Press release

On-Demand Insurance Market Outlook 2025-2034: Key Trends, Growth Drivers, and Market Share

"How Big Is the On-Demand Insurance Market Expected to Be, and What Will Its Growth Rate Be?The size of the on-demand insurance sector has experienced significant growth in recent years. The expansion is projected to continue from $5.5 billion in 2024 to $6.33 billion in 2025, representing a compound annual growth rate (CAGR) of 15.2%. Factors contributing to the growth observed in the historic period include the rise of smartphone and internet use, consumers' preference for convenience, a transition from conventional to digital insurance channels, regulatory shifts towards digital insurance, and growing awareness about digital financial services.

In the coming years, swift expansion is anticipated in the on-demand insurance market, which is predicted to surge to $11.01 billion by 2029 with a CAGR of 14.8%. This expected growth in the projected period is due to various factors such as the expanding use of big data analytics, surging demand for tailored insurance products, prevalence of digital-only insurance service providers, augmented funding in Insurtech startups, and the escalating trend of peer-to-peer insurance models. Key trends to watch during this period include the incorporation of AI-powered chatbots for customer assistance, heightened application of blockchain for enhanced transparency and security, the broadening of on-demand insurance to fresh markets, heightened significance of cybersecurity insurance, and collaborations among conventional insurers and technology corporations.

What Is Stimulating Growth in the On-Demand Insurance Market?

The rising use of digital platforms is anticipated to boost the expansion of the on-demand insurance market. Digital platforms pertain to online systems that offer a range of services such as buying, managing, and modifying insurance policies. This uptick is due to the escalating consumer desire for convenience, financial progress, technological innovation, and enticing cost structures. Digital platforms fuel the expansion of on-demand insurance by streamlining the purchasing procedure, proposing competitive rates, and instilling confidence in customers about their insurance choices. For example, data disseminated by the Bureau of the Census, a Federal Statistical System agency based in the US, reveals that the initial quarter 2024 e-commerce prediction rose 8.6% (±1.1%) from the initial quarter of 2023. Whereas, overall retail sales saw an increase of 1.5% (±0.5%) in the same timeframe. E-commerce sales comprised 15.9% of entire sales in the first quarter of 2024. Thus, the rising utilization of digital platforms is propelling the expansion of the on-demand insurance market.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=17213&type=smp

Who Are the Dominant Companies Influencing On-Demand Insurance Market Trends?

Major companies operating in the on-demand insurance market are Life Insurance Corporation of India, Tata Consultancy Services Limited, Infosys Limited, DXC Technology, Pegasystems Inc., Bajaj Allianz General Insurance, Xceedance Inc., Zego, Appian, Getsafe, Metromile, Max Life Insurance Company, Cuvva, Sure Inc., Trōv, Slice Insurance, Thimble, VSure.life, JAUNTIN, SkyWatch Insurance Services Inc., Tapoly Ltd.

How Is the On-Demand Insurance Market Evolving?

Leading firms in the on-demand insurance sector are concentrating on creating innovative goods such as mobile telematics-based all-inclusive motor insurance. This offers bespoke, adaptable coverage options and makes use of real-time driving data for accurate risk assessment, usage-based premiums, and improved customer interaction. Through the use of an app-based solution, mobile telematics fosters safer drivers and advances fleet management and other similar aspects. For example, in July 2023, the India-based Zuno General Insurance (previously Edelweiss General Insurance or EGI) rolled out their product, SWITCH. By employing mobile telematics and real-time driving data, it switches on coverage and calculates tailored premiums according to usage and driving patterns, thereby offering a flexible, usage-based insurance resolution. This groundbreaking approach promotes careful driving and challenges the traditional motor insurance setup by providing a personalised, data-led, and client-focused experience in the on-demand insurance sector.

What Are the Different Segmentations in the On-Demand Insurance Market?

The on-demand insurance market covered in this report is segmented -

1) By Coverage: Car Insurance, Home Appliances Insurance, Entertainment Insurance, Contractor Insurance, Electronic Equipment Insurance, Other Coverages

2) By Insurance: General Insurance, Life Insurance, Cybersecurity Insurance, Other Insurances

3) By End-User: Individuals, Business

Subsegments:

1) By Car Insurance: Personal Car Insurance, Commercial Car Insurance

2) By Home Appliances Insurance: Kitchen Appliances Insurance, Home Electronics Insurance, HVAC Insurance

3) By Entertainment Insurance: Event Cancellation Insurance, Media & Film Production Insurance, Ticket Refund Insurance

4) By Contractor Insurance: General Liability Insurance, Workers' Compensation Insurance, Professional Indemnity Insurance

5) By Electronic Equipment Insurance: Mobile Device Insurance, Laptop & Tablet Insurance, Wearable Technology Insurance

6) By Other Coverages: Travel Insurance, Health Insurance, Pet Insurance

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/on-demand-insurance-global-market-report

Which Region Is at the Forefront of the On-Demand Insurance Market?

North America was the largest region in the on-demand insurance market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the on-demand insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The On-Demand Insurance Global Market Report?

- Market Size Analysis: Analyze the On-Demand Insurance Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the On-Demand Insurance Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall On-Demand Insurance Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the On-Demand Insurance Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=17213

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release On-Demand Insurance Market Outlook 2025-2034: Key Trends, Growth Drivers, and Market Share here

News-ID: 3864471 • Views: …

More Releases from The Business research company

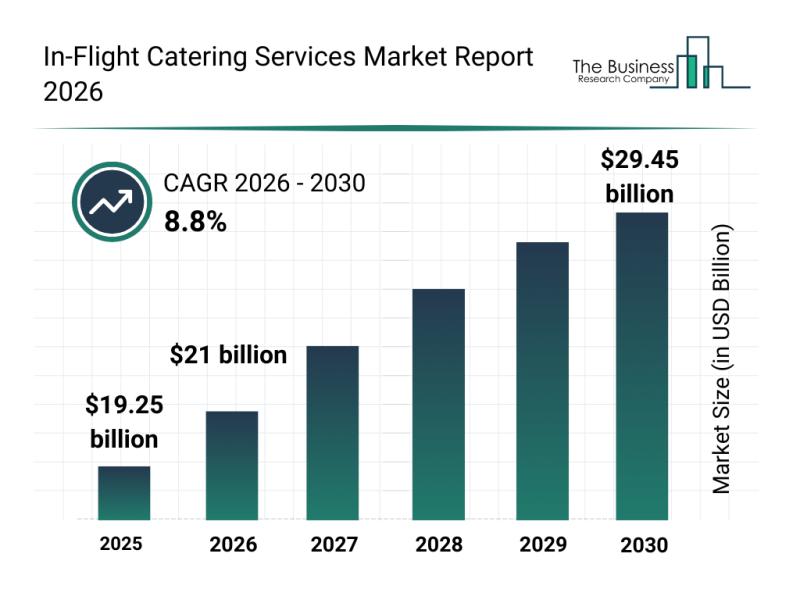

Global Trends Overview: The Rapid Evolution of the In-Flight Catering Services M …

The in-flight catering services sector is poised for significant expansion as global air travel continues to recover and evolve. Changing passenger preferences, technological advancements, and sustainability efforts are all shaping the future of this market. Below, we explore its projected growth, leading industry players, emerging trends, and key market segments.

Strong Growth Outlook for the In-Flight Catering Services Market

The in-flight catering services market is anticipated to grow impressively, reaching…

Leading Companies Enhancing Their Presence in the Indian Ginseng Market

The Indian ginseng market is on the cusp of substantial growth, driven by increasing consumer awareness around natural health and wellness products. As demand for adaptogenic herbs rises globally, the market is expected to witness notable expansion, fueled by innovations and shifting preferences toward plant-based supplements.

Projected Expansion and Market Size of Indian Ginseng

The Indian ginseng market is forecasted to reach a value of $1.36 billion by 2030, growing…

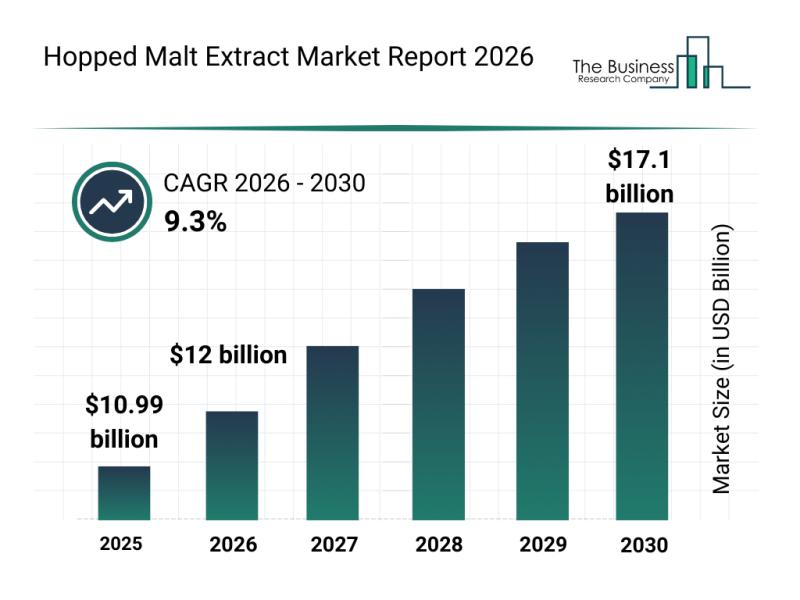

Future Perspective: Key Trends Shaping the Hopped Malt Extract Market up to 2030

The hopped malt extract market is set for significant expansion as consumer preferences evolve and brewing technologies advance. This sector is increasingly benefiting from the rising demand for specialized beers and innovative brewing practices, which are shaping its growth trajectory. Let's explore how the market is expected to develop, who the main players are, and the emerging trends driving change.

Expected Growth Trajectory of the Hopped Malt Extract Market

The…

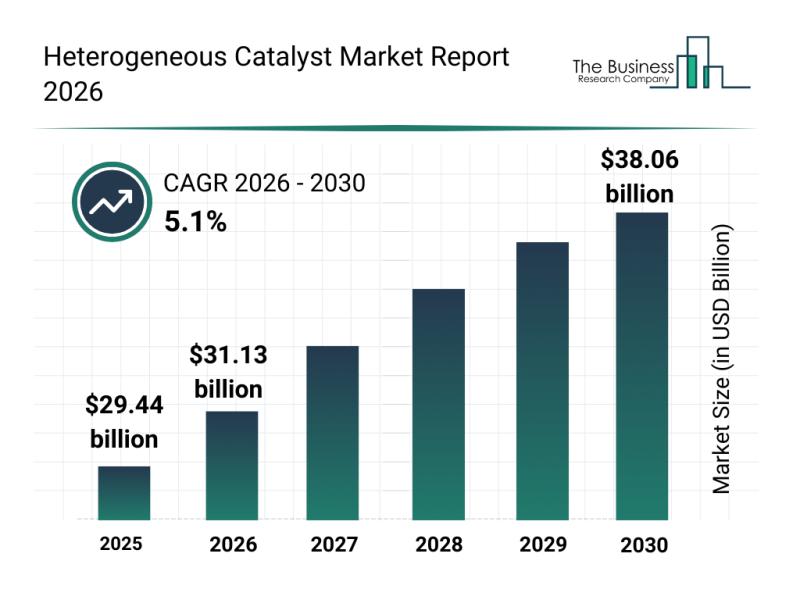

Analysis of Key Market Segments Driving the Heterogeneous Catalyst Market

The heterogeneous catalyst industry is positioned for significant expansion as demand for environmentally friendly and efficient industrial processes continues to rise. Innovations in catalyst technology and growing applications across various sectors are setting the stage for robust market growth. Here is a detailed overview of the market size, key players, influential trends, and segment forecasts shaping this dynamic industry.

Projected Market Size and Growth Outlook for the Heterogeneous Catalyst Industry …

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…