Press release

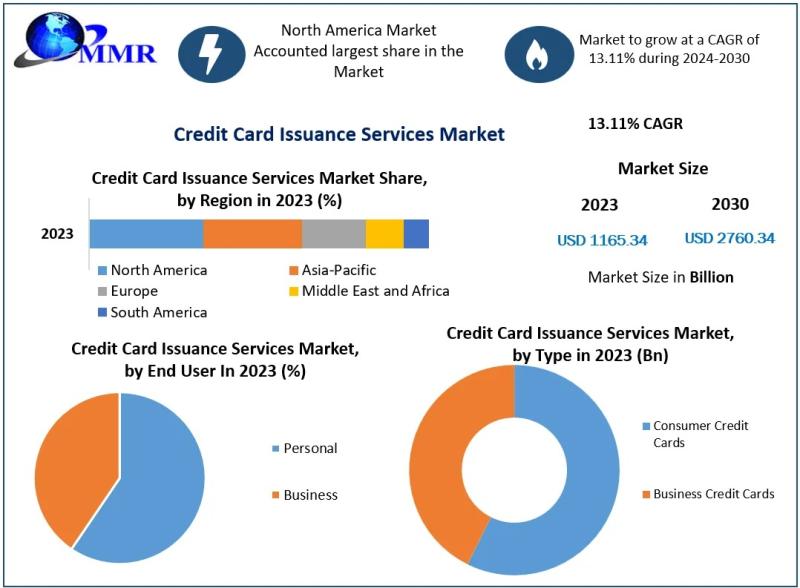

Credit Card Issuance Services Market Set for Strong Growth, Expected to Hit USD 2760.34 Bn by 2030

the 𝐂𝐫𝐞𝐝𝐢𝐭 𝐂𝐚𝐫𝐝 𝐈𝐬𝐬𝐮𝐚𝐧𝐜𝐞 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 expected to hit USD 2760.34 Bn by 2030 from USD 1165.34 Bn in 2023 at a CAGR of 7.9 % during the forecast period. This growth is driven by an increased usage of digital payment methods trend, the increasing contactless payments trend, and the exponentially increasing demand for the use of credit cards in developing nations.𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐋𝐢𝐧𝐤 𝐅𝐨𝐫 𝐌𝐨𝐫𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐬:https://www.maximizemarketresearch.com/request-sample/186182/

𝐅𝐚𝐜𝐭𝐨𝐫𝐬 𝐀𝐧𝐝 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐅𝐨𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

As one of the key factors fueling the expansion of the credit card issuance services market, the increasing popularity of digital payment systems across the globe is a key contributor. The access of digital transactions are penetrating into every economy in the world, and thus, credit cards remain one of the most preferred ways of spending money because of their ease of use, security, and rewards. With the evolution of more consumers using the cashless way of living, the search of credit card continues to increase even more as there are credit cards with additional benefits of cashback, travelling facilities, and purchasing security as well.

Another significant reason which is supporting the market, is high demand for contactless payments. At least 8 in every 10 cardholders are consistent with contactless payment options, and studies show it will only further increase with time. With consumers looking for speed and security, credit card issuers are keeping digital-first services, such as virtual cards and mobile app-based solutions, front of mind. Such technological innovations are anticipated to propel the market growth over the forecast period.

The growing BNPL services that do not report to national credit agencies but still provide credit is another major reason behind the growth in the market. And these services are gaining traction with younger consumers, who are eager to pay for things but without the hassle of credit history checks. BNPL is witnessing a huge surge, which also leads to increased adoption of credit cards as this is part of a wider changing pattern in consumer credit behavior.

𝐖𝐚𝐧𝐭 𝐭𝐨 𝐚𝐜𝐜𝐞𝐬𝐬 𝐦𝐨𝐫𝐞 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬? 𝐓𝐡𝐞 𝐣𝐨𝐮𝐫𝐧𝐞𝐲 𝐬𝐭𝐚𝐫𝐭𝐬 𝐟𝐫𝐨𝐦 𝐫𝐞𝐪𝐮𝐞𝐬𝐭𝐢𝐧𝐠 𝐒𝐚𝐦𝐩𝐥𝐞 :https://www.maximizemarketresearch.com/request-sample/186182/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

𝐁𝐚𝐬𝐞𝐝 𝐨𝐧 𝐓𝐲𝐩𝐞: Credit card issuance services are classified in the market as credit cards, prepaid cards and virtual cards. Despite this, the market is still overwhelmingly dominated by traditional credit cards which have been around for quite some time and are universally accepted and bring a lot of benefits. That said, virtual cards are becoming more popular, especially for online transactions, because of the added protection and convenience for consumers who prefer to shop online.

𝐁𝐲 𝐈𝐬𝐬𝐮𝐞𝐫: Major participants in the sector include fintech businesses, non-banking financial corporations (NBFCs), and commercial banks. Because of their well-established clientele and extensive range of financial services, commercial banks presently hold the biggest market share. Nonetheless, it is anticipated that the expanding function of fintech companies in offering cutting-edge financial solutions would propel substantial expansion in this market, especially in developing nations where the use of digital payments is growing.

𝐄𝐧𝐝-𝐔𝐬𝐞𝐫: Credit card issuance services are used by individuals, corporations, and government organizations. Individuals account for the biggest portion, as more and more consumers around the world use credit cards for their everyday purchases such as shopping, travel, entertainment and more. Another product is the corporate credit card, which is gaining popularity as organizations increasingly go cashless for expense management and travel.

𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬

𝐍𝐨𝐫𝐭𝐡 𝐀𝐦𝐞𝐫𝐢𝐜𝐚: North America is estimated to be the largest region in the credit card issuance services market share owing to presence of large financial institutions such as American Express, MasterCard and Discover.) Additionally, the growing adoption of digital payments and the high penetration of credit cards among consumers further complement the market growth. Today, the U.S. is still one of the largest credit cardholder markets in the world, and the demand for cutting-edge payment options is expected to keep growing in the years to come.

𝐀𝐬𝐢𝐚 𝐏𝐚𝐜𝐢𝐟𝐢𝐜: The credit card issuance services market in the Asia pacific is estimated to grow at the highest over the given forecast period owing to the rising credit card users in emerging economies such as India, China and Japan. This trend is driven by the embrace of digital payment methods and the growing demand for contactless payment. The increase in credit card usage in India is another indicator of a growth trend, with the overall credit card user base rising to 55 million in 2023.

𝐄𝐮𝐫𝐨𝐩𝐞 - Europe continues to be an important market for credit card issuance services, as the transition away from cash accelerates and the need for digital payment solutions rises. Credit cards are still relatively common in these countries, with the UK, Germany and France adopting these as a means of payment more than the other EU countries especially in online commerce or travel. Regulatory changes like EU's Payment Services Directive (PSD2) have also impacted the market in Europe by advocating more transparency and security for the payment industry.

𝐌𝐢𝐝𝐝𝐥𝐞 𝐄𝐚𝐬𝐭 & 𝐀𝐟𝐫𝐢𝐜𝐚𝐧 𝐑𝐞𝐠𝐢𝐨𝐧 : The Middle East & Africa is being the digital payment system highly adoptive regions where in other countries credit cards are boosting up in region such as the UAE and Saudi Arabia. Demand for credit card issuance services are largely fueled by increasing financial inclusion and urbanization in the region.

𝐓𝐨 𝐆𝐚𝐢𝐧 𝐌𝐨𝐫𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐢𝐧𝐭𝐨 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬, 𝐁𝐫𝐨𝐰𝐬𝐞 𝐒𝐮𝐦𝐦𝐚𝐫𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 : https://www.maximizemarketresearch.com/market-report/credit-card-issuance-services-market/186182/

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐨𝐫 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

Some of the major players associated with the credit card issuance services market include American Express, Discover Bank, MasterCard, Fiserv Inc., and Marqeta Inc. The companies have been making huge investments in innovations with the goal of enabling effortless payment experiences for both consumers and businesses. For example, Fiserv has recently acquired NetPay to improve its payment facilitation capabilities whilst Marqeta has established itself as a leader in card-issuing platforms for businesses that need to issue virtual and physical cards around the world.

On the other hand the competition is decked with more collaborations and partnerships. Here, the recent interest shown by a payment platform, CRED, to partner with SBI Card has highlighted the digital platforms having increasingly influenced the growth of credit cards in emerging markets.

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧

However, the credit card issuance services market is expected to gain traction, owing to the rise of digital payment systems, increasing technological adoption for innovative financial products, and the need for contactless payments. With a growing number of consumers using cashless payment methods and fintech players making their mark in the traditional financial services market, the credit card issuing services market is likely to witness significant growth in the coming years. This layer of innovation will keep the market growing and pushing the envelope, a phenomenon that benefits consumers, enterprises and financial institutions alike, as new entrants innovate on payment solutions without compromising the position of big players that expand their value and promote the verifying processes that facilitate their services.

𝐅𝐨𝐫 𝐚𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐫𝐞𝐩𝐨𝐫𝐭𝐬 𝐨𝐧 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐭𝐨𝐩𝐢𝐜𝐬, 𝐯𝐢𝐬𝐢𝐭 𝐨𝐮𝐫 𝐰𝐞𝐛𝐬𝐢𝐭𝐞:

♦ Global Virtual Fitting Room Market https://www.maximizemarketresearch.com/market-report/global-virtual-fitting-room-market/29023/

♦ intelligent Traffic Management System Market https://www.maximizemarketresearch.com/market-report/intelligent-traffic-management-system-market/123435/

♦ Retail Automation Market https://www.maximizemarketresearch.com/market-report/global-retail-automation-market/29378/

♦ Global Blockchain Supply Chain Market https://www.maximizemarketresearch.com/market-report/global-blockchain-supply-chain-market/63534/

♦ Software Consulting Market https://www.maximizemarketresearch.com/market-report/global-software-consulting-market/115784/

♦ Online Banking Market https://www.maximizemarketresearch.com/market-report/global-online-banking-market/84177/

♦ Online Lottery Market https://www.maximizemarketresearch.com/market-report/online-lottery-market/145747/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Card Issuance Services Market Set for Strong Growth, Expected to Hit USD 2760.34 Bn by 2030 here

News-ID: 3871354 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

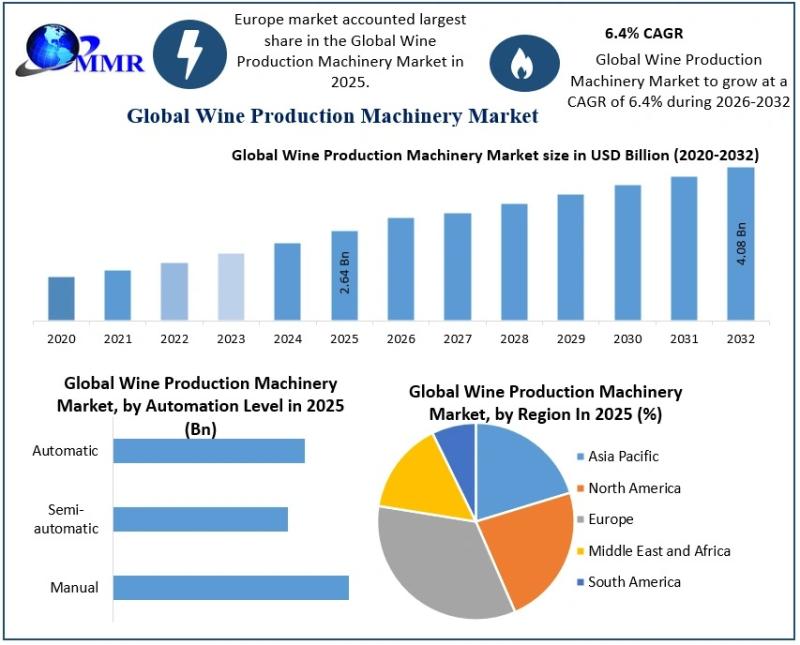

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

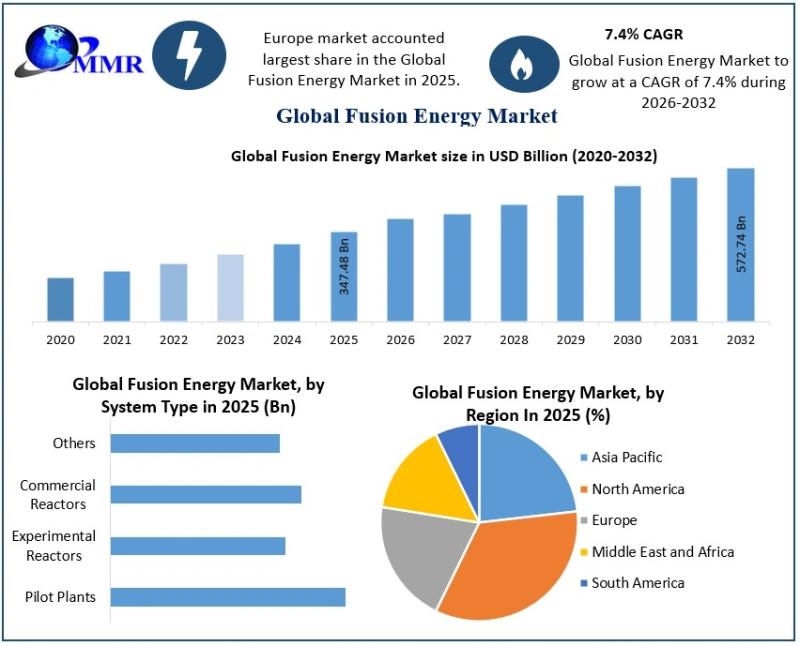

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…