Press release

Trade Finance Global Market Current Scenario and Growth by 2020

About Trade Financing, Trade financing is when finance is made available by banks to various trading companies to perform cross-border transactions. It also acts as an engine that drives the growth of a country's GDP. When a country produces goods or services, it exports some of those goods and services to other countries. However, there is a time lag between the production and delivery time required for the consignment to reach the importing country. So, there is a certain degree of uncertainty about whether the parties will honor their part of the transaction. Hence, the importing country appoints a bank to issue a financial instrument that promises to make the payment to the exporting country upon the successful delivery of the consignment to the importing country. Research Beam’s analysts forecast the Global Trade Finance Market to Grow at A CAGR of 3.77% During the Period 2016-2020.Read Full Report with TOC @ http://www.researchbeam.com/global-trade-finance-2016-2020-market

Covered in this report

The report covers the present scenario and the growth prospects of the global trade finance market for 2016-2020. To calculate the market size, the report considers the revenue generated by banks from the structured trade finance, supply chain finance, and traditional trade finance market in the Americas, Asia Pacific (APAC), and Europe, the Middle East, and Africa (EMEA).

The market is divided into the following segments based on geography:

• Americas

• APAC

• EMEA

Research Beam's report, Global Trade Finance Market 2016-2020, has been prepared based on an in-depth market analysis with inputs from industry experts. The report covers the market landscape and its growth prospects over the coming years. The report also includes a discussion of the key vendors operating in this market.

Download PDF Sample @ http://www.researchbeam.com/global-trade-finance-2016-2020-market/request-sample

Key vendors

• BNP Paribas

• Citigroup

• HSBC

• JPMorgan Chase

• Mitsubishi UFJ Financial

Other prominent vendors

• ANZ

• Arab Bank

• Bank of America Merrill Lynch

• BNP Paribas

• BNY Mellon

• Capital

• Commerzbank

• Credit Agricole

• Deutsche Asset & Wealth Management

• Deutsche Bank

• Factor Funding

• Goldman Sachs

• Itaú Unibanco

• Morgan Stanley

• New Century Financial

• Nordea

• Paragon Financial

• Royal Bank of Scotland

• Royal Bank of Scotland

• Santander

• Standard Chartered Bank

• Sumitomo Mitsui Financial

• SunTrust Bank

• UBS AG

• UniCredit

• Wells Fargo

Market driver

• High involvement of clearing house and trade through financial market integration

• For a full, detailed list, view our report

Ask for Discount @ http://www.researchbeam.com/global-trade-finance-2016-2020-market/purchase-enquiry

Market challenge

• Volatile political and economic environment

• For a full, detailed list, view our report

Market trend

• Enhanced strategic formulation and adoption of structuring and pricing tools

• For a full, detailed list, view our report

Key questions answered in this report

• What will the market size be in 2020 and what will the growth rate be?

• What are the key market trends?

• What is driving this market?

• What are the challenges to market growth?

• Who are the key vendors in this market space?

• What are the market opportunities and threats faced by the key vendors?

• What are the strengths and weaknesses of the key vendors?

Table of Contents

PART 01: Executive summary

PART 02: Scope of the report

PART 03: Market research methodology

PART 04: Introduction

PART 05: Market landscape

PART 06: Geographical segmentation

PART 07: Market drivers

PART 08: Impact of drivers

PART 09: Market challenges

PART 10: Impact of drivers and challenges

With the arsenal of different search reports, Research Beam helps you here to look and buy research reports that will be helpful to you and your organization. Our research reports have the capability and authenticity to support your organization for growth and consistency. With the window of opportunity getting open and shut at a speed of light, it has become very important to survive in the market and only the fittest and competent enough can do so. So, we try and provide with latest changes in the market that can suit your needs and help you take decision accordingly.

5933 NE Win Sivers Drive, #205, Portland, OR 97220

U.S. & Canada Toll Free: + 1-800-910-6452

UK: + 44-845-528-1300, India: +91 20 66346070

Fax: +1 (855) 550-5975

Email: http://www.researchbeam.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Global Market Current Scenario and Growth by 2020 here

News-ID: 386531 • Views: …

More Releases from Research Beam

Proton Therapy Market: Global Analysis & Forecast by Koninklijke Philips N.V., A …

Market study on Global Proton Therapy Market 2018 by Manufacturers, Regions, Type and Application, Forecast to 2023 Research Report presents a professional and complete analysis of Global Proton Therapy Market on the current market situation.

This report focuses on the Proton Therapy in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application.

Request…

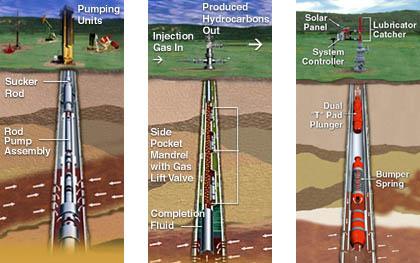

Artificial Lift System Market by Top Key Participant The major companies profile …

The market research report ‘Global Artificial Lift System, 2018 Market Research Report’ aims to offer insights into new business opportunities for companies active in Artificial Lift Systemas well as for those players that are aiming to get an entry into the industry.

Artificial Lift System Market by Type (Rod lift, ESP, PCP, Plunger, Gas lift, Others), Component (Pump, Motor, Cable System, Drive head, Separator, Pump Jack, Sucker Rod, Gas-lift Valves,…

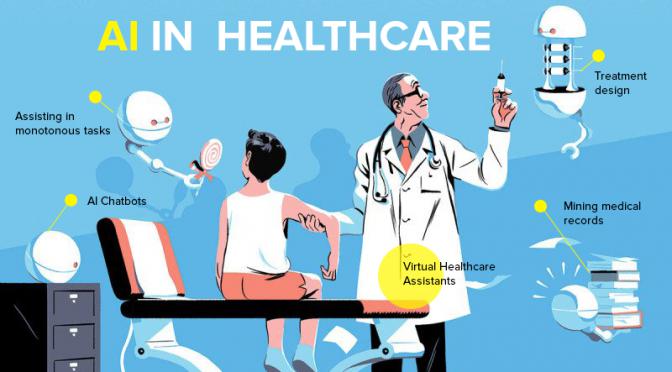

Artificial Intelligence in Healthcare Market Report Competition by Manufacturers …

Artificial Intelligence in Healthcare Market by Offering (Hardware, Software, and Services), Technology (Deep Learning, Querying Method, Natural Language Processing, and Context Aware Processing), Application (Robot-assisted Surgery, Virtual Nursing Assistant, Administrative Workflow Assistance, Fraud Detection, Dosage Error Reduction, Clinical Trial Participant Identifier, Preliminary Diagnosis, and Others), and End User (Healthcare Provider, Pharmaceutical & Biotechnology Company, Patient, and Payer) - Global Opportunity Analysis and Industry Forecast, 2017-2023

Request Sample copy of this Report…

Artificial Turf Market Key Player Analysis By - Victoria PLC (Avalon Grass), Spo …

Artificial turfs are synthetic surfaces made of fibers including polyethylene, polypropylene, and polyamides. These are used across the globe due to attractive features such as high durability, low maintenance, superior quality, all weather utility, visual appeal, and eco-friendly attribute. Such turfs are in high demand in sports such as football, hockey, baseball, golf, and other activities that require a durable grass surface. Furthermore, these turfs can be 100% recycled due…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…