Press release

By 2030, UAE Residential Real Estate Market to Reach USD 52.32 Billion Driven by Growing Development Initiatives

The residential real estate comprises the properties utilized for living purposes, as single-family homes, apartments, condominiums, and townhouses. It plays a significant role in wealth-building, and financial planning, by offering potential for long-term growth. This sector of real estate emphasis housing individuals and families and involves both property ownership and rental agreement. The UAE residential real estate industry is witnessing huge upsurge, owing to the growing spending on infrastructure, relaxed laws for foreign investors, new government initiatives to drive investments, and new project announcements. This growth is also analysed by the recently published report by renowned data analytics and market research firm, Markntel Advisors. According to the comprehensive report, the UAE Residential Real Estate Market size was valued at around USD 36.32 Billion in 2024 and is projected to reach USD 52.32 billion by 2030."𝑰𝒇 𝒚𝒐𝒖'𝒓𝒆 𝒊𝒏𝒕𝒆𝒓𝒆𝒔𝒕𝒆𝒅 𝒊𝒏 𝒊𝒏𝒔𝒊𝒈𝒉𝒕𝒔 𝒐𝒏 𝒕𝒉𝒆 2025-2030 𝒇𝒐𝒓𝒆𝒄𝒂𝒔𝒕, 𝒓𝒆𝒂𝒄𝒉 𝒐𝒖𝒕 𝒇𝒐𝒓 𝒕𝒂𝒊𝒍𝒐𝒓𝒆𝒅 𝒊𝒏𝒇𝒐𝒓𝒎𝒂𝒕𝒊𝒐𝒏 𝒕𝒉𝒂𝒕 𝒄𝒂𝒏 𝒉𝒆𝒍𝒑 𝒚𝒐𝒖 𝒏𝒂𝒗𝒊𝒈𝒂𝒕𝒆 𝒕𝒉𝒊𝒔 𝒈𝒓𝒐𝒘𝒊𝒏𝒈 𝒔𝒆𝒄𝒕𝒐𝒓!!!"

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 - https://www.marknteladvisors.com/query/request-sample/uae-residential-real-estate-market.html

" Growing Factors Shaping the UAE Residential Real Estate Industry"

• Increasing preference for large homes with outdoor spaces

• Improving economic conditions and evolving demographics

• Rise of remote working and online learning

• Strategic government regulations and investors initiatives

• Increasing transaction value and investment in UAE's real estate industry

• Providing provision of 5-year and 10-year residency visas to attract foreign capital

• Rising demand for sustainable and smart homes

• Emerging requirement of affordable housing for middle-income earners, young professionals, and expatriates

• Launching new projects that offer high-quality, affordable living spaces well connected to urban amenities

• Availability of attractive financing options

• Stability in political environment across country

• Encouraging R&D investment in real estate sector

" Key Competitors and their Strategic Initiatives Strengthening Industry Growth"

Prominent players essentially contributing in the growth of the UAE residential real estate sector are Dubai Holding LLC, Emaar Properties PJSC, DAMAC Properties, Vincitore Realty LLC, Aldar Properties, Majid Al Futtaim Properties, Deyaar Properties, Azizi Developments, Omniyat, Manazel, and others.

𝐕𝐢𝐞𝐰 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 - https://www.marknteladvisors.com/research-library/uae-residential-real-estate-market.html

Recent Initiatives and Developments by Industry Players

• Emaar Properties PJSC: Emaar Properties (or simply Emaar) is an Emirati real estate development company located in the United Arab Emirates, recently agreed to sell a prime beachfront plot in Murooj Golf Community District, King Abdullah Economic City (KAEC), to Al Bilad Tourism Fund, a Shariah-compliant investment fund regulated by the CMA. In exchange, Emaar will acquire fund units valued at USD 717 million, representing 41.15% of the fund's equity. The fund aims to develop a Rixos Premium resort and exit the investment after 12 years.

• Dubai Holding: Dubai Holding is a global investment and real estate developer recently announced its acquisition of full ownership of The Westin Paris - Vendôme by purchasing Henderson Park's remaining stake in the property. This strategic acquisition enhances Dubai Holding's already extensive portfolio by adding another world-class asset in a prime location. It also aligns with the Group's long-term global expansion strategy, aimed at increasing its presence in key international markets across North America, the Middle East, Europe, and Asia.

" Segmentation Analysis Based on Type and Geography"

- Type Analysis: Apartments and Condominiums Segment to Hold Highest Market Share

The type segment is sub divided into apartments & condominiums and Villas & Landed Houses. Condominiums are a large apartment building in which each apartment is owned separately by the people living in it, and also contains shared areas. Besides, Villas are individual homes which are sold as a single unit. Among both, apartments and condominiums segment is projected to led the industry growth. This is because with rising urbanization and influx of international workers resulted in growing demand for rental properties such as apartments. Additionally, ongoing development of new high-rise complexes and luxury condominiums by leading real estate developers continues to enrich the market.

𝐂𝐥𝐢𝐜𝐤 𝐭𝐨 𝐂𝐨𝐧𝐧𝐞𝐜𝐭 𝐖𝐢𝐭𝐡 𝐎𝐮𝐫 𝐀𝐧𝐚𝐥𝐲𝐬𝐭 - https://www.marknteladvisors.com/query/talk-to-our-consultant/uae-residential-real-estate-market.html

- Geographical Analysis

This segment is classified as Abu Dhabi & Al Ain, Dubai, and Sharjah & Northern Emirates, these cities are famous for tourism as well as commercial purpose. Amongst all, Dubai capture the substantial growth in overall industry, determined by availability of flourished destinations renowned for their strategic locations and high-quality living standards. The key areas such as Dubai Marina, Downtown, Dubai, and Palm Jumeirah, gained widespread residential investments further results in exponential growth of Residential Real Estate Industry.

"Future Outlook"

As per the report by Markntel Advisors, the UAE Residential Real Estate Market is expected to demonstrate upward graph in terms of growth perspectives, owing to the widespread rising factors. According to these dynamics, the industry players can effortlessly project valuable approaches and therefore, contribute to the exponential growth of the UAE residential real estate market.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:

• Oman Residential Real Estate Market - https://www.marknteladvisors.com/research-library/oman-residential-real-estate-market.html

• India Luxury Residential Real Estate Market - https://www.marknteladvisors.com/research-library/india-luxury-residential-real-estate-market.html

For Media Inquiries, Please Contact:

Phone: +1 628 895 8081 | +91 120 4278433

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

About US:

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release By 2030, UAE Residential Real Estate Market to Reach USD 52.32 Billion Driven by Growing Development Initiatives here

News-ID: 3856935 • Views: …

More Releases from MarkNtel Advisors LLP

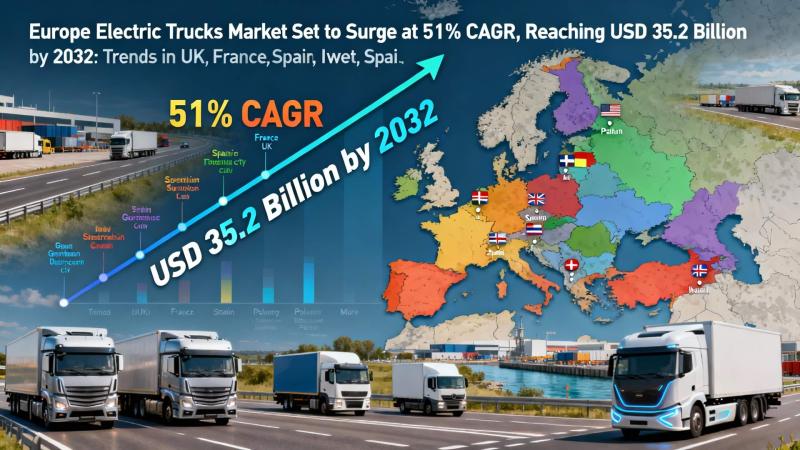

Europe Electric Trucks Market Set to Surge at 51% CAGR, Reaching USD 35.2 Billio …

Latest Research Report of European Electric Trucks Market Size and CAGR

According to MarkNtel Advisors latest market research report data, the Europe Electric Trucks Market is projected to grow from USD 1.96 billion in 2025 to USD 35.2 billion by 2032, registering a remarkable CAGR of 51.07%. Growth is primarily driven by stringent EU emission standards, expansion of high-capacity charging networks, and fleet electrification by major OEMs like Volvo Trucks and…

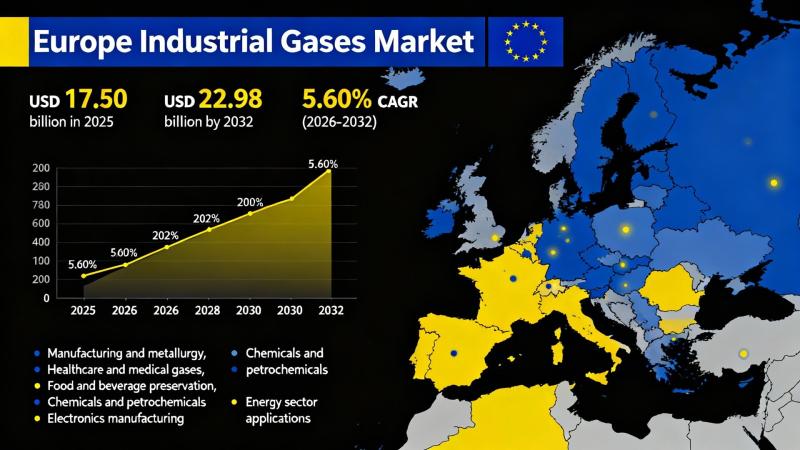

Europe Industrial Gases Market Expected to Reach Nearly $22.98 Billion by 2032: …

Europe Industrial Gases Market: Trends, Insights, and Future Outlook

The Europe Industrial Gases Market is seeing robust growth, driven by increasing demand across key sectors such as petrochemicals, healthcare, and steelmaking. Innovations in hydrogen production and carbon capture technologies are prominent factors influencing market dynamics. A shift towards renewable and low-carbon sources presents significant opportunities amid growing environmental regulations. Additionally, the rise in energy costs is reshaping the landscape for industrial…

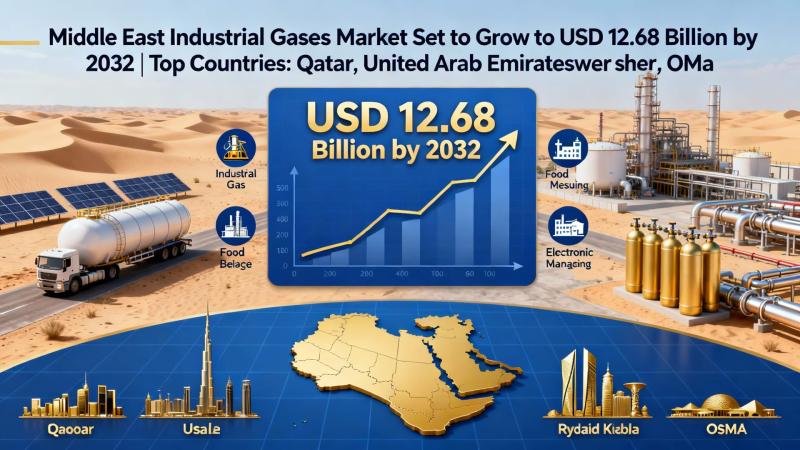

Middle East Industrial Gases Market Set to Grow to USD 12.68 Billion by 2032 | T …

The Middle East Industrial Gases Market is forecasted to expand from USD 10.06 billion in 2025 to USD 12.68 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.72% during the period of 2026 to 2032. The primary drivers fueling this growth are the increasing demand for hydrogen and the robust expansion of the petrochemical industry, which necessitates high-purity gases for various applications such as chemical synthesis and…

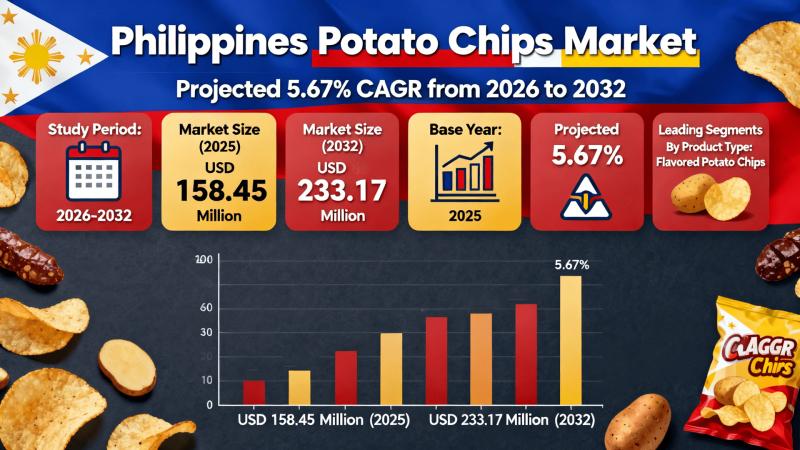

Potato Chips Market in Philippines Set to Grow to USD 233.17 Million by 2032 as …

The Philippines Potato Chips Market is entering a significant growth phase, projected to expand from USD 158.45 million in 2025 to USD 233.17 million by 2032, with a robust compound annual growth rate (CAGR) of 5.67%. Key growth drivers include government initiatives aimed at bolstering local potato production and the rising popularity of flavored varieties among consumers.

Philippines Potato Chips Market Growth Outlook:

As snack food preferences evolve, the Philippines Potato Chips…

More Releases for UAE

Introduces "E-Invoicing UAE" - Simplifying Digital Compliance for UAE Businesses

KGRN Chartered Accountants, a leading name in financial and compliance consulting, has officially introduced its new service, "E-Invoicing UAE," to help organizations across the United Arab Emirates achieve effortless compliance with the Federal Tax Authority (FTA)'s digital invoicing regulations.

The E-Invoicing UAE platform by KGRN enables businesses to streamline their billing operations, automate tax compliance, and transition to the UAE's paperless invoicing system with confidence. The service is tailored for both…

Ashish Jain, a Renowned Fund Manager Expands into UAE Real Estate in UAE

Dubai - Ashish Jain, a world-renowned fund manager and CEO of Fortune Capital, Fortune Wealth, and the newly launched Alieus Hedge Fund, is stepping into the UAE real estate market as part of his latest strategic expansion. This move marks Jain's entry into the thriving property market, further cementing his reputation as a leader in global finance and innovation.

Image: https://www.getnews.info/uploads/9b42e4a62bfaef7aaf02043c03240d75.jpg

A Visionary Leader in Finance

With over 15 years of experience in…

Fitness Equipment Market UAE | UAE Fitness Market Revenue | Member Penetration U …

The fitness services means any service treatment, diagnosis, advice or instruction concerning to the physical fitness, comprising but not restricted to diet, body building, cardio-vascular fitness, or physical training programs and which you function as or on behalf of the named insured. The fitness services market is commonly propelled by the increasing concerns over the healthy lifestyles around the populace throughout the UAE. Growing health awareness concerning the advantages of…

UAE Fitness Services Market, UAE Fitness Services Industry, Covid-19 Impact UAE …

A strong growth has been witnessed with a considerable expansion in the number of boutique and budget fitness centers directly contributing to the economy.

High Obese and Obesity Rate: Increase in membership rate in UAE fitness centers due to the prevalence of high obese population and obesity rate (Adult obesity in the UAE stood at 27.8% in 2019) has positively affected the market.

Growth of Ladies Fitness Center: Opening up…

wifi solution in uae

Welcome to MAK, Wifi solutions provider in UAE. We bring everything that you would expect from an internet service provider – a highly professional installation and setup, high internet speed, a reliable network, great technical support and customer service to create a remarkable experience for the users, thereby remaining the most trusted WiFi Solutions provider in Dubai and across UAE.

Designing Efficient and Cost Effective Home Wifi Networks

Keep the connections to…

UAE Nuclear Power Sector UAE Nuclear Power Sales Report

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. UAE Power Sector Scenario

1.1 Existing Power Generation Outlook

1.2 Current & Projected Power Demand

2. Why UAE Energy Policy beyond Oil & Gas?

3. UAE Nuclear Power Sector Overview

3.1 UAE Entering into Nuclear Power Sector

3.2 Nuclear Policy Overview

4. UAE Nuclear Power Sector Dynamics

4.1 Favorable Parameters

4.2 Nuclear Power Sector…