Press release

Energy Trading & Risk Management (ETRM) Market Outlook 2034: Navigating Growth, Technological Advancements, and Regional Dynamics in a Rapidly Evolving Energy Landscape

The global energy sector is undergoing a transformative phase, driven by the dual forces of renewable energy adoption and volatile commodity markets. As we look ahead to 2034, the Energy Trading & Risk Management (ETRM) market( https://www.transparencymarketresearch.com/energy-trading-risk-management-market.html ) is poised for remarkable growth-from a valuation of US$ 37.4 billion in 2023 to an anticipated US$ 68.2 billion, growing at a CAGR of 4.9% between 2024 and 2034. This article provides a comprehensive analysis of the market's evolution, key drivers, emerging technologies, regional trends, and the competitive landscape shaping its future.Discover key insights and takeaways from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=19019

Market Overview and the Role of ETRM

Energy Trading & Risk Management (ETRM) systems play a critical role in modernizing the energy industry by managing trading activities and mitigating associated risks. These systems support the buying, selling, and trading of energy commodities such as electricity, natural gas, and oil while integrating functions such as:

Trading & Position Management: Real-time monitoring of positions and profit and loss (P&L) metrics.

Risk Analysis & Reporting: Tools to evaluate and report on market risks.

Settlement and Compliance: Streamlining settlements and ensuring adherence to regulatory requirements.

By integrating hyperautomation and data analytics, ETRM solutions not only optimize cost structures but also simplify legacy systems, reduce overheads, and enhance scalability and performance across operations.

Key Drivers and Industry Trends

Rise in Adoption of Renewable Energy

A significant catalyst for the ETRM market growth is the global shift toward renewable energy. With an increasing number of energy companies adopting renewable sources, the demand for specialized ETRM solutions has surged. These systems are designed to manage counterparty and operational risks more effectively, ensuring a stable energy supply despite the intermittent nature of renewable sources. Government initiatives-such as tax benefits and large-scale programs like Europe and Central Asia's Renewable Energy Scale-up (ECARES)-are further accelerating this transition. For instance, the U.S. government's participation in the UN's 24/7 Carbon-Free Energy Compact underscores the global commitment to achieving a clean energy economy.

Substantial Fluctuations in Energy Prices

The inherent volatility in energy markets, fueled by factors such as weather variations, geopolitical events, supply chain disruptions, and fluctuating production costs, makes price stability a critical concern. These fluctuations necessitate robust ETRM systems capable of real-time position management, accurate valuation, and comprehensive risk reporting. As weather patterns and climate conditions significantly influence the output of renewable energy sources, market participants increasingly rely on sophisticated ETRM solutions to navigate these uncertainties.

Technological Innovations: AI, ML, and Blockchain

The integration of emerging technologies is reshaping the ETRM landscape. Artificial Intelligence (AI) and Machine Learning (ML) are being leveraged to automate trading processes, enhance data analytics, and support predictive decision-making, thereby improving overall efficiency. In addition, blockchain technology is gaining traction for its ability to bolster security and transparency in energy transactions. These innovations not only streamline operations but also empower stakeholders to maintain a competitive edge in an increasingly digital market.

Explore critical insights and in-depth analysis in our latest report - https://www.transparencymarketresearch.com/energy-trading-risk-management-market.html

Market Segmentation and Software Ecosystem

The ETRM market encompasses a broad array of software solutions that address diverse aspects of energy trading and risk management. Key segments include:

By Orientation:

Trading & Risk Management Software

Commodity Management Software

Data Management and Analytics Software

Logistics & Operations Management Software

Settlements & Accounting Software

Regulatory Compliance Software

Others

By Deployment Model:

On-Premise

Cloud-Based

By Trading Market:

Physical Trading

Derivatives Trading

Exchange-Traded Instruments

Over-the-Counter (OTC) Trading

By End-Use Industry:

Oil & Gas

Power & Utilities

Renewable Energy

Commodities Trading Firms

Energy Trading Exchanges

Financial Institutions

Others

This segmentation not only highlights the versatility of ETRM systems but also underscores their critical role in enhancing operational efficiency, data management, and regulatory compliance in the energy sector.

Regional Outlook and Competitive Landscape

Leading Region: North America

In 2023, North America emerged as the dominant region in the ETRM market, bolstered by robust oil and gas trading activities and a surge in advanced natural gas trading solutions. North American market dynamics are further enhanced by the region's proactive adoption of intelligent, cloud-native ETRM systems that streamline trading operations and reduce the need for extensive in-house IT support. Notably, in 2022, the U.S. demonstrated significant trading prowess, standing out in natural gas exports alongside Australia.

Competitive Landscape and Key Players

The global ETRM market is characterized by fierce competition, with key players continually innovating to offer comprehensive, cost-effective solutions. Major vendors include:

ION

Amphora Inc.

Eka

SAP

Publicis Sapient

ABB

Trayport Limited

FIS

These companies are at the forefront of developing modern ETRM ecosystems that facilitate real-time and day-ahead trading, minimize human intervention, and support a broad spectrum of services from risk management to regulatory compliance.

Notable Market Developments

Recent strategic moves have further underscored the dynamic nature of the ETRM market:

April 2024: Symphony Technology Group, a leading private equity firm, acquired Eka Software Solutions, reinforcing its commitment to advancing commodity management solutions.

2023: Trayport Limited, in collaboration with Montel Marketplace, enhanced access to new trading opportunities through its Joule platform, enabling more efficient trading of Guarantees of Origin (GOs).

These developments reflect the market's continuous evolution, driven by both technological advancements and strategic acquisitions that expand service portfolios and market reach.

The Energy Trading & Risk Management market is on a clear upward trajectory, with substantial growth projected through 2034. Driven by the rise in renewable energy adoption, persistent energy price fluctuations, and rapid technological advancements in AI, ML, and blockchain, the sector is evolving into a more efficient, secure, and transparent ecosystem. As North America continues to lead and key industry players push the envelope on innovation, stakeholders across the energy landscape must embrace these changes to remain competitive and resilient in an ever-changing market.

The comprehensive outlook for 2034 not only highlights the transformative trends shaping the industry but also underscores the critical need for agile and sophisticated ETRM solutions to navigate the future of energy trading and risk management.

Take a closer look at vital insights and expert analysis from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=19019

Discover the Latest Research Reports from Transparency Market Research -

Floating Nuclear Power Plant EPC Market: https://www.transparencymarketresearch.com/floating-nuclear-power-plant-epc-market.html

Hydrogen Plants Market: https://www.transparencymarketresearch.com/hydrogen-plants-market.html

Contact Us:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

About Us Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. The firm scrutinizes factors shaping the dynamics of demand in various markets. The insights and perspectives on the markets evaluate opportunities in various segments. The opportunities in the segments based on source, application, demographics, sales channel, and end-use are analysed, which will determine growth in the markets over the next decade.

Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision-makers, made possible by experienced teams of Analysts, Researchers, and Consultants. The proprietary data sources and various tools & techniques we use always reflect the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in all of its business reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Energy Trading & Risk Management (ETRM) Market Outlook 2034: Navigating Growth, Technological Advancements, and Regional Dynamics in a Rapidly Evolving Energy Landscape here

News-ID: 3883889 • Views: …

More Releases from Transparency Market Research

Electric Wheelchair Market Expanding at 9.2% CAGR Through 2036 - By Control Type …

The global electric wheelchair market continues to demonstrate strong and sustained growth, fueled by demographic transitions, technological innovation, and expanding healthcare access worldwide. Valued at US$ 5.8 billion in 2025, the market is projected to reach US$ 15.3 billion by 2036, expanding at a compound annual growth rate (CAGR) of 9.2% from 2026 to 2036.

Discover essential conclusions and data from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4198

This robust trajectory reflects rising…

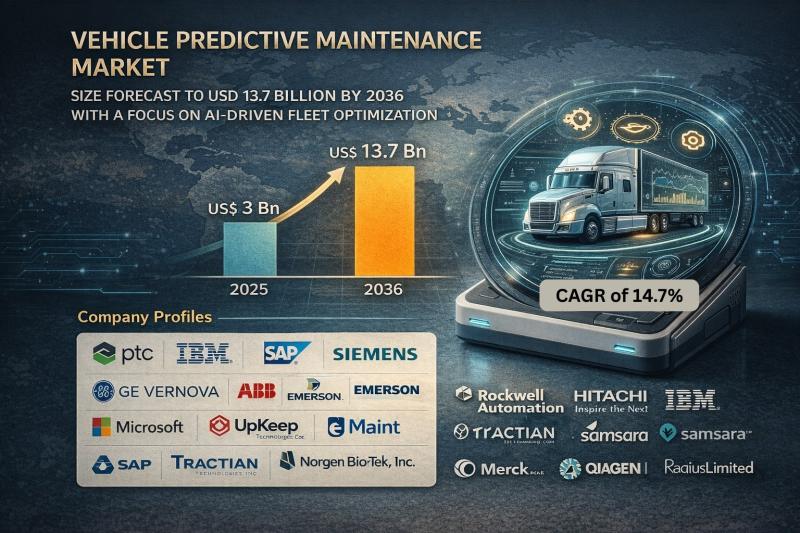

Vehicle Predictive Maintenance Market Size Forecast to USD 13.7 Billion by 2036 …

Vehicle Predictive Maintenance Market Outlook 2036

The global vehicle predictive maintenance market was valued at USD 3 Billion in 2025 and is projected to reach USD 13.7 Billion by 2036, expanding at a robust CAGR of 14.7% from 2026 to 2036. Market growth is driven by increasing adoption of connected vehicles, rising fleet digitalization, advancements in AI-driven analytics, and growing emphasis on minimizing vehicle downtime and maintenance costs.

👉 Get your sample…

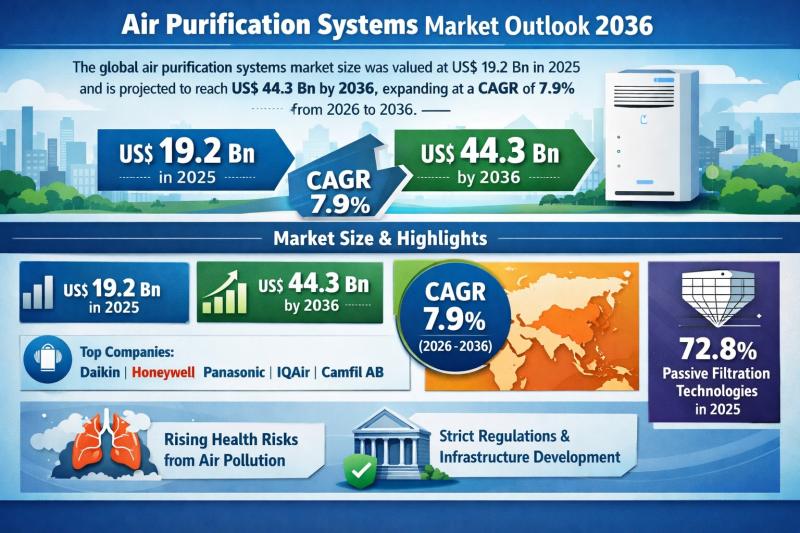

Global Air Purification Systems Market to Reach USD 44.3 Billion by 2036 at 7.9% …

The global Air Purification Systems Market was valued at US$ 19.2 Bn in 2025 and is projected to expand to US$ 44.3 Bn by 2036, registering a compound annual growth rate (CAGR) of 7.9% from 2026 to 2036. The market's upward trajectory reflects the structural shift in indoor air quality (IAQ) management, moving from discretionary consumer spending to mission-critical infrastructure investment.

With historical data available from 2021 to 2024, the industry…

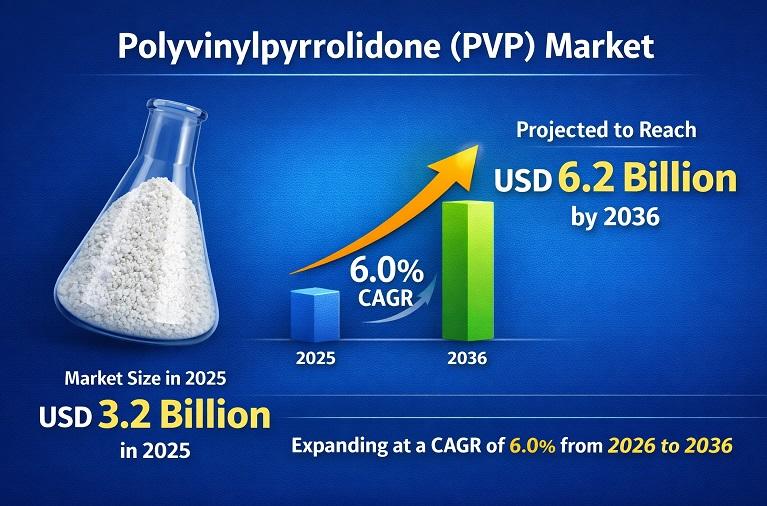

Polyvinylpyrrolidone (PVP) Market to Reach USD 6.2 Billion by 2036 Driven by Pha …

The Polyvinylpyrrolidone (PVP) Market was valued at around US$ 3.2 billion in 2025 and is projected to reach approximately US$ 6.2 billion by 2036, expanding at a steady CAGR of about 6.0% during the forecast period. This growth is primarily driven by rising demand from the pharmaceutical industry, where PVP is widely used as a tablet binder, solubilizer, and stabilizer, along with increasing consumption in cosmetics and personal care products…

More Releases for ETRM

Intellimachs Offers Targeted ETRM Services and Training Solutions for Energy Mar …

Image: https://www.globalnewslines.com/uploads/2025/11/1762411878.jpg

Intellimachs is a technology services company that supports businesses across software development, along with artificial intelligence and enterprise systems. The company works with energy trading firms and risk management teams that need reliable systems to track trades and manage exposure. Intellimachs focuses on delivering solutions that reduce complexity and help teams make better decisions faster. The company has built its reputation by solving real problems for organizations that cannot…

Global CTRM-ETRM Software Market Size, Share and Forecast By Key Players-Openlin …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global CTRM-ETRM Software market is projected to grow at a robust compound annual growth rate (CAGR) of 12.05% from 2024 to 2031. Starting with a valuation of 10.56 Billion in 2024, the market is expected to reach approximately 20.9 Billion by 2031, driven by factors such as CTRM-ETRM Software and CTRM-ETRM Software. This significant growth underscores the expanding demand for…

Energy Trading and Risk Management (ETRM) Market Size

According to a new market research report published by Global Market Estimates, the Global Energy Trading and Risk Management (ETRM) Market is projected to grow at a CAGR of 6.5% from 2023 to 2028.

Allegro Development Corporation, Amphora Inc., Triple Point Technology Inc., Openlink LLC., Eka Software Solutions, SAP, Sapient, Ventyx and Trayport among others, are some of the key players in the global energy trading and risk management (ETRM) market.…

INPEX ENERGY TRADING SINGAPORE PTE. LTD. selects ENTRADE® for ETRM

Singapore (November 2020) — Enuit, LLC announced today that INPEX ENERGY TRADING SINGAPORE PTE. LTD. (IETS) has begun implementing its flagship product, ENTRADE® to manage their trading risk and derivatives for crude oil.

INPEX CORPORATION (INPEX), the ultimate parent company of IETS, is a leading energy company that proactively undertakes oil & gas exploration, development and production activities to contribute to a stable and efficient supply of energy. INPEX is currently…

Energy Trading and Risk Management (ETRM) Market Trends, Insights, Analysis, For …

"Energy Trading and Risk Management (ETRM) Market Scope

“Energy Trading and Risk Management (ETRM) Market is expected to see huge growth opportunities during the forecast period, i.e., 2020 – 2027”, Says Decisive Markets Insights.

The report covers market size and forecast, market share, market share of the key players in the global market, current growth trends and future trends, market segmentation, value chain analysis, market dynamics which includes market drivers, restraints and…

Energy Trading and Risk Management (ETRM) Market 2020 Real Time Analysis And For …

This report studies the Energy Trading and Risk Management (ETRM) Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Energy Trading and Risk Management (ETRM) Market analysis segmented by companies, region, type and applications in the report.

“The final report will add…