Press release

Global Renewable Energy M&A Hits $117B in 2024, Led by ~$60B in Private Equity Investments

Global Renewable Energy M&A Hits $117B in 2024, Led by ~$60B in Private Equity InvestmentsEnerdatics Reports Key Market Trends and 2025 Outlook

Key Takeaways from Enerdatics' 2024 Renewable Energy M&A Analysis:

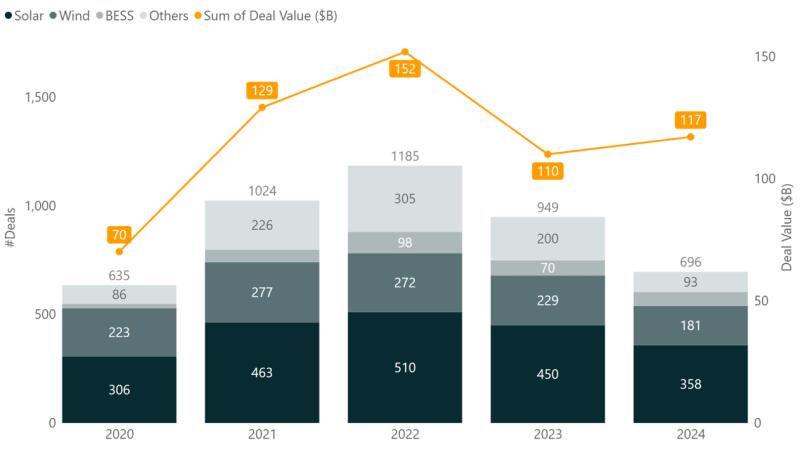

Global renewable energy M&A activity reached a record $117B in 2024, with North America leading at $50 billion and private equity driving major corporate acquisitions.

Emerging markets, including Romania, Greece, and Saudi Arabia, are poised for increased M&A activity, backed by favorable policy environments, rising PPA adoption, and investor interest in high-growth regions.

Battery energy storage (BESS) poised for strong growth in 2025, as grid constraints drive demand for flexible energy solutions.

[February 12, 2025] - The global renewable energy sector demonstrated remarkable resilience in 2024, with mergers and acquisitions (M&A) activity exceeding $117B, marking another record-breaking year despite macroeconomic uncertainties.

According to Enerdatics' 2024 Renewable Energy M&A Analysis and 2025 Outlook, private equity (PE) firms, infrastructure funds, and strategic investors played a pivotal role in transactions, focusing on platform acquisitions, asset rotation strategies, and expansion into emerging markets.

North America Leads Global M&A, While Europe Sees Strong Private Equity Activity

North America accounted for over $50 billion in M&A activity, with corporate acquisitions and PE investments dominating the landscape. A regional shift was observed, as MISO overtook ERCOT in transaction volume, driven by increasing data center expansion and a rise in build-transfer agreements (BTAs).

"2024 was a defining year for renewable energy M&A, as investors actively adjusted strategies to navigate economic and policy headwinds while securing high-quality project pipelines," said Kshitij NR, Head of Research and Analysis at Enerdatics. "The continued influx of capital highlights sustained confidence in the renewable energy transition, even amid evolving market dynamics."

In Europe, M&A activity totaled $40 billion, with private equity-backed deals reaching $22 billion. The UK and Germany maintained their dominance, while Romania and Greece gained traction, driven by competitive power pricing and favorable regulatory policies.

Across the Asia-Pacific region, over $15 billion in deals were executed, with Australia surpassing India as the region's top M&A market. The strong appeal of PPA-backed projects and corporate acquisitions underscored long-term investor confidence in the sector.

Meanwhile, Latin America recorded $8 billion in transactions, with Brazil leading at $5 billion in corporate M&A. The region also witnessed a milestone in energy storage investments, with SUSI Partners acquiring an 860 MW battery portfolio in Chile.

2025 Outlook: Growth in Energy Storage and Market Adaptations

Enerdatics forecasts private equity to continue dominating renewable energy M&A in 2025, leveraging declining interest rates to acquire premium assets.

The battery energy storage sector (BESS) is set for significant growth, particularly in Australia, Chile, and Europe, as grid constraints and renewable intermittency drive demand for flexible energy solutions.

"Investors in 2025 must navigate an evolving regulatory landscape while maintaining a focus on asset diversification and long-term financial resilience," said Hari Krishnan, Principal Analyst at Enerdatics. "In the U.S., wind repowering projects are becoming a priority as potential policy shifts influence investment decisions."

Additionally, Romania, Greece, and Saudi Arabia are emerging as key investment destinations, supported by pro-renewable policies and a growing power purchase agreement (PPA) market. The U.S. remains a focal point, though regulatory uncertainties could impact valuations and acquisition strategies.

Strategic Shifts Will Define the Next Phase of Renewable Energy M&A

As global deal activity reaches historic levels and market conditions evolve, investors and developers will need to adapt to shifting policies, changing regional dynamics, and increased energy storage demand. The ability to navigate these shifts will define investment strategies in 2025 and beyond.

About Enerdatics

Enerdatics is a business intelligence platform delivering data, insights, and analytics on renewable energy transactions across the globe. The company offers exhaustive datasets on M&As, Opportunities, Financings, and Power Purchase Agreements (PPAs), augmented by granular data on Renewable Energy Projects. Founded in October 2021, Enerdatics is currently a data partner to several large-cap energy majors, amongst other clients.

Download the full report now: https://enerdatics.com/annualma2024/

For media inquiries, please contact:

Vini Pandit

vini@enerdatics.com

+1-832-699-0009

-- Enerdatics

-- 3H4X+448 Brigade Triumph, Dasarahalli Main Rd, Sector B, Hebbal Kempapura, Bengaluru, Byatarayanapura CMC and OG Part, Karnataka 560064

-- Mohit Kaul

Founder, Enerdatics

+1 832 699 0009

Enerdatics is a leading data product company in the energy transition space. We empower our clients with cutting-edge data-driven solutions that facilitate informed decision-making and drive growth. Our team of experts brings together extensive knowledge in energy, data analytics, and technology to design and develop innovative products that enable our clients to navigate the complex energy landscape and accelerate their transition to a sustainable future.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Renewable Energy M&A Hits $117B in 2024, Led by ~$60B in Private Equity Investments here

News-ID: 3867225 • Views: …

More Releases for M&A

industrials m&a,m&a project management,corporate finance mergers and acquisition …

Mergers and acquisitions (M&A) in the industrial sector refer to the process of one company acquiring another company or assets in the manufacturing, construction, and engineering industries. The industrial sector is characterized by a diverse range of businesses, including heavy machinery, aerospace, and defense, chemicals, and engineering services.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

The industrial sector is characterized by a high level of consolidation, with companies looking to acquire other companies to gain access…

m&a company,m&a integration,cross border merger,m&a due diligence,m&a strategy,m …

Mergers and acquisitions (M&A) are a common way for companies to grow and diversify their business operations. The process of merging or acquiring another company can be complex and time-consuming, but when executed successfully, it can bring significant benefits to the acquiring company, such as access to new markets, technologies, and customers.

https://upworkservice.com

China M&A advisory

E-mail:nolan@pandacuads.com

When it comes to successful M&A, the key is to ensure that the two companies are a…

private equity m&a,international mergers and acquisitions,technology m&a,m&a pro …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. In the M&A process, there are two main parties involved: the buyer and the seller. One type of buyer that is becoming increasingly prevalent in the M&A landscape is private equity firms.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

Private equity firms are investment firms that raise capital from institutional investors and high net…

buy side m&a,global m&a,bank mergers and acquisitions,m&a advisory firms,success …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. In the M&A process, there are two main parties involved: the buyer and the seller. The term "buy side" refers to the party that is acquiring the target company. In contrast, the "sell side" refers to the party that is being acquired.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

The buy side M&A process…

due diligence in mergers and acquisitions,recent m&a deals 2023,m&a management,m …

Due diligence is an investigation process that companies undertake prior to a merger or acquisition (M&A) in order to assess the target company's financial and operational condition. The goal of due diligence is to identify any potential risks or opportunities that may impact the value of the acquisition and to ensure that the deal is in the best interest of the acquiring company. Due diligence is a critical step in…

m&a valuation,corporate mergers,m&a business,merger integration,sell side m&a pr …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. One crucial aspect of the M&A process is the valuation of the target company. Valuation is the process of determining the fair value of a company, and it is an essential step in the M&A process because it helps companies to determine the terms of the acquisition, such…