Press release

Saudi Arabia Fintech Market Booms with Digital Payments and Regulatory Support

Mordor Intelligence has published a new report on the Saudi Arabia Fintech Market, offering a comprehensive analysis of trends, growth drivers, and future projections.Saudi Arabia's fintech sector is experiencing rapid growth, fueled by a young, tech-savvy population, robust digital infrastructure, and strong governmental support. As of 2025, the market is valued at USD 67.78 billion and is projected to reach USD 91.00 billion by 2030, reflecting a compound annual growth rate (CAGR) of over 6.07% during the forecast period.

This expansion aligns with the objectives of Saudi Vision 2030, which aims to diversify the economy and promote digital transformation across various sectors, including financial services.

Report Overview: https://www.mordorintelligence.com/industry-reports/saudi-arabia-fintech-market

Key Trends

1. Dominance of Digital Payments

The money transfer and payments segment continues to lead the Saudi fintech market, accounting for approximately 96% of the market share in 2024. This dominance is driven by initiatives such as Saudi Payments and its key brands-Mada, Esal, Sarie, and Sadad-which have significantly enhanced the digital payment infrastructure. The proliferation of fintech startups in this space, comprising about 41% of all fintech ventures in the country, further underscores the sector's growth.

2. Growth in Savings and Investments Platforms

The savings and investments segment is emerging as the fastest-growing area within Saudi Arabia's fintech landscape, with an anticipated growth rate of approximately 18% between 2024 and 2029. This surge is attributed to the rising adoption of digital investment platforms and robo-advisory services, supported by the Capital Market Authority's (CMA) initiatives to foster fintech innovations in equity crowdfunding, robo-advisory, and sukuk fractionalization.

3. Regulatory Support and Infrastructure Development

The Saudi Arabian government's commitment to digital transformation through Vision 2030 serves as a fundamental driver for the fintech market's growth. The establishment of dedicated organizations like Saudi Fintech demonstrates the government's proactive approach in creating a robust ecosystem for financial technology innovation.

Market Segmentation

The Saudi Arabian fintech market is segmented by service propositions, each contributing uniquely to the sector's expansion.

1. Money Transfer and Payments

Encompasses digital wallets, electronic payment solutions, and remittance services.

Supported by initiatives like Saudi Payments, enhancing the digital payment infrastructure.

2. Savings and Investments

Includes digital investment platforms, robo-advisory services, and personal finance applications.

Growth driven by CMA's support for fintech innovations in investment services.

3. Digital Lending and Lending Marketplaces

Comprises platforms offering personal and SME financing through digital channels.

Supported by regulatory frameworks from the Saudi Arabian Monetary Authority (SAMA).

4. Online Insurance and Insurance Marketplaces

Features insurtech platforms providing insurance aggregation and comparison services.

Aims to make insurance products more accessible and user-friendly.

Get a Customized Report Tailored to Your Requirements. - https://www.mordorintelligence.com/market-analysis/fintech

Key Players

The Saudi Arabian fintech market is characterized by a mix of established companies and innovative startups driving digital transformation in financial services. Notable players include:

Rasanah Technologies LLC: A prominent fintech company offering a range of digital financial solutions tailored to the Saudi market.

Lendo: Specializes in providing digital lending services, focusing on small and medium-sized enterprises (SMEs) to facilitate access to capital.

SURE: Offers comprehensive digital payment solutions, including mobile wallets and payment gateways, enhancing transaction efficiency.

Foodics: Provides fintech solutions integrated with point-of-sale systems, catering primarily to the food and beverage industry.

Sulfah: Focuses on consumable micro-lending, offering quick and accessible personal loans through a fully digital platform.

These companies are at the forefront of innovation, leveraging technology to enhance financial services and contribute to the market's growth.

Conclusion

Saudi Arabia's fintech market is poised for substantial growth, driven by advancements in digital payments, supportive regulatory frameworks, and a burgeoning interest in digital financial services. As the nation progresses towards the goals outlined in Vision 2030, the fintech sector is expected to play a pivotal role in shaping the future of financial services, offering innovative solutions that cater to the evolving needs of consumers and businesses alike.

Industry Related Reports

MENA Fintech Market: The MENA Fintech Market Report is categorized by Service Proposition (Money Transfer & Payments, Savings & Investments, Digital Lending & Lending Marketplaces, Online Insurance & Insurance Marketplaces, and Others) and Country (United Arab Emirates, Saudi Arabia, Bahrain, Qatar, Iran, Egypt, Israel, and the Rest of MENA).

To know more visit this link: https://www.mordorintelligence.com/industry-reports/mena-fintech-market

UAE Fintech Market: The report covers Fintech Companies in the Dubai Region and segments the market by Service Proposition (Money Transfer & Payments, Savings & Investments, Digital Lending & Lending Marketplaces, and Online Insurance & Insurance Marketplaces).

To know more visit this link: https://www.mordorintelligence.com/industry-reports/uae-fintech-market

China Fintech Market: The China Fintech Market Report is categorized by Service Segments: Digital Payments, Personal Finance, Alternative Lending, and Alternative Financing.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/china-fintech-market

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Fintech Market Booms with Digital Payments and Regulatory Support here

News-ID: 3853683 • Views: …

More Releases from Mordor Intelligence

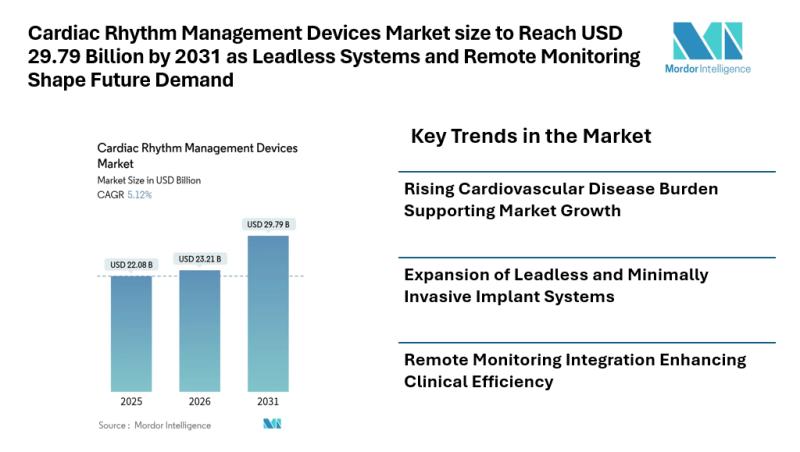

Cardiac Rhythm Management Devices Market size to Reach USD 29.79 Billion by 2031 …

Mordor Intelligence has published a new report on the cardiac rhythm management devices market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Cardiac Rhythm Management Devices Market Overview

According to Mordor Intelligence, the cardiac rhythm management devices market is set to expand from USD 22.08 billion in 2025 to USD 23.21 billion in 2026 and is projected to reach USD 29.79 billion by 2031, registering a…

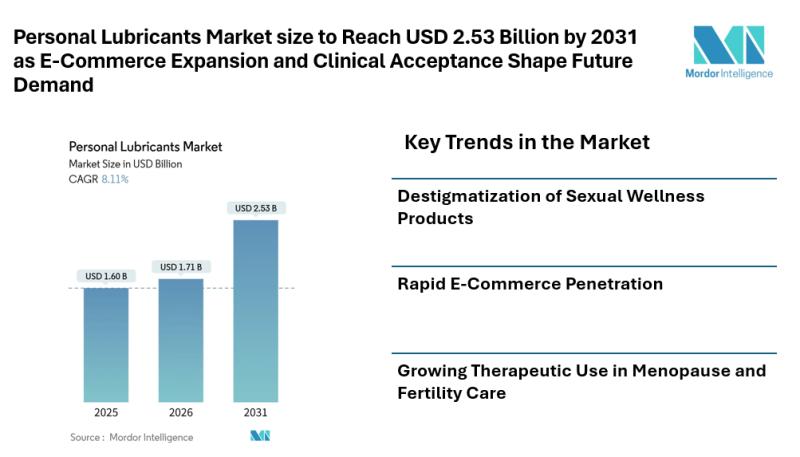

Personal Lubricants Market size to Reach USD 2.53 Billion by 2031 as E-Commerce …

Mordor Intelligence has published a new report on the personal lubricants market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the personal lubricants market size is estimated at USD 1.71 billion in 2026 and is projected to reach USD 2.53 billion by 2031, registering a CAGR of 8.11% during the forecast period. These steady personal lubricants market growth reflects wider…

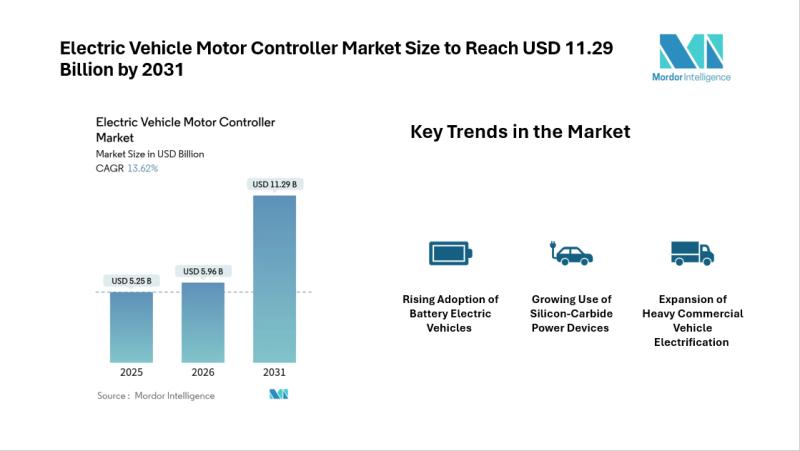

Electric Vehicle Motor Controller Market Size to Reach USD 11.29 Billion by 2031 …

Electric Vehicle Motor Controller Market Overview

According to Mordor Intelligence, the electric vehicle motor controller market size is projected to reach USD 11.29 billion by 2031, growing from USD 5.96 billion in 2026 at a CAGR of 13.62% during the forecast period. The electric vehicle motor controller market forecast reflects steady expansion supported by stricter emission regulations, rising battery electric vehicle adoption, and the increasing use of silicon-carbide power devices.…

Beverage Market Size to Reach USD 2.67 Trillion by 2031, Driven by Health and Su …

Introduction: Beverage Market Growth Outlook

According to a research report by Mordor Intelligence, the global Beverage Market is projected to grow from an estimated USD 2.03 trillion in 2026 to USD 2.67 trillion by 2031, reflecting a steady CAGR of 5.65% over the forecast period. This growth is supported by increasing consumer awareness around health, wellness, and sustainable consumption, along with the rising demand for premium and functional beverages. Non-alcoholic…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…