Press release

Long Island Medicaid Planning Attorney Seth Schlessel Offers Insights on Applying for Medicaid

Long Island Medicaid planning attorney Seth Schlessel (https://www.schlessellaw.com/how-to-apply-for-medicaid-on-long-island/), of Schlessel Law PLLC, recently shared vital information to help Long Island residents manage the complex aspects of applying for Medicaid and protecting their assets. Medicaid provides critical healthcare coverage for individuals and families with limited income, but its strict requirements often make the process overwhelming.Medicaid plays a crucial role in covering healthcare expenses, including nursing home care and personal care services, for those who meet specific income and asset criteria. According to Seth Schlessel, many applicants struggle with the program's strict requirements, but working with a Long Island Medicaid planning attorney can make a significant difference. "Proper planning allows individuals to qualify for Medicaid while retaining assets and minimizing the impact of estate recovery programs on their beneficiaries," Schlessel explains.

To qualify for Medicaid in New York, applicants must pass a means test, which evaluates their household income against state-determined thresholds. In 2024, these limits range from $1,732 per month for single individuals to $2,351 for married couples applying jointly. Additionally, applicants must navigate a five-year look-back period for asset transfers, a process that a Long Island Medicaid planning attorney such as Seth Schlessel can help simplify.

Medicaid planning involves strategies such as spending down assets or creating trusts to meet financial eligibility criteria while preserving family wealth. "Planning ahead is crucial," says Schlessel. "A delay in addressing eligibility requirements can lead to missed benefits and financial strain during critical times."

New York's Medicaid program provides various services, including community Medicaid for basic healthcare needs, long-term care under Medicaid with extended services such as rehabilitation and housekeeping, and nursing home Medicaid for dedicated facility care. Eligibility extends to U.S. nationals, citizens, green card holders, and legal residents who meet specific criteria, such as being under 21, over 65, or having a disability.

Despite these options, the process can be daunting. Seth Schlessel emphasizes the importance of proper documentation and planning to facilitate smooth applications. "Timely submissions and accurate paperwork are essential for approval," Schlessel notes. Applications typically take 45 to 90 days to process, with delays caused by missing documents or errors.

Denials are common in Medicaid applications due to incomplete forms, missing information, or exceeding financial limits. Seth Schlessel advises applicants to work closely with their caseworkers to address these issues promptly. Financial hurdles, such as surpassing income limits, can often be overcome by using strategies such as the Medicaid Excess Income Program or Qualified Income Trusts.

"If an application is denied, it's critical to act quickly," Schlessel states. "Requesting a fair hearing and presenting well-organized documentation can increase the likelihood of approval." Schlessel also highlights the need for detailed medical records to establish eligibility when medical needs are questioned.

Certain assets, including a primary residence valued below $955,000, one vehicle, and personal items such as jewelry and clothing, are exempt from Medicaid's look-back period. Burial allowances and retirement accounts in payout status also qualify. A Medicaid planning attorney can help determine eligibility for these exemptions and explore other options to protect assets.

For families who fail to meet income limits, spending down assets by paying for medical bills, mortgages, or other allowable expenses is a viable strategy. Medicaid planning, which incorporates estate planning tools, is another approach to preserve wealth while helping ensure eligibility.

Applying for Medicaid requires a thorough understanding of income limits, asset exemptions, and the look-back period. Seth Schlessel urges families to plan well in advance to avoid complications. "Taking early action can allow individuals to protect their assets and secure the care they need without unnecessary delays or financial hardships," Schlessel says.

About Schlessel Law PLLC:

Schlessel Law PLLC, led by Seth Schlessel, focuses on Medicaid planning, estate planning, and elder law. Located on Long Island, New York, the firm can assist families in protecting their assets, planning for long-term care, and managing complex legal processes. Seth Schlessel's dedication to his clients helps ensure personalized solutions and compassionate legal representation.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=ZcjiEFM1Xa4

GMB: https://www.google.com/maps?cid=7387587768064061142

Email and website

Email: seth@schlessellaw.com

Website: https://www.schlessellaw.com/

Media Contact

Company Name: Schlessel Law PLLC

Contact Person: Seth Schlessel

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=long-island-medicaid-planning-attorney-seth-schlessel-offers-insights-on-applying-for-medicaid]

Phone: (516) 574-9630

Address:34 Willis Ave Suite 300

City: Mineola

State: New York 11501

Country: United States

Website: https://www.schlessellaw.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Long Island Medicaid Planning Attorney Seth Schlessel Offers Insights on Applying for Medicaid here

News-ID: 3854743 • Views: …

More Releases from ABNewswire

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

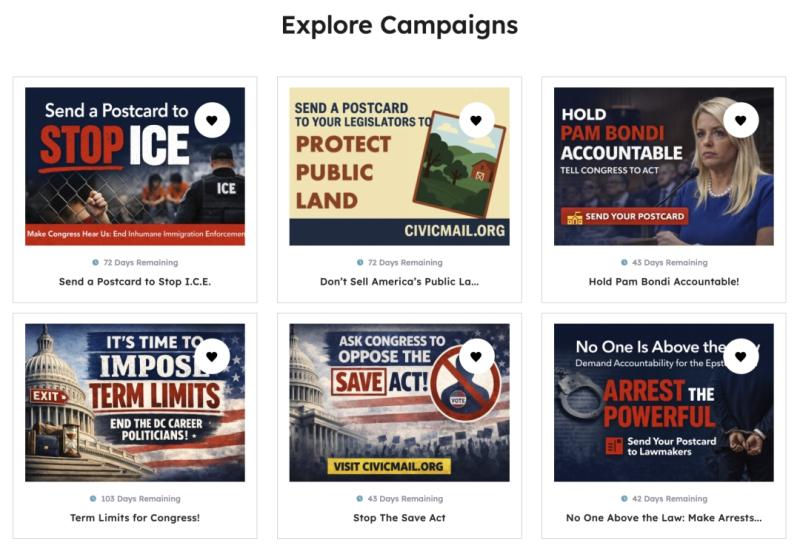

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

More Releases for Medicaid

Houston Medicaid Planning Lawyer Whitney L. Thompson Discusses Texas Medicaid Sp …

HOUSTON, TX - Understanding Medicaid eligibility in Texas can be challenging, especially when navigating spend-down rules and income limits. Houston Medicaid planning lawyer Whitney L. Thompson of The Law Office of Whitney L. Thompson (https://www.wthompsonlaw.com/does-texas-have-spend-down-medicaid/) is helping families across Texas make sense of complicated Medicaid requirements, whether they're applying under the Medically Needy program or preparing for long-term-care Medicaid.

For families seeking coverage under the Medically Needy program, income spend-down is…

Houston Medicaid Planning Attorney Whitney L. Thompson Discusses Texas Medicaid …

HOUSTON, TX - For families in Texas facing the difficult decisions that come with nursing home care, understanding what Medicaid covers and how to qualify can be overwhelming. At The Law Office of Whitney L. Thompson (https://www.wthompsonlaw.com/nursing-home-care-and-medicaid-eligibility/), Houston Medicaid Planning Attorney Whitney L. Thompson provides clear and practical legal support to clients seeking long-term care benefits through Texas Medicaid.

Medicaid does cover nursing home care in Texas, but only for individuals…

New Jersey Medicaid Trust Lawyer Christine Matus Outlines Medicaid Asset Protect …

Toms River, NJ - New Jersey Medicaid trust lawyer Christine Matus of The Matus Law Group (https://matuslaw.com/new-jersey-medicaid-trust-lawyer/) releases updated guidance on Medicaid Asset Protection Trusts for families preparing for long-term care. The firm's latest overview explains how a properly structured Medicaid asset protection trust can safeguard non-exempt resources while maintaining eligibility for Medicaid Long Term Services and Supports. The announcement addresses application timing, trustee selection, five-year look-back documentation, and current…

Nassau County Medicaid Planning Lawyer Seth Schlessel Outlines Key Asset Protect …

Understanding which assets can be preserved during the Medicaid application process is critical, particularly in New York, where the financial thresholds and eligibility guidelines are highly specific. In a detailed blog post titled "What Assets Can You Keep When You Go on Medicaid?", Nassau County Medicaid planning lawyer Seth Schlessel (https://www.schlessellaw.com/what-assets-can-you-keep-when-you-go-on-medicaid/) of Schlessel Law PLLC breaks down the categories of assets applicants may retain without compromising their eligibility. The content…

Long Island Medicaid Planning Attorney Seth Schlessel Explains the Disadvantages …

Long Island Medicaid planning attorney Seth Schlessel (https://www.schlessellaw.com/disadvantages-of-a-medicaid-trust/) offers critical insight into the often-overlooked downsides of Medicaid Asset Protection Trusts (MAPTs), a popular estate planning tool for those aiming to preserve assets while qualifying for long-term care benefits. While these trusts can protect wealth from being depleted by nursing home costs, they also present legal and financial hurdles that require careful evaluation. At Schlessel Law PLLC, Seth Schlessel helps Long…

Long Island Medicaid Planning Attorney Seth Schlessel Explains Spousal Refusal i …

Long Island Medicaid planning attorney Seth Schlessel (https://www.schlessellaw.com/what-is-spousal-refusal-and-how-does-it-work/) provides insight into spousal refusal, a key legal strategy for protecting assets when one spouse requires long-term care. In Medicaid planning, spousal refusal allows a non-applicant spouse to legally decline to use their financial resources to pay for the care of the Medicaid applicant spouse. This approach is particularly relevant for married couples in New York who seek to safeguard their financial…