Press release

Embedded Insurance Market Size Forecasted to Grow at 20.18% CAGR, Reaching USD 793.64 Billion by 2034

Embedded Insurance Market Research Report By Policy Type (Homeowners, Renters, Auto, Travel, Life), By Distribution Channel (Insurance agents, Online platforms, Financial institutions), By Product Offering (Single product, Bundled insurance), By Application (Automotive, Consumer Electronics, Healthcare, Travel, Fintech) and By Regional (North America, Europe, South America, Asia Pacific, Middle East and Africa) - Forecast to 2034The global Embedded Insurance Market [https://www.marketresearchfuture.com/reports/embedded-insurance-market-24048] has witnessed rapid expansion in recent years and is expected to grow significantly over the next decade. In 2024, the market size was valued at USD 126.25 billion and is projected to grow from USD 151.73 billion in 2025 to USD 793.64 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 20.18% during the forecast period (2025-2034). The market's growth is fueled by the increasing integration of insurance into digital platforms, rising consumer demand for seamless coverage, and advancements in AI-driven underwriting.

Key Drivers of Market Growth

Growing Integration of Insurance with Digital Platforms

The rise of e-commerce, fintech, and mobility services has led to the seamless embedding of insurance products into transactions. Platforms such as ride-sharing apps, travel booking sites, and digital wallets offer integrated insurance solutions, increasing accessibility and adoption.

Advancements in AI and Big Data Analytics

AI-driven underwriting, claims processing, and risk assessment are improving efficiency and personalization in embedded insurance. Insurers leverage data analytics to offer customized policies based on consumer behavior, further driving market growth.

Increasing Consumer Demand for Convenience

Consumers prefer hassle-free, embedded coverage that eliminates the need for separate policy purchases. The demand for instant, flexible, and usage-based insurance is rising, particularly in industries like automotive, healthcare, and retail.

Expansion of InsurTech and Embedded Finance

The growth of InsurTech companies and embedded finance ecosystems is transforming the insurance industry. Startups and technology providers are partnering with insurers to deliver integrated, on-demand coverage across digital ecosystems.

Regulatory Support and Industry Adoption

Governments and regulatory bodies are creating frameworks to support embedded insurance, ensuring transparency and consumer protection. Major industries, including automotive, travel, and electronics, are actively adopting embedded insurance solutions.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24048

Key Companies in the Global Embedded Insurance Market Include

* Slice

* Superscript

* Trov

* Root Insurance

* Arthur J. Gallagher Co.

* Munich Re

* Lemonade

* SCOR

* Acrisure

* Marsh McLennan Companies

* Willis Towers Watson

* Aon plc

* Swiss Re

* Metromile

* Hannover Re

Market Segmentation

To provide a comprehensive analysis, the global Embedded Insurance Market is segmented based on insurance type, distribution channel, and region.

1. By Insurance Type

* Automotive Embedded Insurance: Coverage offered at the point of vehicle purchase or rental.

* Travel & Ticketing Insurance: Embedded within airline tickets, hotel bookings, and event ticketing platforms.

* Retail & E-commerce Insurance: Protection plans for electronics, appliances, and consumer goods.

* Healthcare Embedded Insurance: Integrated health and wellness coverage in medical services and telehealth platforms.

* Financial & Cyber Insurance: Fraud protection and digital risk coverage embedded in fintech and banking services.

2. By Distribution Channel

* E-commerce Platforms

* OEMs (Original Equipment Manufacturers)

* Banking & FinTech Services

* Digital Payment Platforms

* Ride-Sharing & Mobility Services

3. By Region

* North America: Leading market with high adoption of digital insurance solutions.

* Europe: Strong growth due to increasing regulatory support and InsurTech investments.

* Asia-Pacific: Fastest-growing region with expanding e-commerce and mobile payment adoption.

* Rest of the World (RoW): Emerging markets in Latin America, the Middle East, and Africa are seeing growing demand.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24048

The Embedded Insurance Market is on a strong upward trajectory, driven by digital transformation, AI-powered automation, and evolving consumer expectations. As industries continue to integrate seamless, real-time insurance solutions into their products and services, embedded insurance is set to become a mainstream offering. With vast opportunities in various sectors and technological advancements enhancing accessibility, the future of the embedded insurance industry looks highly promising.

Related Report -

Robotic Process Automation in Financial Services Market [https://www.marketresearchfuture.com/reports/robotic-process-automation-in-financial-services-market-34152]

Social Media Analytics-Based Insurance Market [https://www.marketresearchfuture.com/reports/social-media-analytics-based-insurance-market-34159]

About Market Research Future -

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Media Contact

Company Name: Market Research Future

Contact Person: Media Relations

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=embedded-insurance-market-size-forecasted-to-grow-at-2018-cagr-reaching-usd-79364-billion-by-2034]

Country: United States

Website: https://www.marketresearchfuture.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Embedded Insurance Market Size Forecasted to Grow at 20.18% CAGR, Reaching USD 793.64 Billion by 2034 here

News-ID: 3879660 • Views: …

More Releases from ABNewswire

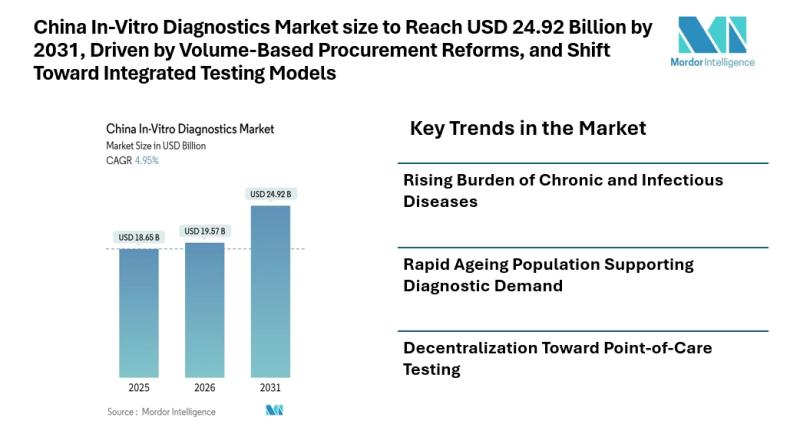

China In-Vitro Diagnostics Market size to Reach USD 24.92 Billion by 2031, Drive …

Mordor Intelligence has published a new report on the china in-vitro diagnostics market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the china in-vitro diagnostics market size [https://www.mordorintelligence.com/industry-reports/china-in-vitro-diagnostics-market?utm_source=abnewswire] is projected to reach USD 24.92 billion by 2031, growing from USD 19.57 billion in 2026 at a CAGR of 4.95% during the forecast period. The china in-vitro diagnostics market size reflects steady expansion supported by…

Hyaluronic Acid Market Size to Reach USD 4.07 Billion by 2030 - Mordor Intellige …

Mordor Intelligence has released an in-depth analysis of the hyaluronic acid market, outlining expanding cosmetic, orthopedic, and pharmaceutical applications driving global demand.

Hyaluronic Acid Market Overview

According to Mordor Intelligence, the global hyaluronic acid market size [https://www.mordorintelligence.com/industry-reports/hyaluronic-acid-market?utm_source=abnewswire] reached USD 2.84 billion in 2025 and is projected to grow to USD 4.07 billion by 2030, registering a CAGR of 7.46% during the forecast period.

The strong hyaluronic acid market growth is supported by:

* Increasing…

Scott Bryant Unveils Moon Valley's "Best Value" Listing in Hillcrest East; Signa …

Bryant Real Estate Leverages Data-Driven Performance Metrics to Position New Hillcrest East Property as the Region's Premier Investment Opportunity

PHOENIX, AZ - Scott Bryant, Founder and Team Leader of Bryant Real Estate and a top-performing agent with Keller Williams, has announced the debut of a landmark listing in the Hillcrest East subdivision of Moon Valley. Positioned as "Moon Valley's Best Deal," the property is being introduced at a strategic price point…

Jennifer Rollin Named Best Individual Therapist in Best of Bethesda Awards

Bethesda, MD, USA - Jennifer Rollin, LCSW-C, eating disorder therapist and founder of The Eating Disorder Center, has been named Best Individual Therapist in the 2025 Best of Bethesda Awards. She was selected from among therapists across Montgomery County, Maryland and Upper Northwest Washington, D.C., an honor that reflects both community support and her longstanding commitment to helping individuals recover from eating disorders.

Jennifer Rollin provides eating disorder therapy [https://www.theeatingdisordercenter.com/eatingdisordertherapyrockvilleservices.html] in…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…