Press release

Commercial flood insurance Market to Reach $30.0 Billion, Globally, by 2033 at 14.1% CAGR: Allied Market Research

How is Commercial Flood Insurance Evolving with Technology and Data?Commercial flood insurance is a specific kind of business coverage that safeguards the business from flooding losses. Unlike other commercial property insurance, this policy covers flood-related losses. It also covers damage to buildings and loss or damage of business property because of flooding. It is applicable for companies operating in flood-prone areas because it would offset the huge cost to repair or replace buildings, equipment, inventory, and other assets involved. Coverage includes protection for the building's structure, such as walls, floors, and permanent fixtures, and personal property owned by the business, including furniture, machinery, and inventory.

NFIP, also managed by FEMA, offers standardized coverage with a specific limit. Businesses can also get policies directly from private insurers that offer more customized plans with a higher limit and more options. Securing commercial flood insurance reduces the risk of potential losses, and recovery during and after a flood can be faster and the operations continue. A report published by Allied Market Research states that the commercial flood insurance market is projected to register the fastest CAGR of 14.1% by 2033. The industry is witnessing growth due to rising frequency and intensity of floods, the growth of government programs and efforts to enhance floodplain management, and increase in number of insurance providers.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂: https://www.alliedmarketresearch.com/request-sample/A324203

The efficiency of parametric insurance in flood recovery

Parametric insurance is a new model that uses predefined criteria, such as rainfall or river levels, to provide quicker payouts than the traditional claims process. This is helpful in flood-prone areas, where fast access to finance can help in the recovery process. This model will utilize data from IoT-connected sensors that detect flooding and thus recover businesses more quickly. Parametric insurance is flexible coverage, and business organizations can create their policies as per the needs of specific flood risks and their financial requirements.

Parametric insurance does not involve damage assessments and paperwork. Since the payout is determined based on objective criteria rather than the actual losses, policyholders can eliminate the usual intricacy and delays involved in the claims process in conventional insurance.

The power of satellite imagery in insurance

The use of satellite imagery helps simplify the claims process because it provides pre- and post-flood assessments of the affected properties. Insurers can quickly evaluate the level of damage to buildings caused by flooding without necessarily making extensive on-site visits, thus speeding up claims processing and enhancing customer satisfaction.

he building coverage segment is expected to grow faster throughout the forecast period.

Based on the coverage type segment, building coverage held the highest market share in 2023, accounting for more than two-fifths of the global commercial flood insurance market revenue throughout the forecast period. The demand for building coverage is driven by unpredictable weather patterns and the frequency of extreme weather events, such as hurricanes and heavy rains, have heightened awareness of flood risks. This leads businesses to seek comprehensive coverage, including building coverage, to safeguard their operations, which drives market growth.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/A324203

Such efficiency is highly valued during mass disasters where conventional assessment techniques would be too slow or impracticable.

Satellite imagery supports predictive modeling by helping to forecast potential flooding events through weather patterns and soil conditions analysis. By examining multispectral images that assess soil moisture and terrain features, insurers can predict flood risks and formulate proactive strategies to minimize losses. This forecasting ability is crucial for insurers and policyholders in preparing for potential disasters.

Players

Assurant, Inc.

Chubb Group

FloodFlash Limited

Hylant Group, Inc.

Insurance America LLC

JMG Insurance Corp

Main Street America Insurance

Nationwide Mutual Insurance Company

Sutcliffe Insurance Brokers Limited

The Hartford

The report provides a detailed analysis of these key players in the global commercial flood insurance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

North America to maintain its dominance by 2033

Based on region, North America held the highest market share in terms of revenue in 2023, accounting for nearly two-fifths of the global commercial flood insurance market revenue throughout the forecast timeframe. The rising occurrence of floods due to climate change and the large presence of commercial flood insurance providers are expected to drive the growth of the commercial flood insurance market. In addition, the growing initiatives involving public-private partnerships are promoting the development of more comprehensive flood insurance products which are expected to boost market growth.

Get Your 250-Page Report Now (PDF with Detailed Insights, Charts, Tables, and Figures) @ https://bit.ly/3YxqMoq

🔰𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬🔰

Insurance Market https://www.alliedmarketresearch.com/insurance-market-A17037

Drone Insurance Market https://www.alliedmarketresearch.com/drone-insurance-market-A323694

Term Life Insurance Market https://www.alliedmarketresearch.com/term-life-insurance-market-A177239

Professional Liability Insurance Market https://www.alliedmarketresearch.com/professional-liability-insurance-market-A120260

Medical Loans Market https://www.alliedmarketresearch.com/medical-loans-market-A323693

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial flood insurance Market to Reach $30.0 Billion, Globally, by 2033 at 14.1% CAGR: Allied Market Research here

News-ID: 3853688 • Views: …

More Releases from Allied Market Research

Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion …

Allied Market Research published a new report, titled, "Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion by 2032." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

MarTech Market Witnessing CAGR of 18.5% Hit USD 1.7 Trillion by 2032

The global marketing technology market is experiencing growth due to several factors, including the increasing digital transformation, the surge in demand for personalized experience, and the proliferation of automation and efficiency. However, data privacy and compliance, and the high cost of implementation are expected to hamper market growth. Furthermore, the growing integration of AI and ML technologies and the increase in demand for real-time marketing are anticipated to provide lucrative…

Feedback Management Software Market Growing with CAGR of 12.9% Reach USD 28.7 Bi …

Allied Market Research published a new report, titled, "Feedback Management Software Market Growing with CAGR of 12.9% Reach USD 28.7 Billion by 2031 ." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry and…

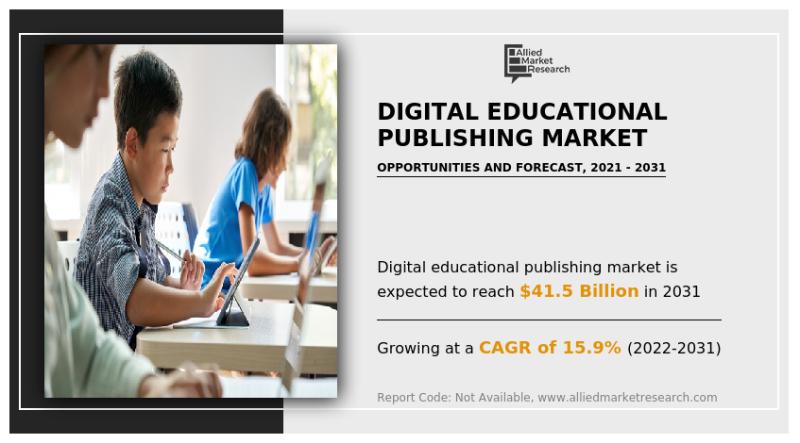

Digital Educational Publishing Market Growing at 15.9% CAGR Reach USD 41.5 Billi …

The Market report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers a valuable guidance to leading players, investors, shareholders, and startups in devising strategies for the sustainable growth and gaining competitive edge in the market.

The global Digital Educational Publishing Market was valued at $9.9 billion in 2021, and is projected to reach $41.5 billion by 2031, growing at…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…