Press release

E-Wallet Market to Reach USD 590.2 Billion by 2032 | Your Money, One Tap Away

The E-Wallet market is transforming the way we transact, offering secure, convenient, and instant payment solutions for a digital-first world.

The e-wallet market has experienced significant growth in recent years, driven by increasing digitalization, smartphone penetration, and the rising demand for cashless transactions. E-wallets, also known as digital wallets, provide a convenient and secure way for consumers to make payments, transfer money, and store financial information. With the integration of advanced technologies such as blockchain, artificial intelligence, and biometric authentication, the market is expected to expand further. Governments and financial institutions worldwide are also promoting digital payment solutions, further fueling the adoption of e-wallets among individuals and businesses.

According to a new report published by Market Research Future, The E-Wallet Market [https://www.marketresearchfuture.com/reports/e-wallet-market-4633] was valued at USD 124.6 Billion in 2024, and is estimated to reach USD 590.2 Billion by 2032, growing at a CAGR of 22.10% from 2024 to 2032.

Market Key Players:

Several key players dominate the e-wallet market, offering a wide range of services and innovative solutions. Leading companies include PayPal, Google Pay, Apple Pay, Samsung Pay, Alipay, and WeChat Pay. These companies have established a strong presence by partnering with merchants, banks, and financial institutions. Emerging players like Revolut, Venmo, and Paytm are also gaining traction due to their user-friendly interfaces and attractive promotional offers. Competition in the market is fierce, with companies continuously enhancing security features, expanding their service offerings, and adopting new technologies to attract and retain customers.

Download Sample Report (Get Full Insights in PDF - 100 Pages) at - https://www.marketresearchfuture.com/sample_request/4633

Market Segmentation:

The e-wallet market can be segmented based on type, application, and end-user. By type, it includes closed, semi-closed, and open e-wallets, each offering different levels of flexibility in transactions. In terms of application, e-wallets are widely used in retail, e-commerce, banking, entertainment, transportation, and utility payments. The market is also categorized by end-users, including individuals, small businesses, and large enterprises. As businesses and consumers increasingly embrace digital payments, the demand for tailored e-wallet solutions is growing across different industries and regions.

Scope of the Report:

The report covers an in-depth analysis of the e-wallet market, including current trends, competitive landscape, and future growth prospects. It examines market size, revenue forecasts, and technological advancements shaping the industry. Additionally, the report highlights key challenges and opportunities for market players, focusing on regional developments and regulatory frameworks. By analyzing consumer behavior, adoption rates, and payment preferences, the report provides valuable insights for businesses looking to expand their e-wallet offerings and enhance their market positioning.

Market Drivers:

Several factors are driving the growth of the e-wallet market. The increasing adoption of smartphones and internet connectivity has facilitated seamless digital transactions. Consumers prefer e-wallets for their convenience, speed, and security. Additionally, the growing demand for contactless payments, fueled by the COVID-19 pandemic, has accelerated e-wallet adoption. Government initiatives promoting digital payment infrastructures, coupled with financial incentives for users and merchants, further contribute to market expansion. Moreover, the rise of e-commerce and online shopping has made digital wallets an essential tool for both consumers and businesses.

Market Opportunities:

The e-wallet market presents numerous growth opportunities, particularly in emerging economies where digital payments are still in the nascent stage. Expansion into untapped markets, particularly in rural areas, can drive significant adoption. Additionally, integrating advanced technologies such as blockchain for enhanced security and artificial intelligence for personalized user experiences can further boost market potential. The development of multi-currency wallets for international transactions also presents a lucrative opportunity for companies looking to expand globally. Partnerships with financial institutions and retailers can enhance the accessibility and usability of digital wallets.

Buy Now Premium Research Report [https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=4633]

Restraints and Challenges:

Despite its rapid growth, the e-wallet market faces several challenges. Security concerns, including data breaches and fraud, remain a significant issue. Cybersecurity threats and hacking incidents can undermine consumer trust in digital payment solutions. Additionally, regulatory hurdles and compliance requirements vary across regions, posing a challenge for market expansion. Limited digital literacy among certain demographics and resistance to adopting cashless transactions also hinder market growth. Moreover, high competition and the need for continuous innovation place pressure on companies to invest in technology and customer retention strategies.

Regional Analysis:

The e-wallet market varies significantly across different regions, driven by varying levels of digital adoption and regulatory environments. North America and Europe lead the market with strong digital payment infrastructures and widespread smartphone penetration. Asia-Pacific is the fastest-growing region, with countries like China, India, and Japan witnessing a surge in e-wallet usage due to government initiatives and high mobile penetration. Latin America and the Middle East & Africa are also experiencing growth, driven by increased financial inclusion and the expansion of fintech startups offering innovative payment solutions.

Industry Updates:

The e-wallet industry continues to evolve, with companies launching new features and expanding their market reach. Recent developments include the introduction of biometric authentication, AI-driven fraud detection, and integration with cryptocurrencies. Strategic partnerships between financial institutions and technology companies are enhancing service offerings and driving adoption. Governments worldwide are implementing policies to regulate digital transactions and ensure consumer protection. Additionally, innovations such as super apps that combine multiple financial services into a single platform are gaining popularity, further revolutionizing the e-wallet landscape.

Top Trending Reports:

Education Consulting Market [https://www.marketresearchfuture.com/reports/education-consulting-market-11663]

Europe IT Services Market [https://www.marketresearchfuture.com/reports/europe-it-services-market-13895]

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Media Contact

Company Name: Market Research Future

Contact Person: Media Relations

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=ewallet-market-to-reach-usd-5902-billion-by-2032-your-money-one-tap-away]

Country: United States

Website: https://www.marketresearchfuture.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release E-Wallet Market to Reach USD 590.2 Billion by 2032 | Your Money, One Tap Away here

News-ID: 3876898 • Views: …

More Releases from ABNewswire

Newman's Brew Proves Smooth, Flavorful Coffee Begins with Ethical Sourcing and P …

Newman's Brew has built its reputation on delivering the smoothest coffee available by combining organic bean sourcing with fresh-per-order roasting. The rapidly expanding company demonstrates that ethical business practices and exceptional product quality are not mutually exclusive, while supporting abandoned animal feeding programs as part of its commitment to positive social impact.

In an industry where freshness is often sacrificed for operational convenience, Newman's Brew has chosen a different path. The…

Playground Play Equipment Innovation Sets New Benchmark for Safe, Engaging Space …

As schools, communities, and commercial venues worldwide continue to invest in healthier and more inclusive outdoor environments, playground play equipment [https://www.indooroutdoorplayground.com/what-makes-playground-play-equipment-truly-safe-and-engaging/] is entering a new era-one defined by higher safety standards, smarter design, and broader community engagement. Golden Times (Wenzhou Golden Times Amusement Toys CO., LTD.) today announced an expanded product and market strategy focused on delivering next-generation playground solutions that balance safety, durability, and creativity.

Industry expectations for playgrounds have…

Time.so Reports 300% Growth in Business Users

Time.so reports 300% growth in business users as global teams rely on its fast world clock, city times, time zones, and weather for planning.

Jan 31, 2026 - Time.so today announced a 300% increase in business users, reflecting rising demand for dependable time data across distributed teams, global customer support, and cross border operations.

The surge follows a clear shift in how companies schedule work. Meetings span continents. Deadlines move with daylight…

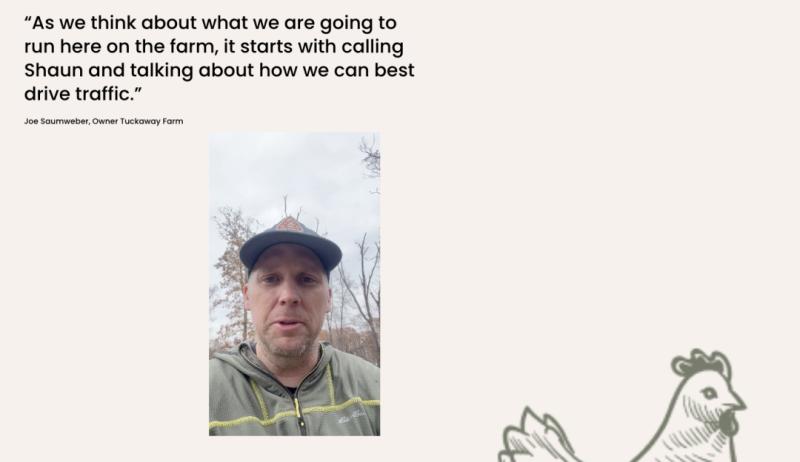

Shaun Savvy Helps Tuckaway Farm in Bentonville, Arkansas Sell Out Two CSA Season …

Buffalo-based SEO consultant Shaun Savvy partnered with Tuckaway Farm in Bentonville, Arkansas to help the farm sell out two consecutive CSA seasons, generating over $80,000 in revenue while spending less than $1,000 on paid advertising through a strategic blend of local SEO, high-intent content, and targeted social media campaigns.

Shaun Savvy, a Buffalo-based SEO and digital marketing consultant, announced a successful local marketing case study showcasing how Tuckaway Farm sold out…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…