Press release

RPA in Insurance Market : Top Players Vuram, UiPath, Automation Anywhere, Inc., Aspire Systems, Pegasystems

How has the Introduction of RPA in Insurance Industry Improved the Operational Efficiency of Insurance Companies?In most developing countries, the maximum share of an average household savings is spent on expenses related to education and healthcare. As per many imminent economists, most of these expenses are recurring in nature, thereby keeping a check on the savings of middle-income households. Moreover, expenditure due to unforeseen circumstances and accidents further reduces the purchasing power of these households. In such a scenario, a comprehensive financial security mechanism like insurance becomes important to help middle-class individuals improve their fiscal stability.

☑𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 :

https://www.alliedmarketresearch.com/request-sample/A53549

As per a research paper published by Susan Holliday, Fiona Stewart, and Inna Remizova in Open Knowledge Repository publications, insurance plays an extremely important role in helping countries achieve their UN Sustainable Development Goals related to social inclusion, economic growth, and environmental protection. Hence, governments in emerging economies such as the U.S., China, India, Germany, the UK, France, Brazil, Indonesia, and more, have launched schemes to provide indemnity protection to middle-income populations in various sectors, including education, healthcare, agriculture, aviation, environment, and others.

However, the main problem faced by the insurance sector in these countries is the low penetration of services due to lack of awareness and financial literacy among the population. Moreover, processes involved in traditional insurance claims are quite tedious and expensive which further deters consumers from subscribing to such policies. To tackle these issues, insurance companies are taking help from modern digital technologies to improve their operational reach and make service delivery easier. One such innovation that has played a major role in broadening the scope of the insurance sector is robotic process automation.

☑𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠:

https://www.alliedmarketresearch.com/purchase-enquiry/A53549

Integrating Robotic Process Automation into Insurance Processes

Robotic process automation, also called software robotics, is a business automation technology that mainly involves the handling of repetitive processes associated with different enterprise applications. A study on robotic process automation published by IBM, a multinational technology company, states that RPA involves intelligent automation which helps enterprises perform certain tasks proactively, without any human intervention, thus enhancing productivity and efficiency in the long run.

Currently, RPA solutions are widely used in various end-use industries, including manufacturing, banking, insurance, retail, healthcare, and more. Recently, Allied Market Research published a report on the RPA in insurance market, which highlights that the industry is expected to register a revenue of $1.2 billion by 2031. The sector accounted for $98.6 million in 2021 and is predicted to surge at a CAGR of 28.3% during 2021-2031. Rise in adoption of advanced data analytics solutions by insurers to make informed business decisions has created numerous opportunities for the growth of the market.

As compared to other digital technologies, the integration of robotic process automation in the insurance process is easier primarily because no specialized coding is required from the software development side. These solutions offer easy drag-and-drop functionalities that make it straightforward even for non-technical staff in an insurance firm to execute the protocols associated with the RPA-powered software application.

Deployment of RPA in Claims Processing and Underwriting

Over the years, robotic process automation has been employed to simplify different insurance-related tasks. One area where RPA has made a significant impact is in claims processing and underwriting. An insurance claim is an official request made by the policyholder to the insurer for the completion of the payment as per the rules and norms set out in the insurance policy. Once the claim is made by the customer, the company then begins the claim investigation wherein the extent of damage or loss is analyzed, and the liable parties are identified. Also, the witnesses, if any, are called upon to corroborate the facts, thus improving the accuracy of the process. At the same time, another team is tasked with reviewing the insurance policy to find out if any deductibles are involved as part of the agreement. Once these tasks are completed, the payment is finalized by the insurer and the transaction is completed.

Robotic process automation tools contribute significantly to claims investigation processes by extracting data from multiple sources and verifying the information automatically. This improves the precision and accuracy exponentially and reduces the chances of human-induced errors significantly. Moreover, software bots that are essential elements of these tools help collect unstructured data and identify the patterns in the gathered information. The primary aim behind deploying these tools is to accelerate the processing of policyholder claims by streamlining the administration, thus ensuring customer satisfaction in the long run.

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://www.alliedmarketresearch.com/checkout-final/ec3974bb8048a683a27f7fed1d36dc81

Apart from claims processing, RPA tools also aid insurance companies in simplifying underwriting tasks. Underwriting is the most important step of indemnity policy formulation as it involves the determination of coverage eligibility, risk evaluation, and establishment of price norms. These procedures enable insurance firms to analyze the creditworthiness of the policyholder or lender, thereby helping them in framing appropriate policies. In the long run, this reduces the chances of default and assists companies in improving the health of their balance sheets. In the last few years, RPA tool developers have been integrating AI and machine learning algorithms to process large amounts of data at high speeds to enhance their operational efficiency.

In December 2024, Pints.ai, an AI platform developer, announced the launch of Auto-thought, an automation solution specifically designed for insurance companies. Powered by generative AI technology and small language models, this tool helps insurers in improving their business workflows related to claims summarization, advisor assistance, and product comparisons. As per the press release issued by Pints.ai, Autothought has been developed to aid claim managers in automating the reviewing of insurance documents and providing personalized insights to customers based on their preferences. Partha Rao, CEO of Pints.ai, highlighted that the platform has been designed keeping in mind the evolving dynamics of the insurance sector.

Use of RPA in Fraud Detection in Insurance

Rise in use of robotic process automation, along with AI and machine learning, to detect fraudulent claims is one of the latest trends in the industry. The deployment of RPA in insurance mainly helps companies perform background checks of potential customers and policyholders, thus increasing the assessment quality in the long run. Also, the use of AI-based tools assists companies in analyzing behavioral patterns, transaction history, consumer preferences, and more. The data obtained through these sources is then studied for forecasting purposes, thus enabling insurers to predict instances of fraudulent and unauthorized claims. Financial studies have shown that the use of RPA tools reduces the operational costs of the firm and ultimately increases its profitability.

Recently, many leading technology businesses have launched advanced RPA solutions to address the demands of the insurance sector and improve their revenue share. For example, in October 2024, Neutrinos, an AI tools developer, unveiled a new Intelligent Automation Platform developed to help companies transition to digital insurance models. The low-code innovation foundry and unified control management functionality offered by this tool make it an ideal solution for insurance companies looking to expand their service delivery mechanisms.

Similarly, Esker, a software company, announced the launch of an automated tool for insurance order processing using efficient data extraction methodologies. In October 2024, DataSnipper, a technology firm, unveiled its AI-power audit automation solution developed for indemnity service providers. Such product launches are expected to contribute significantly to the expansion of the RPA in the insurance industry in the coming period.

In conclusion, the RPA in insurance market is predicted to witness tremendous growth in the coming period due to a rise in demand for insurance policies in developed and developing countries. Furthermore, the growing applicability of robotic process automation in claims processing, underwriting, and fraud detection has impacted the sector positively.

🔰𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬🔰

Premium Finance Market https://www.alliedmarketresearch.com/premium-finance-market-A15358

Portfolio Management Software Market https://www.alliedmarketresearch.com/portfolio-management-software-market-A10393

Travel Credit Card Market https://www.alliedmarketresearch.com/travel-credit-card-market-A14957

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release RPA in Insurance Market : Top Players Vuram, UiPath, Automation Anywhere, Inc., Aspire Systems, Pegasystems here

News-ID: 3853590 • Views: …

More Releases from Allied Market Research

Insulation Coating Market to Grow at a Surprising CAGR of 5.9% by 2033

Allied Market Research published a report, titled, "Insulation Coating Market by Type (Acrylic, Epoxy, Polyurethane, YSZ, Mullite, Others), by End User (Aerospace, Automotive, Marine, Industrial, Building and Construction, Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". According to the report, the "insulation coating market" was valued at $10.2 billion in 2023, and is estimated to reach $17.9 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.…

![[CAGR of 6.7%] Biocatalyst Market shows positive signs of growth with fastest CAGR by 2032](https://cdn.open-pr.com/L/1/L113826587_g.jpg)

[CAGR of 6.7%] Biocatalyst Market shows positive signs of growth with fastest CA …

Allied Market Research published a report, titled, "Biocatalyst Market by Source (Plant, Animal, Microorganism), By Type (Oxidoreductases, Transferases, Hydrolases, and Others), By End-Use Industry (pharmaceutical, food & beverage, water treatment, biofuel, and others): Global Opportunity Analysis and Industry Forecast, 2023-2032." According to the report, the global biocatalyst industry was valued at $1.1 billion in 2022 and is estimated to reach $2.1 billion by 2032, exhibiting a CAGR of 6.7% from…

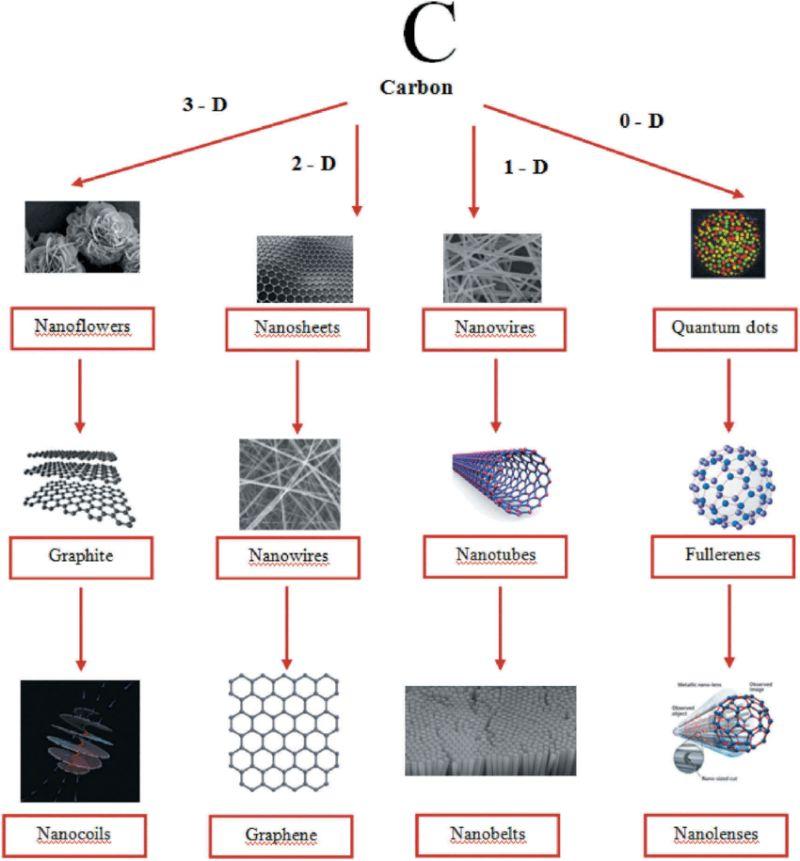

Carbon Filler Based Nanocomposite Market Insights, Trends and Forecast to 2033

A report by Allied Market Research provides an in-depth analysis of the competitive landscape in the carbon filler based nanocomposite industry, equipping key players with the insights needed to drive revenue growth and sustain a competitive edge. The report evaluates market dynamics and highlights strategic investment opportunities by utilizing analytical frameworks like Porter's Five Forces. It also offers data-driven guidance for strategic planning through key performance indicators such as CAGR…

Fluorite Market to Exhibit a Remarkable CAGR of 5.3% from 2025 to 2033

Allied Market Research published a report, titled, "Fluorite Market by Deposit Type (Hydrothermal Veins and Stockworks, Stratiform Replacement Deposits, and Others), Grade (Acid Grade Fluorite, Ceramic Grade Fluorite, and Metallurgical Grade Fluorite), and End-use Industry (Chemical Industry, Building Material Industry, Metallurgical Industry, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". According to the report, the "fluorite market" was valued at $3.6 billion in 2023, and is estimated to reach…

More Releases for RPA

Robotic Process Automation (RPA) Market Size Analysis by Application, Type, and …

USA, New Jersey- According to Market Research Intellect, the global Robotic Process Automation (RPA) market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Robotic Process Automation (RPA) market is witnessing rapid expansion as organizations across industries seek to streamline operations and reduce operational costs. The…

Top Factor Driving RPA And Hyperautomation Market Growth in 2025: Robotics' Asce …

What combination of drivers is leading to accelerated growth in the rpa and hyperautomation market?

The rise in prominence of robotics across diverse industries is fueling the expansion of the RPA and Hyper automation markets. An automated machine known as a robot can execute specific tasks rapidly and accurately with minimal human intervention. Hyper automation facilitates automation of any recurring task carried out by business operators by marrying robotic process automation…

Rubber Process Analyzers(RPA) Market by Types (RPA 2000, RPA 8000, RPA 9000, Oth …

The global Rubber Process Analyzers (RPA) market has the potential to grow by xx million USD with a growing CAGR in the forecast period from 2021 to 2026.

Global Rubber Process Analyzers(RPA) Market Overview

The market research report offers great competitor analysis of the industries and highlights the key aspect of their business like success stories, market development and growth rate.A rubber process analyzer is a type of instrument that measures the…

RPA Platform Training Market Is Booming Worldwide | UiPath Training, The RPA Aca …

Global RPA Platform Training Market Size, Status and Forecast 2020-2026 , Covid 19 Outbreak Impact research report added by Report Ocean, is an in-depth analysis of market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography. It places the market within the context of the wider RPA Platform…

RPA Platform Training Market SWOT Analysis by Key Players: UiPath Training, The …

Latest 2020 COVID Edition

HTF MI Latest publication of the " Global RPA Platform Training Market Size, Status and Forecast 2019-2025 " examines the market for RPA Platform Training and the various changing dynamics and growth trends. The 100+ page report reviews the growing market for Global RPA Platform Training, market size and estimation till 2026 by key business segments and applications, plus the latest trends, opportunities and challenges.

Get an Inside…

RPA Platform Training Market Rising Growth With Keyplayer: UiPath Training, The …

A new Profession Intelligence Report released by Stats and Reports with the title Global RPA Platform Training Market "can grow into the most important market in the world that has played an important role in making progressive impacts on the global economy. Global RPA Platform Training Market Report presents a dynamic vision to conclude and research market size, market hope and competitive environment. The study is derived from primary and…