Press release

Mortgage Brokerage Services Market Set to Reach $166.86 Billion by 2029 with 10.2% Yearly Growth

What Is the Estimated Market Size and Growth Rate for the Mortgage Brokerage Services Market?In the past years, the market size of mortgage brokerage services has seen quick expansion. The market is expected to enhance from $102.55 billion in 2024 to $113.26 billion in 2025, indicating a compound annual growth rate (CAGR) of 10.5%. Contributing factors to the growth during the historic period include variations in interest rates, housing market developments, adjustments in regulations, economic expansion, and trends in consumer demands.

The market size for mortgage brokerage services is slated for a swift expansion in the coming years, growing to $166.86 billion by 2029 with a compound annual growth rate (CAGR) of 10.2%. The escalation during the forecasted period can be credited to factors like increased demand for housing, urbanization, advantageous low-interest rates, government incentives, and a rise in disposable income. In the same forecast period, the market will be moulded by key trends such as AI-assisted mortgage processing, blockchain technology for safe transactions, automated underwriting systems, virtual property visitations, and enhanced data analytics to gain customer insights.

What Factors Are Fueling Growth in the Mortgage Brokerage Services Market?

The surge in the need for customized financial assistance is projected to foster the expansion of the mortgage brokerage services market. Customized financial assistance entails financial strategies and measures tailored to a thorough comprehension of an individual's financial requirements and objectives. The rates for individualized financial advice are escalating due to numerous contributing influences such as interest rates, inflation, economic development, increased market complexity, and developments in technology. Mortgage brokerage services serve as a link between borrowers and lenders, offering bespoke advice dependent on individual financial circumstances and long-term ambitions. For example, as per the U.S. Bureau of Labor Statistics in April 2024, a US government entity, the count of employed personal financial advisors is predicted to surge by 13%, from 327,600 in 2022 to 42,000 in 2032, noticeably surpassing the usual growth rate for all jobs. Consequently, the burgeoning demand for customized financial assistance is stimulating the mortgage services brokerage market.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18677&type=smp

Who Are the Dominant Companies Influencing Mortgage Brokerage Services Market Trends?

Major companies operating in the mortgage brokerage services market are JPMorgan Chase & Co, Federal National Mortgage Association, Wells Fargo Bank N.A., Fairway Independent Mortgage Corporation, Rocket Mortgage, Homebridge Financial Services Inc, Mr. Cooper Group Inc, PennyMac Financial Services Inc, Guild Mortgage Company, Caliber Home Loans Inc, Movement Mortgage LLC, American Pacific Mortgage Corporation, LendingTree Inc, PrimeLending A PlainsCapital Company, Loan Factory Inc, Union Home Mortgage Corp, CitiMortgage Inc, Morty Inc, A-M-S Mortgage Services Inc, Counsel Mortgage Group LLC, New American Funding Inc, Sierra Pacific Mortgage Company Inc.

How Is the Mortgage Brokerage Services Market Evolving?

Leading firms in the mortgage brokerage services market are focusing on creating novel services, such as brokerage as a service (BAAS), to improve their product range and align with evolving market requirements. Brokerage as a service (BAAS) is a modern and cutting edge solution that empowers businesses, especially within the financial industry, to delegate their brokerage operations to a third party. This scheme provides companies with the means to use a third-party provider's infrastructure and innovation, allowing them to deliver brokerage services without the stress of controlling their own brokerage systems. For example, in November 2023, GPARENCY, a commercial mortgage broker company based in the US, introduced its pioneering Brokerage as a Service (BaaS) department with the goal of revolutionizing the commercial real estate sector. This fresh department aims to attract beginner and seasoned mortgage brokers alike by providing a competitive commission setup and flexible pricing options for customers.

What Are the Different Segmentations in the Mortgage Brokerage Services Market?

The mortgage brokerage services market covered in this report is segmented -

1) By Interest Rate: Fixed Rate, Floating Rate

2) By Distribution Channel: Online, Offline

3) By Application: Residential Property Loans, Commercial Property Loans

4) By End User: Individuals, Businesses

Subsegments:

1) By Fixed Rate: 15-Year Fixed Rate, 30-Year Fixed Rate, Other Fixed Rate Terms

2) By Floating Rate: 1-Year Floating Rate, 3-Year Floating Rate, 5-Year Floating Rate, Other Floating Rate Terms

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/mortgage-brokerage-services-global-market-report

Which Region Is at the Forefront of the Mortgage Brokerage Services Market?

North America was the largest region in the mortgage brokerage services market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the mortgage brokerage services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Mortgage Brokerage Services Global Market Report?

- Market Size Analysis: Analyze the Mortgage Brokerage Services Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Mortgage Brokerage Services Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Mortgage Brokerage Services Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Mortgage Brokerage Services Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18677

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mortgage Brokerage Services Market Set to Reach $166.86 Billion by 2029 with 10.2% Yearly Growth here

News-ID: 3864157 • Views: …

More Releases from The Business Research Company

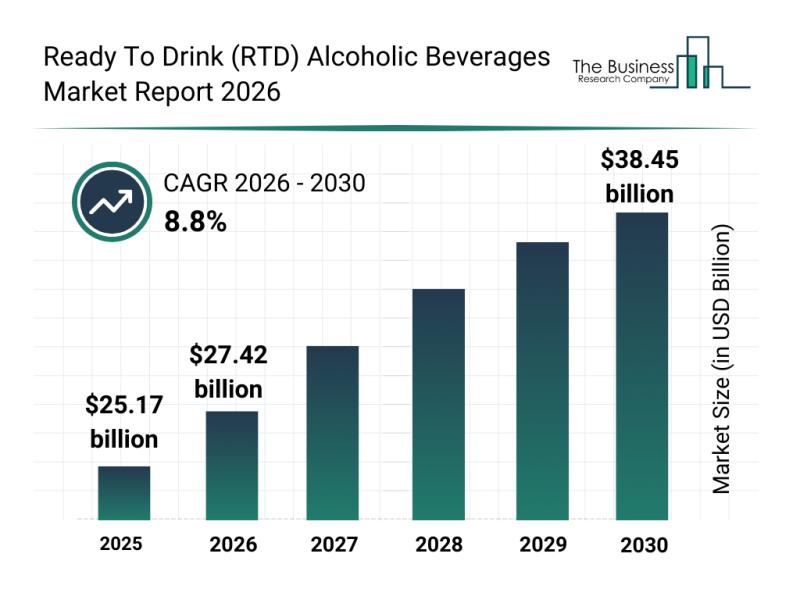

Outlook for the Ready To Drink (RTD) Alcoholic Beverages Market: Major Segments, …

The ready-to-drink (RTD) alcoholic beverages market is on track to experience significant growth over the coming years, driven by evolving consumer preferences and industry innovations. This sector is rapidly expanding as more consumers seek premium, convenient, and sustainable options in their alcoholic beverage choices. Let's explore the market's projected size, key drivers, major players, emerging trends, and segmentation details shaping its future.

Projected Expansion and Market Size of the Ready To…

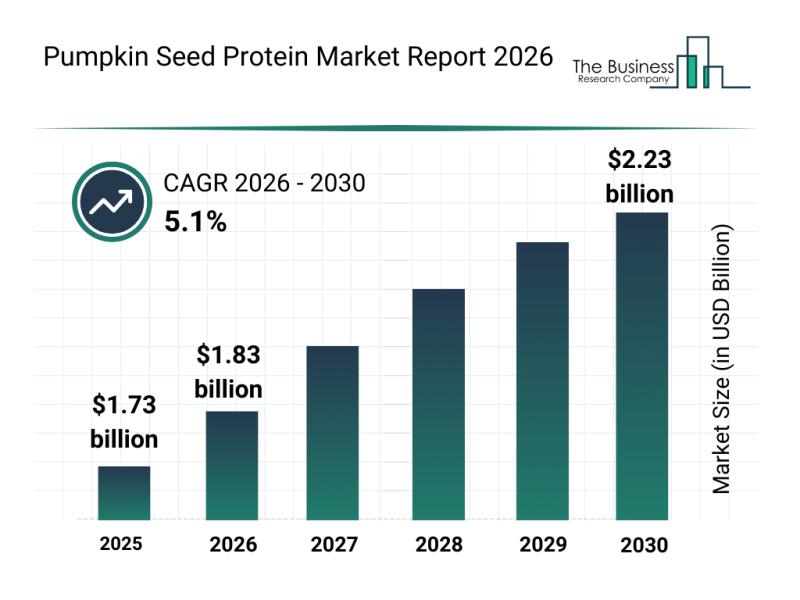

Emerging Sub-Segments Transforming the Pumpkin Seed Protein Market Landscape

The pumpkin seed protein market is emerging as a promising sector within the broader landscape of plant-based proteins. With increasing consumer interest in alternative, allergen-free protein sources and sustainable nutrition, this market is set to witness substantial growth and innovation. Let's explore the market size projections, key players, current trends, and major product segments shaping the future of pumpkin seed protein.

Projected Market Valuation and Growth Expectations for Pumpkin Seed Protein…

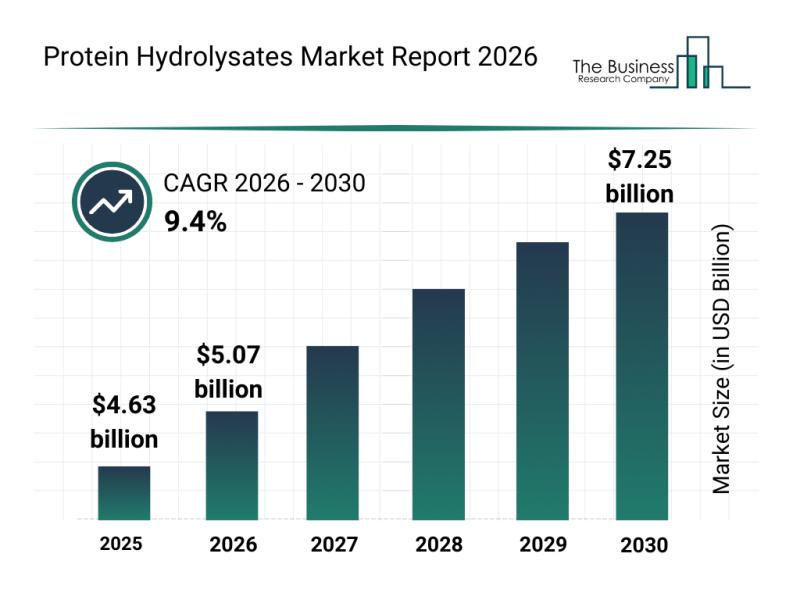

Top Players and Market Competition in the Protein Hydrolysates Industry

The protein hydrolysates market is positioned for significant expansion in the coming years as consumer preferences and nutritional science continue to evolve. With increasing attention on tailored nutrition solutions and the rise of plant-based options, this market is gearing up for robust growth and innovation.

Protein Hydrolysates Market Size Projections Through 2030

The protein hydrolysates market is forecasted to grow substantially, reaching a value of $7.25 billion by 2030. This…

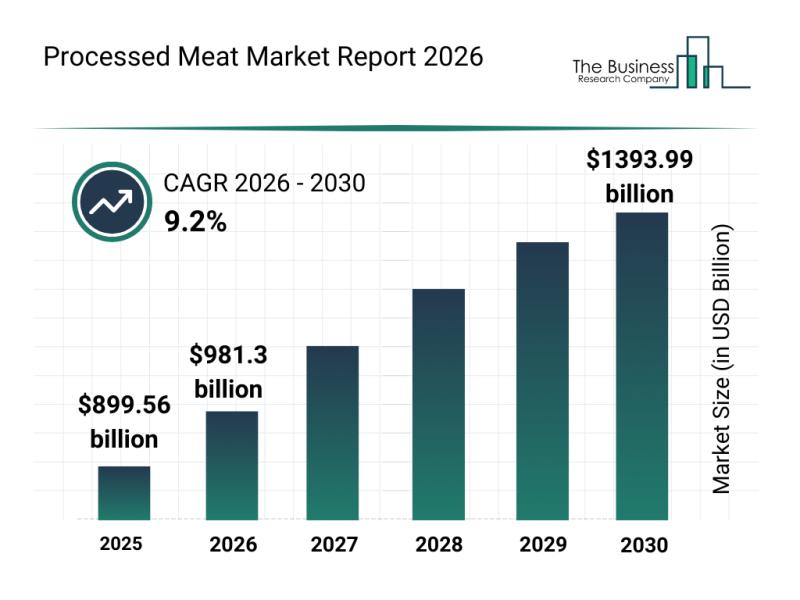

Processed Meat Market Overview: Major Segments, Strategic Developments, and Lead …

The processed meat industry is positioned for substantial expansion over the coming years, driven by evolving consumer preferences and technological advancements. As the market adapts to changing demands and regulatory landscapes, it is expected to reach impressive valuation milestones. Let's explore the current market size, key players, emerging trends, and detailed segment analyses shaping this sector's future.

Forecasted Market Size and Growth Trajectory of the Processed Meat Market

The processed…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…