Press release

NY Asset Protection Lawyer Seth Schlessel Releases Insightful Article on Spousal Lifetime Access Trusts

NY asset protection lawyer Seth Schlessel (https://www.schlessellaw.com/what-is-a-spousal-lifetime-access-trust/), of Schlessel Law PLLC, has shed light on the importance and advantages of Spousal Lifetime Access Trusts (SLATs) in a recently published article. Designed to protect assets, preserve wealth, and reduce tax burdens, SLATs are an invaluable tool for families seeking long-term financial security. With the rising need for strategic estate planning, Seth Schlessel underscores how these trusts can serve as an effective solution for safeguarding one's legacy.A Spousal Lifetime Access Trust is an irrevocable trust created to benefit a spouse while securing wealth for future generations. According to Seth Schlessel, SLATs allow the grantor spouse to transfer assets into the trust, benefiting the non-grantor spouse during their lifetime. "These trusts provide financial security to families while leveraging tax exemptions and reducing the taxable estate," NY asset protection lawyer Seth Schlessel explains. This aspect is particularly vital under New York trust laws, where asset protection strategies are often nuanced.

The NY asset protection lawyer emphasizes that the primary benefit of a SLAT lies in its ability to minimize estate taxes and protect assets from creditors. Through a reduction of the size of the taxable estate through lifetime gifts, SLATs shield wealth and ensure it remains available for future generations. This dual-purpose approach of tax reduction and asset protection makes SLATs a valuable addition to any estate planning strategy.

SLATs are particularly advantageous for those with federally taxable estates. With the federal lifetime gift tax exemption currently set at $13.61 million per individual for 2024, SLATs enable substantial tax-free gifting. Seth Schlessel points out that transferring significant assets into a SLAT not only reduces the taxable estate but also safeguards the financial needs of the non-grantor spouse through asset distributions.

The irrevocable nature of SLATs is another key feature. Once the trust is established, the grantor relinquishes control over the assets, ensuring robust legal protections. However, Seth Schlessel notes that careful drafting is necessary to prevent complications, such as triggering the reciprocal trust doctrine, which can negate tax benefits. "Selecting a competent trustee and structuring the trust appropriately are critical steps to maximize its advantages," Schlessel advises.

In addition to benefiting the non-grantor spouse, SLATs can include children and grandchildren as beneficiaries. Seth Schlessel highlights this multi-generational aspect, explaining that SLATs can be structured to provide ongoing financial support to descendants. Through the inclusion of provisions for health, education, maintenance, and support, these trusts allow wealth to be preserved across generations while complying with legal and tax requirements.

However, Schlessel warns of potential risks, such as the loss of indirect access to the trust in cases of divorce or the non-grantor spouse's passing. "Provisions can be included to address these scenarios, such as redirecting funds to the grantor or terminating the ex-spouse's interest in the trust," Schlessel explains. These considerations highlight the importance of consulting an experienced NY asset protection lawyer when creating a SLAT.

Establishing a SLAT involves managing various legal and financial aspects, particularly under New York's trust laws. As Seth Schlessel notes, the trust must be structured to adapt to changing circumstances, maintaining uninterrupted access to assets for the non-grantor spouse. Additionally, while the assets in a SLAT are protected from creditors, they do not receive a step-up in cost basis at the grantor's death, potentially resulting in capital gains tax liabilities for beneficiaries.

Despite these challenges, the advantages of a SLAT often outweigh its drawbacks. "SLATs provide a strategic way to achieve asset protection and tax efficiency while securing financial stability for your family," says Schlessel. For individuals and families with significant assets, this estate planning tool offers a comprehensive solution for meeting both immediate and long-term financial goals.

Leveraging Spousal Lifetime Access Trusts can allow families to reduce estate taxes, protect assets, and help ensure wealth is preserved for future generations. Seth Schlessel and the team at Schlessel Law PLLC are committed to guiding clients through the complex aspects of SLATs, providing tailored solutions that align with their unique needs and goals.

About Schlessel Law PLLC:

Schlessel Law PLLC is a trusted name in asset protection and estate planning in New York. With a commitment to providing personalized legal services, the firm can help clients tackle complex trust laws to achieve financial stability and security for their families. From Spousal Lifetime Access Trusts to other estate planning strategies, Schlessel Law PLLC is dedicated to protecting the wealth and legacy of their clients.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=BPOqyPyFEjE

GMB: https://www.google.com/maps?cid=7387587768064061142

Email and website

Email: seth@schlessellaw.com

Website: http://www.schlessellaw.com/

Media Contact

Company Name: Schlessel Law PLLC

Contact Person: Seth Schlessel

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=ny-asset-protection-lawyer-seth-schlessel-releases-insightful-article-on-spousal-lifetime-access-trusts]

Phone: (516) 574-9630

Address:34 Willis Ave Suite 300

City: Mineola

State: New York 11501

Country: United States

Website: https://www.schlessellaw.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release NY Asset Protection Lawyer Seth Schlessel Releases Insightful Article on Spousal Lifetime Access Trusts here

News-ID: 3852356 • Views: …

More Releases from ABNewswire

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

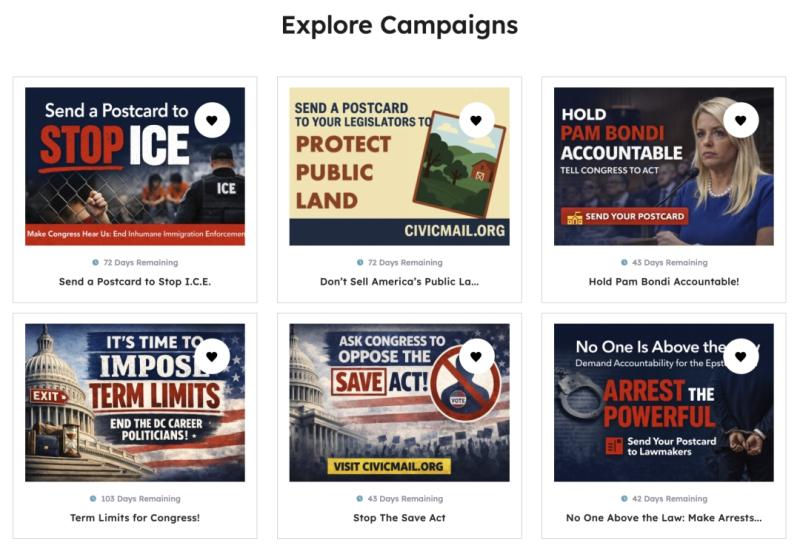

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

More Releases for Schlessel

Long Island Medicaid Planning Attorney Seth Schlessel Clarifies Medicaid's Estat …

Medicaid estate recovery can pose a significant risk to the financial legacy of individuals who rely on long-term care benefits. In a recent article titled "What is Medicaid's Estate Recovery Program?", Long Island Medicaid planning attorney Seth Schlessel (https://www.schlessellaw.com/what-is-medicaids-estate-recovery-program/) provides a clear explanation of how Medicaid may seek to reclaim funds after a recipient's death. The article, published by Schlessel Law PLLC, discusses the rules and limitations of the estate…

Long Island Trust Lawyer Seth Schlessel Explains Grantor Trusts in New York

A grantor trust is a key estate planning tool that allows individuals to manage assets, reduce taxes, and ensure a smooth transfer of wealth. Long Island trust lawyer Seth Schlessel (https://www.schlessellaw.com/what-is-a-grantor-trust-in-new-york/) provides insights into how these trusts function under New York law and their role in financial planning. At Schlessel Law PLLC, he assists clients in structuring trusts that align with their long-term goals.

Under New York law, a grantor is…

Long Island Trust Lawyer Seth Schlessel Explains the Benefits of a Dynasty Trust

Planning for the future requires more than just wealth transfer; it involves establishing a structure that preserves financial security for multiple generations. A dynasty trust is a tool that allows families to protect their assets, reduce tax burdens, and maintain control over how wealth is distributed over time. Long Island trust lawyer Seth Schlessel (https://www.schlessellaw.com/what-is-a-dynasty-trust/) discusses the advantages of dynasty trusts and how they operate under New York law.

A dynasty…

Long Island Medicaid Planning Attorney Seth Schlessel Explains Spousal Refusal i …

Long Island Medicaid planning attorney Seth Schlessel (https://www.schlessellaw.com/what-is-spousal-refusal-and-how-does-it-work/) provides insight into spousal refusal, a key legal strategy for protecting assets when one spouse requires long-term care. In Medicaid planning, spousal refusal allows a non-applicant spouse to legally decline to use their financial resources to pay for the care of the Medicaid applicant spouse. This approach is particularly relevant for married couples in New York who seek to safeguard their financial…

Nassau County Medicaid Planning Attorney Seth Schlessel Explains the Medicaid Sp …

Nassau County Medicaid planning attorney Seth Schlessel (https://www.schlessellaw.com/spend-down-medicaid-in-new-york/) provides essential information on the Medicaid Spend Down process, a crucial financial strategy for individuals seeking to qualify for Medicaid despite having income or assets above the eligibility limits. Through Schlessel Law PLLC, he helps individuals navigate Medicaid rules, ensuring access to essential healthcare services.

Medicaid Spend Down allows individuals who exceed Medicaid's financial thresholds to qualify by allocating excess income toward medical…

Nassau County Elder Law Attorney Seth Schlessel Explains Elder Law in New York

Nassau County elder law attorney [https://www.schlessellaw.com/long-island-elder-law-attorney/] Seth Schlessel of Schlessel Law PLLC has published an informative article discussing elder law in New York. The article provides essential insights into legal matters affecting seniors and aims to help older adults and their families make informed decisions about their future while protecting their legal and financial interests.

Elder law encompasses a range of legal issues specifically affecting aging individuals and their families. The…