Press release

Mutual Fund Assets Market Set to Reach $1116.72 Billion by 2029 with 10.6% Yearly Growth

"What Is the Estimated Market Size and Growth Rate for the Mutual Fund Assets Market?In recent years, we have witnessed a swift expansion in the mutual fund assets market size. The expectations indicate a growth from $671.98 billion in 2024 to $745.82 billion in 2025 signifying a compound annual growth rate (CAGR) of 11.0%. Factors such as stock market performance, increased disposable income and savings, tax benefits on mutual fund investments provided by governments, increasing significance of retirement planning and the level of financial literacy and education attribute to the growth observed in the historic period.

In the coming years, the mutual fund assets market size is anticipated to experience accelerated growth. The market is projected to expand to $1116.72 billion in 2029, with a compound annual growth rate (CAGR) of 10.6%. This growth during the projected period can be linked to factors such as progress in regulatory frameworks, increasing opportunities for cross-border investments, rising levels of awareness and education, a lower interest rate environment and heightened participation from institutional investors. Noteworthy trends in this projected period include the rise of artificial intelligence and machine learning, the adoption of blockchain technology, the use of cloud-based solutions enhancing the scalability, flexibility and security of mutual fund operations, and the creation of mobile applications for managing mutual funds and regtech.

What Is Stimulating Growth in the Mutual Fund Assets Market?

Advancements in the mutual fund assets market are predicted to be spurred by the escalating population of elderly individuals. The term aging population pertains to those who are 65 years old or above, classified as senior citizens. Longer lifespan and falling birth rates are the main reasons for the increasing number of elderly people. This demographic change can amplify the mutual fund assets market, with seniors looking for steady investment opportunities to secure their retirement savings. As people get closer to retirement, they typically shift from risky, growth-seeking investments to safer, income-generating mutual funds that provide stability and consistent income, thereby pushing the mutual fund assets market up. For instance, data from the UK Parliament's House of Commons Library, a government administration in the UK, reveals that in 2022, the UK's 65 and older population totaled 12.7 million, making up 19% of the overall population. This number is estimated to climb to 22.1 million by 2072, forming 27% of the population. Consequently, the increasing elderly population is the catalyst for the mutual fund assets market growth.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18684&type=smp

Who Are the Dominant Companies Influencing Mutual Fund Assets Market Trends?

Major companies operating in the mutual fund assets market are JPMorgan Chase & Co., Citigroup Inc., Morgan Stanley, BNP Paribas Asset Management Holding, Goldman Sachs Group Inc., Charles Schwab & Co. Inc., BlackRock Inc., Principal Financial Group Inc., Ameriprise Financial Inc., State Street Corporation, Franklin Resources Inc., Capital Group Companies Inc., The Vanguard Group Inc., Amundi Asset Management US Inc., Legg Mason Inc., Janus Henderson Group plc, Federated Hermes Inc., OppenheimerFunds Inc., Massachusetts Financial Services Company, Eaton Vance Corp., Pacific Investment Management Company LLC, Dimensional Fund Advisors LP, Wellington Management Company LLP, AllianceBernstein L.P., Dodge & Cox, Teachers Insurance and Annuity Association of America (TIAA), Putnam Investments LLC

How Is the Mutual Fund Assets Market Evolving?

Prominent organizations in the mutual fund assets market are prioritizing their efforts to broaden their mutual fund assets, focusing on emerging sectors that have a high potential for growth. This could involve investing in unique sectors such as sustainable technology or trailblazing industries, a move that holds potential to attract investors searching for robust returns and investments that are immune to future changes. For instance, Mirae Asset Mutual Fund, a company from India that offers investment services, introduced the Mirae Asset Nifty EV and New Age Automotive ETF (Exchange Traded Fund) in June 2024. This is the first exchange-traded fund in India solely dedicated to the electric vehicle (EV) and the novel age automotive industries. The ETF aims to provide investors with a long-term capital increase primarily by investing in the stocks of companies that are involved in the evolving automotive industry, including those dealing with electric and hybrid vehicles, battery technology, and automotive parts. The fund plans to monitor the Nifty EV and New Age Automotive Total Return Index's performance.

What Are the Different Segmentations in the Mutual Fund Assets Market?

The mutual fund assets market covered in this report is segmented -

1) By Type: Open-Ended, Close-Ended

2) By Investor Type: Retail, Institutional

3) By Investment Strategy: Equity Strategy, Fixed Income Strategy, Multi-Asset Or Balanced Strategy, Sustainable Strategy, Money Market Strategy, Other Investment Strategy

4) By Investment Style: Active, Passive

5) By Distribution Channel: Direct Sales, Financial Advisor, Broker-Dealer, Banks, Other Distribution Channels

Subsegments:

1) By Type: Open-Ended: Equity Mutual Funds, Bond Mutual Funds, Hybrid Mutual Funds, Money Market Funds, Index Funds, Exchange-Traded Funds (ETFS), Close-Ended: Equity Close-Ended Funds, Debt Close-Ended Funds, Interval Funds

2) By Investor Type: Retail: Individual Investors, High Net-Worth Individuals (HNWIS), Affluent Investors, Institutional: Pension Funds, Endowments And Foundations, Insurance Companies, Sovereign Wealth Funds, Corporations

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/mutual-fund-assets-global-market-report

Which Region Is at the Forefront of the Mutual Fund Assets Market?

North America was the largest region in the mutual fund assets market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the mutual fund assets market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Mutual Fund Assets Global Market Report?

- Market Size Analysis: Analyze the Mutual Fund Assets Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Mutual Fund Assets Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Mutual Fund Assets Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Mutual Fund Assets Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18684

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mutual Fund Assets Market Set to Reach $1116.72 Billion by 2029 with 10.6% Yearly Growth here

News-ID: 3864444 • Views: …

More Releases from The Business research company

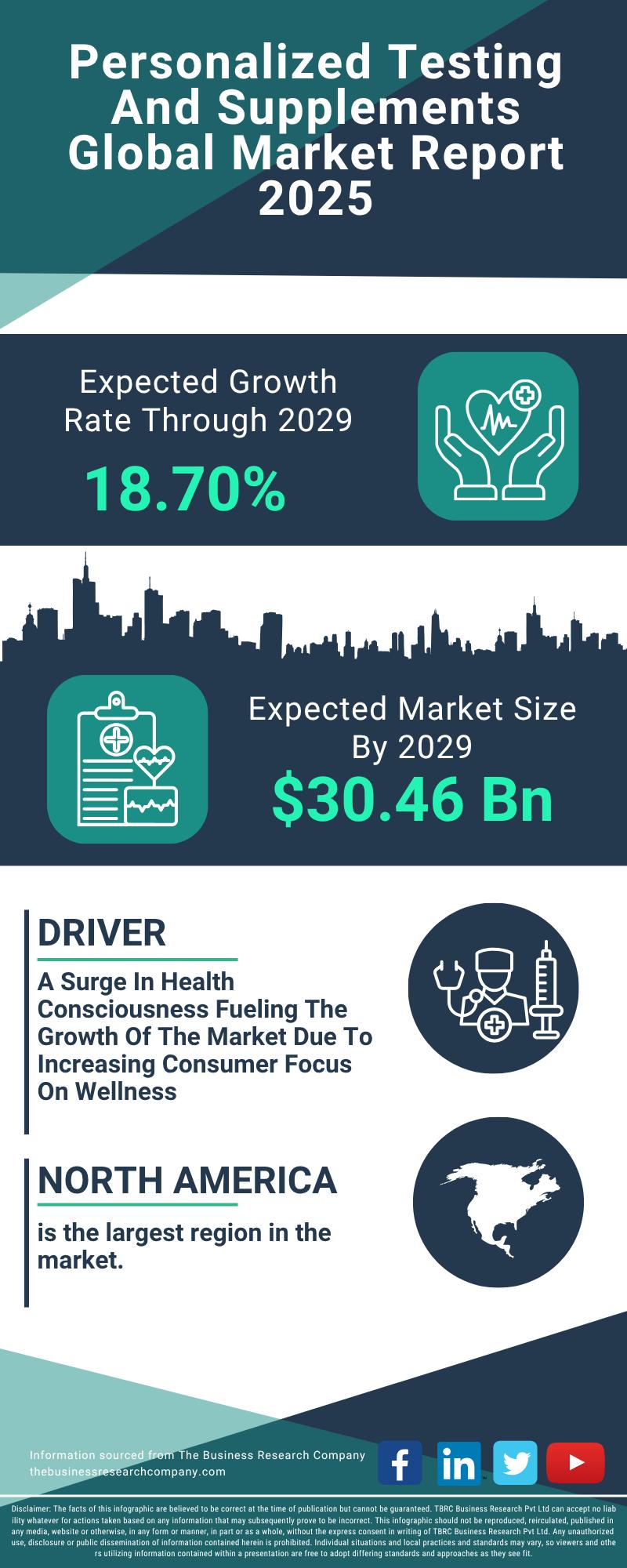

Segment Evaluation and Major Growth Areas in the Personalized Testing and Supple …

The personalized testing and supplements sector is gaining remarkable traction, driven by advancements in technology and a rising consumer focus on tailored health solutions. As more individuals seek customized wellness options, this market is set to experience substantial expansion in the coming years. Here's an in-depth look at its current valuation, key players, significant trends, and the main market segments shaping its future.

Market Valuation and Expansion Forecast for Personalized Testing…

Top Players and Market Competition in the Skin Microbiome Industry

The skin microbiome market is emerging as a significant area of interest due to growing awareness about the critical role of skin health and innovative skincare technologies. As research advances and consumer preferences shift towards more natural and science-backed products, this market is set to undergo substantial growth. Let's explore the current market size, key players, driving factors, and upcoming trends shaping the skin microbiome industry.

Projected Expansion in the Skin…

Key Strategic Developments and Emerging Changes Shaping the Upadacitinib Market …

The upadacitinib market is poised for significant expansion over the coming years, driven by advances in treatment options and increasing awareness of autoimmune diseases. This report delves into the market's current size, key drivers, major players, and the emerging trends shaping its future trajectory.

Steady Growth Expected in Upadacitinib Market Size Through 2029

The market for upadacitinib is projected to reach $2.54 billion by 2029, growing at a robust compound annual…

Analysis of Key Market Segments Driving the Alzheimer's Disease Diagnostic Marke …

The Alzheimer's disease diagnostic sector is rapidly evolving as advancements in technology and healthcare infrastructure open new possibilities for early detection and personalized treatment. With rising awareness and innovative approaches, this market is poised for significant growth in the coming years. Let's explore the current market size, key drivers, leading companies, and emerging trends that are shaping this critical healthcare field.

Projected Market Size and Growth Trends in Alzheimer's Disease Diagnostics…

More Releases for Fund

Broad-Based Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong F …

The Broad-Based Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Broad-Based Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E Fund, …

The Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Exchange-Traded Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fun …

The Exchange-Traded Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Exchange-Traded Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Equity Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Equity Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Equity Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Bond Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E …

The Bond Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Bond Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Money Market Funds Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Money Market Funds research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Money Market Funds market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…