Press release

Evolving Investment Strategies Drive Growth in the Global Pension Funds Market

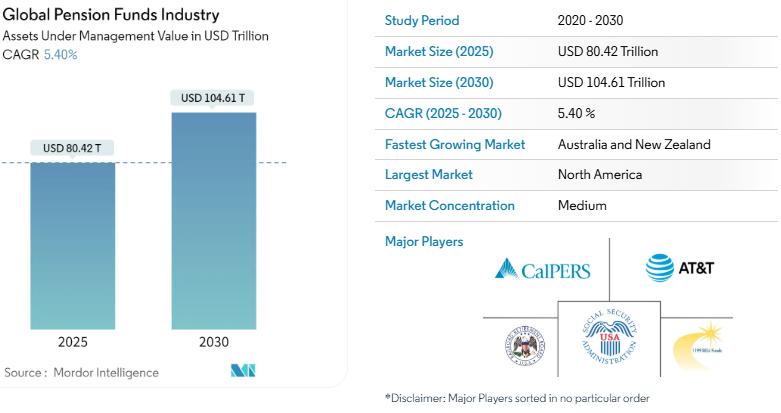

Mordor Intelligence has published a new report on the Pension Funds Market, offering a comprehensive analysis of trends, growth drivers, and future projections.The global pension funds market is experiencing substantial growth, with assets under management (AUM) expected to increase from USD 80.42 trillion in 2025 to USD 104.61 trillion by 2030, reflecting a compound annual growth rate (CAGR) of 5.4% during this period. This expansion is primarily driven by pension funds diversifying into alternative investments, such as real estate, private equity, and infrastructure, to enhance returns and manage risks in a complex financial environment.

Report Overview: https://www.mordorintelligence.com/industry-reports/global-pension-fund-industry

Key Trends Driving Market Growth

Shift Toward Alternative Investments

Over the past two decades, pension funds have significantly increased their allocations to alternative assets. Allocations to real estate, private equity, and infrastructure have grown from 6% to 23%, as these investments offer attractive returns that can offset the challenges of traditional asset classes. Despite governance complexities, the pursuit of higher yields has made alternatives a focal point in pension fund portfolios.

Regional Growth Dynamics

North America: Currently holds the largest market share, driven by well-established pension systems and a strong culture of retirement savings.

Australia and New Zealand: Identified as the fastest-growing markets, with increasing participation in pension schemes and proactive regulatory frameworks supporting growth.

Adoption of Exchange-Traded Funds (ETFs)

European pension funds are increasingly incorporating ETFs into their investment strategies. Since 2020, there has been a notable surge in ETF adoption among institutional investors, including pension funds and insurance companies. This trend is attributed to ETFs' resilience during market shocks, enhanced liquidity, and cost-effectiveness compared to underlying securities. The shift towards passive index investing and low fees further supports the rising preference for ETFs among pension funds.

Increased Investment in Private Markets

Public pension schemes and sovereign wealth funds plan to increase their investments in private markets over the coming year, despite warnings from financial authorities about potential risks. A survey by the Official Monetary and Financial Institutions Forum (OMFIF) indicates that half of the funds intend to boost their private credit exposure, with a significant number also planning to increase allocations to infrastructure and private equity. This enthusiasm persists despite concerns about a potential bubble due to the influx of capital into these assets.

Market Segmentation

The global pension funds market is segmented based on the type of pension plan and geographical regions:

By Type of Pension Plan:

Defined Contribution (DC): Plans where contributions are defined, but the benefit amount received upon retirement depends on investment performance.

Defined Benefit (DB): Plans that promise a specified monthly benefit upon retirement, typically based on salary and years of service.

Reserved Fund: Funds set aside by employers or governments to meet future pension liabilities.

Hybrid: Plans that combine elements of both defined contribution and defined benefit schemes.

By Geography:

North America: Dominates the market with the largest share, supported by robust pension systems and high participation rates.

Europe: Features mature pension markets with a mix of public and private pension schemes.

Asia-Pacific: Experiencing rapid growth due to economic development and increasing adoption of pension schemes.

Rest of the World: Includes regions with emerging pension markets focusing on expanding coverage and sustainability.

Get a Customized Report Tailored to Your Requirements. - https://www.mordorintelligence.com/market-analysis/pension-funds

Key Players in the Pension Funds Market

The pension funds market comprises several major entities managing substantial assets:

Social Security Trust Funds: Manages the U.S. Social Security program's funds, providing retirement, disability, and survivor benefits.

AT&T Corporate Pension Fund: One of the largest corporate pension funds in the United States, managing retirement benefits for AT&T employees.

California Public Employees' Retirement System (CalPERS): The largest public pension fund in the U.S., serving over 1.9 million members in the state of California.

1199SEIU Pension and Retirement Funds: Provides pension and retirement benefits to healthcare workers affiliated with the 1199SEIU labor union.

National Railroad Retirement Investment Trust: Manages assets to provide retirement benefits to U.S. railroad workers.

These organizations play a pivotal role in the global pension landscape, influencing investment strategies and market dynamics.

Conclusion

The global pension funds market is on a robust growth trajectory, driven by strategic diversification into alternative investments and regional economic developments. As pension funds adapt to the complexities of the modern financial environment, their evolving investment strategies aim to secure and enhance returns for beneficiaries. With significant assets under management, these funds continue to shape global investment trends and contribute to financial market stability.

Industry Related Reports

United Kingdom's Pension Fund Market: The United Kingdom's Pension Fund Market is categorized based on pension plan types, including Defined Contribution (DC), Defined Benefits (DB), Hybrid, and Other Pension Plans.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/united-kingdom-pension-fund-market

Canada's Pension Fund Market: Canada's Pension Fund Market is segmented by plan type, including Distributed Contribution, Distributed Benefit, Reserved Fund, and Hybrid Plans.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/canada-pension-fund-market

United States Pension Fund Industry: The United States Pension Fund Industry is categorized by pension plan type, including Distributed Contribution, Distributed Benefit, Reserved Fund, and Hybrid Plans.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/us-pension-funds-market

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Evolving Investment Strategies Drive Growth in the Global Pension Funds Market here

News-ID: 3869030 • Views: …

More Releases from Mordor Intelligence

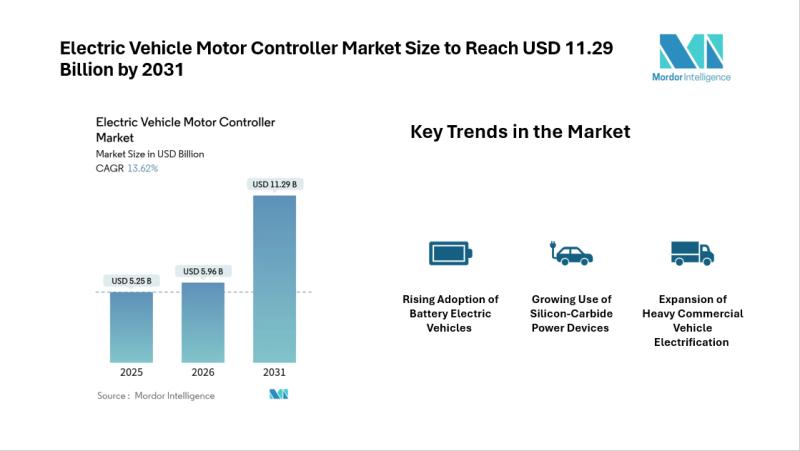

Electric Vehicle Motor Controller Market Size to Reach USD 11.29 Billion by 2031 …

Electric Vehicle Motor Controller Market Overview

According to Mordor Intelligence, the electric vehicle motor controller market size is projected to reach USD 11.29 billion by 2031, growing from USD 5.96 billion in 2026 at a CAGR of 13.62% during the forecast period. The electric vehicle motor controller market forecast reflects steady expansion supported by stricter emission regulations, rising battery electric vehicle adoption, and the increasing use of silicon-carbide power devices.…

Beverage Market Size to Reach USD 2.67 Trillion by 2031, Driven by Health and Su …

Introduction: Beverage Market Growth Outlook

According to a research report by Mordor Intelligence, the global Beverage Market is projected to grow from an estimated USD 2.03 trillion in 2026 to USD 2.67 trillion by 2031, reflecting a steady CAGR of 5.65% over the forecast period. This growth is supported by increasing consumer awareness around health, wellness, and sustainable consumption, along with the rising demand for premium and functional beverages. Non-alcoholic…

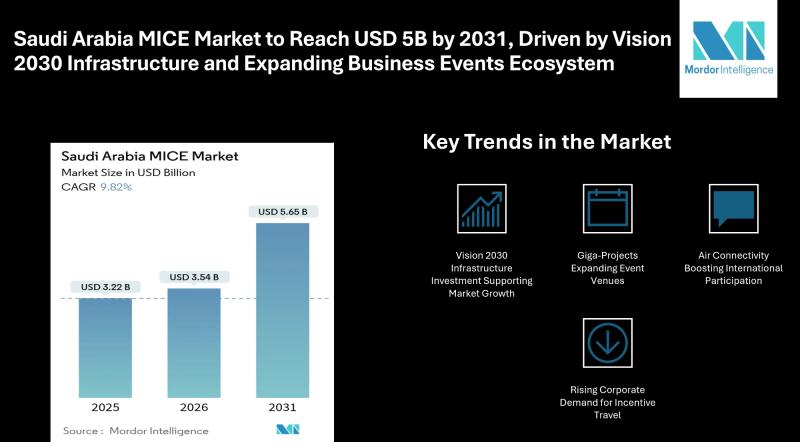

Saudi Arabia MICE Market to Reach USD 5B by 2031, Driven by Vision 2030 Infrastr …

Mordor Intelligence has published a new report on the Saudi Arabia MICE market, offering a comprehensive analysis of trends, growth drivers, and future projections

Saudi Arabia MICE Market Overview

According to Mordor Intelligence, the Saudi Arabia MICE market was valued at USD 3.22 billion in 2025 and is estimated to grow from USD 3.54 billion in 2026 to reach USD 5.65 billion by 2031, registering a CAGR of 9.82%…

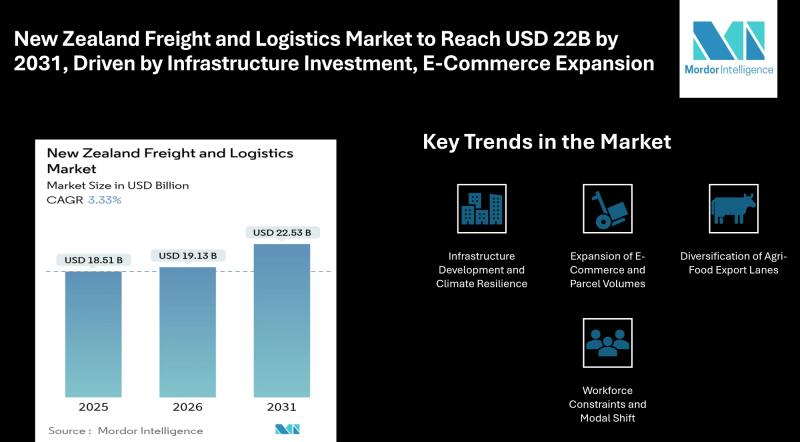

New Zealand Freight and Logistics Market to Reach USD 22.53 Billion by 2031, Dri …

Mordor Intelligence has published a new report on the New Zealand freight and logistics market, offering a comprehensive analysis of trends, growth drivers, and future projections

Overview of the New Zealand Freight and Logistics Market

The New Zealand freight and logistics market is projected to reach USD 22.53 billion by 2031, growing from USD 19.13 billion in 2026, at a CAGR of 3.33%. The steady rise reflects continued infrastructure…

More Releases for Fund

Broad-Based Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong F …

The Broad-Based Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Broad-Based Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E Fund, …

The Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Exchange-Traded Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fun …

The Exchange-Traded Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Exchange-Traded Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Equity Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Equity Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Equity Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Bond Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E …

The Bond Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Bond Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Money Market Funds Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Money Market Funds research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Money Market Funds market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…