Press release

Carbon Credit Market to Reach USD 2859.31 Billion by 2030, Growing at a CAGR of 30.2%

Increased regulations by government agencies advanced commitments to sustainable practices by corporates and overcome climate concerns are propelling the growth of carbon credit market globally. Cite this research: According to Facts & Factors, the global carbon credit market was USD 9.5 billion in 2023 and will grow by a CAGR of 15.3% between 2024 and 2032, reaching nearly USD 41.75 billion by the end of the forecast period. The growth is driven by the global effort to reduce greenhouse gas emissions, as businesses and governments seek to meet climate targets established through international agreements such as the Paris Agreement.𝐋𝐨𝐨𝐤𝐢𝐧𝐠 𝐟𝐨𝐫 𝐦𝐨𝐫𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 𝐨𝐫 𝐢𝐧𝐪𝐮𝐢𝐫𝐞 𝐧𝐨𝐰 : https://www.maximizemarketresearch.com/request-sample/198127/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐚𝐧𝐝 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

The global carbon credit market is driven by factors such as A major contributor is the escalation of regulatory pressures on corporations and industries to lower their carbon footprint. It is no wonder that governments globally are introducing carbon pricing mechanisms, carbon tax systems, and cap-and-trade programs for companies to trade carbon credits among themselves as a means of regulating and reducing emissions.

The market is also majorly benefiting from trending corporate sustainability. The way that many companies are handling things like sustainability targets (the old catchphrase being net zero by _) is by simply buying carbon credits to offset emissions that they obviously are never going to avoid completely. Carbon credits have emerged as an important instrument for organizations around the world to showcase sustainability, ensuring regulatory compliance and achieving sustainability targets.

Innovations in carbon offset projects-particularly those in renewable energy, reforestation, and carbon capture and storage (CCS) technologies-help to support the increasing prominence of carbon credits in fulfilling climate objectives. This should drive more demand for carbon credits as these projects are increasingly made easier and more cost efficient to conduct.

Moreover, rising prominence of investment in carbon trading platforms and exchanges are enhancing the liquidity and efficiency of the market, facilitating the buying and selling of carbon credits in a more efficient manner by businesses and organizations. In addition, the increasing use of blockchain technology to improve transparency and security in carbon credit transactions is promoting the expansion of this market.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

𝐀𝐜𝐜𝐨𝐫𝐝𝐢𝐧𝐠 𝐭𝐨 𝐝𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐭 𝐭𝐲𝐩𝐞𝐬, 𝐚𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬, 𝐚𝐧𝐝 𝐠𝐞𝐨𝐠𝐫𝐚𝐩𝐡𝐲, 𝐭𝐡𝐞 𝐠𝐥𝐨𝐛𝐚𝐥 𝐜𝐚𝐫𝐛𝐨𝐧 𝐜𝐫𝐞𝐝𝐢𝐭 𝐦𝐚𝐫𝐤𝐞𝐭 𝐜𝐚𝐧 𝐛𝐞 𝐬𝐞𝐠𝐦𝐞𝐧𝐭𝐞𝐝.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐛𝐚𝐬𝐞𝐝 𝐨𝐧 𝐭𝐲𝐩𝐞: 𝐓𝐡𝐞 𝐜𝐚𝐫𝐛𝐨𝐧 𝐜𝐫𝐞𝐝𝐢𝐭 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐬 𝐦𝐨𝐬𝐭𝐥𝐲 𝐜𝐥𝐚𝐬𝐬𝐢𝐟𝐢𝐞𝐝 𝐚𝐬 𝐭𝐰𝐨 𝐭𝐲𝐩𝐞𝐬 𝐨𝐟 𝐜𝐫𝐞𝐝𝐢𝐭:

𝐕𝐨𝐥𝐮𝐧𝐭𝐚𝐫𝐲 𝐂𝐚𝐫𝐛𝐨𝐧 𝐂𝐫𝐞𝐝𝐢𝐭𝐬 : These credits are purchased by company and individuals on voluntary basis for offsetting their emissions beyond regulatory obligations. The voluntary market is expanding rapidly in response to CSR projects and environmental pledges.

𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞 𝐂𝐚𝐫𝐛𝐨𝐧 𝐂𝐫𝐞𝐝𝐢𝐭𝐬 -these are used by companies or organizations that are forced either by law or government regulation to cap their total greenhouse gas emissions. For their part, compliance credits are most often bought by companies involved in a particular industry (e.g. energy, manufacturing, transportation) that are required to reduce GHG emissions by a certain amount (such as specific provisions in the legislation).

𝐋𝐨𝐨𝐤𝐢𝐧𝐠 𝐟𝐨𝐫 𝐦𝐨𝐫𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 𝐨𝐫 𝐢𝐧𝐪𝐮𝐢𝐫𝐞 𝐧𝐨𝐰 : https://www.maximizemarketresearch.com/request-sample/198127/

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭 𝐛𝐲 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧, 𝐭𝐡𝐞 𝐂𝐚𝐫𝐛𝐨𝐧 𝐂𝐫𝐞𝐝𝐢𝐭 𝐜𝐚𝐧 𝐛𝐞 𝐬𝐩𝐥𝐢𝐭 𝐢𝐧𝐭𝐨-

𝐂𝐚𝐫𝐛𝐨𝐧 𝐨𝐟𝐟𝐬𝐞𝐭𝐭𝐢𝐧𝐠 𝐟𝐨𝐫 𝐜𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐢𝐨𝐧𝐬 : A lot of companies buy carbon credits to offset their emissions, thus allowing them to achieve their sustainability goals and comply with environmental, social and governance (ESG) targets.

𝐂𝐥𝐢𝐦𝐚𝐭𝐞𝐂𝐡𝐚𝐧𝐠𝐞 𝐌𝐢𝐭𝐢𝐠𝐚𝐭𝐢𝐨𝐧 : Corporate buyers of carbon credits include governments that need to conform to climate agreements or carbon trading schemes and corporations that need to comply with emission reduction target.

𝐈𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥𝐬 : As awareness of climate change rises, a growing number of individuals are purchasing carbon credits in order to offset the carbon emissions from activities like aviation, driving, and daily consumption.

Geography-based Carbon Credit Market Segment: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The carbon credit industry leader in Europe and North America boasts stable regulations and great demand for emissions trading programs. The Asia-Pacific region is projected to grow considerably, led by China and India, due to rising regulatory pressures and environmental awareness.

𝐂𝐨𝐮𝐧𝐭𝐫𝐲-𝐋𝐞𝐯𝐞𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

𝐔𝐒𝐀 : The USA is a major player in the carbon credit market, particularly due to its state-level programs such as California's Cap-and-Trade Program, as well as increasingly strong commitments by corporations to achieve sustainability goals. Fewer companies based in the U.S., including the technology, energy and transportation sectors, are turning to carbon credits to meet their emission reduction targets.

𝐆𝐞𝐫𝐦𝐚𝐧𝐲 : The European carbon credit market is well developed and Germany is heavily involved in this thanks to its pledge to achieve carbon neutrality by 2050. Carbon credits are being driven by the world's carbon trading programs, complemented by the push on renewable energy and sustainable industry practices across the country.

𝐂𝐡𝐢𝐧𝐚 : With the largest greenhouse gas emissions, China has seen higher participation within the carbon credit market. A national carbon trading system has come into place in the country, and increasing industrialization is leading to greater demand for carbon credits from both governmental and corporate buyers to meet emission reduction quotas.

𝐈𝐧𝐝𝐢𝐚 : India's carbon credit marked is expanding as the country increases on its journey to reducing emissions and promoting sustainability. India, particularly in its energy, manufacturing and transportation sectors, is set to emerge as a major player in the carbon credit market, with large industries and corporates announcing emission targets.

𝐁𝐫𝐚𝐳𝐢𝐥 : Brazil is a rapidly emerging player in the carbon credit market highlighting forestry and sustainable agricultural initiatives. With a strong commitment to preserving the Amazon rainforest and reducing deforestation, the country plays host to its fair share of carbon credit demand.

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐨𝐫 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

The global carbon credit market is a competitive one and is led by some of the key players and carbon trading platforms across the world. Major players in the market are:

𝐂𝐥𝐢𝐦𝐚𝐭𝐞 𝐀𝐜𝐭𝐢𝐨𝐧 𝐑𝐞𝐬𝐞𝐫𝐯𝐞 - North Americas leading carbon offset program with standards for sale and purchase of carbon credits The Reserve is a leader in forestry and land-use activities.

𝐕𝐞𝐫𝐫𝐚

- A key player in the voluntary carbon market, Verra offers standards and the certification of carbon offset projects. It offers one of the most popular carbon credit certification programs known as the Verified Carbon Standard (VCS).

𝐆𝐨𝐥𝐝 𝐒𝐭𝐚𝐧𝐝𝐚𝐫𝐝

- A non-profit that develops certification standards for carbon offset initiatives. Gold Standard projects include renewable energy, forest conservation, and sustainable development projects to generate premium carbon credits.

𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐔𝐧𝐢𝐨𝐧 𝐄𝐦𝐢𝐬𝐬𝐢𝐨𝐧𝐬 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐜𝐡𝐞𝐦𝐞 (𝐄𝐔 𝐄𝐓𝐒)

- As one of the world's biggest compliance markets EU ETS provides the right for businesses in the EU to buy carbon credits to be able to offset against regulatory emission reduction targets These soft measures are at the core of the EU's climate ambitions, the market.

South Pole South Pole is a leading player in both the voluntary and compliance carbon credit markets that is providing carbon offset solutions to businesses looking to cut their carbon footprint. They do a lot of sustainability projects, ones working to preserve forests, and then others that actually get into renewable energy measures as well.

The carbon credit market has seen recent developments as more and more financial institutions enter the market, new carbon trading platforms are created, and distributed ledger technologies, such as blockchain, are used to improve transparency and trust in carbon credit transactions. In addition, global movements targeting carbon neutrality like the UN's Race to Zero are projected to further stimulate carbon credit demand over the coming years.

𝐆𝐞𝐭 𝐝𝐞𝐞𝐩𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬-𝐫𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 𝐨𝐫 𝐢𝐧𝐪𝐮𝐢𝐫𝐞 𝐟𝐨𝐫 𝐦𝐨𝐫𝐞 𝐝𝐞𝐭𝐚𝐢𝐥𝐬 :https://www.maximizemarketresearch.com/request-sample/198127/

𝐔𝐧𝐥𝐨𝐜𝐤 𝐤𝐞𝐲 𝐟𝐢𝐧𝐝𝐢𝐧𝐠𝐬 𝐭𝐨 𝐚𝐝𝐚𝐩𝐭 𝐭𝐨 𝐬𝐡𝐢𝐟𝐭𝐢𝐧𝐠 𝐛𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐝𝐲𝐧𝐚𝐦𝐢𝐜𝐬 :

India Steam Boiler Systems Market https://www.maximizemarketresearch.com/market-report/india-steam-boiler-systems-market/46997/

Water Quality Analyzer Market https://www.maximizemarketresearch.com/market-report/water-quality-analyzer-market/72598/

Spent Nuclear Fuel (SNF) Dry Storage Casks Market https://www.maximizemarketresearch.com/market-report/global-spent-nuclear-fuel-snf-dry-storage-casks-market/77670/

Intelligent Pump Market https://www.maximizemarketresearch.com/market-report/global-hollow-core-insulator-market/19825/

Solar Charge Controllers Market https://www.maximizemarketresearch.com/market-report/global-solar-charge-controllers-market/20856/

𝐑𝐞𝐚𝐜𝐡 𝐎𝐮𝐭 𝐭𝐨 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐟𝐨𝐫 𝐈𝐧-𝐃𝐞𝐩𝐭𝐡 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐚𝐧𝐝 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬

MAXIMIZE MARKET RESEARCH PVT. LTD.

3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

sales@maximizemarketresearch.com

www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carbon Credit Market to Reach USD 2859.31 Billion by 2030, Growing at a CAGR of 30.2% here

News-ID: 3867459 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Commercial Kitchen Appliances Market Poised for Robust Growth, Expected to Reach …

The global Commercial Kitchen Appliances Market, valued at US$ 101.65 billion in 2023, is witnessing strong momentum driven by the rapid expansion of the foodservice industry, technological innovation, and evolving consumer lifestyles. According to the latest market analysis, the industry is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030, reaching nearly US$ 160.05 billion by the end of the forecast period.

Commercial kitchen…

E-Bike Market Poised for Robust Expansion, Projected to Reach USD 153.42 Billion …

The global E-Bike Market is entering a transformative growth phase, underpinned by accelerating demand for eco-friendly transportation, rapid advances in battery and motor technologies, and strong policy support for sustainable urban mobility. Valued at USD 60.65 Billion in 2024, the market is projected to expand at a compound annual growth rate (CAGR) of 12.3% from 2025 to 2032, reaching nearly USD 153.42 Billion by 2032. As cities worldwide seek to…

Data Center Liquid Immersion Cooling Market Set for Rapid Expansion, Driven by H …

Data Center Liquid Immersion Cooling Market to Grow from USD 640.94 Million in 2023 to USD 3,340.83 Million by 2030, Registering a Robust CAGR of 26.6% (2024-2030)

The global Data Center Liquid Immersion Cooling Market is witnessing a transformative phase as data center operators worldwide seek advanced, energy-efficient cooling solutions to address rising power densities, sustainability mandates, and escalating operational costs. Valued at USD 640.94 million in 2023, the market…

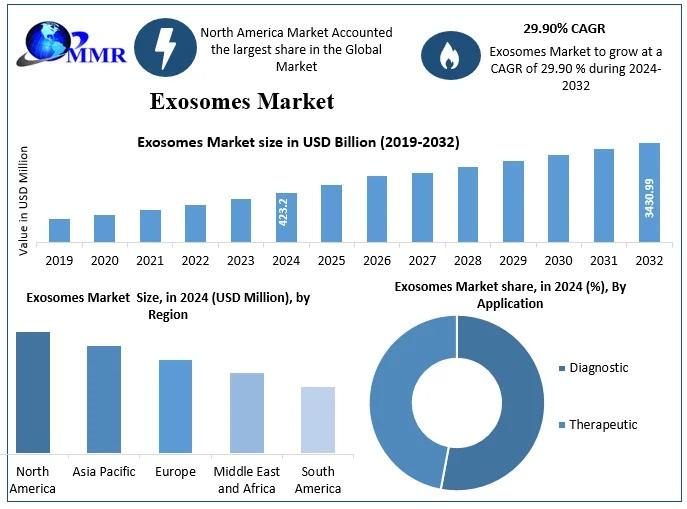

Exosomes Market Forecast: USD 3,430.99 Million Opportunity by 2032

Exosomes Market size was valued at USD 423.2 Mn in 2024 and is expected to reach USD 3430.99 Mn by 2032, at a CAGR of 29.90

The global exosomes market is currently poised for explosive growth, fundamentally driven by the paradigm shift toward non-invasive diagnostics and the rising prominence of "liquid biopsies" in oncology. Once considered mere cellular waste, these extracellular vesicles are now recognized as critical mediators of intercellular communication,…

More Releases for Carbon

Carbon-Carbon Composite Market to Reach $3.31 Billion by 2031 | SGL Carbon, Toyo …

NEW YORK, (UNITED STATES) - QY Research latest 'Carbon-Carbon Composite Market 2025 Report' offers an unparalleled, in-depth analysis of the industry, delivering critical market insights that empower businesses to enhance their knowledge and refine their decision-making processes. This meticulously crafted report serves as a catalyst for growth, unlocking immense opportunities for companies to boost their return rates and solidify their competitive edge in an ever-evolving market. What sets this report…

Carbon Black Market Next Big Thing | Cabot, Tokai Carbon, Jiangxi Black Carbon, …

Market Research Forecast published a new research publication on "Global U.S. U.S. Carbon Black Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the U.S. U.S. Carbon Black Market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Carbon-Carbon Composite Material Market Size, Share 2024, Impressive Industry Gr …

Report Description: -

QY Research's latest report 'Carbon-Carbon Composite Material Market 2024 Report' provides a comprehensive analysis of the industry with market insights will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. Finally, this will increase the return rate and strengthen the competitive advantage within. Since it's a personalised market report, the services are catered to the particular difficulty. The…

Carbon Black Market Scenario & Industry Applications 2020-2025 | Phillips Carbon …

The global carbon black market size is projected to surpass USD 18 billion by 2025. Carbon black act as a reinforcement material for tires and rubber, and possess electrical conductive properties. Carbon black provide pigmentation, conductivity, and UV protection for a number of coating applications along with toners and printing inks for specific color requirements. Its multiple application across various end product along with rising economic outlook has significantly enhanced…

Global Carbon-Carbon Composite Market 2020-2026 SGL Carbon, Toyo Tanso, Tokai Ca …

Global Carbon-Carbon Composite Market 2020-2026 analysis Report offers a comprehensive analysis of the market. It will therefore via depth Qualitative insights, Historical standing and verifiable projections regarding market size. The projections featured inside the report square measure derived victimisation verified analysis methodologies and assumptions. Report provides a progressive summary of the Carbon-Carbon Composite business 2020 together with definitions, classifications, Carbon-Carbon Composite market research, a decent vary of applications and Carbon-Carbon…

Global Carbon Black Market to 2026| Cabot, Orion Engineered Carbons, Birla Carbo …

Albany, NY, 10th January : Recent research and the current scenario as well as future market potential of "Carbon Black Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 - 2026" globally.

Carbon Black Market - Overview

Carbon black (CB) is manufactured through partial combustion of heavy hydrocarbons under controlled temperature and pressure to obtain fine particles and aggregates having a wide range of structure and surface properties. This…