Press release

Anti-Money Laundering Software Market Size Share & Report 2033

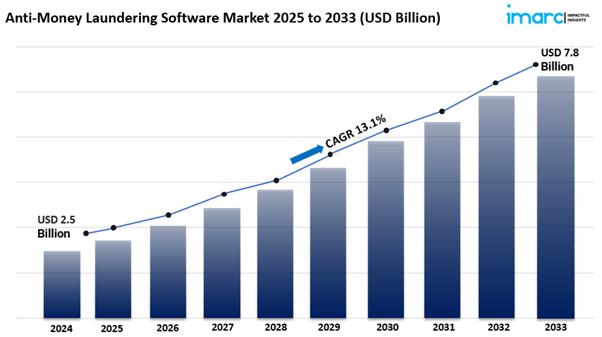

IMARC Group, a leading market research company, has recently released a report titled "Anti-Money Laundering (AML) Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Application, End Use Industry, and Region, 2025-2033". The study provides a detailed analysis of the industry, including the global anti-money laundering software market trends, share, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.The global anti-money laundering software market size reached USD 2.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 13.1% during 2025-2033.

Request to Get the Sample Report: https://www.imarcgroup.com/anti-money-laundering-software-market/requestsample

Anti-Money Laundering Software Market Trends

The anti-money laundering (AML) software market is about to change significantly. Organizations are focusing more on compliance and risk management. As financial transactions become more complex and digital currencies rise, businesses need advanced AML solutions. By 2025, demand for software that uses AI and machine learning will grow. These technologies will allow for real-time monitoring and better fraud detection.

Regulatory bodies are tightening compliance requirements. This pushes organizations to find solutions that meet these standards and streamline their operations. Also, increased awareness of financial crime risks in emerging markets will boost AML software adoption. This trend shows the need for innovation and adaptability in the AML sector. It is becoming a vital part of modern financial operations.

Market Dynamics of the Anti-Money Laundering Software Market

Regulatory Pressure and Compliance Requirements

The anti-money laundering (AML) software market is growing due to rising regulatory pressure and strict compliance rules from governments and financial authorities. As financial crimes get more advanced, regulators are tightening compliance measures. Organizations must implement strong AML programs, especially in high-risk sectors like banking, insurance, and cryptocurrency.

By 2025, companies will need to invest in advanced AML software. This includes features like real-time transaction monitoring, customer due diligence, and reporting tools. Not complying can lead to severe penalties, damage to reputation, and loss of business.

This situation increases the demand for innovative AML software. Such solutions must meet regulatory standards while improving operational efficiency. This allows organizations to effectively detect and prevent illicit activities.

Technological Advancements and Integration of AI

Technological advancements are changing the anti-money laundering (AML) software landscape. Artificial intelligence (AI) and machine learning are key in improving detection capabilities. Traditional transaction monitoring methods are no longer enough. AI and machine learning algorithms can analyze large data sets, find patterns, and flag suspicious activities more accurately and quickly. By 2025, these technologies will help organizations shift from reacting to financial crime to taking proactive measures.

Additionally, the software will adapt and learn from new data, which reduces false positives and boosts compliance. This change not only makes AML processes more efficient but also helps organizations respond quickly to new threats in finance.

Growing Demand from Emerging Markets

Emerging markets are seeing a rise in demand for anti-money laundering (AML) software. These countries want to strengthen their financial systems against illegal activities. As their economies grow and attract foreign investments, strong AML measures are crucial. This helps maintain the integrity of financial institutions.

Regions like Asia-Pacific, Latin America, and Africa are realizing the need for solid AML frameworks. They want to meet international standards and draw in global business. By 2025, the growth of digital financial services, such as mobile banking and fintech, will boost the demand for AML software even more.

Local governments and regulatory bodies are expected to support this shift. They will raise awareness and offer incentives for adopting technology. This situation creates a big opportunity for software providers. They can customize their solutions to fit the unique needs of these emerging markets. This not only expands their global reach but also aids in the fight against financial crime.

Buy Now: https://www.imarcgroup.com/checkout?id=2785&method=502

Anti-Money Laundering (AML) Software Market Report Segmentation:

By Component:

· Software

· Services

Based on the component, the market is segmented into software and services.

By Deployment Mode:

· On-premises

· Cloud-based

On the basis of deployment mode, the market has been categorized into on-premises and cloud-based.

By Application:

· Transaction Monitoring

· Currency Transaction Reporting

· Customer Identity Management

· Compliance Management

· Others

Based on the application, the market is divided into transaction monitoring, currency transaction reporting, customer identity management, compliance management, and others.

By End Use Industry:

· BFSI

· Defense

· Healthcare

· IT and Telecom

· Retail

· Others

On the basis of end use industry, the market has been divided into BFSI, defense, healthcare, IT and telecom, retail, and others.

Regional Insights:

· North America

· Asia Pacific

· Europe

· Latin America

· Middle East and Africa

Based on the region, the market is segregated into North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

Competitive Landscape with Key Players:

The competitive landscape of the anti-money laundering (AML) software market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

· ACI Worldwide Inc.

· AML Partners LLC

· BAE Systems Plc

· CaseWare RCM Inc. (CaseWare International Inc.)

· Experian Plc

· Fair Isaac Corporation

· Fidelity National Information Services Inc.

· Fiserv Inc.

· Oracle Corporation

· SAS Institute Inc.

· Tata Consultancy Services Limited (Tata Sons Private Limited)

Ask Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=2785&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

USA: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-Money Laundering Software Market Size Share & Report 2033 here

News-ID: 3876078 • Views: …

More Releases from IMARC Group

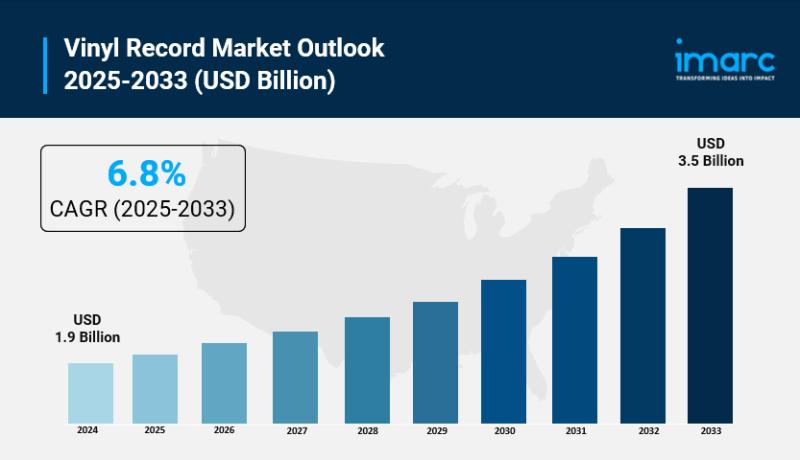

Vinyl Record Market Size to Reach USD 3.5 Billion by 2033 | With a 6.8% CAGR

Market Overview:

According to IMARC Group's latest research publication, "Vinyl Record Market Report by Product (LP/EP Vinyl Records, Single Vinyl Records), Feature (Colored, Gatefold, Picture), Gender (Men, Women), Age Group (13-17, 18-25, 26-35, 36-50, Above 50), Application (Private, Commercial), Distribution Channel (Supermarkets and Hypermarkets, Independent Retailers, Online Stores, and Others), and Region 2025-2033", The global vinyl record market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the…

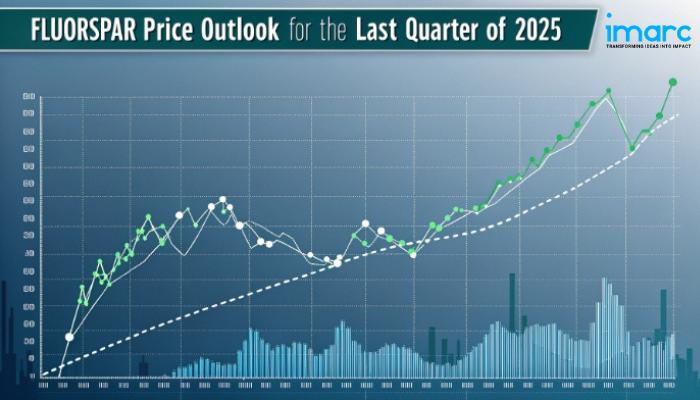

North America Fluorspar Prices Rise in Q4 2025: USA at USD 484/MT, Canada Peaks …

North America Fluorspar Prices Movement Q4 2025:

Fluorspar Prices in USA:

In Q4 2025, fluorspar prices in the USA averaged USD 484 per metric ton. Stable demand from aluminum production and chemical manufacturing supported price levels. Domestic mining operations maintained consistent output, while transportation and energy costs influenced overall supply. Moderate industrial activity and inventory management helped prevent significant price fluctuations across the regional market.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/fluorspar-pricing-report/requestsample

Note: The analysis…

Brazil Hybrid Electric Vehicle Market: Growth Dynamics, Consumer Shifts, and Com …

The Brazil hybrid electric vehicle market size was 348.75 Thousand Units in 2025 and is forecasted to reach 2,551.74 Thousand Units by 2034, reflecting a CAGR of 24.75% during 2026-2034. This robust expansion is fueled by increasing environmental awareness, rising fuel costs, and government policies aimed at emission reduction. Advances in battery technology and flex-fuel hybrid variants leveraging Brazil's ethanol resources also contribute to market growth.

Sample Request Link: https://www.imarcgroup.com/brazil-hybrid-electric-vehicle-market/requestsample

Study Assumption…

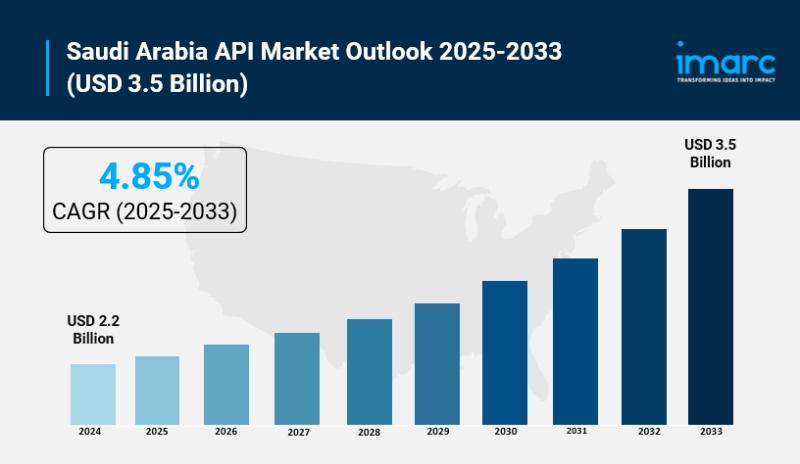

Saudi Arabia API Market Size to Expand USD 3.5 Billion by 2033 at a CAGR of 4.85 …

Saudi Arabia API Market Overview

Market Size in 2024: USD 2.2 Billion

Market Forecast in 2033: USD 3.5 Billion

Market Growth Rate 2025-2033: 4.85%

According to IMARC Group's latest research publication, "Saudi Arabia API Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia API market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate…

More Releases for AML

Xepeng Emphasizes AML Screening in Platform Security

Platform details AML measures, including counterparty checks, to support secure conversions for merchants.

Denpasar, Bali, Indonesia, 30th Dec 2025 -- As digital value conversion systems evolve, enterprises like Xepeng recognize that robust anti-money laundering (AML) practices are essential to maintaining trust, safeguarding merchants, and aligning with regulatory expectations. AML encompasses a set of policies and practices intended to prevent, detect, and respond to financial activity that may be linked to illicit…

Top Trends Transforming the Hemato Oncology Testing Market Landscape in 2025: Ne …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the Hemato Oncology Testing Industry Market Size Be by 2025?

There has been a swift expansion in the hemato oncology testing market in the past few years. The market, which was valued at $3.5 billion in 2024, is predicted to surge to $3.96 billion in 2025, reflecting…

AML BitCoin Founder Asks President Trump to release their AML BITCOIN Classified …

The DOJ and the FBI should practice tough love while also providing financial incentives for government employees that uphold the constitution and obey the law. AG Bondi and Director Patel should ask President Trump for access to some of the billions of dollars that DOGE has saved us and utilize it for pay raises. Their employees need to be taken care of financially, or their hardships will make them the…

Anti-Money Laundering (AML) Software Market Is Booming So Rapidly with Thomson R …

The Latest published market study on Global Anti-Money Laundering (AML) Software Market provides an overview of the current market dynamics in the Anti-Money Laundering (AML) Software space, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2032. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and…

Global Anti Money Laundering (AML) Software Market Size, Share and Forecast By K …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global Anti Money Laundering (AML) Software market is projected to grow at a robust compound annual growth rate (CAGR) of 14.78% from 2024 to 2031. Starting with a valuation of 7.83 Billion in 2024, the market is expected to reach approximately 17.9 Billion by 2031, driven by factors such as Anti Money Laundering (AML) Software and Anti Money Laundering (AML)…

What is AML Verification? A Detailed Guide

With the rise of cryptocurrencies and the increasing adoption of digital assets, regulatory frameworks have become a critical component for ensuring that the cryptocurrency space remains secure and compliant. One of the most important elements in this regulatory framework is AML verification, which stands for Anti-Money Laundering.

Image: https://revbit.net/wp-content/uploads/2024/10/aml-in-crypto-3-1024x640.png

What is AML Verification?

AML (Anti-Money Laundering) verification [https://revbit.net/] refers to a set of procedures and regulations designed to prevent illegal activities such as…