Press release

Expansion Of Non Banking Financial Companies (NBFCs) Drives Growth In Premium Finance Market Driver: Leading Transformation in the Premium Finance Market in 2025

What Are the Projected Growth and Market Size Trends for the Premium Finance Market?The market size of premium finance has seen substantial growth in the recent past. It is projected to surge from $51.37 billion in 2024 to $57.47 billion in 2025, displaying a compound annual growth rate (CAGR) of 11.9%. The escalation in the historical phase could be credited to the rise in high net worth individuals (HNWIs), broadening of luxury goods and services sector, hike in insurance premiums, growth in investments in real estate, along with a heightened emphasis on asset protection.

Anticipated to witness a swift expansion in the upcoming years, the size of the premium finance market is projected to increase to $88.88 billion by 2029, with a compound annual growth rate (CAGR) of 11.5%. This growth during the predicted period can be linked to factors such as growing insurance premiums, wider availability of insurance products, improved access to credit, an upturn in corporate financing and expansion in wealth management services. Key trends foreseen during this period encompass the utilization of digital platforms, the formulation of bespoke financing solutions, advancement in risk evaluation tools, the proliferation of mobile payment solutions and enhancement in customer service technology.

What Are the Key Drivers Behind the Growth of the Premium Finance Market?

The expansion of the premium finance market in the future is projected to be fueled by the growth of non-banking financial companies (NBFCs). NBFCs, financial entities without banking licenses, offer various banking services. Factors such as regulatory reforms and the rising need for credit in underserved markets fuel their growth. By offering flexible loan structures, swift approval procedures, and competitive interest rates, NBFCs assist in premium financing, thereby making insurance more affordable and accessible to insurance holders. As per the Australian Bureau of Statistics, a government agency based in Australia, the distribution of net claims on non-financial corporations in June 2024 was as follows: $1,426.1 billion from financial corporations, $922.4 billion from households, $1,147.0 billion from the rest of the world, and $450.8 billion from the general government. Consequently, the growth of NBFCs is propelling the premium finance market forward.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18705&type=smp

Which Leading Companies Are Shaping the Growth of the Premium Finance Market?

Major companies operating in the premium finance market are JPMorgan Chase & Co., Wells Fargo & Company, Munich Re Group, The Hartford Financial Services Group Inc., Lincoln National Corporation, BNY Mellon Wealth Management, Sun Life Financial Inc., Symetra Life Insurance Company, Valley National Bancorp, Wintrust Financial Corporation, Byline Bancorp Inc., FMG Suite LLC, IPFS Corporation, AgentSync Inc., Parkway Bank & Trust Co., US Premium Finance, PayLink Direct, Succession Capital Inc., ARI Financial Group, ClassicPlan Premium Financing Inc., Agile Premium Finance, Colonnade Advisors LLC

What Are the Major Trends Shaping the Premium Finance Market?

Leading businesses in the premium finance sector are constructing extensive financial networks to augment their services and expedite transactions. A financial network represents a complex system involving interconnected financial services and institutions, enhancing transactions, data interchange, and communication. This enhances financial procedures by increasing the efficiency, precision, and accessibility of financial services. For example, in April 2024, a US-based insurtech and financial services corporation, ePayPolicy, unveiled Finance Connect. This innovative feature aims to streamline premium financing for insurance companies. Working flawlessly with existing premium finance company (PFC) partners, it provides flexible payment methods and simplifies auto-payment and reminders. It enhances conversion rates and operational productivity, answering the surging demand for automated and digital financial solutions in the premium finance market.

What Are the Key Segments of the Premium Finance Market?

The premium finance market covered in this report is segmented -

1) By Type: Life Insurance, Non-Life Insurance

2) By Interest Rate: Fixed Interest Rate, Floating Interest Rate

3) By Provider: Banks, Non Banking Financial Company (NBFCs), Other Providers

Subsegments:

1) By Life Insurance: Whole Life Insurance, Term Life Insurance, Universal Life Insurance, Variable Life Insurance

2) By Non-Life Insurance: Property Insurance, Casualty Insurance, Auto Insurance, Health Insurance, Liability Insurance

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/premium-finance-global-market-report

Which Region Dominates the Premium Finance Market?

North America was the largest region in the premium finance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the premium finance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Premium Finance Global Market Report?

- Market Size Analysis: Analyze the Premium Finance Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Premium Finance Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Premium Finance Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Premium Finance Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18705

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Expansion Of Non Banking Financial Companies (NBFCs) Drives Growth In Premium Finance Market Driver: Leading Transformation in the Premium Finance Market in 2025 here

News-ID: 3864954 • Views: …

More Releases from The Business Research Company

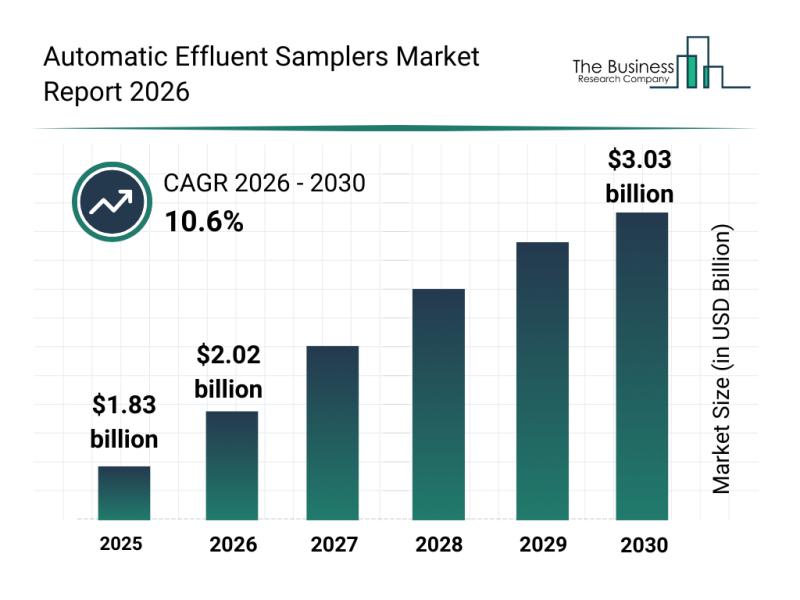

Leading Companies Solidify Their Presence in the Automatic Effluent Samplers Mar …

The automatic effluent samplers market is gaining significant momentum as environmental monitoring and water quality management take center stage worldwide. With technological advancements and increasing regulatory demands, this industry is poised for substantial growth and innovation over the coming years. Let's explore the market size projections, key players, emerging trends, and segment analysis shaping the future of this sector.

Projected Market Size and Growth of the Automatic Effluent Samplers Market

The…

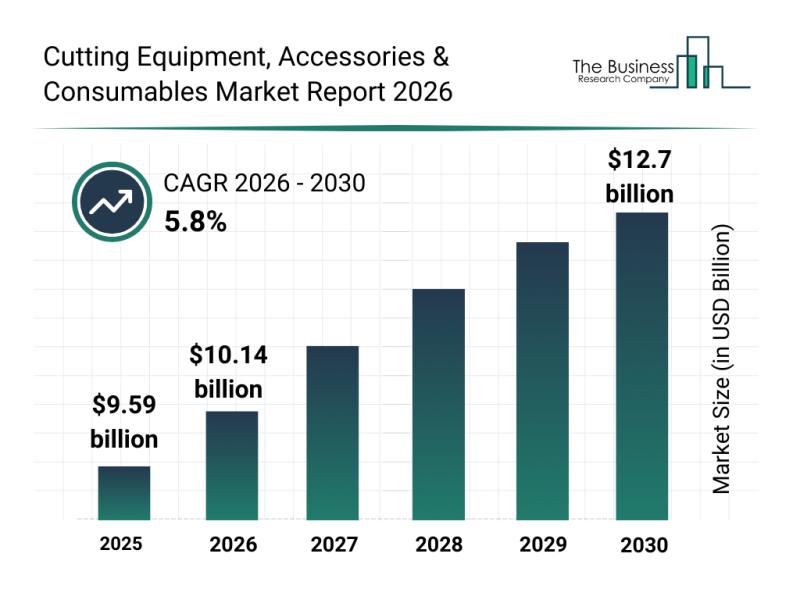

Future Perspectives: Key Trends Shaping the Cutting Equipment, Accessories, and …

The cutting equipment, accessories, and consumables industry is set for notable expansion in the coming years, driven by advancements in manufacturing technologies and increasing demand for precision and efficiency. This sector is evolving rapidly as automation and innovative cutting methods gain prominence across various industrial applications. Let's explore the current market outlook, key players, emerging trends, and major segments shaping this dynamic field.

Projected Expansion and Market Size in Cutting Equipment,…

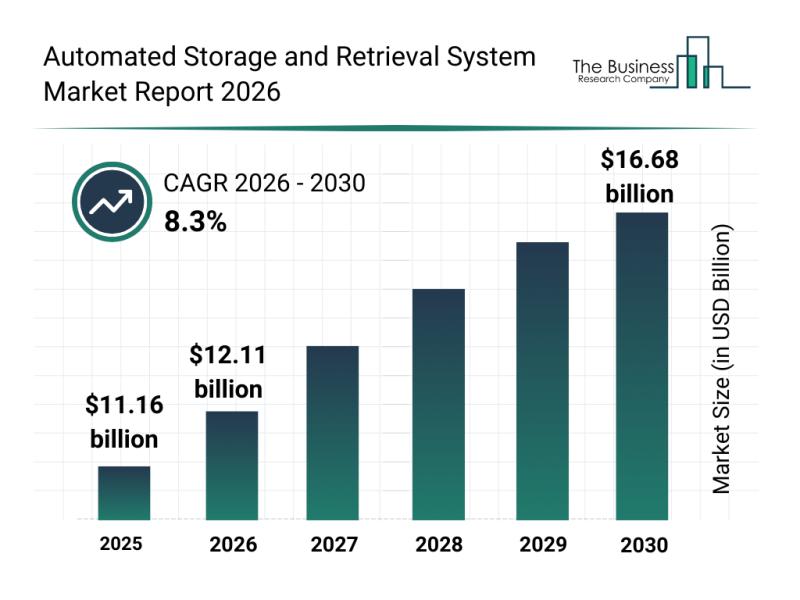

Emerging Growth Trends Driving Expansion in the Automated Storage and Retrieval …

The automated storage and retrieval system market is positioned for substantial growth as industries increasingly seek smarter and more efficient warehousing solutions. With the rise of e-commerce and data-driven logistics, this sector is rapidly evolving to meet the demands of modern supply chains. Let's explore the current market outlook, key players, emerging trends, and the main segments shaping this industry's future.

Projected Market Size and Growth Trajectory in the Automated Storage…

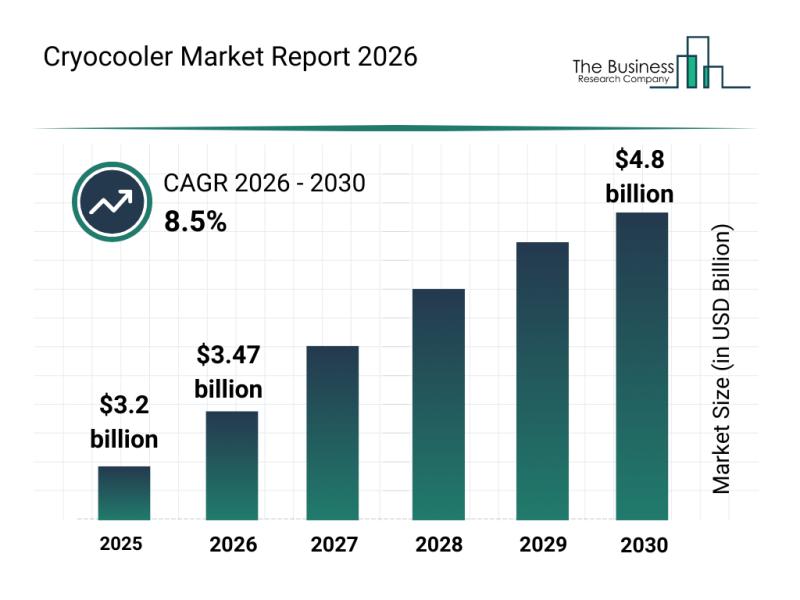

In-Depth Examination of Segments, Industry Trends, and Key Players in the Cryoco …

The cryocooler market is poised for significant expansion over the coming years, driven by advancements in various high-tech sectors and growing demand for specialized cooling solutions. This analysis explores the market's anticipated growth, leading players, emerging trends, and the key segments shaping its future trajectory.

Projected Growth and Market Size of the Cryocooler Industry

The cryocooler market is expected to reach a valuation of $4.8 billion by 2030, growing at a…

More Releases for Premium

Premium Sound, Premium Returns: Inside the Fastest-Growing Segment of Consumer A …

Active Noise Isolation (ANI) Headphones are premium audio devices designed to reduce ambient noise through physical isolation, digital signal processing, and active noise cancellation circuitry

Widely used across commuting, aviation, gaming, remote work, music production, and enterprise communications

Rapid growth driven by hybrid work, travel recovery, gaming/e-sports expansion, and consumer shift toward premium personal audio

Market combines over-ear, on-ear, and in-ear (TWS/earbuds) segments with Bluetooth wireless dominating >85% of shipments

Integration of AI audio…

Premium Sound, Premium Returns: Inside the Fastest-Growing Segment of Consumer A …

Active Noise Isolation (ANI) Headphones are premium audio devices designed to reduce ambient noise through physical isolation, digital signal processing, and active noise cancellation circuitry

Widely used across commuting, aviation, gaming, remote work, music production, and enterprise communications

Rapid growth driven by hybrid work, travel recovery, gaming/e-sports expansion, and consumer shift toward premium personal audio

Market combines over-ear, on-ear, and in-ear (TWS/earbuds) segments with Bluetooth wireless dominating >85% of shipments

Integration of AI audio…

Premium Dedicated Proxy - Unmatched Exclusivity with Oculus Premium Dedicated Pr …

In today's increasingly data-centric world, enterprises are pushing the boundaries of automation, web intelligence, and digital security. Central to these evolving needs is the demand for fast, private, and reliable internet access. For companies that rely on uninterrupted, large-scale data extraction and secure browsing, shared IP infrastructures are simply no longer viable. This has led to a rise in the adoption of premium proxy solutions-particularly exclusive IP resources that deliver…

Mighty Travels Premium

Haven't you wondered why online travel search always started with the same input that a few travel websites first started with in 1996? Two airport codes and two dates and a big search button - where has the innovation been since?

What if we could search by price instead and find trips that are inspiring and sometimes luxurious where we would like to go? The world has changed and flexible schedules…

Sydney Premium Detailing

Operating for more than 12 years, Sydney Premium Detailing provides services such as Paint Protection, Paint Protection Film (Clear Bra), Paint Correction and Interior & Wheel Protection.

Operating for more than 12 years, Sydney Premium Detailing provides services such as Paint Protection, Paint Protection Film (Clear Bra), Paint Correction and Interior & Wheel Protection.

Sydney Premium Detailing

7/3 Salisbury Rd, Castle Hill, NSW 2154…

Paint Colors & Trim Market Growth and Analysis by Major Top Vendors are BEHR Pre …

ResearchReportsInc.com adds a new 2018-2023 Global Paint Colors & Trim Market Report focuses on the major drivers and restraints for the global key players providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market. The Paint Colors & Trim Market report aims to provide a 360-degree view of the market in terms of cutting-edge technology, key developments, drivers, restraints and future trends with impact analysis…