Press release

Asset-Based Lending Market Size To Hit USD 1,324.75 Billion By 2030

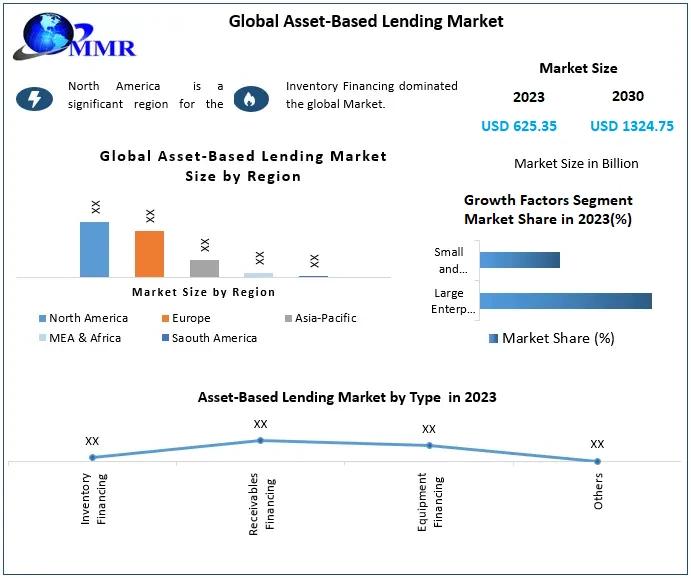

The 𝐀𝐬𝐬𝐞𝐭-𝐁𝐚𝐬𝐞𝐝 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 size was valued at USD 625.35 Billion in 2023 and the total Asset-Based Lending revenue is expected to grow at a CAGR of 11.32% from 2024 to 2030, reaching nearly USD 1324.75 Billion. A critical catalyst for the growth in three digit M1 is the need for additional liquidity and the introduction of new financial products.𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐋𝐢𝐧𝐤 𝐅𝐨𝐫 𝐌𝐨𝐫𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐬:https://www.maximizemarketresearch.com/request-sample/189641/

𝐅𝐚𝐜𝐭𝐨𝐫𝐬 𝐃𝐫𝐢𝐯𝐢𝐧𝐠 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡 𝐚𝐧𝐝 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬

The asset based lending market is booming, driven by a few key factors:

𝐆𝐫𝐞𝐚𝐭𝐞𝐫 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲: Businesses with ABL have greater turnover liquidity since they can use their accounts receivable, inventory, equipment and real estate as collateral. This way of financing is beneficial for fast-growing companies, margin-constraint firms, or firms that make money seasonally, since they can smooth their activity with more stable inflow of money.

𝐍𝐞𝐰 𝐀𝐬𝐬𝐞𝐭-𝐥𝐢𝐧𝐤𝐞𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬: Expansion of the market through introduction of innovative products. Lately, lender have launched new ABL products that enables businesses to get credit based on a whole array of collateral such as inventory, machinery, commercial property, and accounts receivable. These innovations have given companies alternative sources of financing as per their requirements.

𝐋𝐨𝐰 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭 𝐑𝐚𝐭𝐞 𝐂𝐥𝐢𝐦𝐚𝐭𝐞: With interest rates being at historical lows, ABL can often give companies an effective source of gearing. Secured loans are typically at lower interest rates than unsecured loans, making the entire transaction less expensive for companies.

𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐄𝐱𝐩𝐚𝐧𝐬𝐢𝐨𝐧: More regions are opening their regulations to accept asset-based lending as a type of financing. It strengthens ABL credibility and encourages more businesses to consider ABL as one of their strategic financing tools.

𝐄𝐜𝐨𝐧𝐨𝐦𝐢𝐜 𝐒𝐢𝐭𝐮𝐚𝐭𝐢𝐨𝐧: While the essential call for consideration right here is that of a recession or the other, the point is, for the duration of an financial uncertainty, there regularly is a contraction of lending standards, lending stays tough and therefore, companies combat to get hold of unsecured loans. ABL is an alternative in that it provides access to capital by lending against a company as opposed to the creditworthiness of that company.

𝐆𝐞𝐭 𝐭𝐨 𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐭𝐮𝐝𝐲: https://www.maximizemarketresearch.com/market-report/asset-based-lending-market/189641/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

The asset based lending market is divided by type, and end-user.

Market Segment 𝐛𝐲 𝐓𝐲𝐩𝐞, covers - -Type I :It include different forms of asset-based loans, including revolving lines of credit and term loans. A revolving line of credit provides businesses with a flexible option that they can borrow against upfront up to a predetermined limit and then pay back as they require for working capital. Conversely, term loans are paid out as a lump-sum amount with a specified repayment period, typically used for longer-term investments or large capital expenses.

𝐁𝐲 𝐄𝐧𝐝-𝐔𝐬𝐞𝐫: Major end-users include large enterprises and small and medium-sized enterprises (SMEs). The market was valued at $433.2 billion in 2023, of which 63.5% ($274.1 billion) was due to SMEs. And this dominance is likely here to stay, with SME (small and medium enterprises) growth forecast at a 14% CAGR between 2023 and 2028. ABL is popular among SMEs as it is flexible, easily accessible, provides solutions to improve cash shortfall and fund expansion plans.

𝐂𝐨𝐮𝐧𝐭𝐫𝐲-𝐋𝐞𝐯𝐞𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

𝐔.𝐒.: With its mature financial infrastructure and a vast appetite for asset-based lending, the U.S. market is naturally benefitting from its size. Before moving further one should know that asset based lending is a kind of financing solution that is provided by the variety of financial institutions as a product with ABL.

𝐂𝐡𝐢𝐧𝐚: The main reason is that China is going very fast both in economic development and industry development, they need more flexible financing methods. Particularly for Chinese enterprises, especially SMEs, asset-based lending opens the door to use of assets for growth capital, thus helping the market to grow.

𝐆𝐞𝐫𝐦𝐚𝐧𝐲 : Germany, as the largest economy in Europe, has a very strong manufacturing base and the use of asset-based lending to help fund operations and growth. The strength of the German financial market and its wide range of ABL products strengthen the growth of the market.

𝐀𝐮𝐬𝐭𝐫𝐚𝐥𝐢𝐚: Private credit in Australia is on the rise with firms entering the market. The launch of wholesale investor funds shows a continuing appetite for asset-backed lending as an alternative source of corporate financing across industries.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐋𝐢𝐧𝐤 𝐅𝐨𝐫 𝐌𝐨𝐫𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐬:https://www.maximizemarketresearch.com/request-sample/189641/

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐨𝐫 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

The asset-based lending market is largely competitive, majorly driven by key players in the market, capitalizing on high pace a technology. Notable companies include:

𝐂𝐫𝐞𝐝𝐢𝐭: Brookfield Asset Management: Brookfield's credit platform has been a success, putting out billions of asset-based lending and raising large amount of capital for its credit programs. Its firm plans to more than double its credit assets over five years, with a focus on private credit and asset-based lending.

𝐎𝐚𝐤𝐭𝐫𝐞𝐞 𝐂𝐚𝐩𝐢𝐭𝐚𝐥: Oaktree has launched its entry into the private credit space with fresh capital investments from around the globe. This effort continues to illustrate the strategy of the firm to further develop asset-based lending investment capabilities and grow the firms asset in excess of $2 billion over the next few years.

𝐏𝐫𝐢𝐯𝐚𝐭𝐞 𝐂𝐫𝐞𝐝𝐢𝐭 𝐄𝐱𝐩𝐨𝐬𝐮𝐫𝐞 𝐚𝐭 𝐔.𝐒. 𝐁𝐚𝐧𝐤𝐬: Major U.S. banks, including Wells Fargo, have heavy private credit exposure, putting billions of dollars behind asset-backed loans. However, analysts warn that such system risks do not reduce the importance of ABL as a finance component in the financial portfolio embodied by this involvement.

𝐁𝐚𝐧𝐤 𝐨𝐟 𝐀𝐦𝐞𝐫𝐢𝐜𝐚: Bank of America continues to be a leader in providing asset-based lending solutions with their deep footprint in the private credit market able to leverage their expertise, customer base and portfolio nationwide. The Bank should be able to leverage its diversified portfolio and stable capital to mitigate such risks while taking advantage of expected growth in the ABL space.

𝐌𝐞𝐭𝐫𝐨 𝐁𝐚𝐧𝐤: A mid-sized UK lender, Metro Bank has launched market-leading ABL products, enabling businesses to leverage a diverse range of assets to draw down meaningful amounts of credit. It has therefore made Metro Bank an important competitor in the asset-based lending space, providing a traditional bank solution to businesses with varying needs for flexible finance.

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧

The global asset-based lending market is expected to witness sizable growth such as improved liquidity, new & innovative financial products along with favorable regulatory frameworks. With the economy still somewhat uncertain, business financing is at an then all-time low and ABL is only growing in popularity amongst businesses looking for flexible financing solutions. Businesses with sophisticated ABL strategies will benefit from market trends that allow them to grow their total credit portfolios and ensure long-term success.

𝐅𝐨𝐫 𝐚𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐯𝐢𝐬𝐢𝐭:

♦ Artificial Intelligence in Oil and Gas Market https://www.maximizemarketresearch.com/market-report/global-artificial-intelligence-in-oil-and-gas-market/368/

♦Global Contactless Smart Card Market https://www.maximizemarketresearch.com/market-report/contactless-smart-card-market/53982/

♦ Global Hyperloop Technology Market https://www.maximizemarketresearch.com/market-report/global-hyperloop-technology-market/1288/

♦ Global Automatic Content Recognition Market https://www.maximizemarketresearch.com/market-report/global-automatic-content-recognition-market/58219/

♦ Global Commercial Satellite Imaging Market https://www.maximizemarketresearch.com/market-report/global-commercial-satellite-imaging-market/16869/

♦ Global Artificial Intelligence in BFSI Market https://www.maximizemarketresearch.com/market-report/global-artificial-intelligence-ai-in-bfsi-market/30633/

♦ Smart Waste & Recycling System Market https://www.maximizemarketresearch.com/market-report/global-smart-waste-recycling-system-market/103521/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

𝐌𝐀𝐗𝐈𝐌𝐈𝐙𝐄 𝐌𝐀𝐑𝐊𝐄𝐓 𝐑𝐄𝐒𝐄𝐀𝐑𝐂𝐇 𝐏𝐕𝐓. 𝐋𝐓𝐃.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market Size To Hit USD 1,324.75 Billion By 2030 here

News-ID: 3872688 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for ABL

At-Sea Cargo Transfer Market Growth Drivers, and Competitive Landscape |ABL Grou …

The At-Sea Cargo Transfer Market research report represents major insights on the current growth dynamics as well as the primary revenue generation elements that are available in the At-Sea Cargo Transfer industry along with various other factors over the predicted period 2024-2031. The report on the At-Sea Cargo Transfer market is focusing on a series of parameters including top manufacturing strategies, industry share, prime opportunities, industrial channels, profit margin, etc.…

Contract Laboratory Organization Market Sees High Growth Backed by Dominant Tren …

The latest study released on the Global Contract Laboratory Organization Market by HTF MI Research evaluates market size, trend, and forecast to 2029. The Contract Laboratory Organization market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the…

Submarine Cable Laying Services Market to Eyewitness Massive Growth by 2028 | Bo …

Submarine Cable Laying Services market size is expected to grow at a compound annual growth rate of xx% for the forecast period of 2021 to 2028.

Market IntelliX report on Submarine Cable Laying Services market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecasted period while providing their impacts on the market's growth.

Submarine Cable Laying Services Market report offers an overall scope of the market…

Global Bcr Abl Inhibitor Market, Drug Sales and Clinical Trials Insight 2028

Global Bcr-Abl Inhibitor Market, Drug Sales and Clinical Trials Insight 2028 Report Highlights:

* Global Bcr-Abl Inhibitor Market Opportunity > USD 8 Billion

* Approved Bcr-Abl Inhibitor Drugs: 8 Drugs

* Global Bcr-Abl Inhibitor Market Regional Analysis and Forecast Till 2028

* Bcr-Abl Inhibitor Drug Market Past Sales and Future Forecast Till 2028

* Market Analysis By First, Second and Third Generation Approved drugs

* Bcr-Abl Inhibitor Drug Prices, Dosage and Patent Insight

* Global Bcr-Abl Inhibitor…

Online Weight Loss Programs Market to Get a New Boost | Medifast, Technogym, ABL …

The Latest research coverage on Online Weight Loss Programs Market provides a detailed overview and accurate market size. The study is designed considering current and historical trends, market development and business strategies taken up by leaders and new industry players entering the market. Furthermore, study includes an in-depth analysis of global and regional markets along with country level market size breakdown to identify potential gaps and opportunities to better investigate…

Online Weight Loss Programs Market to Witness Astonishing Growth by 2026 | FITTR …

Global Online Weight Loss Programs Market Research Report with Opportunities and Strategies to Boost Growth- COVID-19 Impact and Recovery is latest research study released by Advance Market Analytics evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Online Weight Loss Programs Market.

Some of…