Press release

Exploring the Growth and Opportunities in the Payment Gateway Market

IntroductionThe digital transformation of the financial services sector has revolutionized the way businesses and consumers interact with money. A crucial element of this transformation is the payment gateway market, which plays a vital role in enabling seamless electronic transactions for businesses and consumers alike. Payment gateways serve as the bridge between a customer's payment method and the merchant's bank, ensuring secure and efficient payment processing. They enable online businesses to accept payments through various methods, such as credit and debit cards, digital wallets, and bank transfers.

The increasing shift toward online shopping, digital banking, and e-commerce has made payment gateways a central part of modern financial infrastructure. In a world where contactless payments, mobile banking, and instant money transfers are becoming the norm, the demand for secure, reliable, and efficient payment processing solutions continues to grow. The global payment gateway market is expanding rapidly, driven by technological advancements, the rise of e-commerce, and the increasing adoption of digital payment methods.

Market Size

Data Bridge Market Research analyzes that the global payment gateway market, which was USD 29,290.00 million in 2023, is likely to reach USD 126,784.1 million by 2031 and is expected to undergo a CAGR of 20.10% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

For More Information Visit https://www.databridgemarketresearch.com/reports/global-payment-gateway-market

Market Opportunities

The payment gateway market presents numerous opportunities for growth, especially as technology continues to evolve and the global economy shifts toward a digital-first approach. One of the most notable opportunities is the rise of mobile payments. As mobile phones become the primary tool for making purchases, the demand for mobile payment solutions and seamless payment gateway integration grows. Businesses that can offer optimized mobile payment experiences are positioned to benefit from this trend.

Another opportunity lies in the increasing popularity of cross-border e-commerce. As more businesses expand internationally and consumers increasingly shop across borders, there is a growing need for payment gateways that can process multi-currency transactions and ensure seamless international payment processing. Payment gateway providers that can offer multi-currency support and address the complexities of cross-border transactions are in a strong position to tap into this expanding market.

The growing focus on security and fraud prevention also presents opportunities for payment gateway providers. As cybercrime and online fraud continue to be significant concerns, businesses are seeking payment solutions that provide advanced security features such as encryption, tokenization, and multi-factor authentication. Providers that can innovate and offer enhanced security features stand to gain a competitive advantage.

Market Share

The payment gateway market is fragmented, with several key players holding substantial market share across different regions. Some of the leading payment gateway providers include global giants such as PayPal, Stripe, Square, Adyen, and Worldpay, among others. These companies dominate the market due to their strong technological infrastructure, vast customer base, and wide range of services.

While large players continue to control a significant portion of the market, there is also room for smaller, regional players to carve out a niche, particularly in emerging markets. Providers that offer localized solutions and cater to the unique needs of regional businesses are gaining traction in these areas. The rise of fintech startups is further diversifying the competitive landscape, with new players constantly innovating to meet evolving customer demands.

The Asia-Pacific region is witnessing significant growth in the payment gateway market, with countries like China and India leading the way. The growth in mobile payment adoption, combined with the expansion of e-commerce platforms in these countries, is helping regional players capture a larger share of the market. North America and Europe also hold substantial market shares due to the established presence of major payment gateway providers and the high level of digital payment adoption in these regions.

Market Demand

The demand for payment gateways is driven by several factors, including the growing adoption of e-commerce, the rise of mobile payments, and the need for secure transaction processing. As online shopping continues to rise globally, businesses are increasingly looking for reliable and scalable payment solutions that can handle high volumes of transactions.

The demand for payment gateways is also fueled by the proliferation of digital wallets and alternative payment methods. Consumers are increasingly using mobile wallets like Apple Pay, Google Pay, and Samsung Pay, as well as peer-to-peer (P2P) payment systems like Venmo and PayPal. Payment gateways that integrate with these platforms are in high demand, as they offer businesses and consumers a more seamless and efficient way to conduct transactions.

Another key driver of market demand is the shift toward contactless payments. With the rise of NFC (Near Field Communication) technology, consumers can make payments by simply tapping their cards or mobile devices on payment terminals. This contactless payment trend is gaining traction, particularly in regions like Europe and North America, where it is being widely adopted. Payment gateways that support contactless payment methods are seeing increased demand as businesses seek to meet customer expectations for fast and convenient payment options.

Market Trends

Several key trends are shaping the payment gateway market, reflecting the broader shifts in the global payment ecosystem. One prominent trend is the growing use of artificial intelligence (AI) and machine learning (ML) in payment gateways. These technologies are being leveraged to enhance fraud detection, improve transaction security, and personalize the payment experience. AI-powered payment gateways can identify suspicious patterns in real-time, making them highly effective in preventing fraudulent transactions.

Blockchain technology is another trend gaining traction in the payment gateway market. Blockchain offers secure and transparent transaction processing, and several payment gateway providers are exploring its potential for reducing fraud, lowering transaction costs, and improving settlement times. The decentralized nature of blockchain makes it an attractive solution for cross-border payments, where traditional payment systems often face delays and high fees.

The rise of subscription-based business models is also influencing the payment gateway market. As businesses across various industries adopt recurring billing systems for services such as software-as-a-service (SaaS) or subscription box deliveries, payment gateways are evolving to accommodate subscription-based payments. This includes offering features like automated billing, subscription management, and flexible payment options.

Market Growth

The payment gateway market is set for significant growth in the coming years, driven by the ongoing digital transformation of the global economy. The widespread adoption of smartphones, mobile internet, and digital payment systems continues to drive the demand for payment gateways. The expansion of e-commerce and online services across both developed and emerging markets is a key growth driver, as businesses look for secure and efficient ways to process payments.

The growing adoption of digital wallets and contactless payment methods is also contributing to market growth. As more consumers embrace these technologies, businesses must integrate payment gateways that support these modern payment options. Additionally, the increasing focus on fraud prevention and transaction security is prompting businesses to seek out advanced payment gateway solutions that offer enhanced security features.

Government regulations and policies aimed at promoting digital payment adoption, as well as the increasing focus on financial inclusion, are further contributing to the growth of the payment gateway market. With the rise of fintech companies and digital banking, new market players are constantly emerging, offering innovative solutions that cater to evolving customer needs.

Browse Trending Reports :

https://newsresmarket.blogspot.com/2025/02/industrial-nitrogen-market-size-share.html

https://newsresmarket.blogspot.com/2025/02/document-imaging-market-size-share.html

https://newsresmarket.blogspot.com/2025/02/potato-processing-market-size-share.html

https://newsresmarket.blogspot.com/2025/02/healthcare-logistics-market-size-share.html

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Exploring the Growth and Opportunities in the Payment Gateway Market here

News-ID: 3861413 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

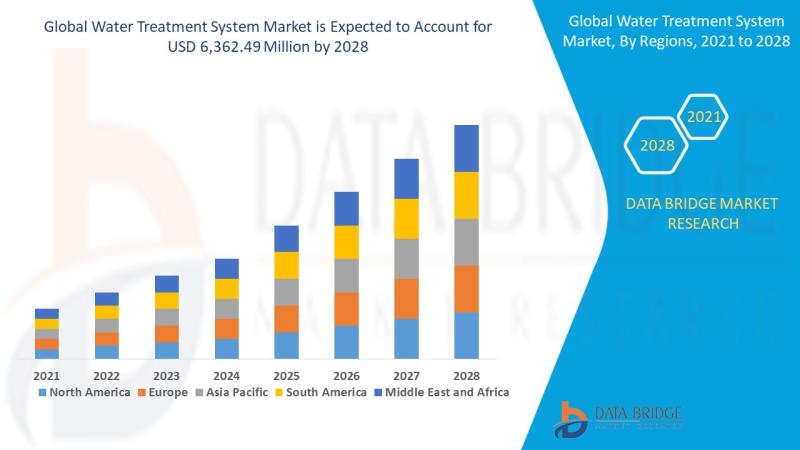

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…