Press release

Takaful Market To Rise at a CAGR of 8.28% During 2025-2033

According to latest research report by IMARC Group, titled "Takaful Market Report by Product Type (Life/Family Takaful, General Takaful), and Region 2025-2033" offers a comprehensive analysis of the takaful market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. the global takaful market size was valued at USD 36.57 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 75.26 Billion by 2033, exhibiting a CAGR of 8.28% during 2025-2033. Gulf Cooperation Council (GCC) currently dominates the market, holding a significant market share of 85% in 2024. The market is experiencing growth because of the rising global Muslim population and increasing awareness about Islamic finance among individuals. Besides this, the takaful market share is influenced by the introduction of supportive governmental policies, continual technological advancements, and economic development in Islamic countries.Sample free Copy of Report at - https://www.imarcgroup.com/takaful-market/requestsample

Technological Advancements and Digital Transformation:

The Takaful industry is undergoing a significant transformation driven by technological advancements aimed at enhancing operational efficiency and customer engagement. The integration of digital platforms, mobile applications, and artificial intelligence (AI) has revolutionized policy management, claims processing, and customer service. For instance, the adoption of blockchain technology is enhancing transparency and security in transactions, fostering greater trust among participants. Additionally, the collaboration between Takaful operators and Insurtech firms is leading to innovative solutions such as peer-to-peer community-based Takaful applications, which streamline customer onboarding and offer self-service options. These technological innovations are not only improving the customer experience but also reducing operational costs, thereby making Takaful products more competitive in the insurance market. As digital transformation continues to evolve, Takaful operators are expected to further leverage emerging technologies to meet the changing needs of consumers and to expand their market reach.

Regulatory Support and Market Expansion:

The growth of the Takaful market is significantly influenced by supportive regulatory frameworks and proactive government policies, particularly in regions with substantial Muslim populations. Governments in countries such as Malaysia, Indonesia, and those within the Gulf Cooperation Council (GCC) are implementing favorable regulations that promote the development of Sharia-compliant insurance products. These policies often include tax incentives, streamlined approval processes, and requirements for financial institutions to offer Takaful options, thereby fostering a conducive environment for market expansion. Moreover, there is a growing interest in Takaful products beyond traditional Muslim-majority markets. The ethical and transparent nature of Takaful is attracting consumers in non-Muslim-majority regions, leading to market penetration in areas like Europe and North America. This expansion is facilitated by strategic partnerships between Takaful operators and conventional insurers, enabling the introduction of Takaful products to a broader audience. As regulatory bodies continue to recognize the value of inclusive financial products, the Takaful industry is poised for sustained growth and diversification across global markets.

Product Diversification and Consumer Awareness:

In response to the evolving needs of consumers, the Takaful industry is diversifying its product offerings to include a wide range of coverage options. Beyond traditional life and general Takaful, operators are introducing specialized products such as health Takaful, micro-Takaful for low-income populations, and investment-linked Takaful plans. This diversification caters to various customer segments, including individuals seeking ethical investment opportunities and businesses requiring Sharia-compliant solutions for asset protection and employee benefits. Concurrently, there is an increasing emphasis on consumer education and awareness. Takaful providers are investing in educational campaigns to inform potential customers about the principles and benefits of Takaful, addressing misconceptions and highlighting its value proposition. These initiatives are crucial in building trust and expanding the customer base, particularly in regions where awareness of Takaful remains limited. As consumers become more informed and demand for ethical financial products rises, the Takaful industry is expected to experience robust growth, driven by innovative products and heightened consumer engagement.

Leading Key Players Operating in the Takaful Industry:

• Islamic Insurance Company

• JamaPunji

• AMAN

• Salama

• Standard Chartered

• Takaful Brunei Darussalam Sdn Bhd

• Allianz

• Prudential BSN Takaful Berhad

• Zurich Malaysia

• Takaful Malaysia

• Qatar Islamic Insurance Company

Emerging Trends in the Takaful Market:

The Takaful industry is witnessing several emerging trends that are shaping its future trajectory. One notable trend is the increasing integration of fintech solutions, which streamline operations and enhance customer service. For example, the adoption of blockchain technology is improving transparency and efficiency in policy management and claims processing. Another significant trend is the expansion of Takaful services into non-Muslim-majority regions, driven by the ethical appeal of Takaful products to a broader audience.

This expansion is facilitated by strategic partnerships between Takaful operators and conventional insurers, enabling access to new markets and customer segments. Additionally, there is a growing focus on product innovation, with Takaful providers developing customized solutions such as micro-Takaful and investment-linked plans to cater to diverse consumer needs. These trends reflect the dynamic evolution of the Takaful market, positioning it for sustained growth and increased global presence.

Visit Full Report with TOC and Buy Now - https://www.imarcgroup.com/checkout?id=1027&method=502

Key Market Segmentation:

Breakup by Product Type:

• Life/Family Takaful

• General Takaful

General takaful accounts for the majority of the market share due to the rising popularity in both Islamic and non-Islamic nations.

Regional Insights:

• Gulf Cooperation Council (GCC)

• Southeast Asia

• Africa

• Others

Gulf Cooperation Council (GCC) leads the market due to high economic growth and a substantial Muslim population.

TOC for the Takaful Market Research Report:

• Preface

• Scope and Methodology

• Executive Summary

• Introduction

• Global Takaful Market

• SWOT Analysis

• Value Chain Analysis

• Price Analysis

• Competitive Landscape

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Takaful Market To Rise at a CAGR of 8.28% During 2025-2033 here

News-ID: 3878350 • Views: …

More Releases from IMARC Group

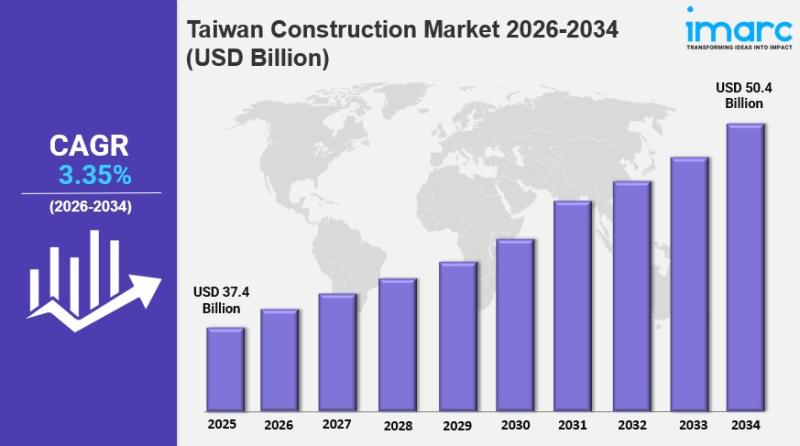

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

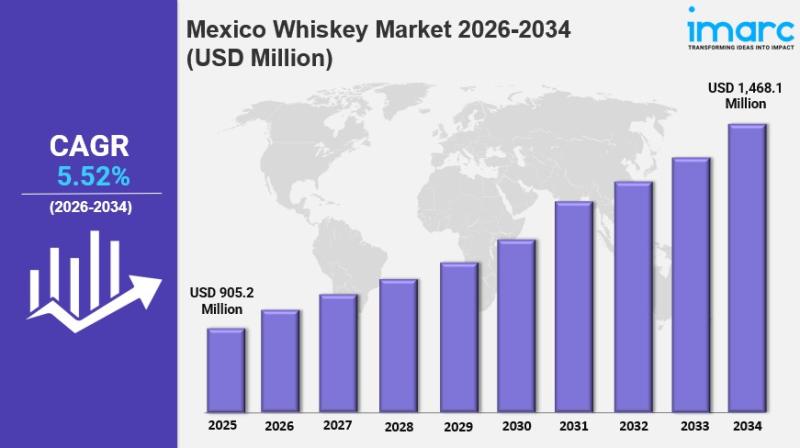

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

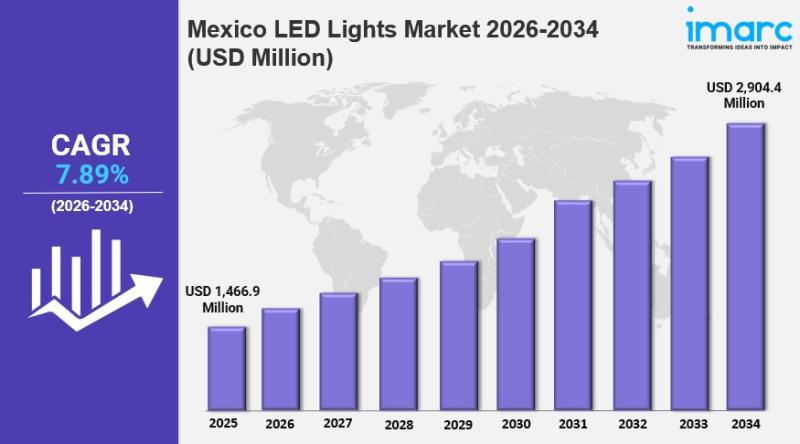

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

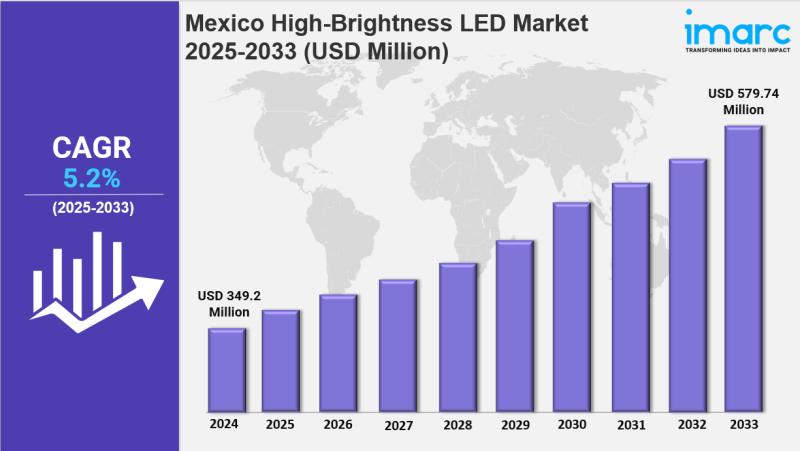

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Takaful

Islamic Insurance (Takaful) Market Hits New High | Major Giants Takaful Malaysia …

HTF MI recently introduced Global Islamic Insurance (Takaful) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Takaful Malaysia, Syarikat Takaful Malaysia, Abu Dhabi Islamic Insurance.

Download Sample Report PDF…

Takaful Market Is Going To Boom | Etiqa, SALAMA, Takaful Emarat

According to HTF Market Intelligence, the Global Takaful market is expected to grow from USD 35 Billion in 2023 to USD 65 Billion by 2032, with a CAGR of 9.10% from 2025 to 2032.

HTF MI recently introduced Global Takaful Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024-2032, Product Type (Life/Family Takaful, General Taka …

According to latest research report by IMARC Group, titled "Takaful Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," The global takaful market size reached US$ 33.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 74.0 Billion by 2032, exhibiting a growth rate (CAGR) of 8.9% during 2024-2032.

Sample Copy of Report at - https://www.imarcgroup.com/takaful-market/requestsample

Takaful Market Trends:

The global takaful market is experiencing significant growth…