Press release

Global Cash Advance Services Market Projected to Surpass $144.04 Billion by 2029 with 9.5% Annual Growth

What Are the Market Size and Growth Forecast for the Cash Advance Services Market?There has been substantial growth in the cash advance services market in the past few years. The market size is forecasted to proliferate from $91.02 billion in 2024 to $100.03 billion in 2025, marking a compound annual growth rate (CAGR) of 9.9%. Factors influencing the growth during the historic period include economic uncertainty, elevated consumer debt levels, restricted access to conventional credit, a surge in demand for swift cash resolutions, increased credit card use, and steep interest rates for personal loans.

The market size for cash advance services is projected to experience robust growth in the upcoming years, escalating to a value of $144.04 billion by 2029, with a compound annual growth rate (CAGR) of 9.5%. This growth over the prediction period can be attributed to factors such as the rising consumer demand for instantaneous financial solutions, the proliferation of fintech firms providing alternative credit products, increased awareness of flexible repayment alternatives, economic instability impacting consumer expenditure, and a surge in credit and debit card usage. Key trends in the predicted period include the growing adoption of digital platforms for fast fund accessibility, advanced integration of artificial intelligence in credit assessment, increasing demand for flexible repayment options, extension of cash advance services to emerging markets, improved regulatory structures for consumer safety, and growth in collaborations between fintech firms and conventional financial institutions.

What Factors Are Propelling the Expansion of the Cash Advance Services Market?

The increasing need for instantaneous cash accessibility is projected to boost the expansion of the cash advance services sector in the coming years. Quick cash access, which could be facilitated through ATMs, bank withdrawals, or cash advances, helps individuals meet immediate financial requirements. This rising demand for fast cash access stems from the escalating cost of living, unforeseen expenses, and the transition towards cashless operations. Effortless ways to obtain money, such as credit card cash advances, services provided by payday lenders, and ATMs, are greatly favored. The ease of cash acquisition without the requirement for comprehensive documentation or extended approval periods draws in consumers who require on-the-spot funding. For instance, data from Link Scheme Holdings Ltd., a UK-based company offering cash access and automated teller machine network, showed that in 2022, ATM cash withdrawal values reached $100.43 billion (£83 billion), an increase from $95.59 billion (£79 billion) the previous year. Thus, the surging demand for instantaneous cash access is significantly propelling the escalation of the cash advance services industry.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18286&type=smp

Which Key Market Leaders Are Driving Cash Advance Services Industry Growth?

Major companies operating in the cash advance services market are Wells Fargo & Co., American Express Company, PayPal Holdings Inc., Square Inc., Stripe Inc., Worldpay Inc., Advance America Cash Advance Centers Inc., SoFi Technologies Inc., TMX Finance LLC, ACE Cash Express Inc., Speedy Cash LLC, Lendio Inc., Moneytree Inc., CAN Capital Inc., BlueVine Inc., National Business Capital and Services Inc., LendNation Inc., Fundbox Inc., MoneyMutual Inc., LendUp Inc., Blue Trust Loans LLC, CashNetUSA Inc., Finova Capital LLC, Payday Express Inc.

What Are the Emerging Trends in the Cash Advance Services Industry?

Leading businesses in the cash advance services market are turning their focus towards the development of innovative technologies, like point-of-sale (POS) cash advances, with the goal of enhancing user experiences. By utilizing POS cash advances, businesses have the opportunity to obtain funds in advance which can be repaid via a segment of their regular sales through POS systems. In a clear example, SumUp, a fintech firm from the UK, rolled out the SumUp Cash Advance in August 2023. This point-of-sale cash advance provision was designed to offer short-term funds to merchants based on their prior payment records. The launch of SumUp Cash Advance was made feasible through a $100 million credit facility backed by Victory Park Capital (VPC), an alternative investment firm. This financial support will facilitate SumUp to offer advance payments to its merchants, initially targeting the UK market before branching out to other European markets.

What Are the Main Segments in the Cash Advance Services Market?

The cash advance services market covered in this report is segmented -

1) By Type: Credit Card Cash Advance, Merchant Cash Advance, Payday Loans, Other Types

2) By Deployment: Online, Offline

3) By Service Provider: Bank, Credit Card Companies, Other Service Providers

4) By End User: Personal, Commercial

Subsegments:

1) By Credit Card Cash Advance: Standard Credit Card Cash Advance, Online Credit Card Cash Advance

2) By Merchant Cash Advance: Business Loan Advances, Point-Of-Sale (POS) Based Advances

3) By Payday Loans: Single Payment Payday Loans, Installment Payday Loans

4) By Other Types: Auto Title Loans, Pawnshop Loans

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/cash-advance-services-global-market-report

Which Geographic Area Leads the Cash Advance Services Market?

North America was the largest region in the cash advance services market in 2024. The regions covered in the cash advance services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Cash Advance Services Global Market Report?

- Market Size Analysis: Analyze the Cash Advance Services Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Cash Advance Services Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Cash Advance Services Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Cash Advance Services Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18286

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Cash Advance Services Market Projected to Surpass $144.04 Billion by 2029 with 9.5% Annual Growth here

News-ID: 3859992 • Views: …

More Releases from The Business Research Company

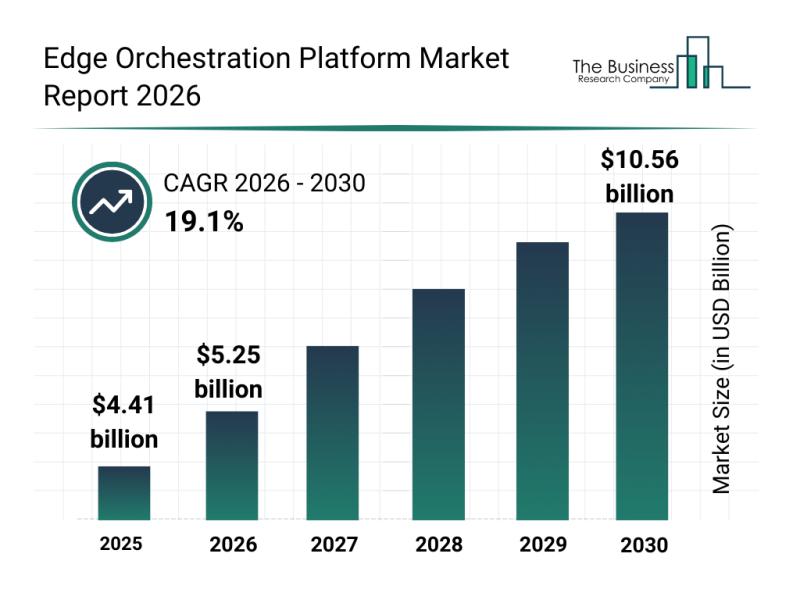

Future Perspective: Key Trends Shaping the Edge Orchestration Platform Market Un …

The edge orchestration platform market is positioned for substantial growth in the coming years, driven by technological advancements and increasing demand for distributed computing solutions. As industries continue to embrace edge computing to enhance efficiency and responsiveness, the market is set to experience significant expansion through 2030. Here is an overview of the market size projections, key players, driving trends, and segmentation details shaping this dynamic sector.

Projected Expansion of the…

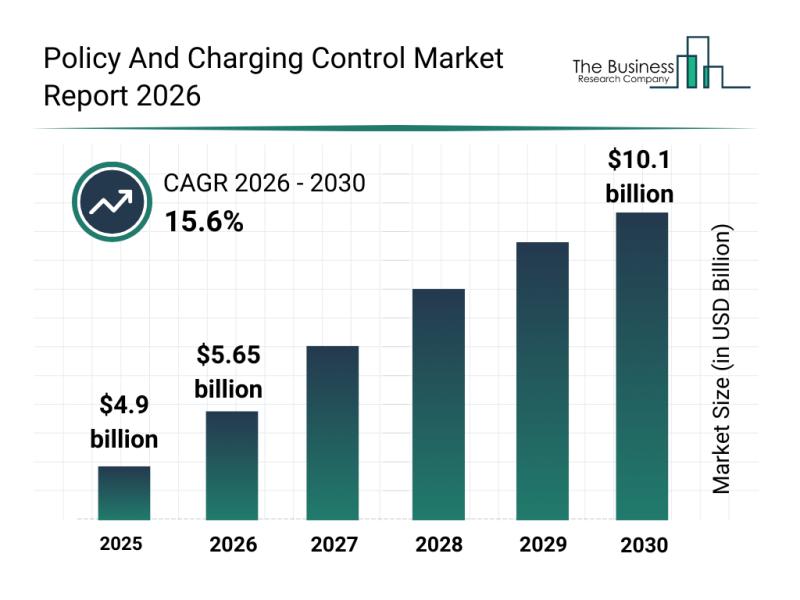

Emerging Sub-Segments Transforming the Policy and Charging Control Market Landsc …

The policy and charging control market is set to experience significant expansion as telecommunications evolve and new technologies gain traction. With increasing demand for faster, more flexible networks, this sector is positioned for strong growth driven by key technological shifts and market needs. Let's explore the current size, key players, driving forces, emerging trends, and important segments shaping the future of this market.

Projected Market Size and Growth Trajectory of the…

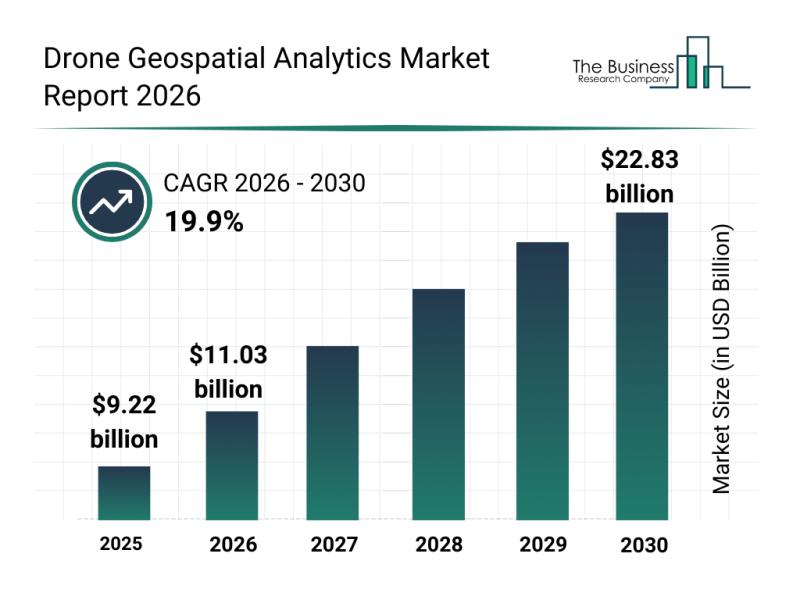

Competitive Landscape: Leading Companies and New Entrants in the Drone Geospatia …

The drone geospatial analytics market is on track for remarkable expansion, driven by the increasing adoption of drone technology across various industries. As the demand for precise spatial data and analytics grows, this sector is becoming crucial for applications ranging from agriculture to disaster management. Let's delve into the projected market valuation, key players, emerging trends, and detailed segment breakdowns shaping this industry's future.

Projected Market Size and Growth Outlook for…

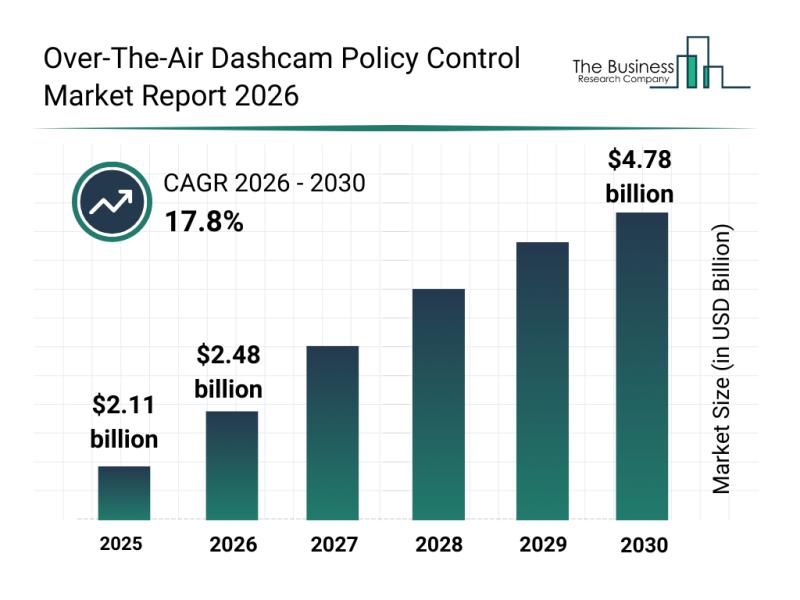

Emerging Growth Trends Driving Expansion in the Over-The-Air Dashcam Policy Cont …

The over-the-air dashcam policy control market is positioned for substantial expansion in the coming years, driven by advancements in connected vehicle technologies and evolving fleet management needs. This market is becoming increasingly important as organizations seek smarter, scalable solutions to manage dashcam devices and data across diverse mobility ecosystems. Let's explore the market's size, key players, notable trends, and segment breakdown in detail.

The Projected Market Size and Growth Trajectory of…

More Releases for Cash

Your Cash Pro Unlocks Immediate Cash from Lapsed Life Insurance

Available to Policyholders Aged 65 or Older with Policies of $100,000 or More

Your Cash Pro is redefining what happens when a life insurance policy no longer fits. Built on transparency and compassion, the company helps policyholders convert lapsed or unneeded policies into immediate cash. Each transaction is structured to protect the policyholder's interests, and Your Cash Pro extends the impact by donating 50% of its own proceeds, never from the…

Teller Cash Recycler Market: Optimizing Cash Management for a Smarter Banking Fu …

The Teller Cash Recycler (TCR) market is witnessing strong momentum as financial institutions, retailers, and cash-heavy industries embrace automation to enhance operational efficiency. Valued at US$ 4,143.47 million in 2024, the market is projected to reach US$ 6,441.49 million by 2033, growing at a steady CAGR of 5.16%.

𝐓𝐡𝐞 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐬𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞: - https://www.astuteanalytica.com/request-sample/teller-cash-recycler-market

TCRs automate cash deposit, dispensing, and recycling functions, significantly reducing manual cash handling and improving transaction…

Cell Phone Cash Review: Is Cell Phone Cash Legit? Find Out!

Ever wondered if you can make money just by using your smartphone? I started looking into cell phone cash with a lot of doubt. With so many sca.ms out there, figuring out if this program is real was key. This review aims to find out if cell phone cash is a genuine way to make money or just another sc.am.

Let's dive into this question together and see what I found…

Optimizing Cash Flow and Customer Satisfaction with Order to Cash Process Mining

Businesses have always been concerned about optimizing the process of business operations and the maximization of cash flow without compromising customer satisfaction. This has led many businesses today to use O2C process mining ( https://businessprocessxperts.com/process-mining/ ), a useful analytical method that helps them fulfill orders effectively and efficiently.

This analytical method helps in the identification of areas in the order fulfillment process, where there is a need for improvement and inefficiency.

𝗞𝗲𝘆…

"Cash Advance by Cash Tools" App Launched for iPhone Users

The "Cash Advance by Cash Tools" app offers up to $1,000 in quick, interest-free advances with flexible repayment options.

Image: https://www.abnewswire.com/uploads/6fb3472a9cfae1320523530583628e84.png

Cash Tools Inc., a financial technology company, has launched its latest service, "Cash Advance by Cash Tools," available now on the App Store [https://apps.apple.com/us/app/cash-advance-by-cash-tools/id6615087395] for iPhone users. This app aims to provide a straightforward and accessible way for individuals to manage short-term financial needs by offering immediate cash advances without traditional…

Car's Cash For Junk Clunkers Pays Cash On The Spot

Image: https://www.getnews.info/wp-content/uploads/2024/05/1716349569.png

Car's Cash gives free quotes over the phone or by email. The buyers pick up the car and pays cash on the spot, sometimes on the same day. A pink slip is not needed.

Car's Cash For Junk Clunkers [https://carscashforjunkclunkerslosangelesca.com/] and Henry Ford are pleased to announce that they pay cash on the spot for junkers cluttering the landscape. Upfront free quotes are available over the phone or by…