Press release

Global Banknote Market Projected to Surpass $17.12 Billion by 2029 with 5.3% Annual Growth

What Are the Market Size and Growth Forecast for the Banknote Market?The expansion of the banknote industry has been pronounced in recent times, with projections indicating an increase from $13.15 billion in 2024 to $13.9 billion in 2025, suggesting a compound annual growth rate (CAGR) of 5.7%. Factors contributing to this growth during the historic period include advancements in print technology, economic fluctuations, inflation trends, a rising necessity for secure currency, the expansion of global commerce, changes in governmental regulations, and the broadening of worldwide financial structures.

There is strong anticipation for the banknote market size to expand significantly in the coming years. It is projected to increase to a sizeable $17.12 billion by 2029, charting a compound annual growth rate (CAGR) of 5.3%. The expansion during the forecast period is largely driven by the evolution in digital payment solutions, the shifting consumer inclination towards digital currencies, potential regulatory alterations, financial inclusion drives, the escalating demand for high-security characteristics, as well as continuous improvements in anti-counterfeit measures. The forecast period will likely see a trend towards the wider adoption of polymer banknotes, an increased focus on the innovative designs of banknotes, the introduction of sophisticated security features, a surge in the demand for cash-handling automated systems, alongside the application of data analysis and AI.

What Factors Are Fueling Growth in the Banknote Market?

The banknote market is anticipated to expand due to the rising volume of cash transactions. Cash transactions, which are financial exchanges conducted with physical money, such as coins or banknotes, are on the rise due to factors like economic instability, usage in the informal economy, security reasons, and small dealings. Banknotes aid these cash transactions by offering a universally recognized and simple exchange method. For instance, UK Finance, a financial services enterprise based in the UK, reported in September 2023 that the total number of cash transactions in the UK had surged to 6.4 billion in 2022 from 6.0 billion in 2021. Consequently, the banknote market's growth is being propelled by the increasing number of cash transactions.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18245&type=smp

Which Key Market Leaders Are Driving Banknote Industry Growth?

Major companies operating in the banknote market are Banque de France, Barry-Wehmiller Companies, Giesecke+Devrient GmbH, Bank of Canada, THE ROYAL MINT LIMITED, SICPA HOLDING SA, Bundesdruckerei GmbH, De La Rue plc, Crane Currency, Landqart AG, Note Printing Australia Limited (NPA), Orell Füssli AG, Oberthur Fiduciaire, Hueck Folien GmbH, CCL Secure, Banknote World, Hungarian Banknote Printing Company, Polish Security Printing Works, Arjowiggins Security, Advast Suisse AG, South African Bank Note Company, Tumba Mill

What Are the Emerging Trends in the Banknote Industry?

Leading firms in the banknote market are prioritizing the creation of improved products, including commemorative polymer banknotes, to increase security features and extend currency longevity. Commemorative polymer banknotes, which are currencies printed on polymer, have enhanced durability and can better withstand wear and tear. They often feature unique design elements that celebrate historical milestones, cultural history, or significant individuals, positioning them as both usable currency and collectors' items. For example, CCL Secure, an Australian firm specializing in the design and production of polymer banknotes, partnered with the Polish Security Printing Works (PWPW), a banknote manufacturer from Poland, in February 2023 to release the Guardian 20 zloty banknote. This revolutionary 20-zloty banknote employs advanced polymer technology, resulting in improved durability and more resistance to wear compared to traditional paper-based currencies. The banknote boasts a vivid and detailed design that honors Polish heritage and accomplishments, with high-definition printing ensuring both aesthetic appeal and security. Additionally, the note incorporates cutting-edge security features such as micro printing, color-changing inks, and integrated holograms to offer strong defense against counterfeiting.

What Are the Main Segments in the Banknote Market?

The banknote market covered in this report is segmented -

1) By Type: State-Owned, Commercial

2) By Material: Paper, Polymer

3) By Application: Intaglio Printing, Offset Printing, Letterpress Printing

Subsegments:

1) By State-Owned: National Currency Banknotes, Central Bank-Issued Banknotes, Government-Backed Banknotes

2) By Commercial: Private Bank-Issued Banknotes, Commercial Banknotes (Issued by Private Banks for Local Circulation), Emergency Or Temporary Commercial Banknotes

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/banknote-global-market-report

Which Geographic Area Leads the Banknote Market?

North America was the largest region in the banknote market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the banknote market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Banknote Global Market Report?

- Market Size Analysis: Analyze the Banknote Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Banknote Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Banknote Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Banknote Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18245

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Banknote Market Projected to Surpass $17.12 Billion by 2029 with 5.3% Annual Growth here

News-ID: 3858513 • Views: …

More Releases from The Business Research Company

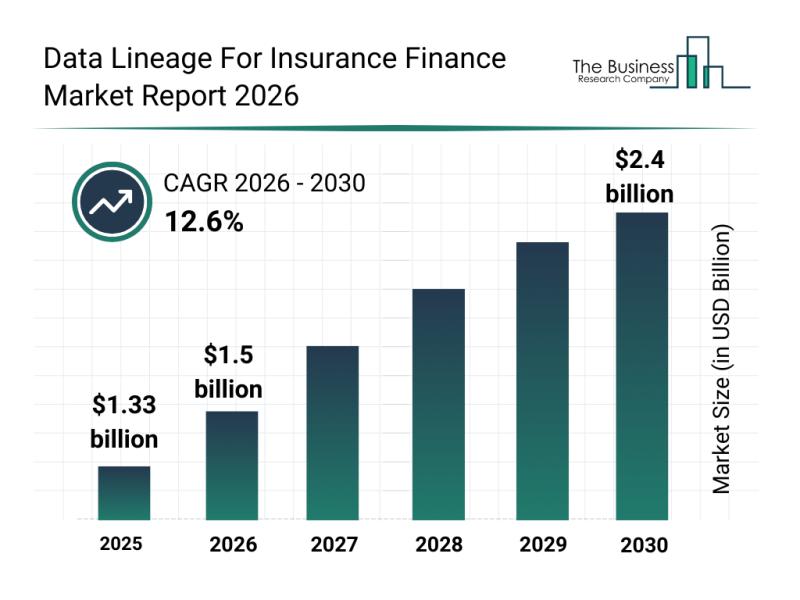

Global Trends Analysis: The Rapid Evolution of Data Lineage in the Insurance Fin …

The insurance finance sector is increasingly turning to data lineage solutions to enhance transparency, compliance, and operational efficiency. As regulations tighten and data complexity grows, organizations are relying more on advanced tracking and auditing tools to manage their financial data. This shift is set to propel the market for data lineage in insurance finance to significant heights over the coming years.

Data Lineage for Insurance Finance Market Size and Growth Outlook…

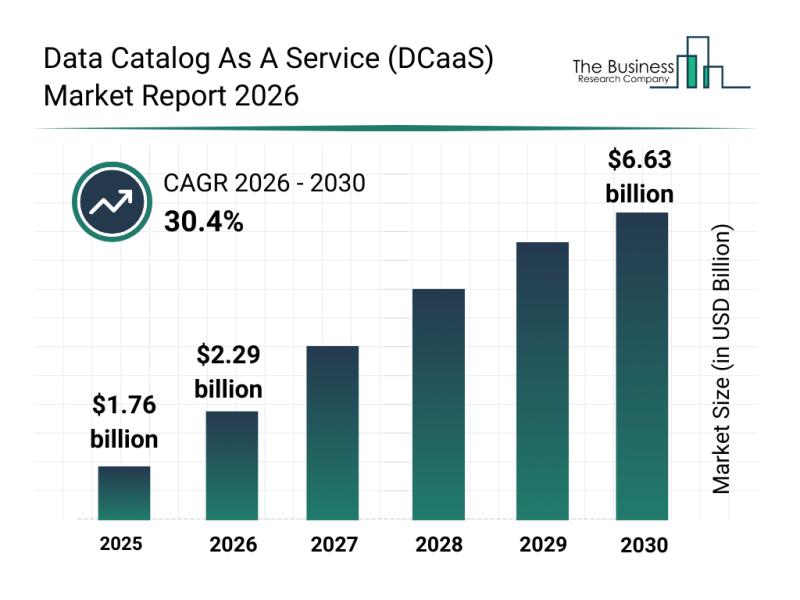

Segmentation, Major Trends, and Competitive Overview of the Data Catalog As A Se …

The data catalog as a service (DCaaS) market is poised for remarkable expansion in the coming years, driven by advancements in artificial intelligence and increasing enterprise demand for efficient data management. As organizations seek better ways to handle vast amounts of data, this market is emerging as a critical component in enabling seamless data discovery, governance, and collaboration. Below is a detailed look at the market's size, leading players, key…

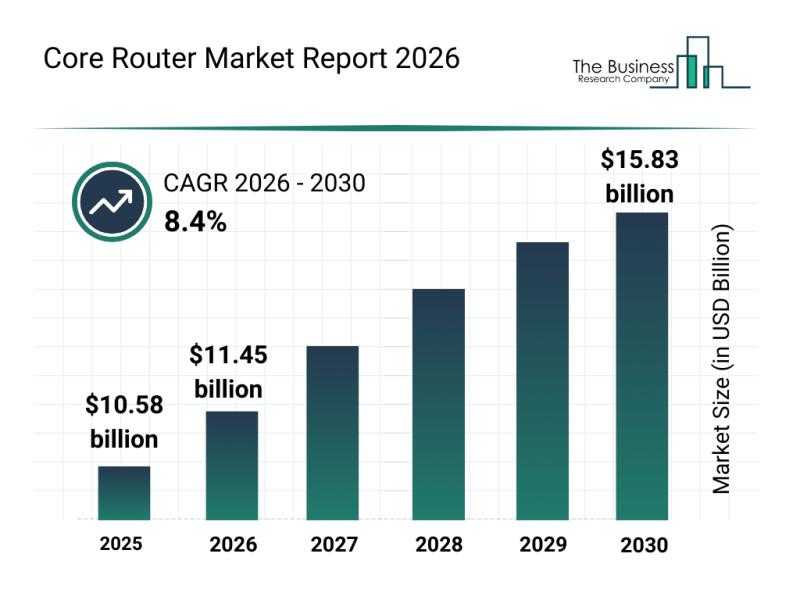

Market Trend Insights: The Impact of Recent Advances on the Core Router Market

The core router market is positioned for significant expansion in the coming years due to rapid technological advancements and rising demand for efficient network infrastructure. With growing emphasis on high-speed data transmission and scalable connectivity, this sector is set to play a crucial role in supporting the digital transformation across various industries.

Forecasted Growth and Market Size of the Core Router Market

The core router market is projected to reach…

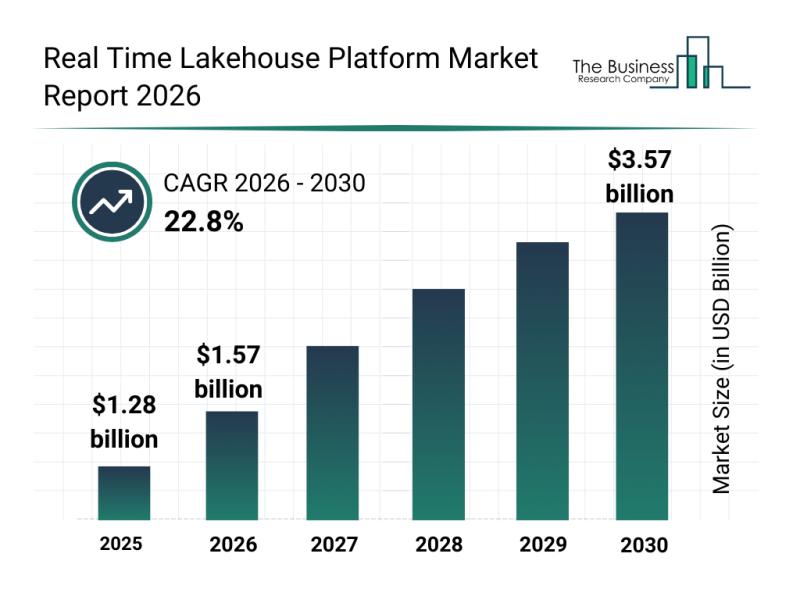

Key Strategic Trends and Emerging Changes Shaping the Real Time Lakehouse Platfo …

The real time lakehouse platform market is set for remarkable expansion in the coming years, driven by rapid technological advancements and increasing demand for efficient data handling solutions. As organizations continue to rely on real-time analytics and AI integration, this market is positioned to deliver significant innovation and growth through 2030.

Projected Growth and Market Size of the Real Time Lakehouse Platform Market

The market for real time lakehouse platforms…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…