Press release

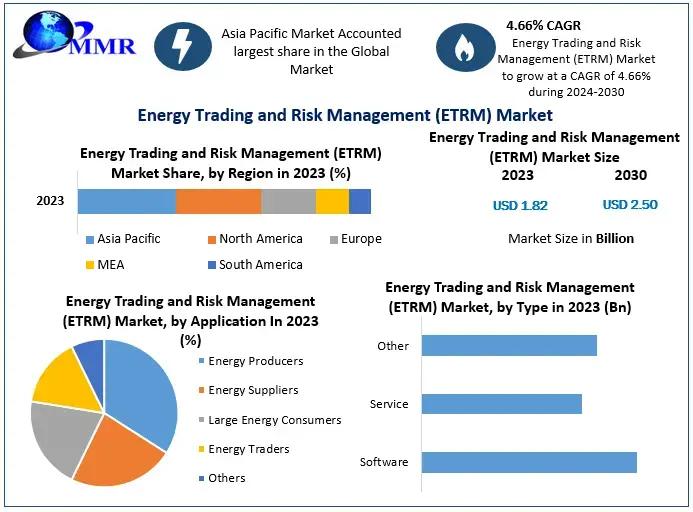

Energy Trading and Risk Management (ETRM) Market size is expected to reach USD 2.50 Bn by 2030

The global Energy Trading and Risk Management (ETRM) market, worth around USD 1.5 billion in 2023, is estimated to be at USD 2.5 billion by 2030 expanding at a CAGR of 7.2%. Contributing factors to this growth include the rising digitalization of energy trading, the adoption of AI and blockchain technologies, and a stronger focus on regulatory compliance in global energy markets.Request Sample Link For More Details:https://www.maximizemarketresearch.com/request-sample/70529/

Factors Affecting Market Growth & Opportunities

As the energy sector goes through its transformational change, with a transition towards renewable energy and increased volatility in commodity pricing and environmental regulations, market dynamics are changing. ETRM systems are those key software platforms that are used to optimize the operations of energy traders and traders by increasing operational efficiency, financial risk management, and compliance capabilities.

AI-driven analytics with instant queries and cloud architecture ETRM platforms adoption are propelling market growth as they facilitate faster access to real-time data and enhance decision-making ability. In addition, the integration of blockchain is changing transaction transparency and security in energy trading. Considering the growing worldwide energy consumption and uncertainties with oil and gas commodity prices, organizations look for market-leading risk management solutions to reduce their financial risk while maintaining business continuity.

Segmentation Analysis

The segmentation of energy trading and risk management market is done on the basis of component, application, deployment model, and industry vertical.

Segmentation by Component: Software and Services Software is the largest segment because of the growing demand for automated trading, risk management solutions, managed, and professional services are gaining immense traction, as organizations focus on customizing ETRM solutions.

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/energy-trading-and-risk-management-etrm-market/70529/

applications: Power | Natural Gas | Crude oil | Refined Products | Renewables Power and natural gas segments contribute a large share owing to the increasing demand for trade optimization and real-time analytics solutions in electricity and gas markets.

Deployment Method: The industry has been segmented into further on-premise and cloud-based. The trend towards cloud-based ETRM solutions is gaining momentum, as more businesses leverage the scalability, cost-effectiveness, and real-time access to critical trading data that cloud technologies can provide.

Industry Vertical: ETRM solutions are used across energy utilities, oil & gas, renewables, and commodity trading sectors. Energy utilities continue to be the highest end user of ETRM platforms as they seek to optimize their energy purchasing strategies while ensuring compliance with changing regulations.

Country-Level Analysis

Germany: Germany is a global leader in the ETRM market due to its large share of renewable energy generation, thus, increasing demand for advanced ETRM solutions across the country. With the escalation of market fluctuations and regulatory hurdles, large energy corporations are shifting towards investment in ETRM solutions to weather these issues.

Germany: The perennial leader in renewable energy adoption, Germany has a strong demand for ETRM solutions with an ability to incorporate wind and solar power generating trading capability. In the European Union, regulatory frameworks are also pushing energy firms to advance their risk management.

China: Due to its growing energy sector and more focus on market liberalization, China is becoming one of the major growth markets for ETRM solutions. Demand is also being driven by government initiatives to promote clean energy trading and emission control measures.

Competitive Landscape

ETRM Market - Key players OpenLink Financial, FIS Global, Brady Technologies, SAP SE, and Eka Software Solutions. Such firms are seeking to gain a competitive edge by arming themselves with AI-driven analytics, cloud-based trading solutions along with Blockchain integration.

Request Sample Link For More Details: https://www.maximizemarketresearch.com/request-sample/70529/

Recent Developments:

FIS Global has rolled out AI-driven predictive analytics tools for its energy trading and risk management (ETRM) offerings.

SAP SE - SAP SE launched blockchain-based solutions to increase transparency in energy trading.

Brady Technologies unveils strategic alliances to bolster renewable energy trading kickstarting the bullish trend with an announcement

Conclusion

The Energy Trading & Risk Management (ETRM) market is all set for a boom, owing to digital transformation, artificial intelligence (AI) adoption, and growing regulatory frameworks. As energy markets become more complex the need for sophisticated trading and risk management solutions is set to rise driving greater reliance on ETRM platforms in the global energy markets as an essential tool for efficiency and compliance.

For additional insights, visit:

♦ Power Generator Rental Market https://www.maximizemarketresearch.com/market-report/power-generator-rental-market/42448/

♦ Global Biodiesel Market https://www.maximizemarketresearch.com/market-report/global-biodiesel-market/17390/

♦ Global Concentrated Solar Power Market https://www.maximizemarketresearch.com/market-report/global-concentrated-solar-power-market/20636/

♦ Water Pump Market https://www.maximizemarketresearch.com/market-report/water-pump-market/12429/

♦ Synchrophasors Market https://www.maximizemarketresearch.com/market-report/synchrophasors-market/69918/

♦ Coal to Liquid Fuel (CTL) Market https://www.maximizemarketresearch.com/market-report/coal-to-liquid-fuel-ctl-market/75490/

♦ Wood Gas Generator Market https://www.maximizemarketresearch.com/market-report/wood-gas-generator-market/187937/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Energy Trading and Risk Management (ETRM) Market size is expected to reach USD 2.50 Bn by 2030 here

News-ID: 3884399 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Morocco Cosmetics Market Poised for Robust Growth, Projected to Reach USD 3.59 B …

Global Morocco Cosmetics Market Overview

The Global Morocco Cosmetics Market is witnessing significant expansion, driven by rising consumer awareness regarding personal grooming, skincare, and wellness. Valued at USD 1.82 billion in 2024, the market is projected to grow at a strong compound annual growth rate (CAGR) of 7.92% from 2024 to 2032, reaching nearly USD 3.59 billion by the end of the forecast period. This steady growth reflects increasing demand for…

Virtual Fitting Room Market to Reach US$ 19.32 Billion by 2030, Driven by Rapid …

The Global Virtual Fitting Room Market is witnessing remarkable growth, fueled by the rapid digital transformation of the fashion and retail industry. Valued at US$ 5.20 billion in 2023, the market is projected to expand at a robust compound annual growth rate (CAGR) of 20.6% from 2024 to 2030, reaching nearly US$ 19.32 billion by 2030. This strong growth trajectory reflects increasing investments in immersive technologies, rising e-commerce penetration, and…

Car Care Products Market to Reach USD 18.02 Billion by 2032, Growing at a CAGR o …

The global car care products market is witnessing steady expansion, driven by rising vehicle ownership, increasing consumer awareness about vehicle maintenance, and rapid technological innovations. According to recent industry analysis, the market was valued at USD 13.96 billion in 2024 and is projected to reach USD 18.02 billion by 2032, registering a compound annual growth rate (CAGR) of 4.2% during the forecast period. This growth reflects the increasing importance of…

Car Care Products Market to Reach USD 18.02 Billion by 2032, Growing at a CAGR o …

The global car care products market is witnessing steady expansion, driven by rising vehicle ownership, increasing consumer awareness about vehicle maintenance, and rapid technological innovations. According to recent industry analysis, the market was valued at USD 13.96 billion in 2024 and is projected to reach USD 18.02 billion by 2032, registering a compound annual growth rate (CAGR) of 4.2% during the forecast period. This growth reflects the increasing importance of…

More Releases for ETRM

Intellimachs Offers Targeted ETRM Services and Training Solutions for Energy Mar …

Image: https://www.globalnewslines.com/uploads/2025/11/1762411878.jpg

Intellimachs is a technology services company that supports businesses across software development, along with artificial intelligence and enterprise systems. The company works with energy trading firms and risk management teams that need reliable systems to track trades and manage exposure. Intellimachs focuses on delivering solutions that reduce complexity and help teams make better decisions faster. The company has built its reputation by solving real problems for organizations that cannot…

Global CTRM-ETRM Software Market Size, Share and Forecast By Key Players-Openlin …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global CTRM-ETRM Software market is projected to grow at a robust compound annual growth rate (CAGR) of 12.05% from 2024 to 2031. Starting with a valuation of 10.56 Billion in 2024, the market is expected to reach approximately 20.9 Billion by 2031, driven by factors such as CTRM-ETRM Software and CTRM-ETRM Software. This significant growth underscores the expanding demand for…

Energy Trading and Risk Management (ETRM) Market Size

According to a new market research report published by Global Market Estimates, the Global Energy Trading and Risk Management (ETRM) Market is projected to grow at a CAGR of 6.5% from 2023 to 2028.

Allegro Development Corporation, Amphora Inc., Triple Point Technology Inc., Openlink LLC., Eka Software Solutions, SAP, Sapient, Ventyx and Trayport among others, are some of the key players in the global energy trading and risk management (ETRM) market.…

INPEX ENERGY TRADING SINGAPORE PTE. LTD. selects ENTRADE® for ETRM

Singapore (November 2020) — Enuit, LLC announced today that INPEX ENERGY TRADING SINGAPORE PTE. LTD. (IETS) has begun implementing its flagship product, ENTRADE® to manage their trading risk and derivatives for crude oil.

INPEX CORPORATION (INPEX), the ultimate parent company of IETS, is a leading energy company that proactively undertakes oil & gas exploration, development and production activities to contribute to a stable and efficient supply of energy. INPEX is currently…

Energy Trading and Risk Management (ETRM) Market Trends, Insights, Analysis, For …

"Energy Trading and Risk Management (ETRM) Market Scope

“Energy Trading and Risk Management (ETRM) Market is expected to see huge growth opportunities during the forecast period, i.e., 2020 – 2027”, Says Decisive Markets Insights.

The report covers market size and forecast, market share, market share of the key players in the global market, current growth trends and future trends, market segmentation, value chain analysis, market dynamics which includes market drivers, restraints and…

Energy Trading and Risk Management (ETRM) Market 2020 Real Time Analysis And For …

This report studies the Energy Trading and Risk Management (ETRM) Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Energy Trading and Risk Management (ETRM) Market analysis segmented by companies, region, type and applications in the report.

“The final report will add…