Press release

AI in Financial Planning and Wealth Management Market Future Trends and Scope Analysis Report

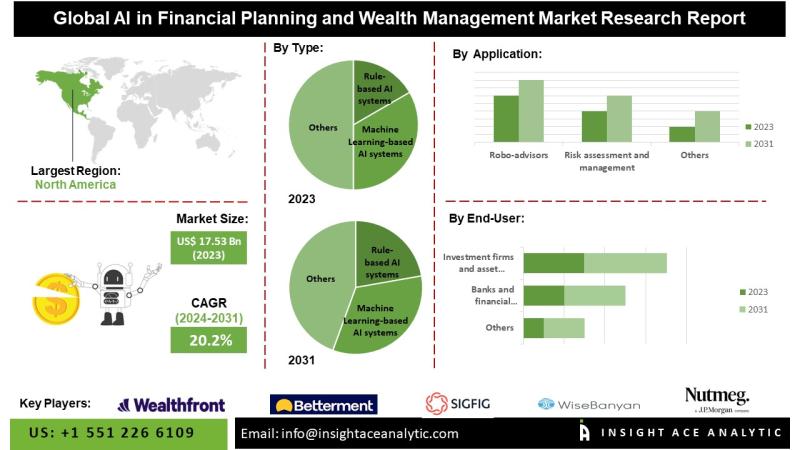

The AI in Financial Planning and Wealth Management Market Size is valued at USD 17.53 billion in 2023 and is predicted to reach USD 73.34 billion by the year 2031 at a 20.2% CAGR during the forecast period for 2024-2031.AI in the financial planning and wealth management industry has been growing in recent years, although leading wealth managers have been using AI and machine learning for years. As AI technology advances, the way the financial sector operates changes, enabling significant improvements and creating new opportunities for wealth management firms. According to OT, driven by client demand and increased expectations of wealth management services, AI is enabling customization and personalization at scale, targeting improved communication with clients, which is more seamless, value-adding, and real-time.

Request A Sample:-

https://www.insightaceanalytic.com/request-sample/2742

In addition, AI can help relationship managers in wealth management build stronger relationships with clients, helping them, based on best practices, to become more effective in client acquisition, client development, client activation, and client retention.

Important drivers of this market include the rising adoption of AI-driven robo-advisors, which provide automated, algorithm-based portfolio management advice with minimal human intervention. These platforms offer cost-effective, personalized financial planning to a broader audience, including those previously underserved by traditional financial advisors. Additionally, wealth management firms must comply with a vast array of regulations, which can vary between jurisdictions and evolve. Compliance requirements seek to protect clients' interests, maintain market integrity, and prevent financial crime. AI can help wealth management firms and managers comply with rules and regulations by automating tasks such as identifying suspicious activities, monitoring transactions, and reporting them to regulators. However, AI must be transparent and accountable.

Competitive Landscape

Some Major Key Players In The AI in Financial Planning and Wealth Management Market:

• Wealthfront

• Betterment

• Personal Capital

• FutureAdvisor

• SigFig

• WiseBanyan

• Nutmeg

• Acorns

• Charles Schwab Intelligent Portfolios

• Vanguard Personal Advisor Services

• BlackRock

• Fidelity Go

• Other Market Players

Market Segmentation:

The AI in Financial Planning and Wealth Management market is segmented on the basis of product, application, end-user, and functionality. As per the product, the market is segmented into rule-based Al systems, machine learning-based Al systems, and natural language processing (NLP) Al systems. By application, the market is segmented into Robo-advisors, Risk assessment and management, Fraud detection and prevention, Customer service and support, personalized financial recommendations, Market analysis and prediction, and Portfolio optimization. Based on end-users, the market is segmented into banks and financial institutions, investment firms and asset managers, insurance companies, individual investors, and customers. The functionality segment includes Data analysis and processing, automated investment management, Cognitive computing and decision-making, Chatbots and virtual assistants, Predictive analytics, and forecasting.

Based On The Product, The Rule-Based Al Systems Segment Accounts For A Major Contributor To The Market.

The Rule-based Al systems category is expected to lead with a major share in the global AI in Financial Planning and Wealth Management market. These systems operate on predefined rules and logic to provide financial advice and manage wealth. They are specifically useful for automating repetitive tasks, such as portfolio rebalancing, tax-loss harvesting, and compliance checks. Rule-based AI systems enhance efficiency and reduce operational costs by eliminating manual interventions. In North America, the adoption of these systems is driven by a mature financial sector and stringent regulatory requirements. At the same time, the Asia Pacific region sees rapid growth due to increasing digitalization and financial inclusion efforts. These systems are crucial for delivering consistent and reliable financial services, thereby improving client satisfaction and trust in AI-driven financial planning solutions.

The Robo-Advisors Segment Witnessed Growth At A Rapid Rate.

Enquiry Before Buying:

https://www.insightaceanalytic.com/customisation/2742

The robo-advisors segment is projected to grow rapidly in the global AI in Financial Planning and Wealth Management market owing to automated platforms leveraging AI algorithms to provide significant investment advice and portfolio management with minimal human intervention. Robo-advisors analyze vast amounts of financial data, assess risk tolerance, and offer tailored recommendations, making investment accessible and affordable to a broader audience. Their ability to operate 24/7, coupled with lower fees compared to traditional financial advisors, has fueled their popularity, especially among tech-savvy millennials and cost-conscious investors. As AI technology continues to advance, robo-advisors are expected to become more sophisticated, offering increasingly precise and customized financial planning solutions, thereby driving significant growth in the financial planning and wealth management market.

In The Region, North America's AI In The Financial Planning And Wealth Management Market Holds A Significant Revenue Share.

The North American AI in Financial Planning and Wealth Management market holds a significant revenue share due to several factors. The region boasts advanced technological infrastructure, high adoption rates of AI technologies, and a robust financial sector. The presence of leading financial institutions and wealth management firms drives the demand for AI solutions to enhance customer experiences, optimize investment strategies, and improve operational efficiency. Additionally, regulatory support for technological innovation and a well-established data analytics ecosystem further contribute to market growth. The increasing need for personalized financial advice and the growing adoption of AI-driven tools for risk management, fraud detection, and compliance are key drivers propelling the market's expansion in North America.

Get Specific Chapter/Information From The Report:

https://www.insightaceanalytic.com/customisation/2742

Segmentation of AI in Financial Planning and Wealth Management Market-

AI in Financial Planning and Wealth Management Market By Type-

• Rule-based Al systems

• Machine Learning-based Al systems

• Natural Language Processing (NLP) Al systems

AI in Financial Planning and Wealth Management Market By Application-

• Robo-advisors

• Risk assessment and management

• Fraud detection and prevention

• Customer service and support

• Personalized financial recommendations

• Market analysis and prediction

• Portfolio optimization

AI in Financial Planning and Wealth Management Market By End-user-

• Banks and financial institutions

• Investment firms and asset managers

• Insurance companies

• Individual investors and customers

AI in Financial Planning and Wealth Management Market By Functionality-

• Data analysis and processing

• Automated investment management

• Cognitive computing and decision-making

• Chatbots and virtual assistants

• Predictive analytics and forecasting

AI in Financial Planning and Wealth Management Market By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Get more information:

https://www.insightaceanalytic.com/report/ai-in-financial-planning-and-wealth-management-market/2742

Contact us:

info@insightaceanalytic.com

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

Twitter: https://twitter.com/Insightace

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.https://www.insightaceanalytic.com/images_data/148861653.JPG

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in Financial Planning and Wealth Management Market Future Trends and Scope Analysis Report here

News-ID: 3853665 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

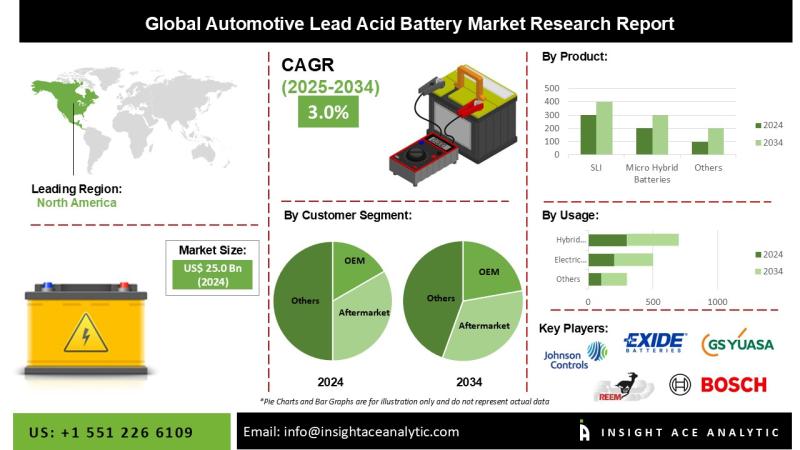

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

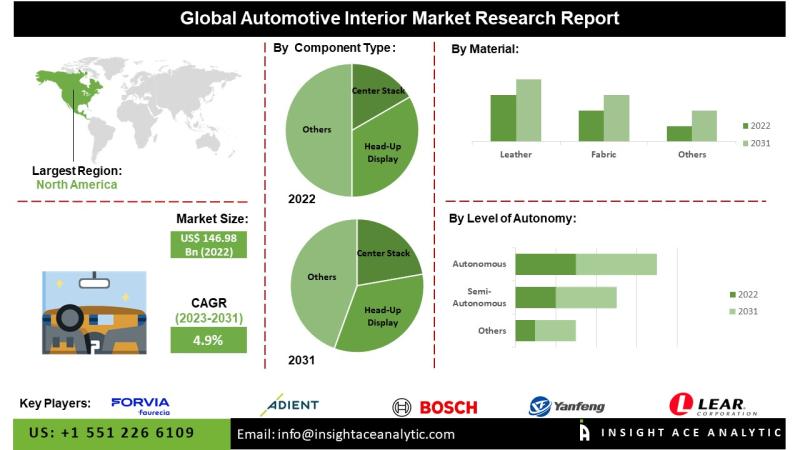

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

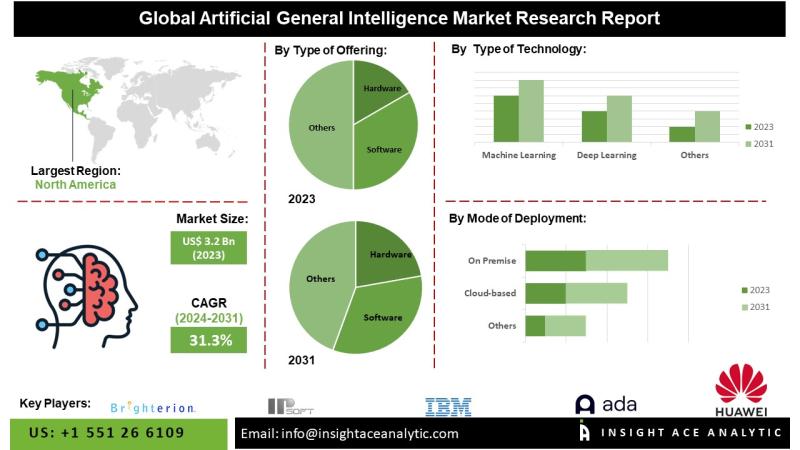

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…