Press release

Capital Exchange Ecosystem Market to Reach $1.8 Trillion, Globally, by 2033 at 5.6% CAGR: Allied Market Research

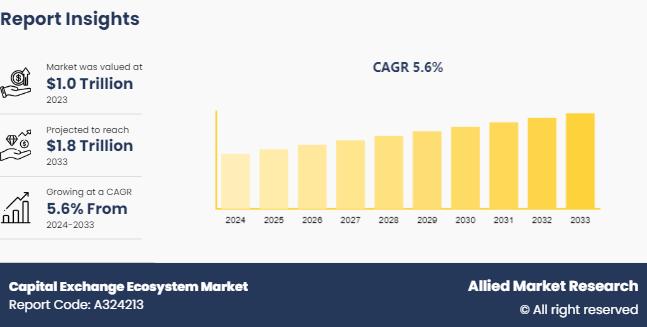

Allied Market Research published a report, titled, "Capital Exchange Ecosystem Market by Market Composition (Primary Market and Secondary Market), by Capital Market (Stocks and Bonds), Stock Type (Common and Preferred, Growth Stock, Value Stock and Defensive Stock), and Bond Type (Government, Corporate, Mortgage and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". According to the report, the capital exchange ecosystem market was valued at $1.0 trillion in 2023, and is estimated to reach $1.8 trillion by 2033, growing at a CAGR of 5.6% from 2024 to 2033.Get Your Sample Report & TOC Today: https://www.alliedmarketresearch.com/request-sample/A324213

Prime Determinants of Growth

The global capital exchange ecosystem market is experiencing growth due to several factors such as the growing developments in capital markets, favorable government policies, including fiscal and monetary measures, and increasing investor confidence and behavior to increase market participation and investment. However, the lack of financial literacy and liquidity constraints, along with the concerns about technological risks and cyber threats hinder market growth to some extent. Moreover, the rising integration of financial technology (Fintech) innovations, along with the growing emphasis on environmental, social, and governance (ESG) factors in emerging markets offer remunerative opportunities for the expansion of the global capital exchange ecosystem market.

Purchase This Comprehensive Report (PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/3AjuPKV

Segment Highlights

The secondary market segment is expected to lead the market throughout the forecast period.

Based on the market composition, the secondary market held the highest market share in 2023, accounting for about half of the global capital exchange ecosystem market revenue throughout the forecast period. The demand for the secondary market is driven by its continuous nature and high volume of transactions. It provides crucial functions such as liquidity, price discovery, and the ability to manage risk and diversify portfolios. In addition, continuous innovations such as algorithmic trading, electronic trading platforms, and high-frequency trading have increased the efficiency and speed of transactions in the secondary market, which drives market growth globally.

The stocks segment is expected to register the largest share throughout the forecast period.

Based on the capital market, the stock segment held the highest market share in 2023, accounting for nearly three-fifths of the global capital exchange ecosystem market revenue. This growth can be attributed to stocks being highly liquid assets, implying that they can be easily bought and sold on stock exchanges. This liquidity ensures that investors can quickly enter or exit positions, making stocks an attractive investment vehicle. Moreover, the robust developments in technology and online trading platforms have made it easier for individuals to participate in the stock market. These factors are projected to accelerate the growth of the market in this segment.

The common and preferred stock segment is expected to register the largest share throughout the forecast period.

Based on stock type, the common and preferred stock segment held the highest market share in 2023, accounting for nearly half of the global capital exchange ecosystem market revenue. This growth can be attributed to the common and preferred stocks offering high liquidity, growth potential, and inclusion in major indices. Thus, it attracts a wide range of investors, from those seeking capital appreciation to those interested in influencing corporate governance, which is expected to accelerate the growth of the market in this segment.

The government bond segment is expected to register the largest share throughout the forecast period.

Based on bonds, the government bond segment held the highest market share in 2023, accounting for nearly half of the global capital exchange ecosystem market revenue. Government bonds generally tend to be high in demand due to their low-risk profile, high liquidity, and role as a benchmark in the financial markets making them a cornerstone for investors seeking stability and safety. This factor is expected to drive the market growth in this segment over the forecast period.

Get More Information Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A324213

North America to maintain its dominance by 2033

Based on region, North America held the highest market share in terms of revenue in 2023, accounting for nearly two-fifths of the global capital exchange ecosystem market revenue throughout the forecast timeframe. The growth is primarily driven by the growing participation of retail investors due to increased financial literacy and access to online trading platforms, along with the rapid advancements in financial technology. In addition, the increasing focus on ESG criteria by investors and companies drives the growth of sustainable investing, which is expected to drive the demand for the capital exchange ecosystem market.

Players

BSE Ltd.

Euronext Group

Hong Kong Exchanges and Clearing Limited

Intercontinental Exchange, Inc.

Japan Exchange Group, Inc.

London Stock Exchange Group plc

Nasdaq, Inc.

National Stock Exchange of India Limited (NSE)

Saudi Exchange

Shanghai Stock Exchange

The report provides a detailed analysis of these key players in the global capital exchange ecosystem market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Access Your Customized Sample Report & TOC Now: https://www.alliedmarketresearch.com/request-for-customization/A324213

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the capital exchange ecosystem market analysis from 2024 to 2033 to identify the prevailing capital exchange ecosystem market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the capital exchange ecosystem market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global capital exchange ecosystem market trends, key players, market segments, application areas, and market growth strategies.

Capital Exchange Ecosystem Market Key Segments:

By Market Composition

Primary Market

Secondary Market

By Capital Market

Stocks

Bonds

By Stock Type

Common and Preferred

Growth Stock

Value Stock

Defensive Stock

By Bond Type

Government

Corporate

Mortgage

Others

By Region

North America (U.S., Canada)

Europe (France, Germany, Italy, Spain, UK, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Mexico, Rest of LAMEA)

Trending Reports in BFSI Industry:

Supply Chain Finance Market https://www.alliedmarketresearch.com/supply-chain-finance-market-A08187

Cross-Border B2C E-Commerce Market https://www.alliedmarketresearch.com/cross-border-b2c-e-commerce-market-A31485

Bitcoin Payments Market https://www.alliedmarketresearch.com/bitcoin-payments-market-A07535

Invoice Factoring Market https://www.alliedmarketresearch.com/invoice-factoring-market-A15351

Smart Bands Payments Market https://www.alliedmarketresearch.com/smart-bands-payments-market-A10050

Weather-Based Crop Insurance Market https://www.alliedmarketresearch.com/weather-based-crop-insurance-market-A10049

NPL Servicing Market https://www.alliedmarketresearch.com/npl-servicing-market-A10392

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Capital Exchange Ecosystem Market to Reach $1.8 Trillion, Globally, by 2033 at 5.6% CAGR: Allied Market Research here

News-ID: 3850676 • Views: …

More Releases from Allied Market Research

Winter Footwear Market 2026 : Expeditious Growth Expected in 2021 - 2031 | UGG, …

According to a new report published by Allied Market Research, titled, "Winter Footwear Market," The winter footwear market was valued at $8.6 billion in 2021, and is estimated to reach $13.6 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

"Numerous varieties of winter footwear are expected to boost the market growth in the foreseeable future. Moreover, incorporation of customization, as well as innovative winter footwear is…

Ergonomic Chair Market Research Insights: Uncovering CAGR and USD Growth Drivers …

An ergonomic office chair is mostly utilized in different firms and other business areas where employees operate in a sitting position for extended hours. Adjustable seats, brackets and natural postures, which minimize back discomfort and stress in the lengthy seating time, are the ergonomic chairs. Currently, the offices are selecting ergonomic office chairs over the standard office chair to make the workplace healthier, happier, and to boost employer productivity. The…

Ethnic Wear Market Forecasting Essentials: Interpreting CAGR and USD Projections …

According to a new report published by Allied Market Research, titled, "Ethnic Wear Market," The ethnic wear market size was valued at $89.3 billion in 2021, and is estimated to reach $177.2 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

The market for ethnic wear is mostly driven by the rising number of fashion influencers across the globe. It is difficult to overlook the importance of…

$8.9+ Billion Commercial Janitorial Equipment Market Value by 2031 with a 4.6% C …

According to a new report published by Allied Market Research, titled, "Commercial Janitorial Equipment Market," The commercial janitorial equipment market size was valued at $5.7 billion in 2021, and is estimated to reach $8.9 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031. There has been a surge in the number of restaurants, hotels, and hospitals across the globe, which further contribute to the demand for…

More Releases for Exchange

Capital Exchange Ecosystem Market Is Booming Worldwide | Japan Exchange Group, S …

Data Insights Market published a new research publication on "Capital Exchange Ecosystem Market" with 230+ pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Capital Exchange Ecosystem market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in the…

Home Exchange Service Market Regional Growth Drivers, Opportunities and Trends 2 …

The global Home Exchange Service market size is projected to reach US$ 4.5 Billion by 2027, at a CAGR of 1.9% during 2021-2027. The convenience and cost benefits associated with extended stays whether travelling or relocating for any reason are the primary drivers of this sector. Home swapping saves you money on hostel fees, costly hotel rooms, and hotel taxes. In some cases, a house swap allows people to bring…

Security, Bond And Stock Trading Market Growth Influencer Trends In Globally Wit …

The global research report titled as a Security, Bond And Stock Trading market has recently published by Report Consultant. It presents the current statistics and future predictions of the market. The base year considered for the studies and forecast period is 2028. This research report has been compiled by using effective research methodologies such as primary and secondary research methodologies. Top level industries have been profiled to get better insights…

Stock Exchanges Market Future Outlook – New York Stock Exchange, NASDAQ London …

WiseGuyRerports.com Presents “Global Stock Exchanges Market Size, Status and Forecast 2020-2026” New Document to its Studies Database

The extensive market study presents a complete analysis of the global Stock Exchanges market, including the latest developments, current market conditions, and the growth potentialities during the review period. Accurate statistics with regard to the product, methods as well as the share belonging to the key businesses in the market are also given in…

Stock Exchanges Market Accelerates Growth Trajectory | New York Stock Exchange, …

ReportsWeb delivers well-researched industry-wide information on the Stock Exchanges market. It studies the market's essential aspects such as top participants, expansion strategies, business models, and other market features to gain improved market insights. Additionally, it focuses on the latest advancements in the sector and technological development, executive tools, and tactics that can enhance the performance of the sectors.

Get Sample Copy of the Report @ http://bit.ly/2QiA4AP

The report evaluates the key…

Stock Exchanges Market 2019: Top Key Players are New York Stock Exchange, NASDAQ …

Stock exchanges comprise all establishments which act as a market place for trading securities. Customers use stock exchanges as a trading platform to transact securities such as equities and bonds. This segment includes capital markets, post trade activities and information and technology services. This channel does not include investment and advisory activities of these stock exchanges.

Blockchain technology, a major trend in the stock exchanges market worldwide, and is being used…