Press release

The Future of NY Medicaid is at Risk: Will Seniors Lose Their Medicaid Benefits in 2025?

With potential Medicaid cuts looming under the current US government, thousands of elderly New Yorkers risk losing vital home care services. A proposed five-year look-back period could disqualify many from Medicaid, forcing them into institutions. Attorney Inna Fershteyn urges families to act now to protect assets and secure care.New York, NY - For thousands of New York seniors, Medicaid is not just a healthcare program - it is the difference between staying in their homes with dignity or being forced into institutional care. With the President's return to office and a Republican-controlled Congress, drastic changes to Medicaid could be on the horizon, threatening vital services that seniors depend on every day.

While Social Security and Medicare cuts appear to be off the table, Medicaid is facing scrutiny as a potential target for federal budget reductions. This could have life-altering consequences for elderly New Yorkers who rely on Medicaid for home health aides, long-term care, and community-based support.

The Looming Five-Year Look-Back Period for Home Care

One of the most alarming proposed changes is the introduction of a five-year look-back period for Medicaid Home Care benefits, a rule that does not currently exist in New York. If implemented, this would mean that seniors who transferred assets within the past five years-even for legitimate, non-fraudulent reasons - could be denied the home care services they desperately need.

"This policy shift is not just an administrative change; it could force thousands of seniors into institutions or leave them without essential care," said Inna Fershteyn, a New York-based elder law attorney. "Families who want to keep their loved ones at home should be preparing now before it's too late."

Medicaid Funding Cuts and Structural Changes

In addition to the look-back period, proposals such as converting Medicaid into block grants or setting per capita spending caps could significantly reduce federal funds available for New York's Medicaid system. If enacted, these changes could result in fewer resources, longer wait times for home care services, and financial hardship for families who are already struggling to navigate elder care options.

"Medicaid has long been a safety net for our most vulnerable populations," Fershteyn added. "If these policies take effect, we could see thousands of elderly New Yorkers losing access to the very care that allows them to remain in their homes and communities."

What New York Seniors Must Do Now

As the potential for Medicaid restrictions grows, taking proactive steps is more urgent than ever. Elder care professionals recommend that seniors and their families:

- Review Medicaid eligibility requirements to understand how proposed changes could affect them.

- Explore legal strategies, such as irrevocable trusts, to safeguard assets while preserving Medicaid eligibility.

- Stay informed on policy updates to ensure they make timely and informed financial and healthcare decisions.

The Clock is Ticking for New York Families

The potential Medicaid changes in 2025 could fundamentally alter the landscape of senior care in New York. If federal cuts are enacted, many families may be forced to make impossible choices between financial stability and securing care for their loved ones.

For those who rely on Medicaid or expect to in the future, planning ahead is the best defense against these uncertain times.

To learn more about Medicaid policy changes and how they may affect you, visit www.brooklyntrustandwill.com [https://brooklyntrustandwill.com/] or consult with an elder law professional for guidance.

Watch this video for more information: NY Medicaid Look Back Under Trump [https://www.youtube.com/shorts/YJ9o_o8BWSg]

For media inquiries, please contact:

Law Office of Inna Fershteyn and Associates, P.C. [https://maps.app.goo.gl/Eik6JRor8F4aQCKh6]

Phone: (718) 333-2394

Email: medicaidnewsnyc@gmail.com

Website: www.brooklyntrustandwill.com [https://brooklyntrustandwill.com/]

Location: https://www.google.com/maps/embed?pb=!1m18!1m12!1m3!1d4497.642915527388!2d-73.9531868!3d40.5859537!2m3!1f0!2f0!3f0!3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x89c245062635ab61%3A0xbd0157967345020c!2sLaw%20Office%20of%20Inna%20Fershteyn%20and%20Associates%2C%20P.C.!5e1!3m2!1sen!2sus!4v1738612538371!5m2!1sen!2sus

Media Contact

Company Name: Law Office of Inna Fershteyn and Associates, P.C.

Contact Person: Law Office of Inna Fershteyn

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=the-future-of-ny-medicaid-is-at-risk-will-seniors-lose-their-medicaid-benefits-in-2025]

Phone: (718) 333-2394

Address:1517 Voorhies Ave 4th Floor

City: Brooklyn

State: New York

Country: United States

Website: https://brooklyntrustandwill.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Future of NY Medicaid is at Risk: Will Seniors Lose Their Medicaid Benefits in 2025? here

News-ID: 3849461 • Views: …

More Releases from ABNewswire

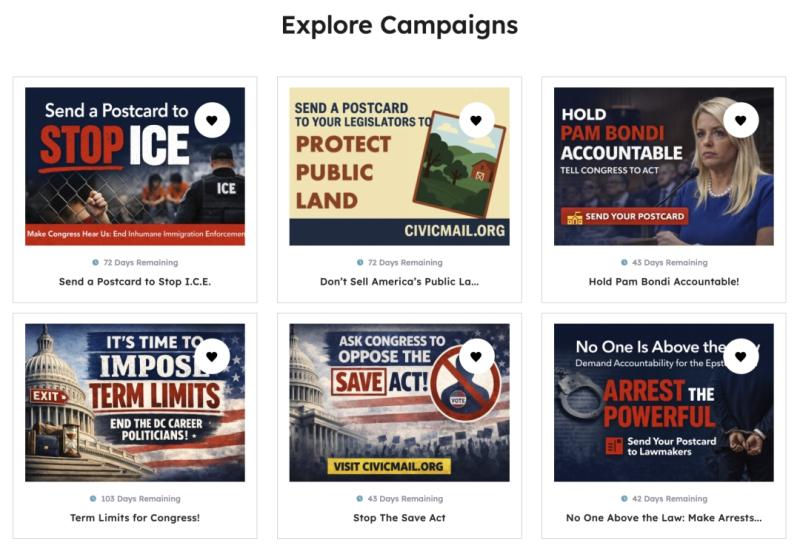

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

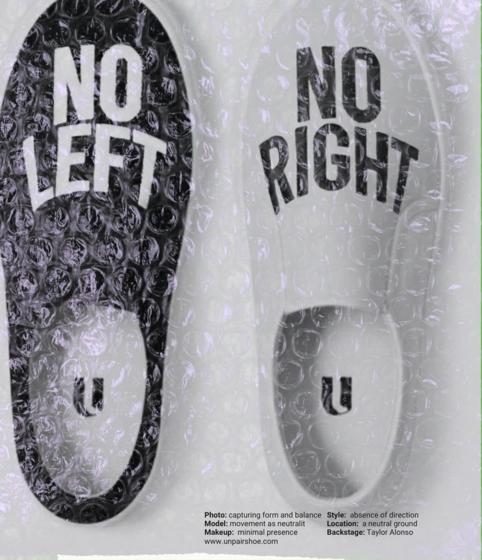

Unpair Introduces a Patent-Pending Symmetrical Footwear System That Eliminates L …

Founded by Taiwanese fashion designer turned inventor Hui Min Yang, Unpair reimagines footwear through symmetry, interchangeability, and universal form.

Houston, TX - February 19th, 2026 - Unpair officially announces a patent-pending symmetrical footwear system that challenges centuries of left-right shoe design. For centuries, footwear has followed a fixed rule: one shoe for the left foot and one for the right.

Image: https://www.abnewswire.com/upload/2026/02/5a16a00cab1f11dd06faa474a3674865.jpg

Unpair challenges that convention by introducing a patent-pending symmetrical footwear system…

More Releases for Medicaid

Houston Medicaid Planning Lawyer Whitney L. Thompson Discusses Texas Medicaid Sp …

HOUSTON, TX - Understanding Medicaid eligibility in Texas can be challenging, especially when navigating spend-down rules and income limits. Houston Medicaid planning lawyer Whitney L. Thompson of The Law Office of Whitney L. Thompson (https://www.wthompsonlaw.com/does-texas-have-spend-down-medicaid/) is helping families across Texas make sense of complicated Medicaid requirements, whether they're applying under the Medically Needy program or preparing for long-term-care Medicaid.

For families seeking coverage under the Medically Needy program, income spend-down is…

Houston Medicaid Planning Attorney Whitney L. Thompson Discusses Texas Medicaid …

HOUSTON, TX - For families in Texas facing the difficult decisions that come with nursing home care, understanding what Medicaid covers and how to qualify can be overwhelming. At The Law Office of Whitney L. Thompson (https://www.wthompsonlaw.com/nursing-home-care-and-medicaid-eligibility/), Houston Medicaid Planning Attorney Whitney L. Thompson provides clear and practical legal support to clients seeking long-term care benefits through Texas Medicaid.

Medicaid does cover nursing home care in Texas, but only for individuals…

New Jersey Medicaid Trust Lawyer Christine Matus Outlines Medicaid Asset Protect …

Toms River, NJ - New Jersey Medicaid trust lawyer Christine Matus of The Matus Law Group (https://matuslaw.com/new-jersey-medicaid-trust-lawyer/) releases updated guidance on Medicaid Asset Protection Trusts for families preparing for long-term care. The firm's latest overview explains how a properly structured Medicaid asset protection trust can safeguard non-exempt resources while maintaining eligibility for Medicaid Long Term Services and Supports. The announcement addresses application timing, trustee selection, five-year look-back documentation, and current…

Nassau County Medicaid Planning Lawyer Seth Schlessel Outlines Key Asset Protect …

Understanding which assets can be preserved during the Medicaid application process is critical, particularly in New York, where the financial thresholds and eligibility guidelines are highly specific. In a detailed blog post titled "What Assets Can You Keep When You Go on Medicaid?", Nassau County Medicaid planning lawyer Seth Schlessel (https://www.schlessellaw.com/what-assets-can-you-keep-when-you-go-on-medicaid/) of Schlessel Law PLLC breaks down the categories of assets applicants may retain without compromising their eligibility. The content…

Long Island Medicaid Planning Attorney Seth Schlessel Explains the Disadvantages …

Long Island Medicaid planning attorney Seth Schlessel (https://www.schlessellaw.com/disadvantages-of-a-medicaid-trust/) offers critical insight into the often-overlooked downsides of Medicaid Asset Protection Trusts (MAPTs), a popular estate planning tool for those aiming to preserve assets while qualifying for long-term care benefits. While these trusts can protect wealth from being depleted by nursing home costs, they also present legal and financial hurdles that require careful evaluation. At Schlessel Law PLLC, Seth Schlessel helps Long…

Long Island Medicaid Planning Attorney Seth Schlessel Explains Spousal Refusal i …

Long Island Medicaid planning attorney Seth Schlessel (https://www.schlessellaw.com/what-is-spousal-refusal-and-how-does-it-work/) provides insight into spousal refusal, a key legal strategy for protecting assets when one spouse requires long-term care. In Medicaid planning, spousal refusal allows a non-applicant spouse to legally decline to use their financial resources to pay for the care of the Medicaid applicant spouse. This approach is particularly relevant for married couples in New York who seek to safeguard their financial…