide network of more than 250 Fellows-a dynamic community of founders, operators, and…

Announcing G2C Venture Partners

Over a decade of Collaboration Transforms into a Venture Vision

We are thrilled to announce what we have been building behind the scenes - G2C Venture Partners is officially launching today!

As three founders-turned-investors - Sunil Grover, Amar Chokhawala, and Vik Ghai - we are bringing our combined decades of experience and co-investment partnerships to a new kind of venture fund.

We are combining our battle-tested experience, relationship networks, and investment…

Gary Fowler's GSD Venture Studios Redefines Venture Building Through Direct Lead …

GSD Venture Studios is an operational family office that created a 360-degree entrepreneurial ecosystem, taking a laser-precise approach to venture building from early stage to Series C companies.

Image: https://www.getnews.info/uploads/d9f450b06da75bff3aa844e08748b0ef.png

While many startups scrounge for capital, resources, and ideas wherever they can, those poised for success turn to Gary Fowler's GSD Venture Studios [https://www.gsdvs.com/]. With a proven track record of success, a forward-thinking actionable approach, a network of avenues connecting capital…

CleanTech Venture Capital Interest

Keynote speaker to share the vision for CleanTech and Venture Capital Funding at EngEx 2010

SAN DIEGO – CleanTech start-ups are grabbing increased interest and investments from venture capital groups that placed almost $2 billion into eco-friendly companies last year and increased the funding pace with another $773 million during the first quarter of 2010. Clean energy business owners and industry professionals attending EngEx 2010 will hear more about the…

Sep. 5th Venture Capital Event

(EMAILWIRE.COM, July 31, 2007)- New York - Argyle Executive Forum is pleased to present its 2007 Leadership in Venture Capital Forum. The event, to take place in Manhattan, will bring together 135–150 CEOs & Board members of public and private large cap and mid cap corporations, complementary areas of executive leadership (CFOs & COOs), members of the endowment, foundation, and family office community, select advisory firms, and select founders /…

European Venture Market ICT 2006

European Venture Market ICT 2006

4th – 6th October 2006

Potsdam, Germany

www.europeanventuremarket.com

The European Venture Market is a platform to facilitate the meeting of entrepreneurs and investors. It is a platform for any kind of financing with focus to equity. Giving the wide variety of investors joining the platform the Market is suitable for any sectors especially for ICT & related as the platform will be organise by Hasso Plattner Ventures.

The European…