Press release

Key Embedded Insurance Market share Trend for 2025-2034: Technological Advancements Revolutionizing Embedded Insurance Solutions

What Is the Future Outlook for the Embedded Insurance Market's Size and Growth Rate?The expansion of the embedded insurance market has been swift in the past few years, with its size expected to increase from $97.57 billion in 2024 to $116.49 billion in 2025, achieving a compound annual growth rate of 19.4%. Factors like regulatory assistance, cost efficiency, heightened cognizance of cyber risks, growing comprehension of environmental hazards, and escalating rates of urbanization have contributed to the market's growth in the historic phase.

In the coming years, the size of the embedded insurance market is anticipated to witness swift expansion, growing to $233.83 billion in 2029 with a compound annual growth rate (CAGR) of 19.0%. The expected growth during this forecasted period can be linked to enhancements in customer experience, deeper market penetration, risk management improvements, operational efficiency, and stricter data privacy and security. Key trends for the forecast period comprise an emphasis on sustainability, the incorporation of IoT devices, blockchain technology, microinsurance, and insurance based on telematics.

What Factors Are Propelling the Expansion of the Embedded Insurance Market?

The incremental surge in the usage of digital systems is projected to fuel the expansion of the embedded insurance industry in the future. These digital platforms are online tools that allow the provision of numerous services, such as buying, controlling, and personalizing insurance coverage. The mounting surge in acceptance is accredited to increased demand for comfort from consumers, financial progression, technological enhancement, and appealing price selections. Digital structures enable the integration of insurance functions into non-insurance systems through Application Programming Interfaces (APIs). This allows firms to directly offer insurance-related products within their digital surroundings. For example, data released by the Bureau of the Census, an agency of the Federal Statistical System based in the US, showed that the e-commerce assessment for the first quarter of 2024 rose by 8.6% (±1.1%) from the first quarter of 2023. Meanwhile, total retail sales witnessed a rise of 1.5% (±0.5%) in the corresponding period, with e-commerce sales making up 15.9% of total sales in the first quarter of 2024. As such, the rising uptake of digital platforms is a key drive for the progress of the embedded insurance industry.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18594&type=smp

Which Key Market Leaders Are Driving Embedded Insurance Industry Growth?

Major companies operating in the embedded insurance market are Zurich Insurance Group Ltd., The Chubb Corporation, Acko General Insurance Ltd., Root Insurance Company, Next Insurance Inc., Zego, Lemonade Insurance Agency LLC, Vouch Inc., Getsafe GmbH, Hippo Enterprises Inc, Qover S.A./N.V, Hepster, Cover Genius Insurance Services LLC, Cuvva, Sure Inc., wefox Insurance AG, SimpleSurance, Akur8 SAS, Trōv, CoverWallet Inc., Slice Insurance Technologies Inc., Boost Insurance USA Inc., Kasko Ltd., Bimaplan, Bsurance GmbH

What Are the Emerging Trends in the Embedded Insurance Industry?

Leading businesses in the embedded insurance market are pioneering sophisticated solutions that combine embedded insurance with artificial intelligence (AI). By doing so, they optimize claims processing, tailor insurance products to individual needs, amplify risk evaluation, and elevate customer service standards. AI bolsters embedded insurance through the automation of procedures, the customization of products, the acceleration of risk analysis, and the efficiency of claim processing. As an example, in June 2024, Qover, an insurance firm based in Belgium, unveiled a solution for embedded insurance powered by AI. Qover's AI-driven embedded insurance solution leverages innovative data extraction technologies like generative artificial intelligence (GenAI) and optical character recognition (OCR) for a swift and efficient claims process. This amalgamation supports claim settlements within minutes after approval, thereby boosting efficiency and pleasing customers.

What Are the Main Segments in the Embedded Insurance Market?

The embedded insurance market covered in this report is segmented -

1) By Type: Intrinsic Insurance, Opt-Out Bundled Insurance, Opt-In Bundled Insurance, Billboard Insurance

2) By Channel: Online, Offline

3) By Industry: Automotive, Healthcare, Real Estate, Consumer Products, Travel And Hospitality, Other Industries

Subsegments:

1) By Intrinsic Insurance: Embedded In Consumer Products (Smartphones, Electronics), Embedded In Automotive (Car Insurance Included With Vehicle Purchase), Embedded In Travel Services (Travel Insurance Included In Booking), Embedded In Financial Products (Life Insurance With Loans)

2) By Opt-Out Bundled Insurance: Insurance Bundled With Services (Consumers Automatically Enrolled But Can Opt Out), Travel Insurance With Ticket Purchase (Opt-Out At Checkout), Extended Warranties With Product Purchases (Electronics, Appliances), Health Insurance With Subscription Services (Wellness Programs)

3) By Opt-In Bundled Insurance: Insurance Bundled With Services But Requires Customer Opt-In, Car Rental Insurance (Optional At Booking), Product Insurance For Electronics Or Appliances (Opt-In At Point Of Sale), Travel Insurance (Optional When Booking Flights, Hotels, Or Vacation Packages)

4) By Billboard Insurance: Insurance Offered Through Advertisements (In-app Insurance Offers Or Digital Billboards), Insurance Ads Via E-Commerce Platforms (Insurance Offers During Online Checkout), Mobile App Insurance Offers (Banners Or Push Notifications For Insurance Products)

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/embedded-insurance-global-market-report

Which Geographic Area Leads the Embedded Insurance Market?

Asia-Pacific was the largest region in the embedded insurance market in 2023. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the embedded insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Embedded Insurance Global Market Report?

- Market Size Analysis: Analyze the Embedded Insurance Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Embedded Insurance Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Embedded Insurance Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Embedded Insurance Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18594

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Embedded Insurance Market share Trend for 2025-2034: Technological Advancements Revolutionizing Embedded Insurance Solutions here

News-ID: 3862163 • Views: …

More Releases from The Business Research Company

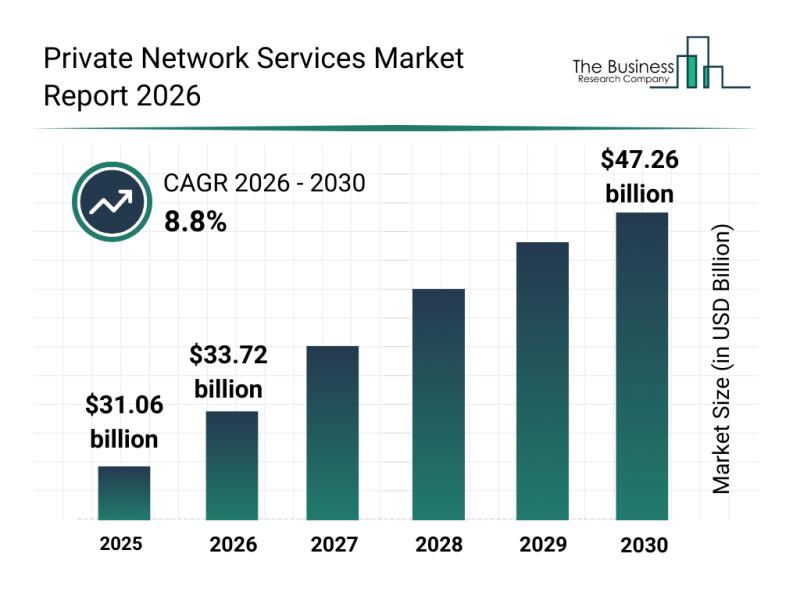

Leading Companies Fueling Innovation and Growth in the Private Network Services …

The private network services sector is set to experience remarkable growth as demand for secure, high-performance connectivity continues to rise across various industries. With advancements in wireless technology and evolving network needs, this market is positioning itself for widespread adoption and innovation over the coming years. Let's explore the market size, key players, driving trends, and segmentation to better understand what lies ahead.

Private Network Services Market Size and Growth Outlook…

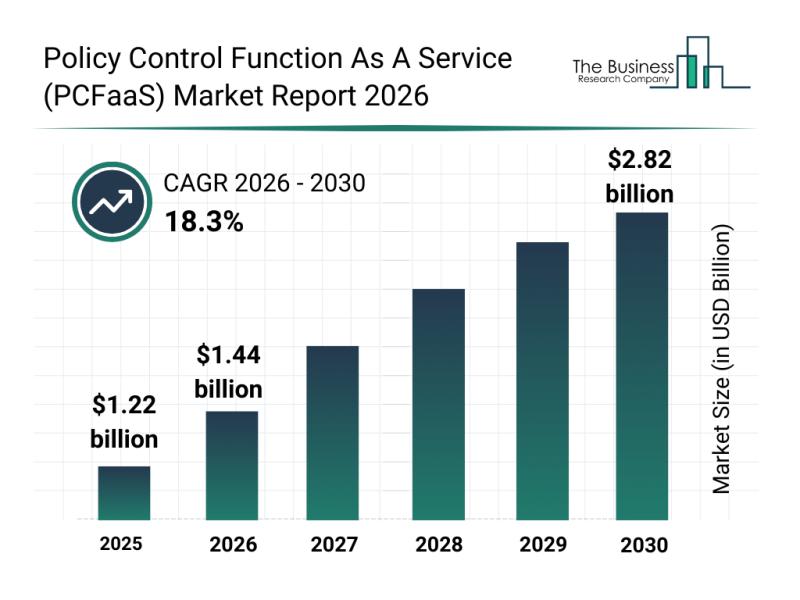

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Po …

The policy control function as a service (PCFaaS) market is on track for substantial expansion over the coming years, driven by technological advancements and increasing demand in telecommunications. This sector is transforming rapidly as operators adapt to next-generation network requirements and cloud-native approaches. Let's delve into the market's expected valuation, key players, emerging trends, and notable segmentations shaping its future.

Significant Growth Forecast for the Policy Control Function As A Service…

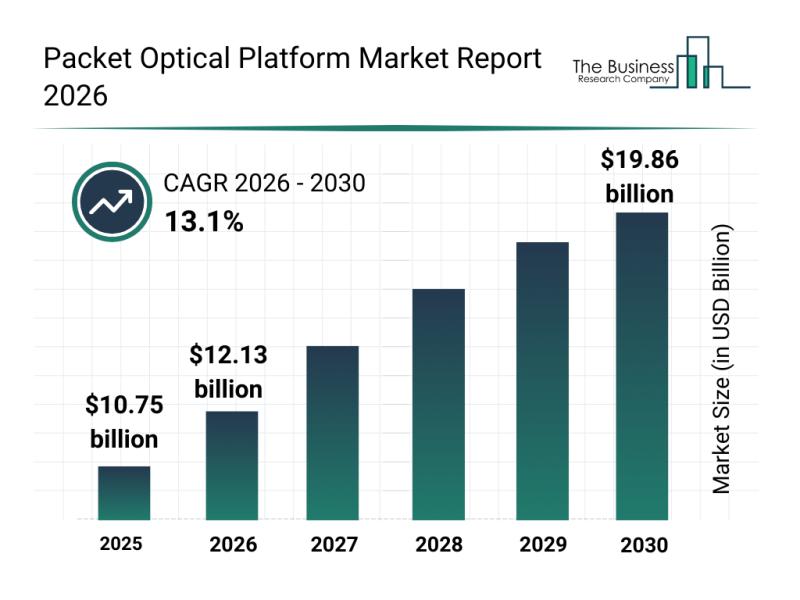

Top Players and Competitive Dynamics in the Packet Optical Platform Market

The packet optical platform market is positioned for significant expansion in the coming years, driven by advances in network technology and increasing demand for high-capacity data transmission. As digital infrastructure evolves, this sector is set to play a crucial role in supporting the growing needs of data centers, telecom providers, and cloud services. Let's explore the market's projected size, key players, emerging trends, and the segments contributing to its growth.

Forecasted…

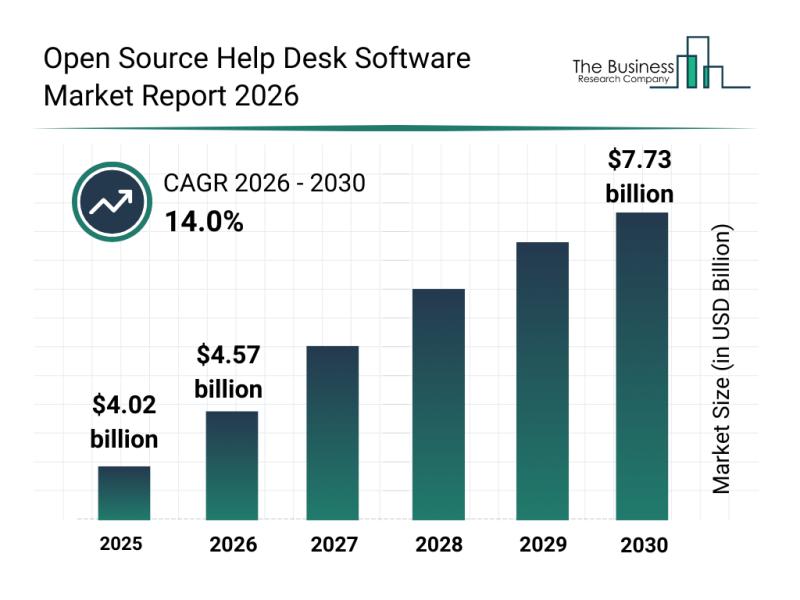

Analysis of Segmentation, Market Trends, and Competitive Landscape in the Open S …

The open source help desk software market is set to experience significant expansion in the coming years, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital customer support, this market is positioned for notable growth through 2030. Below is an in-depth exploration of the market size, leading players, key trends, and segmentation insights.

Projected Market Size and Growth Rate of the Open Source Help Desk Software Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…